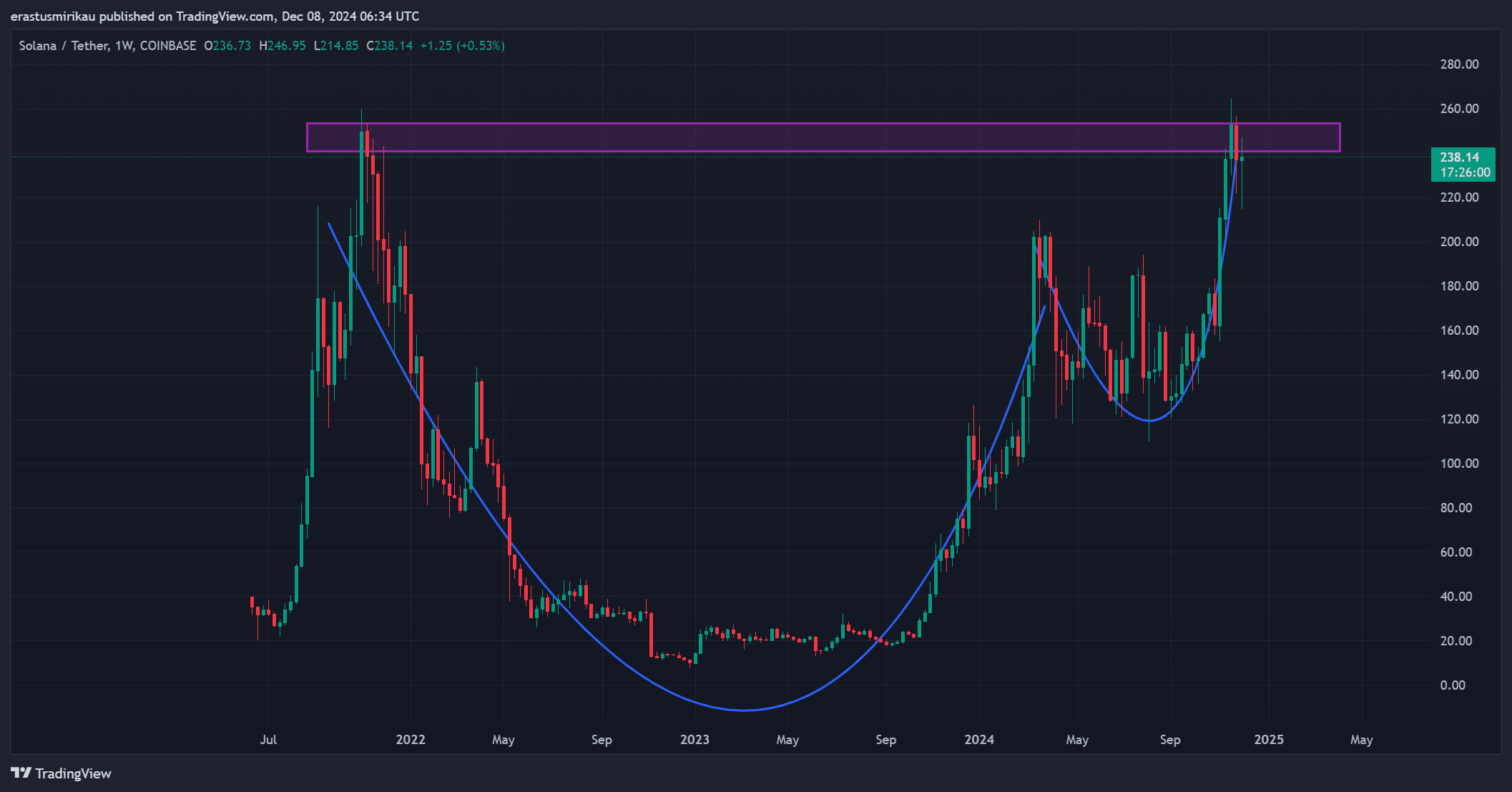

- Solana formed a bullish cup and handle pattern, testing an important supply area.

