- After the CME SOL FUTURES debut, the probability of approval of SOL ETF has increased to 87%.

- Analysts predicted that Sol Price could be bound in the range for weeks or months.

On March 17, Chicago Mercantile Exchange (CME) debuted long -awaited debut. Solana (SOL) Future trading and mobile analysts have helped the probability of ETF approval.

exchange proposal Two SOL FUTURES PRODUCTS: A standard futures contract representing 500 sol and ‘micro’ alternative with 25 soles for each contract.

Solana ETF probability

According to Mathew Sigel, Vaneck’s Digital Assets Research Officer, we were likely to have found ETF GreenLight. that stated,,,

“One step of a step closer to SOL ETF.”

But SIGEL pointed out that CME futures were not needed for ETF approval, but it would still increase the probability.

“There is no need to have a CME future to list the ETF, which was Gensler psyop. But it still helps. ”

In the predicted site poly market multiplication The approval of SOL ETF approval in 2025 increased from 81%to 88%after its launch.

In other words, debut has made SOL a third cryptocurrency for CME gifts after BTC (Bitcoin) and Ethereum (ETH). Giovanni Vicioso, head of Cryptocurrency’s Cryptocurrency product, said:

“As Solana continues to develop into a platform selected by developers and investors, this new futures contract will provide capital efficient tools that support investment and hemp strategies.”

SOL price range

Despite the optimistic update, the price of the SOL may continue to be trapped in the mid -term. According to Crypto Trader, Cryp Nuevo, SOL can change between $ 120- $ 175 if BTC has more than $ 77K.

“We’ll probably spend a few weeks or months between $ 120 and $ 175 if BTC keeps 1W50ema $ 77K.”

Source: X

In fact, Nuevo warned that it could not be ignored. In particular, if Bitcoin’s dominance has increased by more than 63%, the dip of less than $ 100 is less than $ 100.

“If the BTC.D is pumped to 63% -64% at the same time as BTC, if the BTC falls to $ 77K, the SOL can be easily taken out and even shows <$ 100 for several hours/days."

