- Solana is likely to trade within a range over the next two weeks.

- The indicators were bullish, but one chart showed that the price could soon fall to $165.

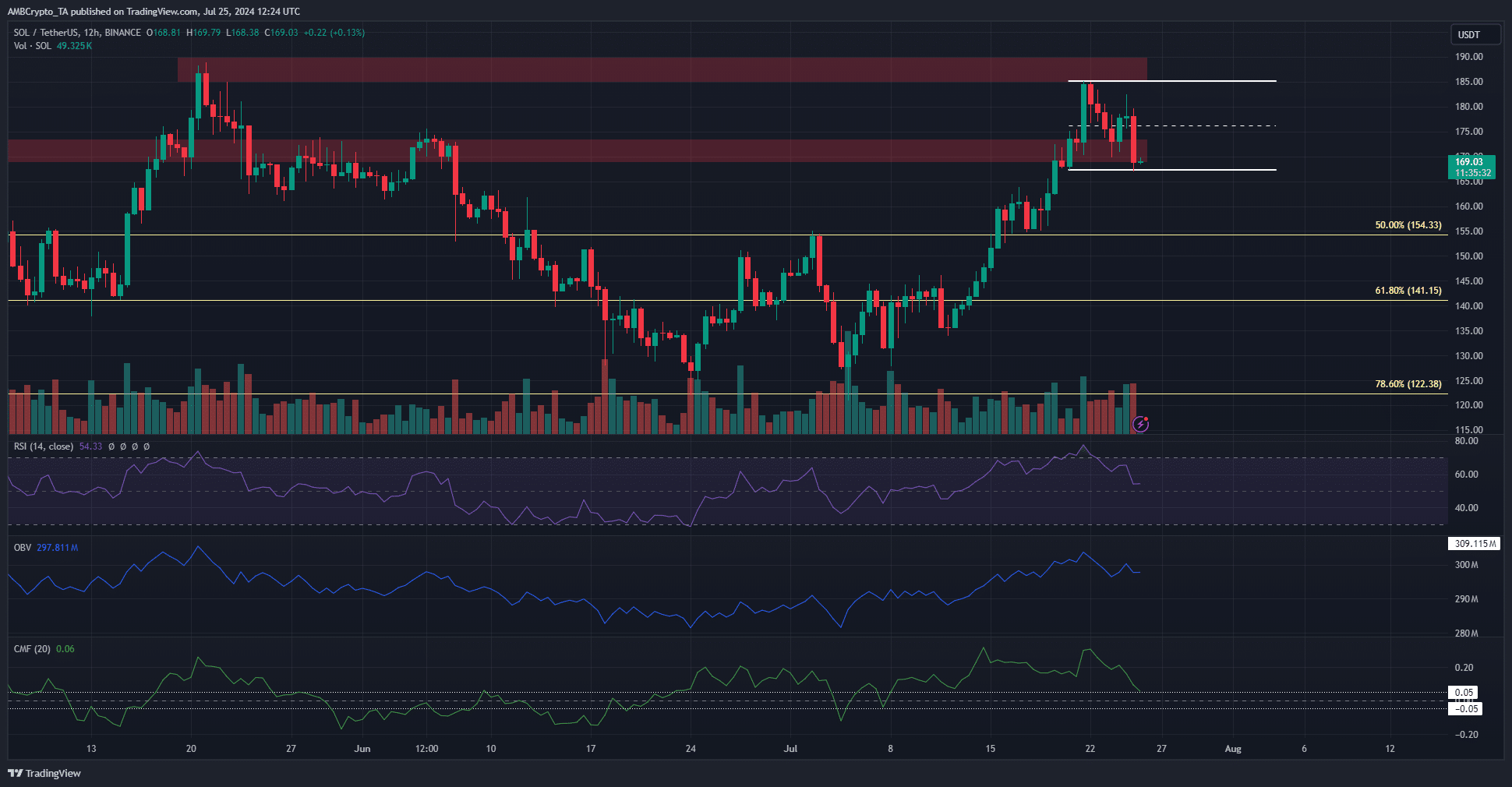

Solana (SOL) has seen significant volatility over the past five days. The altcoin bounced from $167 to $185, recording the most gains in a single day on Sunday, July 21. It has since reversed its gains on the charts.