- Strong technical indicators and social dominance suggested a bullish breakout was more likely.

Solana (SUN) ofA textbook cup and handle pattern has formed on the weekly chart, building a strong bullish setup that hints at a potential breakout. At press time, SOL was trading at $238.32, up 1.08% over the past 24 hours.

Prices are now testing a critical supply zone, where a successful breakout could trigger a significant rally.

Traders and investors are eager to see if SOL can maintain its momentum and overcome this resistance.

Is SOL on the verge of a breakout?

Solana’s weekly chart clearly shows the classic cup and handle shape, a bullish pattern that hints at a potential upward move. Prices are approaching a strong supply area, an important resistance point.

Beyond this area, more buyers may come in, pushing the SOL higher. However, refusal will result in a revocation.

Therefore, traders will closely watch SOL’s movements here to determine the next price trend.

Source: TradingView

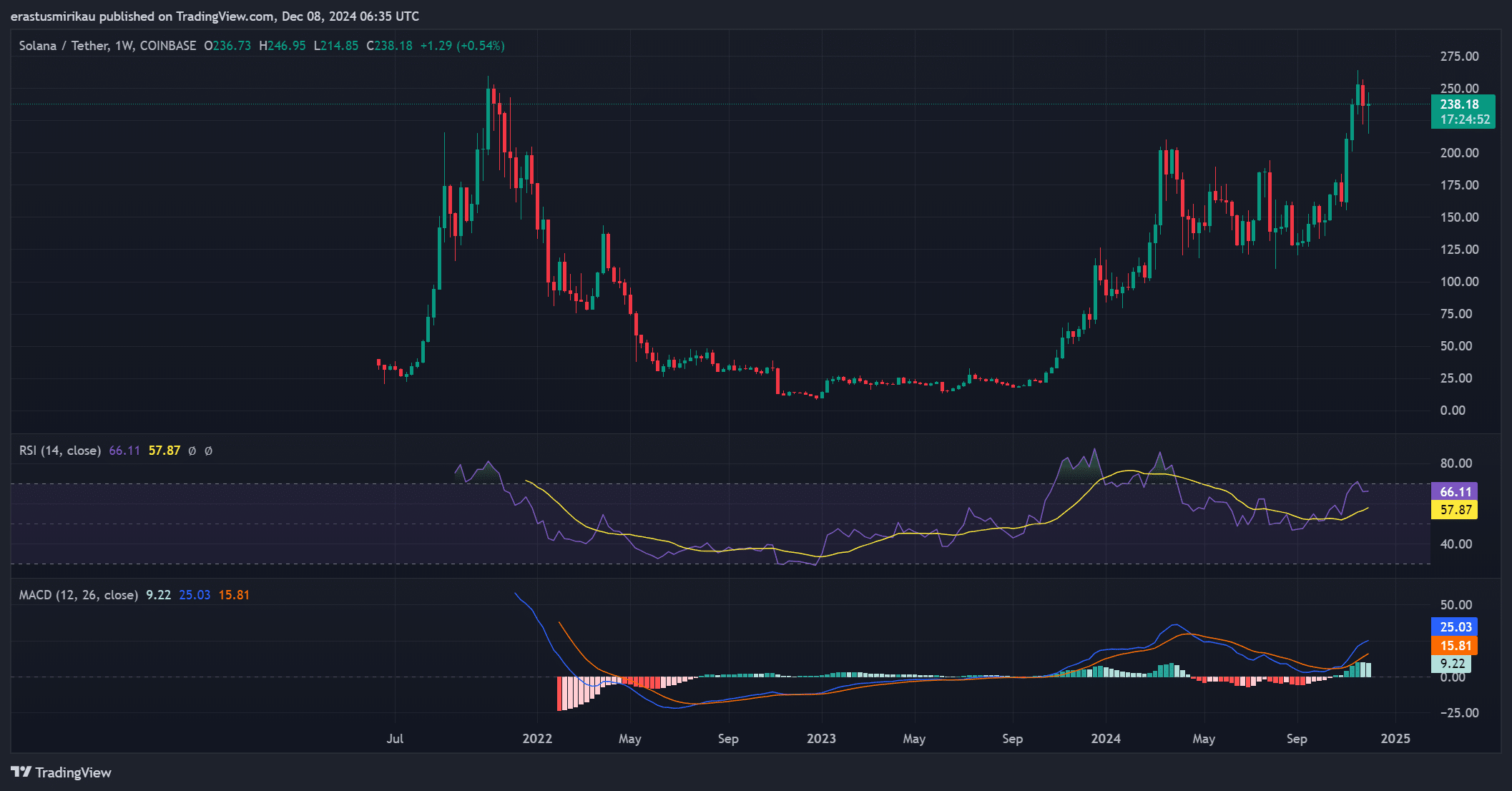

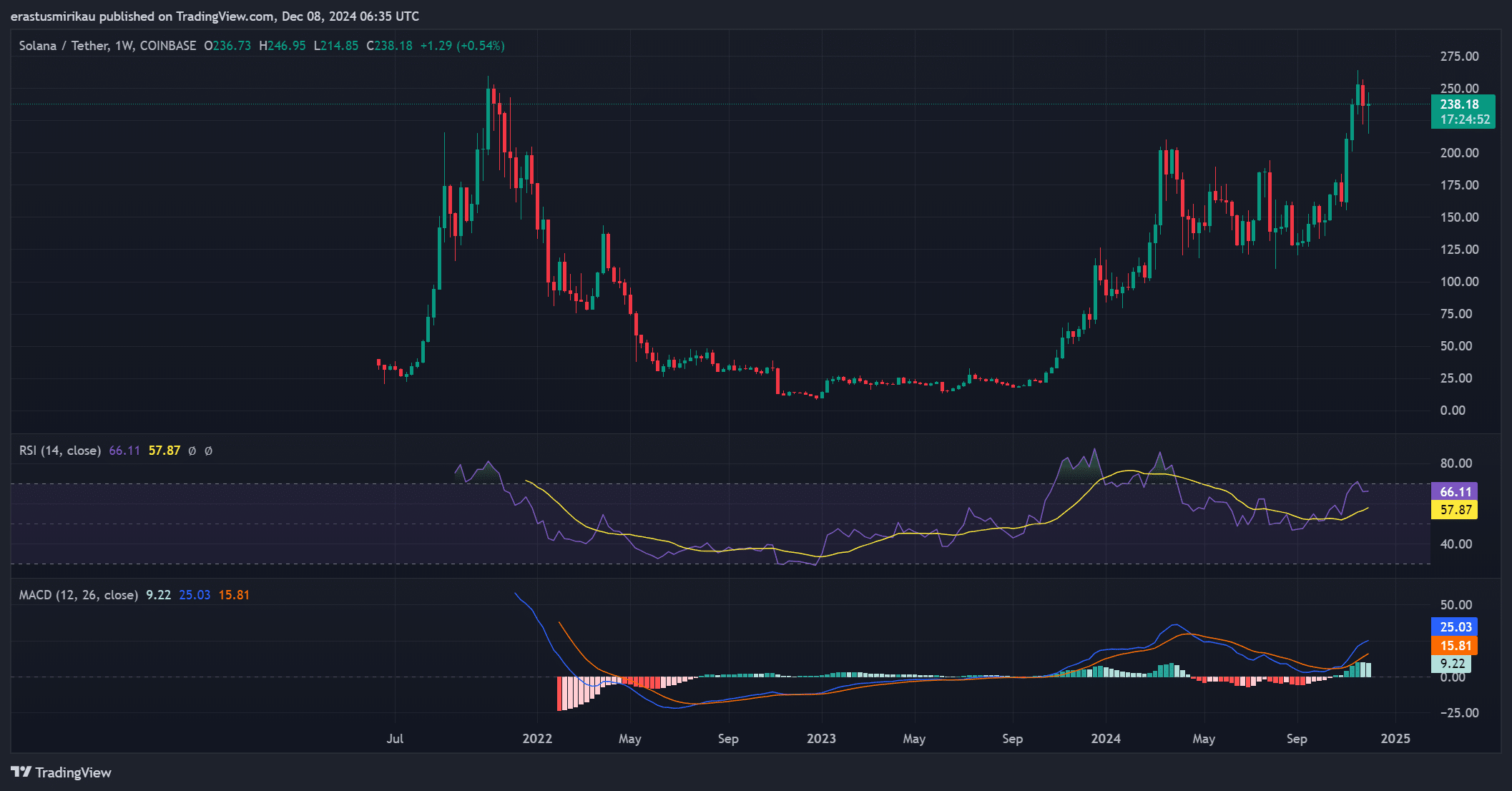

What do technical indicators say?

Technical indicators further support the optimistic outlook. The RSI is at 66.11, indicating solid buying pressure but still room before it becomes overbought.

Additionally, MACD hit 9.22, reinforcing SOL’s upward trend.

This bullish signal suggested that a successful breakout of the supply zone would strengthen these technical indicators, attracting more traders into long positions.