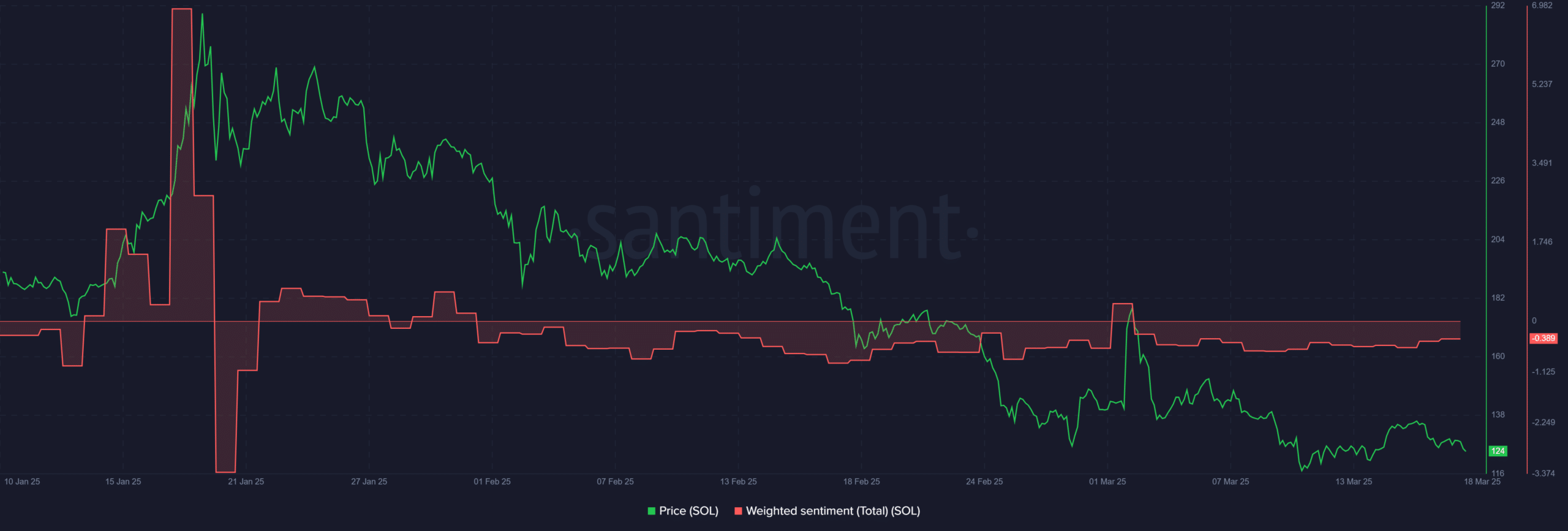

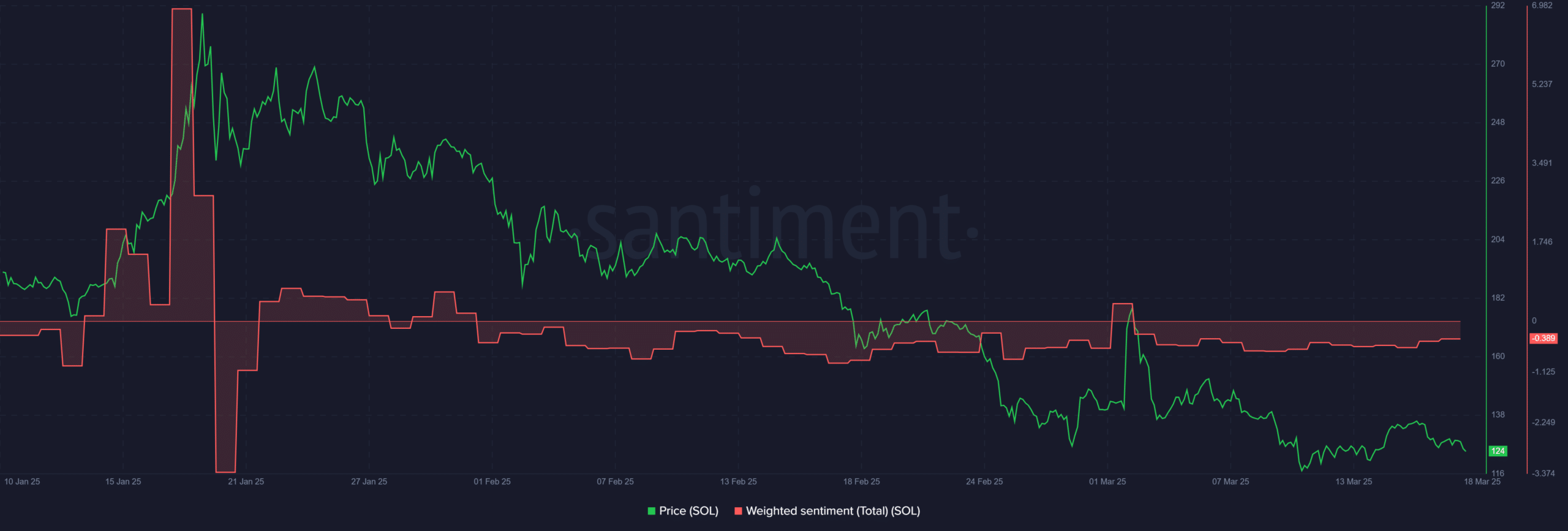

Source: Santiment

The weak grip of the Sol Market was also clear by weighting feelings, which is too negative for most of the first quarter of 2025.