The increased volatility could be related to the approval and trading of the Ethereum (ETH) spot ETF that began on July 23. Pre-event speculation that SOL would be next led to positive sentiment and gains, but their collective impact was short-lived.

Bulls can defend range lows

Source: SOL/USDT on TradingView

The RSI is above neutral 50, reflecting bullish sentiment. The OBV has been slowly rising in July, and despite the recent pullback, this trend has not stopped. The CMF is above +0.05, indicating steady and notable buying pressure.

This is a signal that swing traders might expect to see to defend the low of the range.

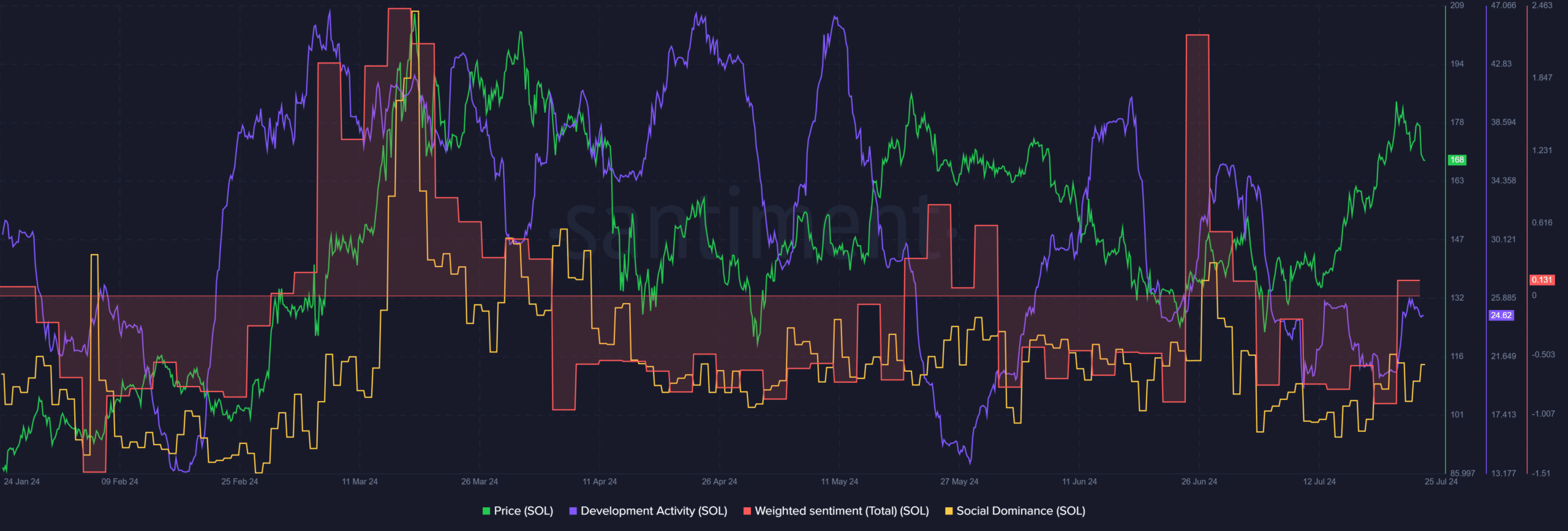

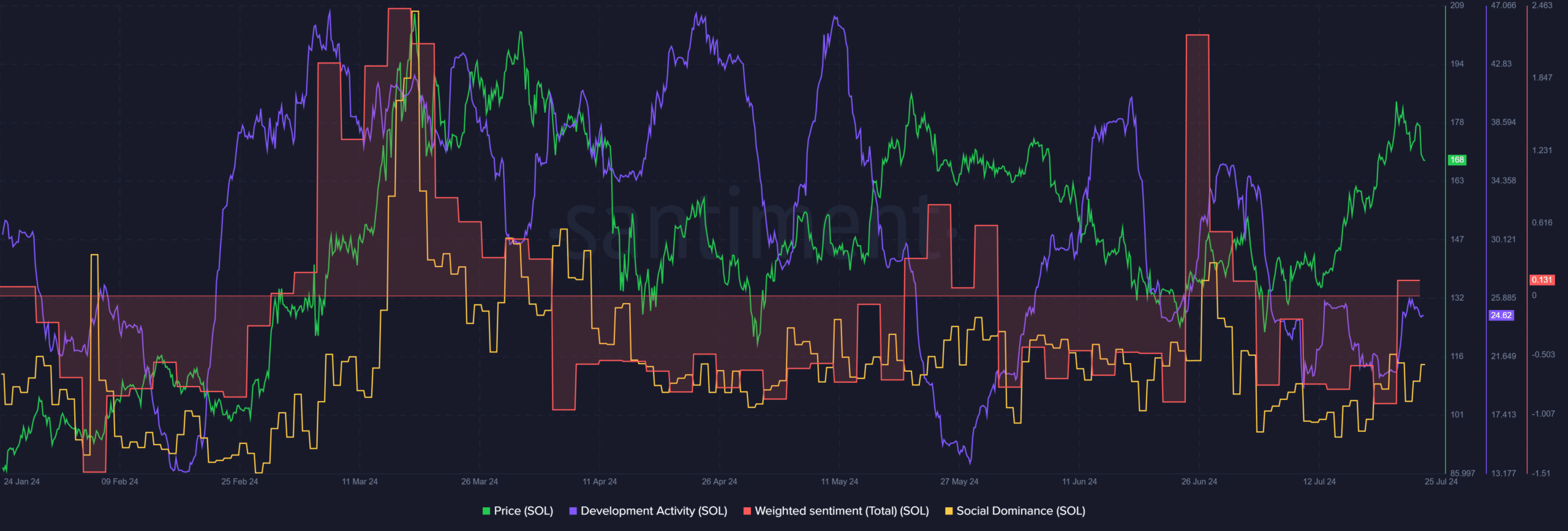

Source: Santiment

However, development activity has declined since June. The indicator’s value of 24.62 was lower than Ethereum’s 44.95 and Cardano’s (ADA) 77.83 reading. Conversely, the weighted sentiment jumped into positive territory.

Along with the technical results, the indicators suggested that sentiment was on the rise. The bullish argument would be strengthened further if SOL’s social dominance were to increase, but it does not seem to be of much help at the moment.

