- Solana is back in bullish territory.

- The two key resistance levels above could start a trend reversal.

Solana (SOL) has seen steady buying pressure in September. Recent reports have shown that rising spot CVDs indicate real demand and that the rally is likely to be sustainable.

This has proven to be true. After dropping to $141.1 on Sunday, September 22, SOL has gained 5.85% to trade at $149.3 at the time of writing. In other news, technical analyst Peter Brandt also believes that the token could make a big rally after its consolidation over the past six months.

Intermediate resistance opposes SOL bullishness.

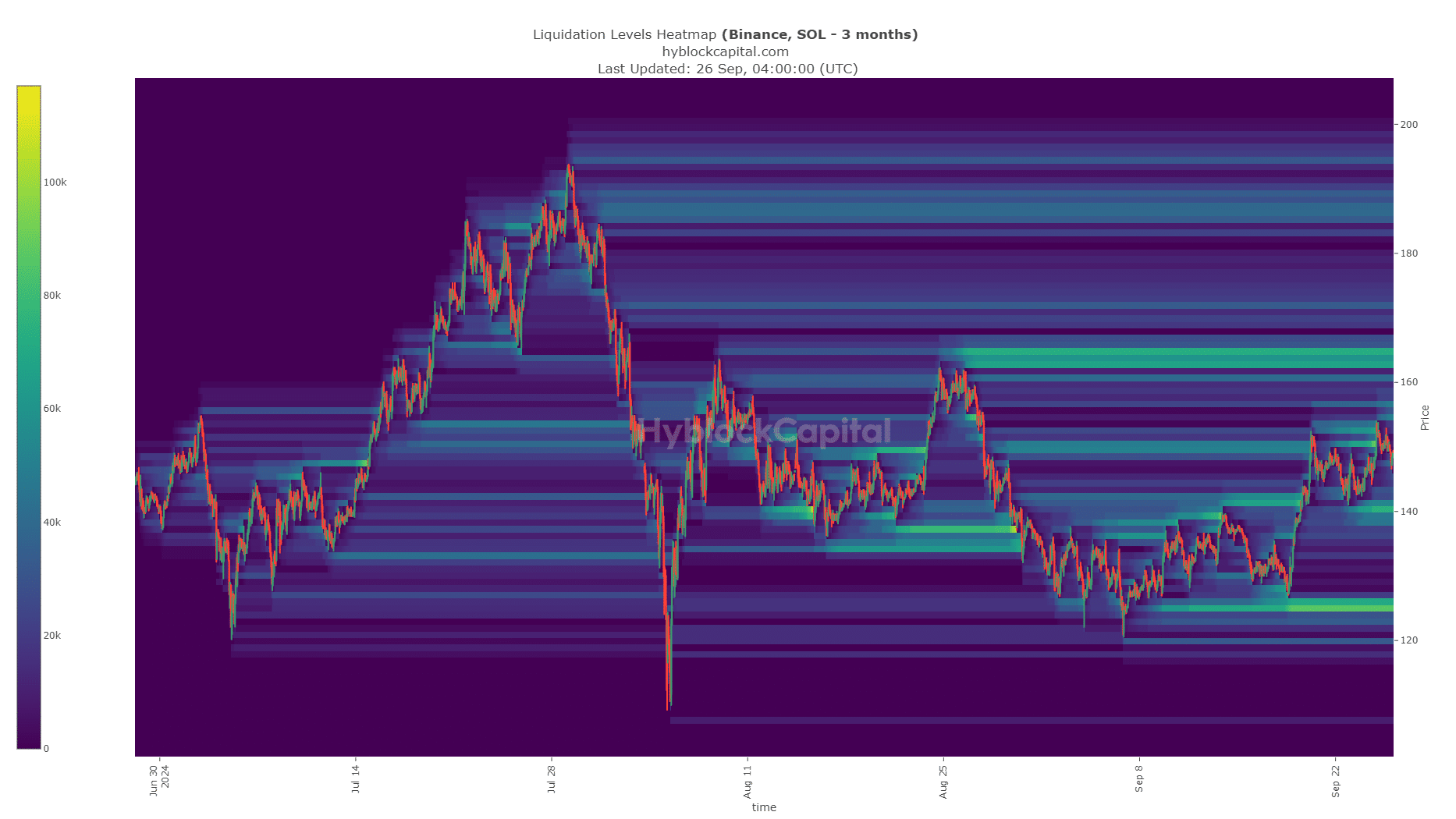

Source: SOL/USDT on TradingView

Over the past four months, Solana has traded within an extended range of $122 to $186. The middle range level of $154 was a 50% correction level based on the rally in February and March.

The confluence of resistance zones has made it difficult to break through, but bulls are hopeful. The accumulation/distribution indicator has been steadily rising in September, highlighting continued buying pressure.