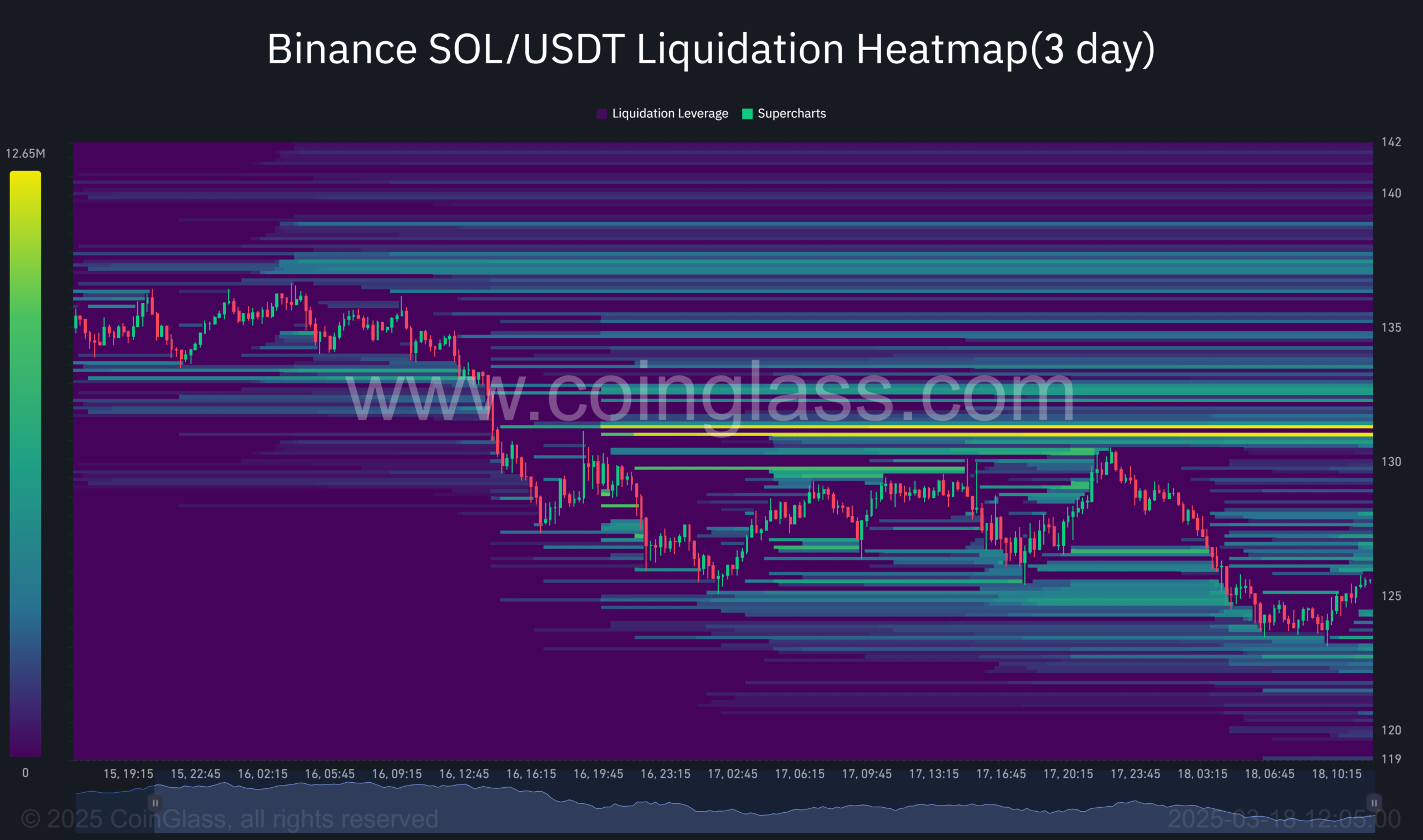

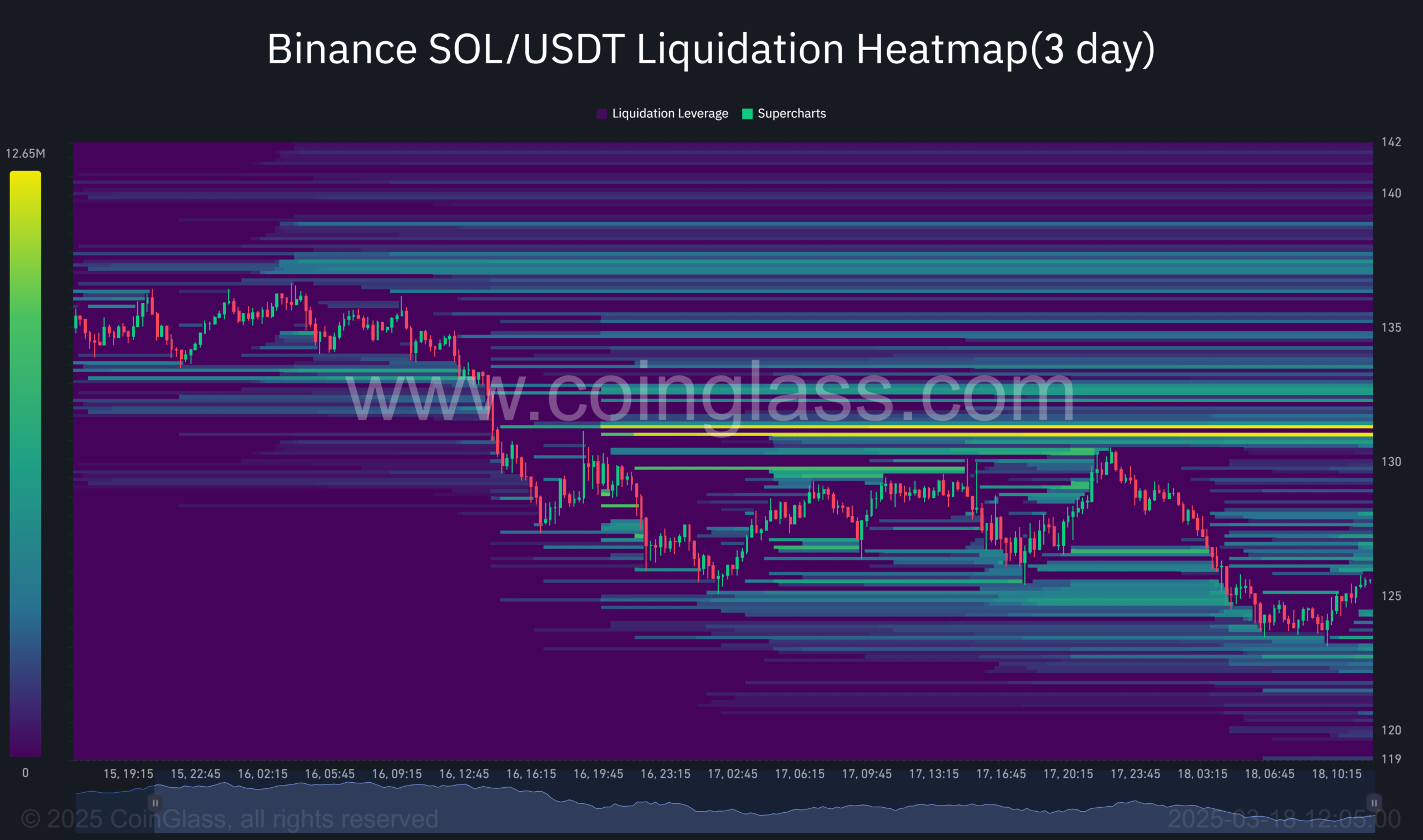

Meanwhile, significant liquidity was more than $ 130 (bright yellow area), with traders open shorts around the level. This can attract price measures in the short term for liquidity -centered pumps.

Source: COINGLASS