Possibility of Solana Short Squeeze

Source: Highblock

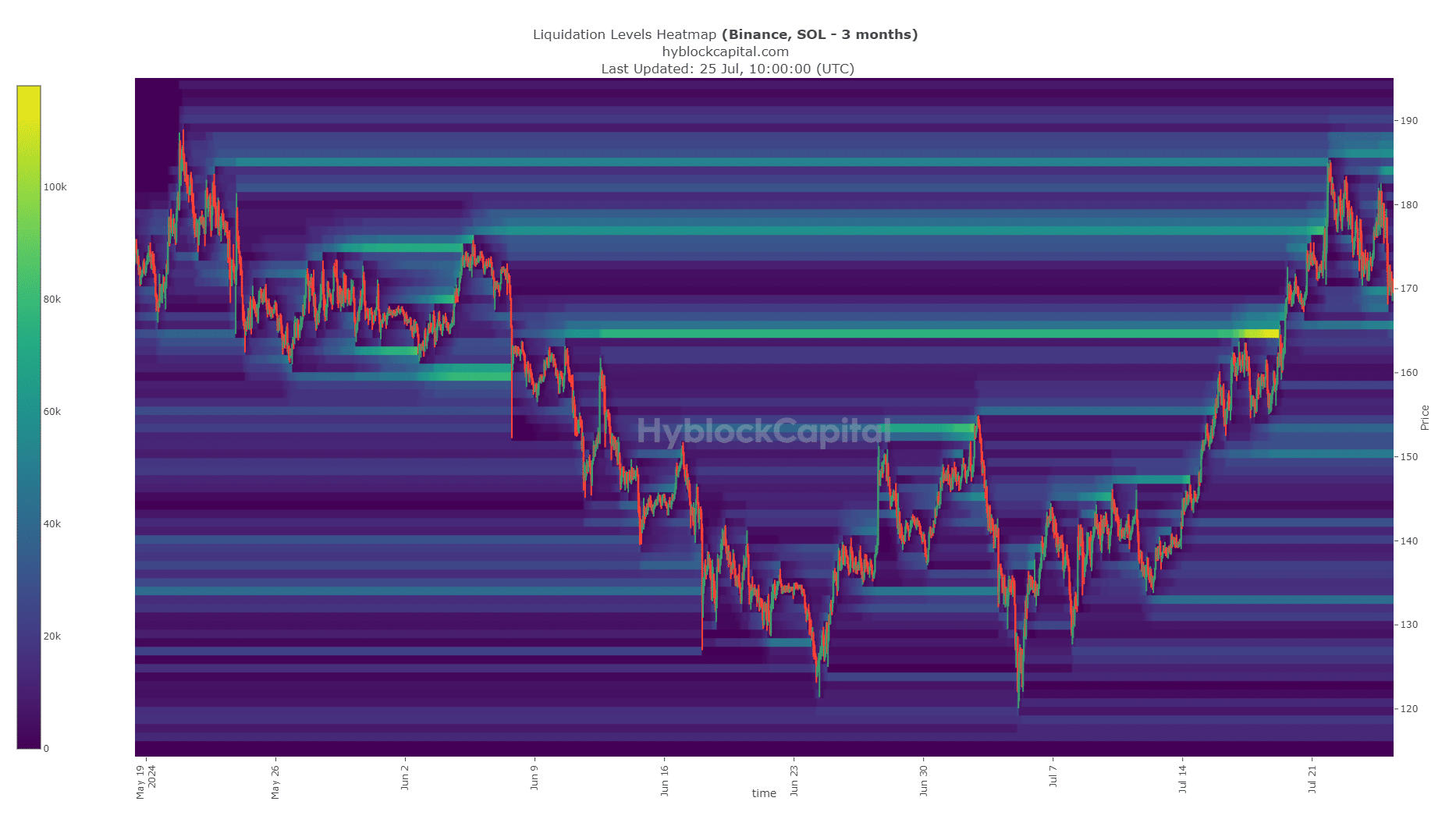

The 3-month lookback period of the Solana liquidation heatmap highlights $170 and $185 as the next areas of interest. The $165 and $150-$155 levels are also potential locations for a downtrend reversal.

They are joined by technical support levels. The range formation is likely to continue after the $170 liquidity zone was swept, but indicators and sentiment are positive.

