- The price of Solana has risen by more than 20% over the past seven days.

- If the rally resumes, SOL could rise above $180.

Solana (SUN) It recovered $175 on May 18, but soon a price correction occurred, causing the token value to fall. Does this mean SOL will fall further in the coming days?

To find out, let’s take a look at the current state of SOL.

Solana is back at $175.

Solana has been a huge success, with the token price rising significantly over the past week. According to CoinMarketCapThe price of SOL has surged more than 20% in the past seven days, reaching $175.

However, SOL was unable to maintain its position as it fell.

At the time of this writing, SOL was trading at $174.39, with a market capitalization of over $78.2 billion.

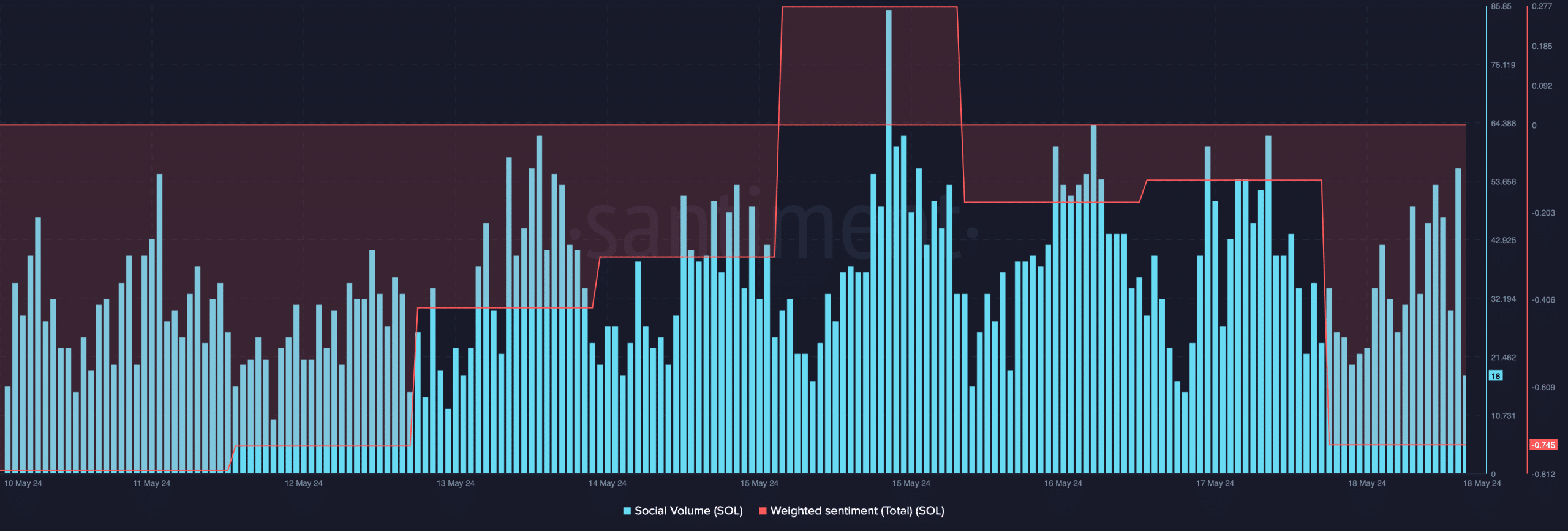

The drop to $175 also had a negative impact on the token’s social metrics. Weighted Sentiment has fallen sharply. This means that the surrounding bearish sentiment is dominant in the market.

Despite this, social volume remained stable.

Source: Santiment

Investors should not be discouraged, as recent analysis suggests that the price of SOL may surge. Alex Clay, a well-known cryptocurrency analyst, recently posted the following: Twitter We highlight interesting developments.

During the monthly period, SOL displayed a rounding bottom pattern. If this pattern is tested, investors could soon witness SOL reaching new highs.

