- Solana traders and investors lost more than $65 million in the last 24 hours.

- Experts say Solana (SOL) is not falling naturally but is being pushed down by whales.

Geopolitical tensions and Japan’s recent interest rate update have caused the entire cryptocurrency market to plunge by 16% in the last 24 hours.

Meanwhile, Solana (SOL), the world’s fifth-largest cryptocurrency by market cap, has experienced a serious breakdown of its $121 support level. This breakdown came as SOL saw a significant price drop of more than 20% in the past 24 hours.

Solana’s major faults

After this massive price drop and collapse, SOL was trading around $113 at the time of writing. Meanwhile, trading volume had surged by over 245% in the last 24 hours.

The surge in trading volume suggests increased participation from investors and traders.

As the price of SOL plummeted, a former Coinbase angel investor posted on X (formerly Twitter) that Solana was not falling naturally, but was being pushed by whales.

He also pointed out that whales lower the SOL, which encourages beginners to sell their holdings and buy them back at lower levels.

He also added:

“They will steal your bag and make you buy it again at a higher price.”

Over the past 24 hours, Solana investors and traders have liquidated approximately $65 million in short and long positions, with $47.16 million liquidated from long positions and $18.28 million liquidated from short positions.

Solana Price Prediction and Upcoming Levels

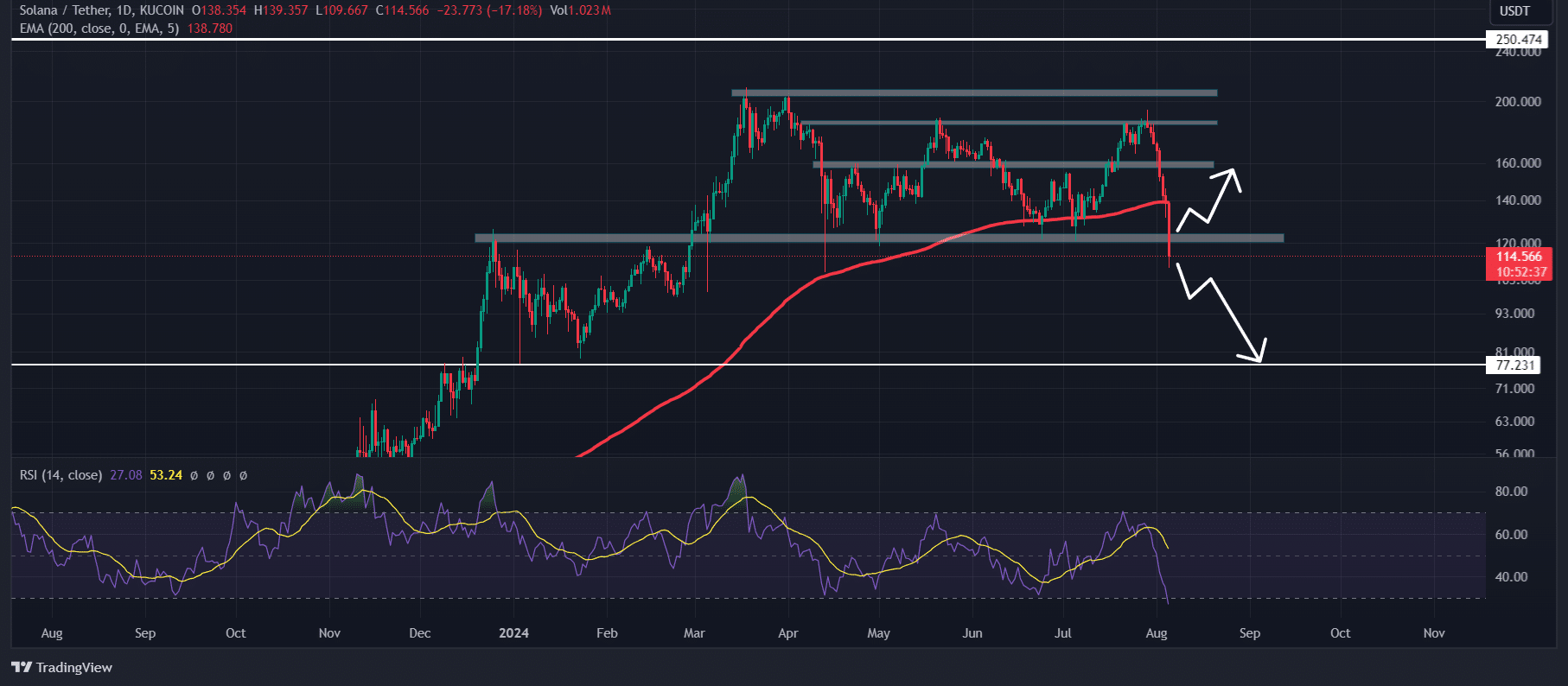

According to expert technical analysis, SOL is highly bearish and is trading below the 200 Exponential Moving Average (EMA) on a daily basis.

In addition to this, there has been a significant breakdown of important support levels. However, the daily candle close will be important in determining whether SOl will continue to decline or see a reversal.

If SOL closes its daily candle below the $122 level, it is likely to fall another 30% to $77 in the coming days.

On the other hand, if SOL closes the candle above $122, there is a high possibility that the price will reverse to $155 in the coming days.

Source: Trading view

Despite Solana’s price prediction, the technical indicator Relative Strength Index (RSI) is in the overheated sell zone, possibly signaling a price reversal.

However, SOL’s outstanding interest fell by 26%, indicating investor interest was waning amid the market crash.

Realistic or not, here is SOL’s market cap in BTC terms:

