- The project notes that MainnetBeta’s v1.17.31 update will address congestion issues.

- The price of SOL has risen, but on-chain activity has slowed.

After days of waiting, Solana (SOL) has finally released an update that addresses network congestion.

According to an update via Solana Status, validators on MainnetBeta can now use the v1.17.31 upgrade, which includes the boost needed to fix congestion issues.

Source: X

No more blockages.

For a while, users were having trouble completing transactions on Solana. According to research by AMBCrypto, the development is primarily due to the increase in the number of memecoins on the blockchain.

While the problem persisted, Solana began analyzing the proposed fix on April 12. At the time, Anza, the network’s developer store, released the v1.18.1 testnet upgrade to this effect.

Network assessments show that Solana is fully functional and has achieved an uptime of 99.77% over the past 90 days.

Meanwhile, now seemed like a good time to resolve the matter. This is because the value of SOL and memecoins on the network has increased in the last 24 hours.

At press time, SOL’s value had increased by 4.68%. Bonk (BONK), a dog-themed network meme coin, soared, followed by DogwigPart (WIF).

Considering that updates may increase demand for the token, the price of SOL is likely to rise further. Despite the potential, it is important to evaluate the feasibility of on-chain.

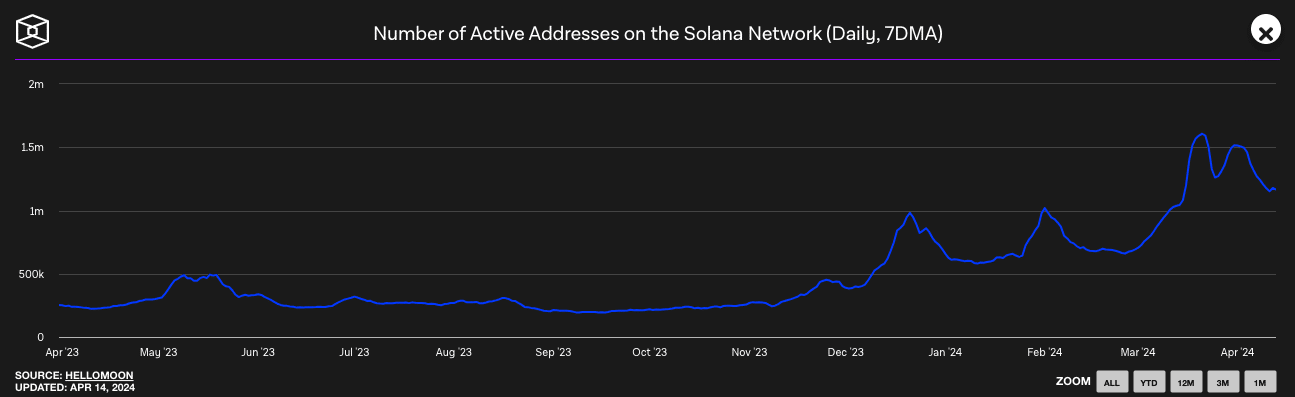

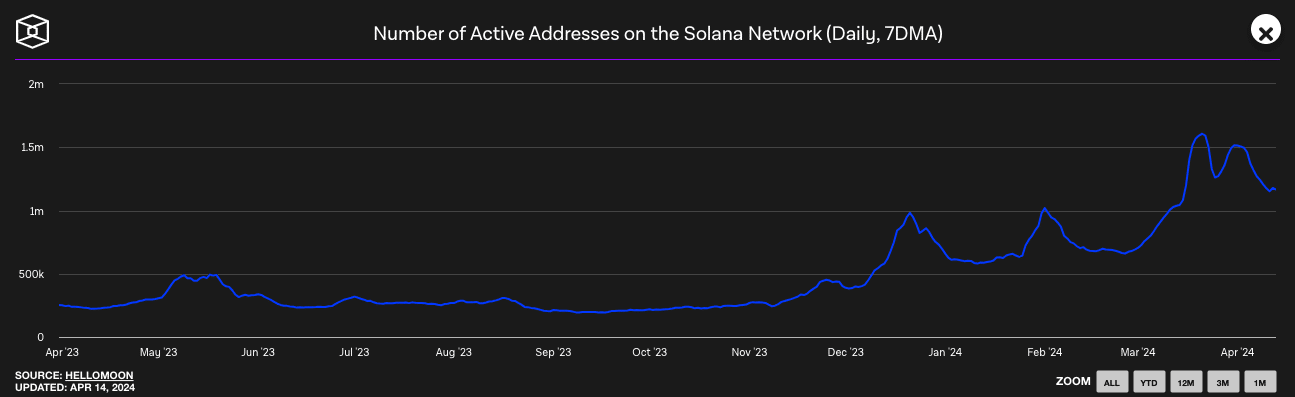

Solana’s active addresses have declined, according to data from TheBlock. At the time of this writing, there were 1.17 million active addresses. This is a noticeable decrease compared to the first week of April.

Source: The Block

Additionally, Solana blockchain explorer Hello Moon showed that the number of assets being moved on the chain remains low.

Are users willing to ask for more SOL?

At the same time, it is too early to assume that the resolution’s impact will be immediate. If network activity continues to decline, your SOL may not spike as expected.

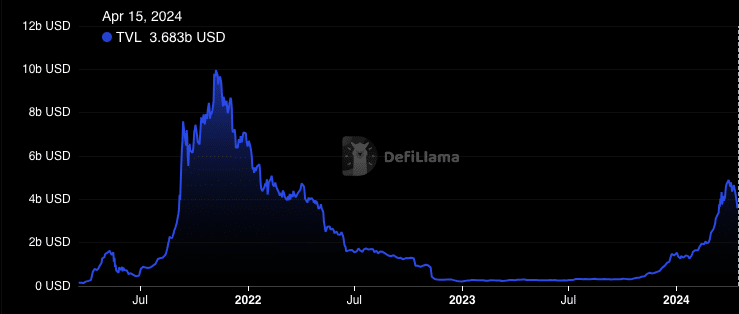

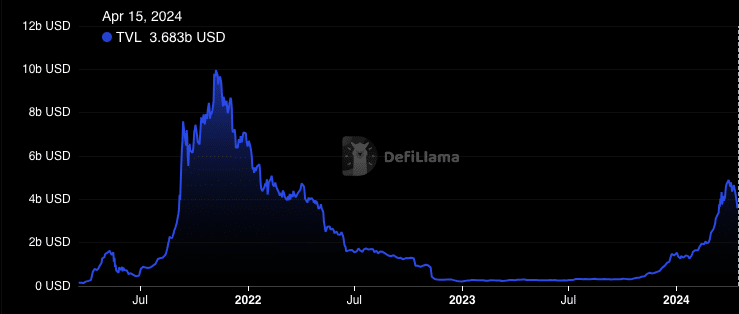

On the other hand, an influx of active users can improve the value status of a token. Another metric that AMBCrypto investigated was Total Value Locked (TVL).

At press time, Solana’s TVL was $3.68 billion. This value has decreased by 22.83% over the last 7 days. TVL is an indicator of the health of the project.

Source: DeFiLlama

An increase in the indicator means an increase in locked assets. But a decline means less liquidity being put into returns.

Therefore, this decline means that market participants have refrained from adding assets to the blockchain’s protocol.

Realistic or not, WIF’s market capitalization at SOL is as follows:

However, the situation may change depending on the market’s reaction to the recent upgrade.

TVL can be increased as users test and ensure that their network is functioning and running at peak performance. If the opposite were true, users could continue to deplete Solana’s liquidity.