Source: TradingView

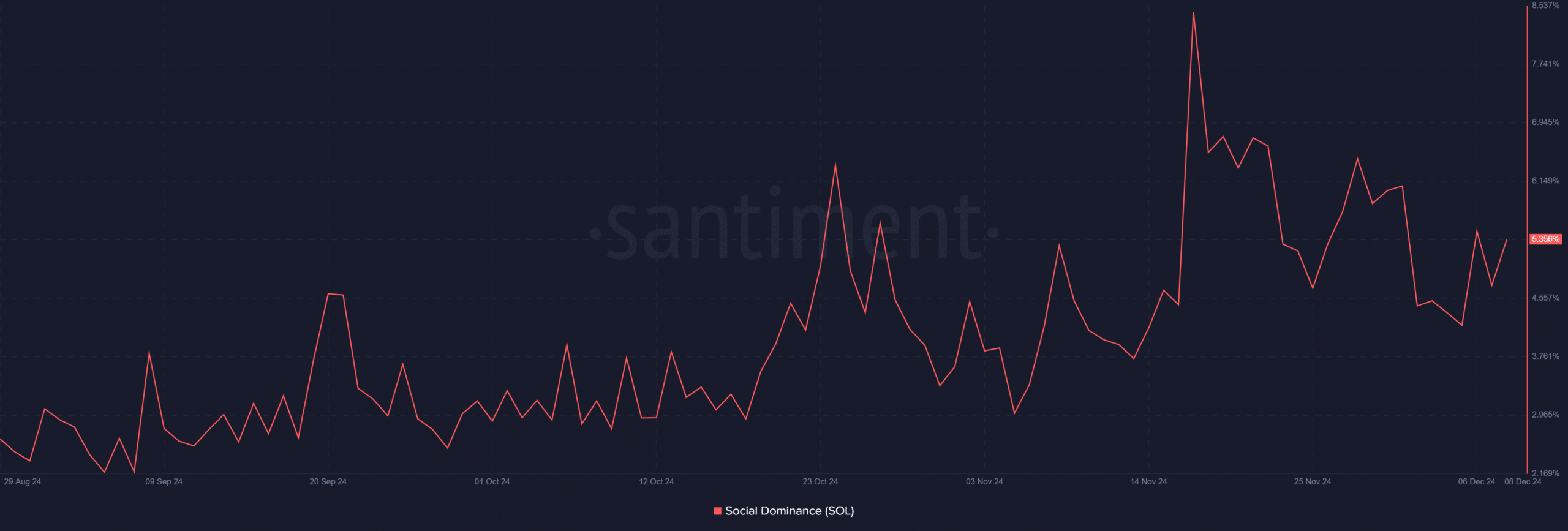

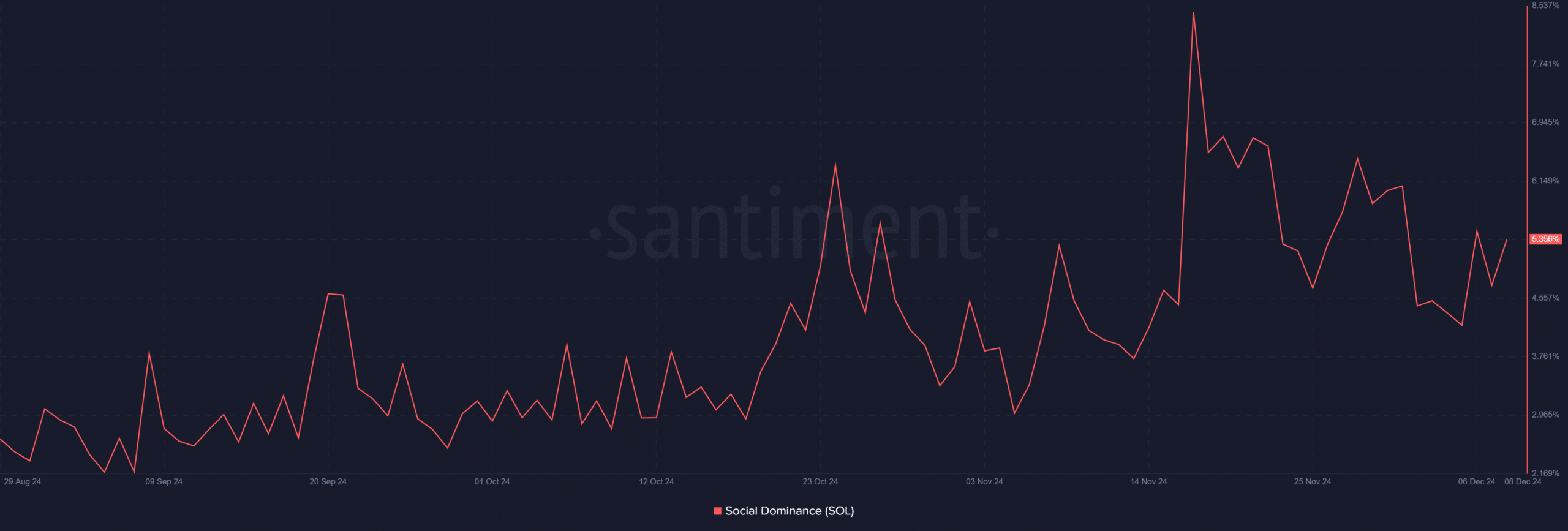

Why does social dominance attract attention?

SOL’s social dominance rose from 4.73% to 5.36% in just one day. This growth reflects increased engagement and interest in social media platforms.

This interest is often associated with higher market participation and price momentum.

Therefore, higher social dominance means more traders are entering the market, which can further fuel SOL’s bullish momentum.