The daily RSI also crossed the neutral 50 level, signaling a change in momentum. Therefore, there is a high possibility that SOL will surpass $154.

There is another strong supply zone just above the major resistance line.

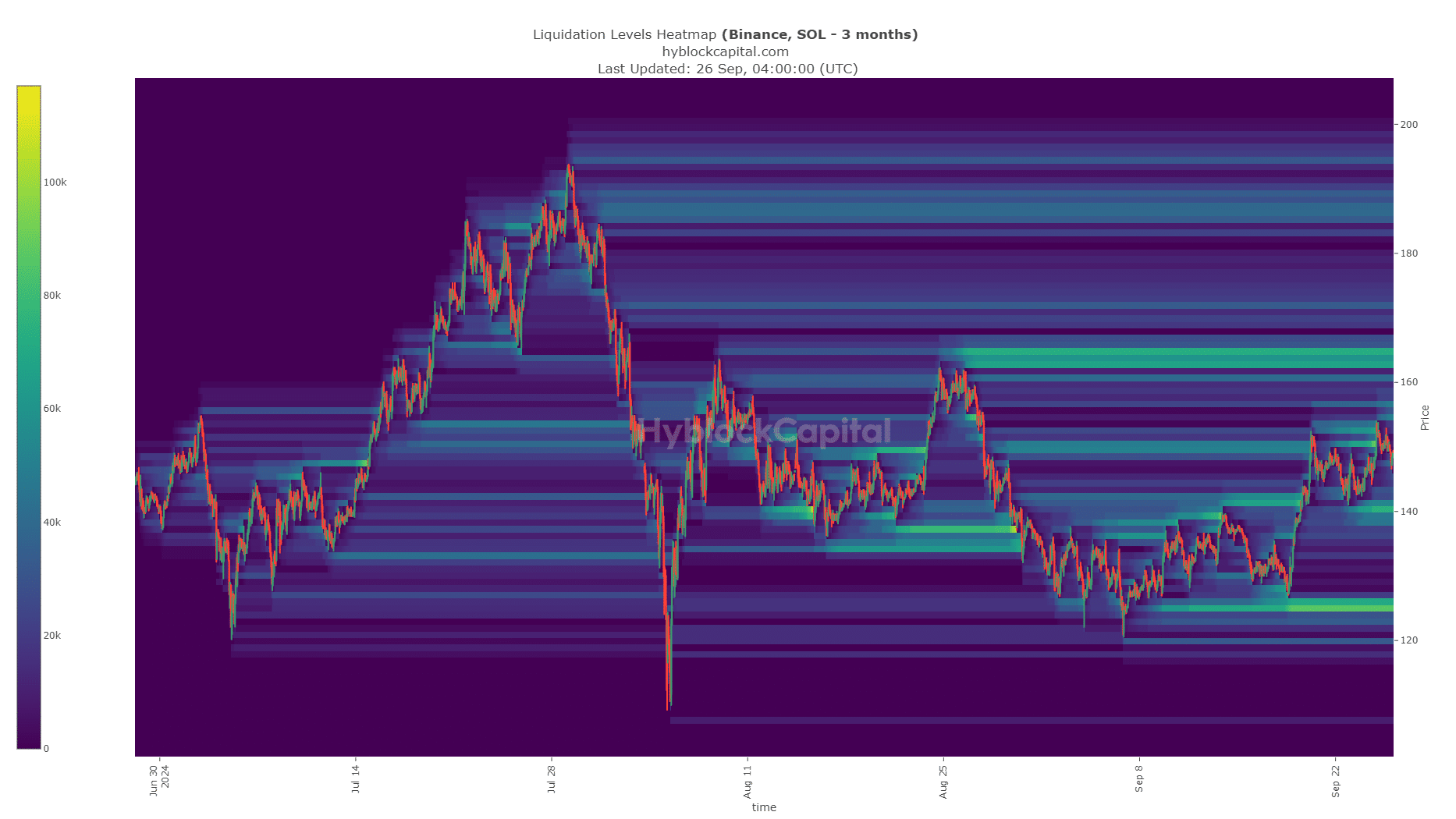

Source: Highblock

A daily session close above $154 could be encouraging, but even then the fight is far from over. According to the price chart, the local highs for the past two months have been formed at $160-$163.

Read Solana (SOL) Price Prediction 2024-25

AMBCrypto analyzed the liquidation heatmap and found a cluster of liquidation levels in the $162-$166 area. This magnetic zone is likely to attract Solana price and force a bearish reversal.

Therefore, bulls will have to be cautious until the $165 level is broken. More risk-averse participants can take profits at $154 and $160 and stay on the sidelines until the $165 level is broken.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.