Source: Highblock

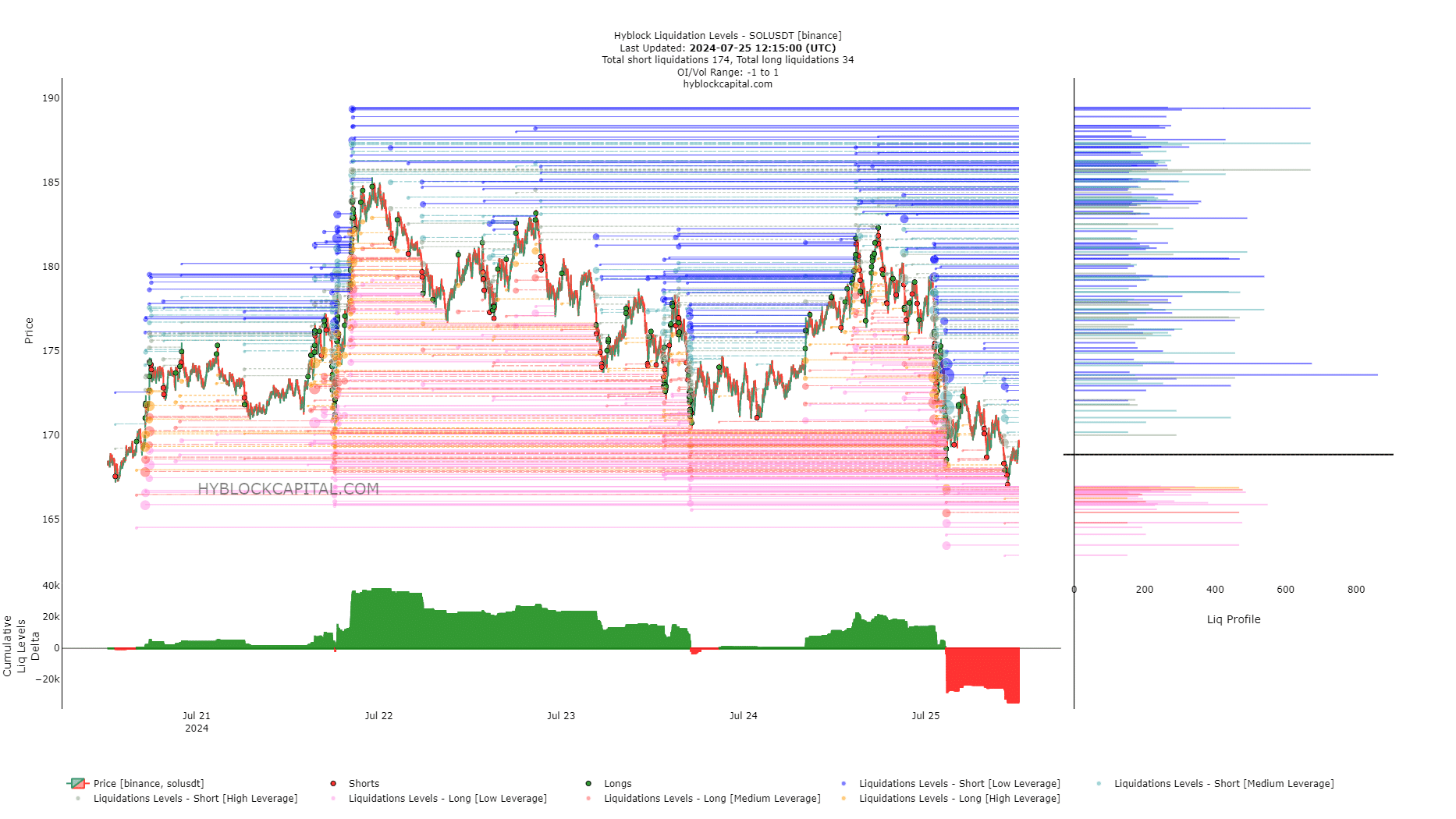

The liquidation levels showed that there may be another twist in the story. The cumulative liquidation levels grew more negative, which is a sign that short positions are becoming more dominant.

Realistic or not, here is SOL’s market cap in BTC terms:

As price consolidates in the $165-$167 zone and attracts more short sellers, more short liquidations will be set in. A bullish short reversal could pressure these short positions and successfully defend the range low.

Overall, traders can expect a price bounce in the $165 zone, but they should also be prepared for a possible breakdown of the range, especially if Bitcoin (BTC) fails to hold $64,000.