Source: Santiment

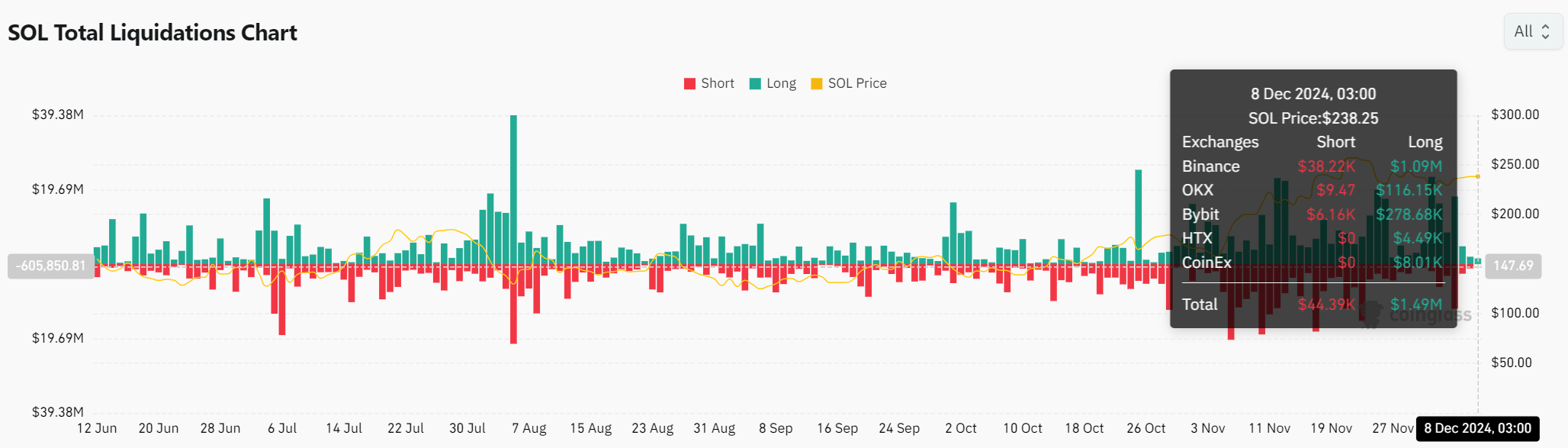

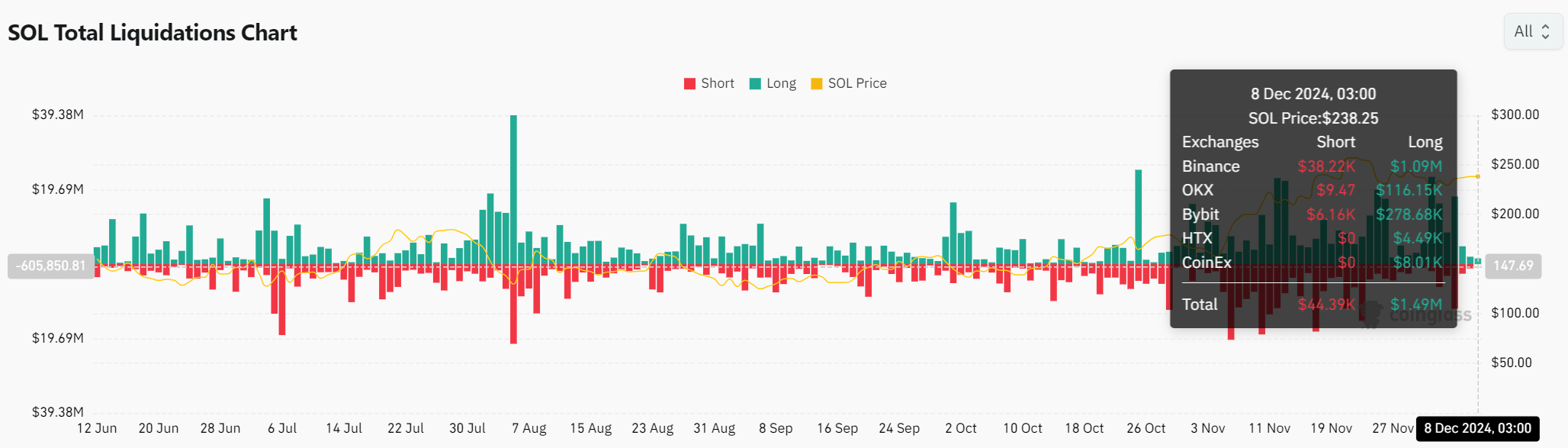

How will liquidation affect SOL’s momentum?

Liquidation data highlighted strong optimism among traders. SOL recorded $44.39 million in short liquidations and $1.49 million in long liquidations.

High buy liquidation volume indicates that many traders believe in an upward move in SOL.

As a result, this clearing supports the possibility of SOL breaking through the supply zone and maintaining a bullish trajectory.