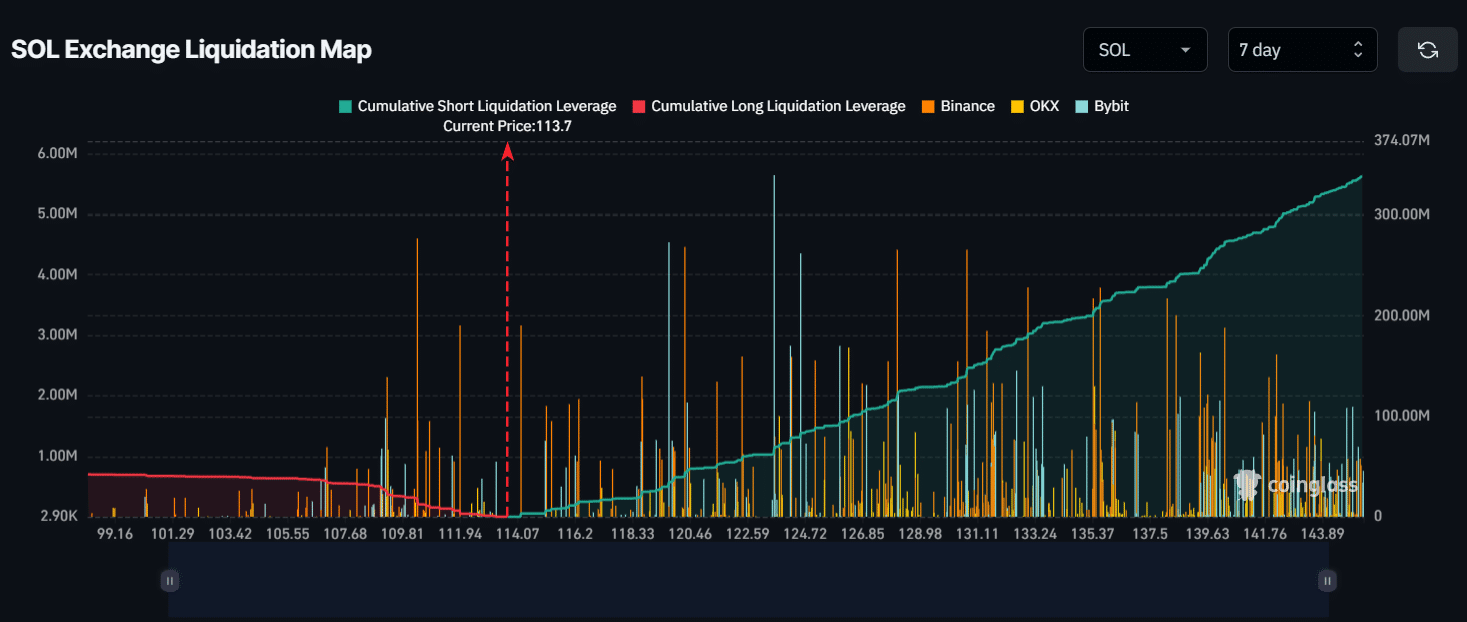

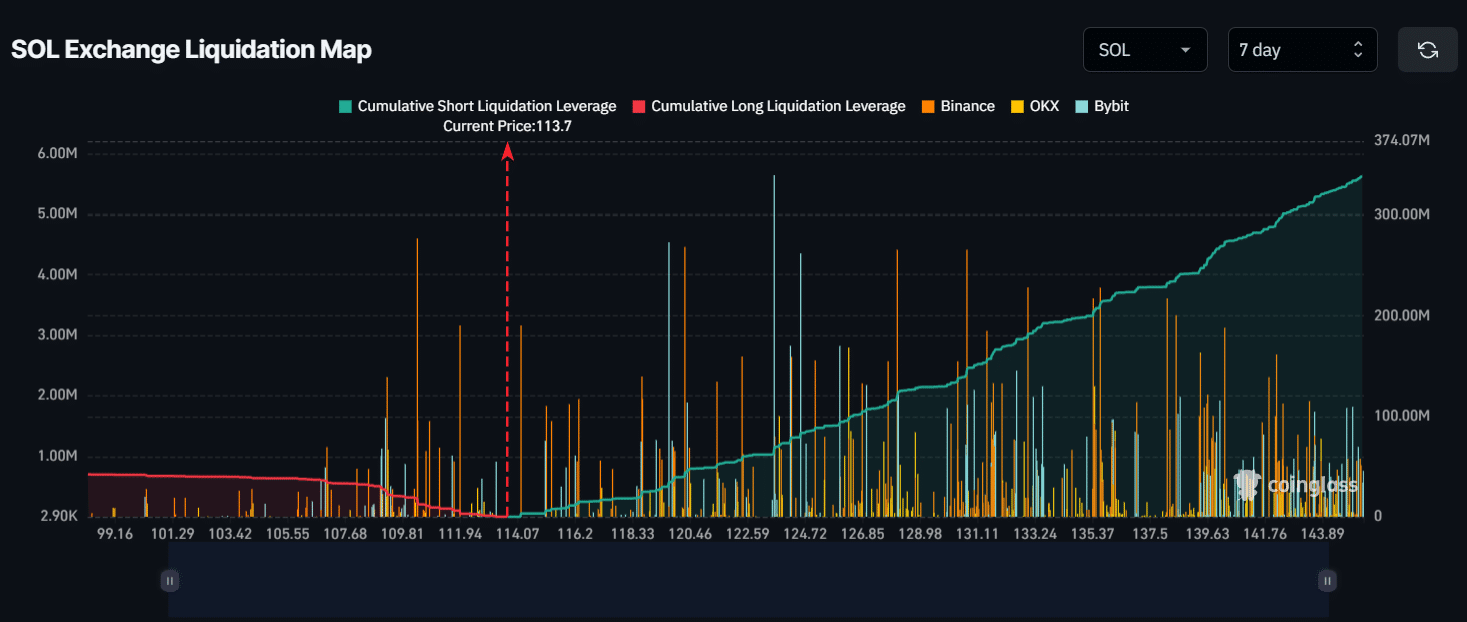

SOL’s upcoming liquidation level

According to on-chain analytics firm CoinGlass, the two major liquidation levels currently are $100 as the lower limit and $130 as the upper limit.

Source: CoinGlass

If the market continues to decline and reaches the $100 level, $40.5m of long positions will be liquidated. Conversely, if sentiment changes and SOL rises to the $130 level, approximately $140m of short positions will be liquidated.