- Two market analysts predicted that Solana’s price movement would be bearish.

- AMBCrypto predicts that the SOL price will fall to $120 or lower in the short term.

Over the past 40 days, Solana has faced some significant challenges on the charts, with SOL down 17.26%. This downward trajectory could accelerate as additional insights supporting the decline come to light.

In particular, SOL is expected to trade higher following this recent decline, so the recent downtrend could be the final catalyst for a major uptrend.

SOL Crossroads, Potential Downside Forecast

According to Karl RunefeldSOL, a prominent market analyst, is at a critical juncture and could either rise or fall in the coming days. According to his analysis, Solana is currently trading within a descending triangle, a pattern that can have either bullish or bearish consequences depending on how it is formed.

Source: Trading View

In fact, Runefelt predicts a drop to $112.50 if the bears dominate the market. Conversely, he also supports a rise to $155, just above the pattern’s peak, where significant liquidity is likely to be present.

Echoing these sentiments, analyst Kaleo also said: A sharper decline is expected For SOL, we are targeting the $80 mark. This level has been identified as a key support area and is expected to attract enough liquidity to offset selling pressure and drive the price higher.

Source: Trading View

According to him,

“(SOL) will reach a new all-time high.”

Kaleo had previously forecast $120 as a key support area to push SOL to new highs. However, as market conditions changed, his focus shifted to the $80 level.

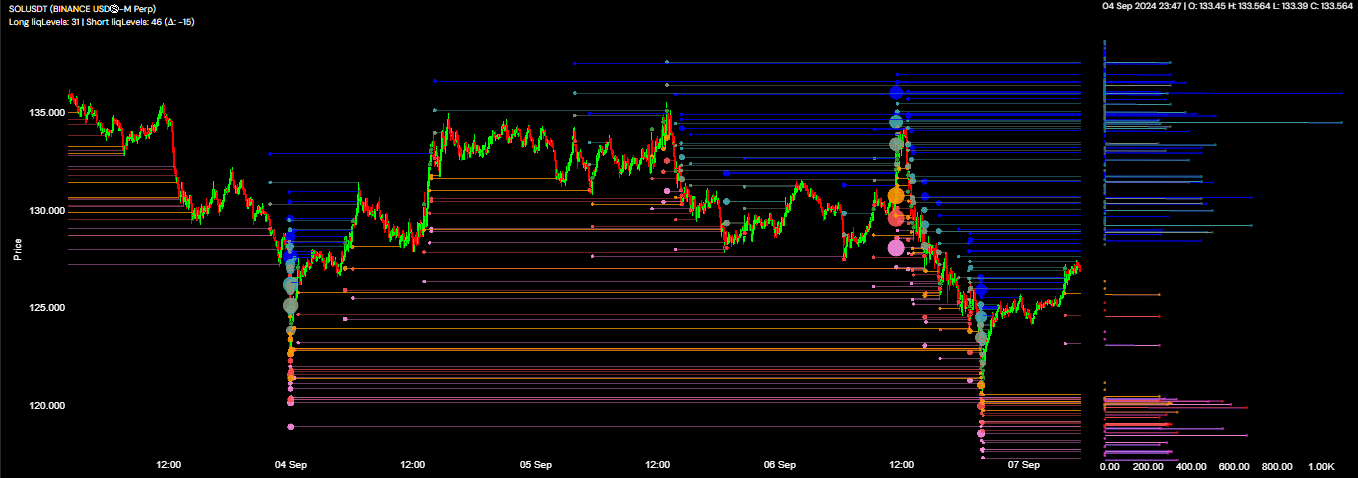

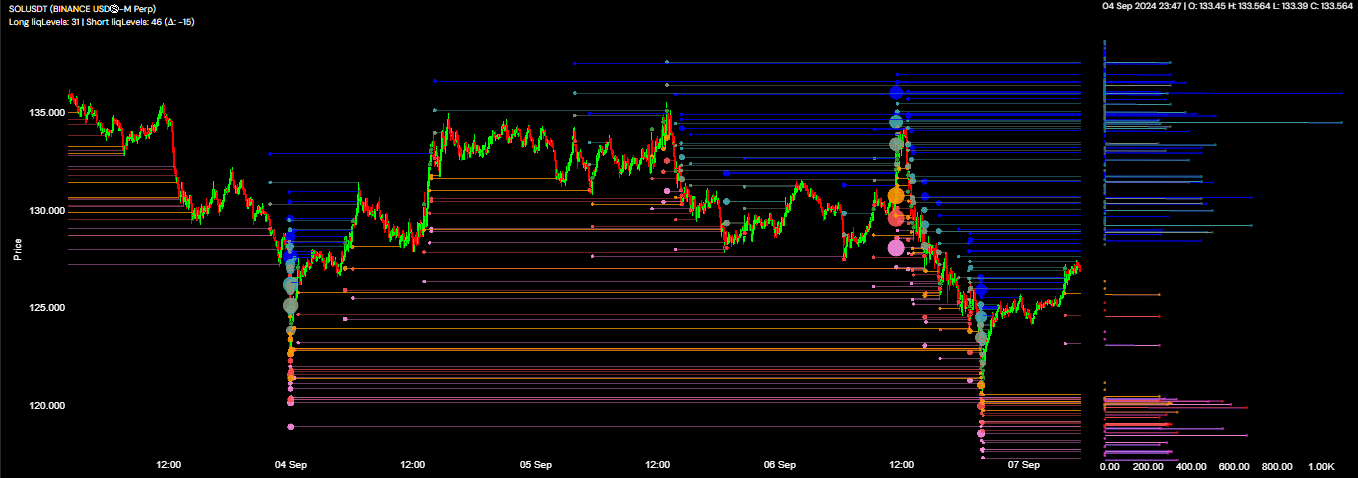

AMBCrypto also observed: Coinglass Trends Long traders who expected the price of SOL to rise have suffered losses. In fact, $8.99 million has been lost in the last 24 hours as the market has moved against their positions.

Additionally, according to Highblock, the cumulative liquidation level delta has turned negative at -15, indicating that short sellers are starting to dominate the market.

Further analysis reveals that there is a significant liquidity cluster at and below the $120 level, suggesting that the price will trade lower into this liquidity zone, potentially clearing the existing liquidity cluster before acting as a pivot point for a price reversal.

Source: Highblock

AMBCrypto went one step further and monitored Open Interest to predict SOL’s next move.

Traders are betting on a decline in SOL.

Open Interest (OI), a measure of total active contracts in the market to gauge liquidity and market sentiment, indicated a bearish outlook for SOL.

At the time of writing, Open Interest had fallen 4.97% in just 24 hours, reaching $1.94 billion. This decline suggested that traders were expecting the price of SOL to fall, and the altcoin was trading at $127.49.

If this downtrend continues, SOL prices are likely to fall further from the aforementioned levels.