Source: Coinglass

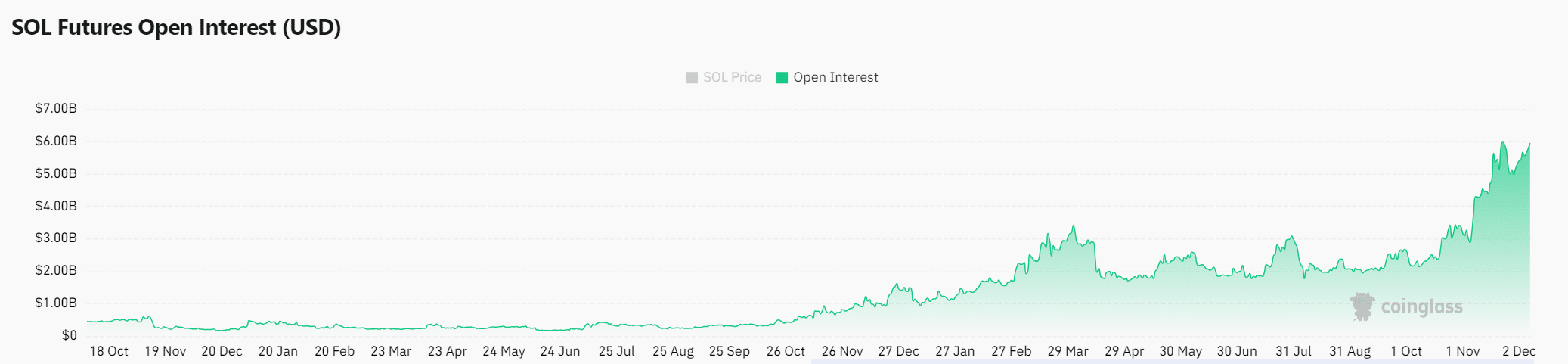

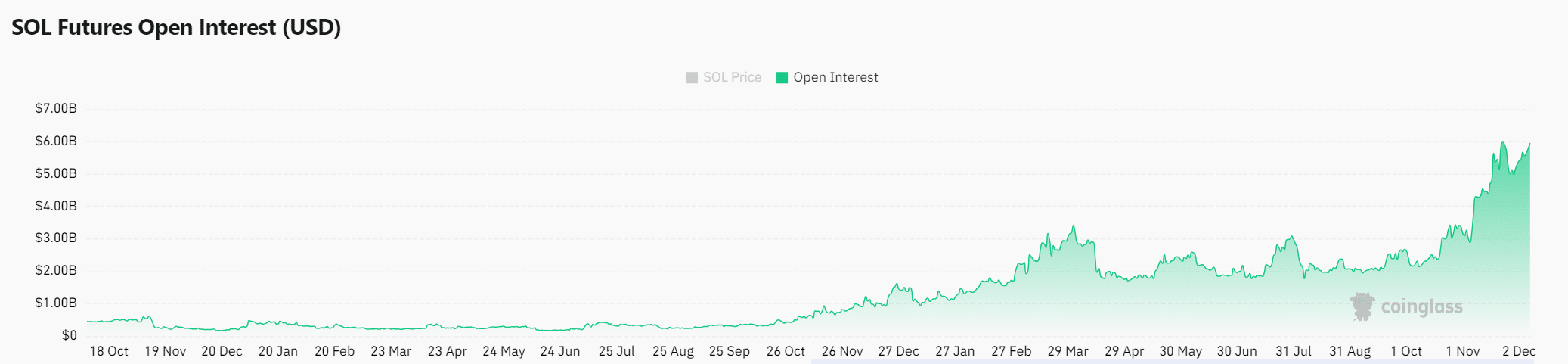

What does Open Interest reveal about the future of SOL?

Open interest surged 4.04% to $6.02 billion. This increase indicates significant capital is flowing into Solana futures contracts.

Higher open interest means more traders are investing heavily, which supports price stability and reinforces bullish trends. This number increases the likelihood of a successful break above the supply zone.

Source: Coinglass

Read Solana (SOL) price prediction for 2024-2025

Solana is on the verge of a decisive breakout with a bullish cup and handle pattern forming on the weekly chart.

Therefore, it is likely that SOL will break through the supply zone, maintaining upward momentum and setting the stage for continued price increases.