Hello cryptocurrency enthusiasts! Today we will talk about the wonderful world of Solana ($SOL). We’ll keep it light and fun, so you won’t need a degree in rocket science to understand what’s going on.

Last week, BTC shocked the world once again, skyrocketing to $35,000 in a matter of hours. Unlike other cryptocurrencies that are currently sighing, $SOL says, “We are just getting started.” It is trading at $31.89, up 2.8% in the last 24 hours.

You can utilize $SOL Trade on Bybit or find Buy it on Binance.

But here’s the deal, friends. There are several signs that suggest we are on a roller coaster ride. If $SOL can’t hold the party above $32, I could see many short-term investors and traders saying, “I’ve got to get out of here!” Sell BTC. This could create some enthusiasm, and we could witness a 15% drop to $27. Brace yourself!

Create a $SOL chart

Now let’s talk about charts. But don’t worry, we won’t go into anything too technical. The Directional Movement Index (DMI) is flashing some warning signs. Sellers are flexing their muscles and bulls must hurry to protect the gains they built during BTC’s recent rise to $35,000. It’s like a tug of war, but BTC is in trouble right now.

For those thinking of selling $SOL (betting that it will fall), keep an eye on the blue +DI line going down while the red -DI line is going up. This basically means that the bears are in control and $SOL could plummet by 15% to $27. Hold on tight!

The overall mood in the cryptocurrency world is not as strong as it was a week or even a few days ago. So traders can safely trade this weekend and Solana can go in either direction, up or down. Similar to flipping a coin, but with more zeros.

If $SOL breaks the $32 resistance, it would be a sign that the bulls are still in the game and eyeing $40. Conversely, if things start to shake out and fall below $30, investors may run for the hills to avoid a cryptocurrency catastrophe.

Bitcoin as an indicator

But there’s more! BTC bulls might have a few tricks up their sleeves. On the daily chart there is something called a ‘golden cross’. No, these are not hip hop dance moves. The slight victory of the short-term moving average (21-day EMA) over the long-term moving average is a technical issue. And recently, the 100-day EMA dropped the mic and overturned the 200-day EMA. This shows that the path of least resistance is up, up and away!

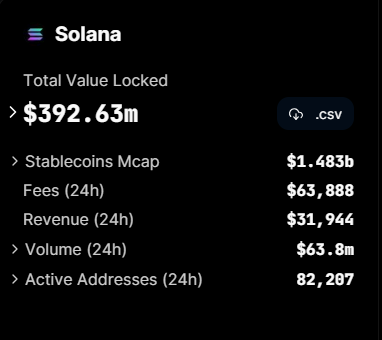

Solana TVL is growing

And check this out. Cryptocurrency data expert Defi Llama shows Solana’s total value locked (TVL) increasing to nearly $400 million. TVL is like a measure of how much cash is left in smart contracts within the Solana universe. Having more cash in a smart contract is like a virtual high-five, increasing trust in the protocol and mitigating the likelihood of a large sell-off. So, if investors continue to pour money into these smart contracts, SOL’s rally could continue to rise.

final thoughts

Now here’s a little BTC update without the confusing jargon and long-winded sentences. Go ahead, prepare your popcorn and see where the cryptocurrency rollercoaster will take us! 😄🚀💰

Solana was one of the blockchains that surprised everyone during the last bull market. We’ll keep a close eye on developments and keep you updated when something cool happens.

If you enjoyed this blog, take a look at the last two token updates for $SHIB and $LINK.