What to Expect in the Short Term

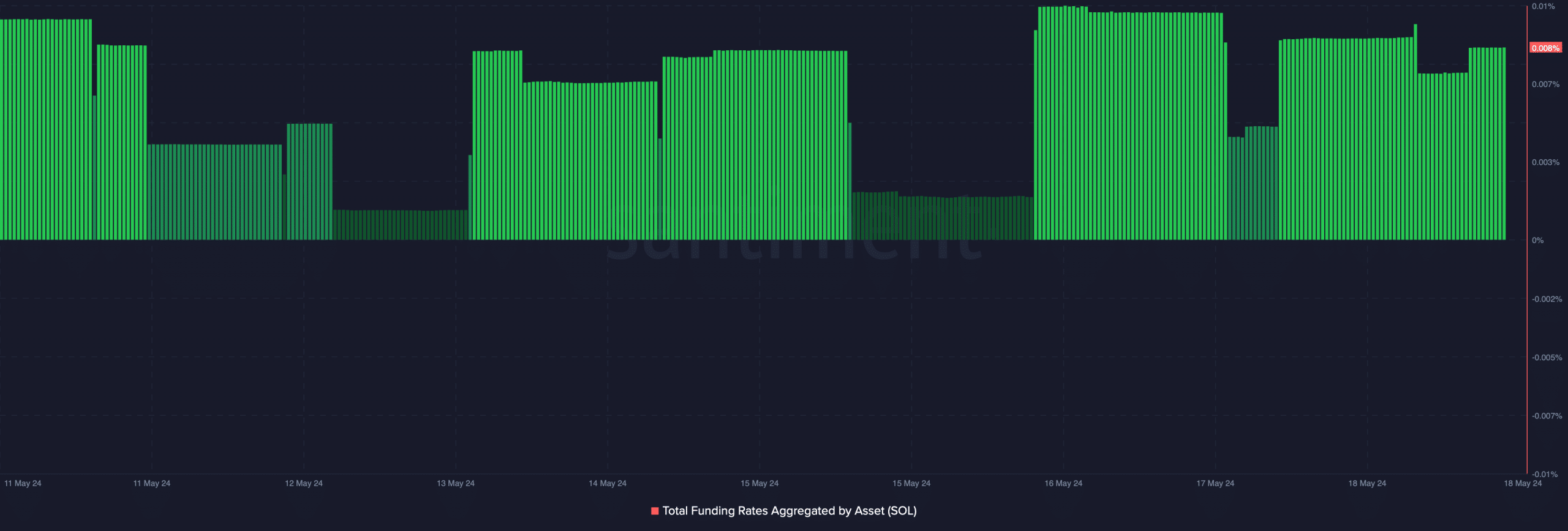

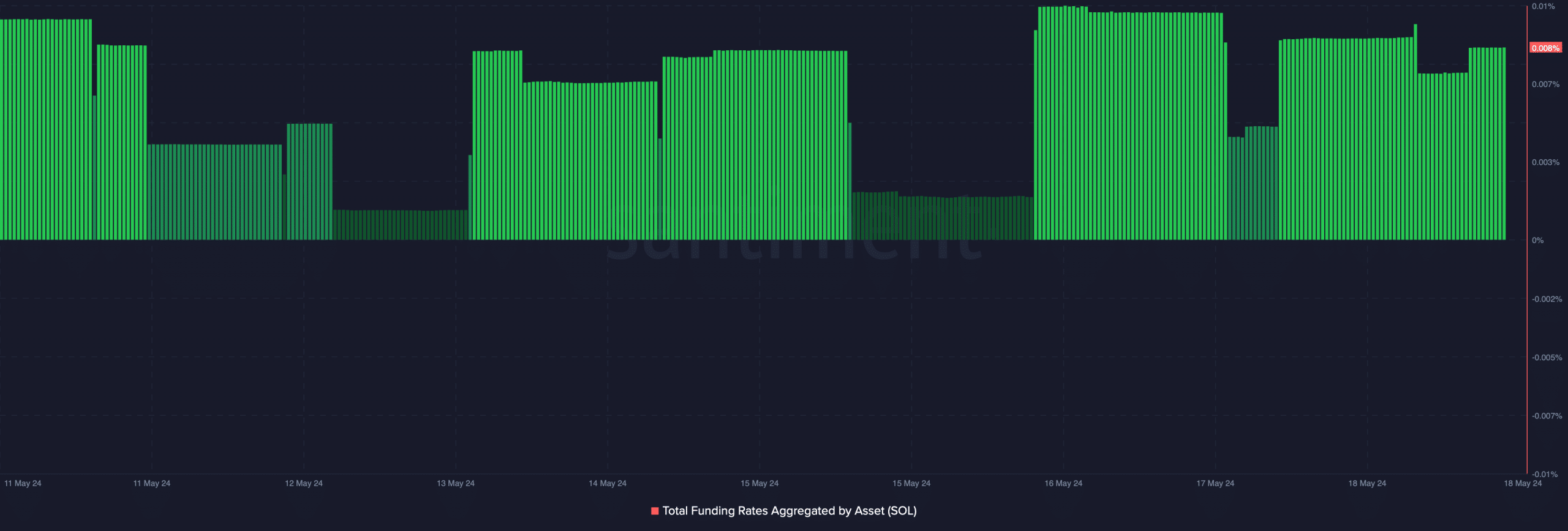

AMBCrypto then analyzed SOL’s on-chain metrics to determine whether investors should expect a huge upside in the near term. Our analysis shows that SOL’s funding rate has increased dramatically.

A rise in the indicator means that derivatives investors are buying SOL. According to Coinglass dataSOL’s open interest may also increase, which could serve to fuel the coin’s weekly rally.

Source: Santiment

But concerns still remain. of coins Fear and Greed Index At press time, the valuation was 75%, meaning the market is in an extreme greed phase. These numbers often lead to lower prices.

We then analyzed SOL’s daily chart to see which direction it was heading.

The relative strength index (RSI) was quite strong at 64. However, Chaikin Money Flow (CMF) moved in the opposite direction. ‘

Additionally, Solana’s price has reached the upper Bollinger Band limit, indicating a possible price adjustment.

Source: TradingView

Is your portfolio green? Please confirm SOL Profit Calculator

If a price correction occurs, liquidations could increase rapidly, pushing the price of SOL down to $173.5, which could act as support. A further decline could push the price of SOL to $165. ‘

However, if SOL continues its weekly bull run, the token could rise above $180.

Source: Hiblock Capital