- Solana has been five years since it was founded as a comprehensive ecosystem.

- Dex volume plummeted and the investor’s convictions are weakened in the cooling sentiment, facing a big downturn.

Solana (SOL), once welcomed by the breakout of the Polish post encryption era, is now found at an important intersection.

During the 5th anniversary, the high -speed block chain, which was once competing with Ether Leeum (ETH) in buzz and activities, is caught with a cold recession.

Dex volume has been craters from $ 330 billion to $ 33 million from $ 330 billion to this year.

As the open interest falls, is Solana simply experiencing a temporary sofa, or is this the beginning of a deeper structural release?

Happy Birthday, Sola Me!

Launched in March 2020, Solana entered the site that promises the unmatched speed and expansion that is unmatched by the next -generation layer that was produced for mass adoption.

Powerful developer communities and flaws are the most likely to be ranked in the NFT project and high frequency trading platforms.

At the peak, Solana boasted billions on tvL and called the deadly “Ethereum Killer.” But five years later, the scenery changed.

Despite the technology upgrade and ecosystem efforts, Solana is fighting against a large amount of reduction and disappearing market enthusiasm, and we’ve looked deeply about what’s wrong.

Dex activity and public interest sink

Source: Artemis

As Solana goes beyond five years of mark, the performance of the chain draws a cool picture. According to Artemis data, Dex volume collapsed from $ 36 billion in January to less than $ 1 billion in mid -March.

Decline is steep, unforgivable, and there is little hope for recovery. This rapid stagnation reflects the decline of decline, decrease in user participation, and the migration of liquidity elsewhere.

Source: COINGLASS

Gift data is added to concern. Even though the price of SOL did not have more than $ 150, the open interest in SOL FUTURES plunged from $ 5 billion to $ 3 billion in more than $ 5 billion in March.

This divergence faints the cooling appetite for investor convictions and leverage locations.

In the case of a network of fierce competitors of Ether Leeum, the silence of the order is becoming more and more difficult to ignore.

Solana price outlook

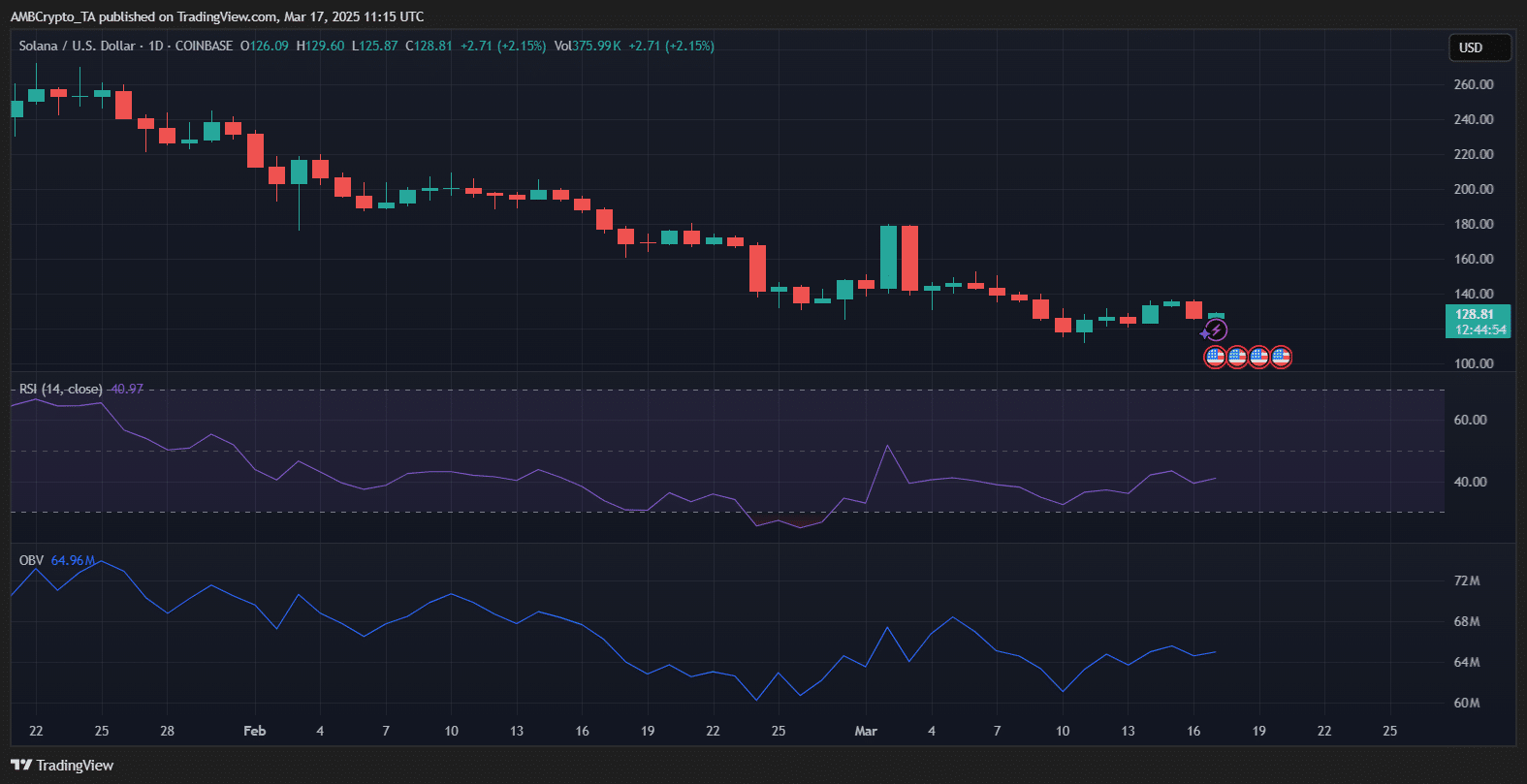

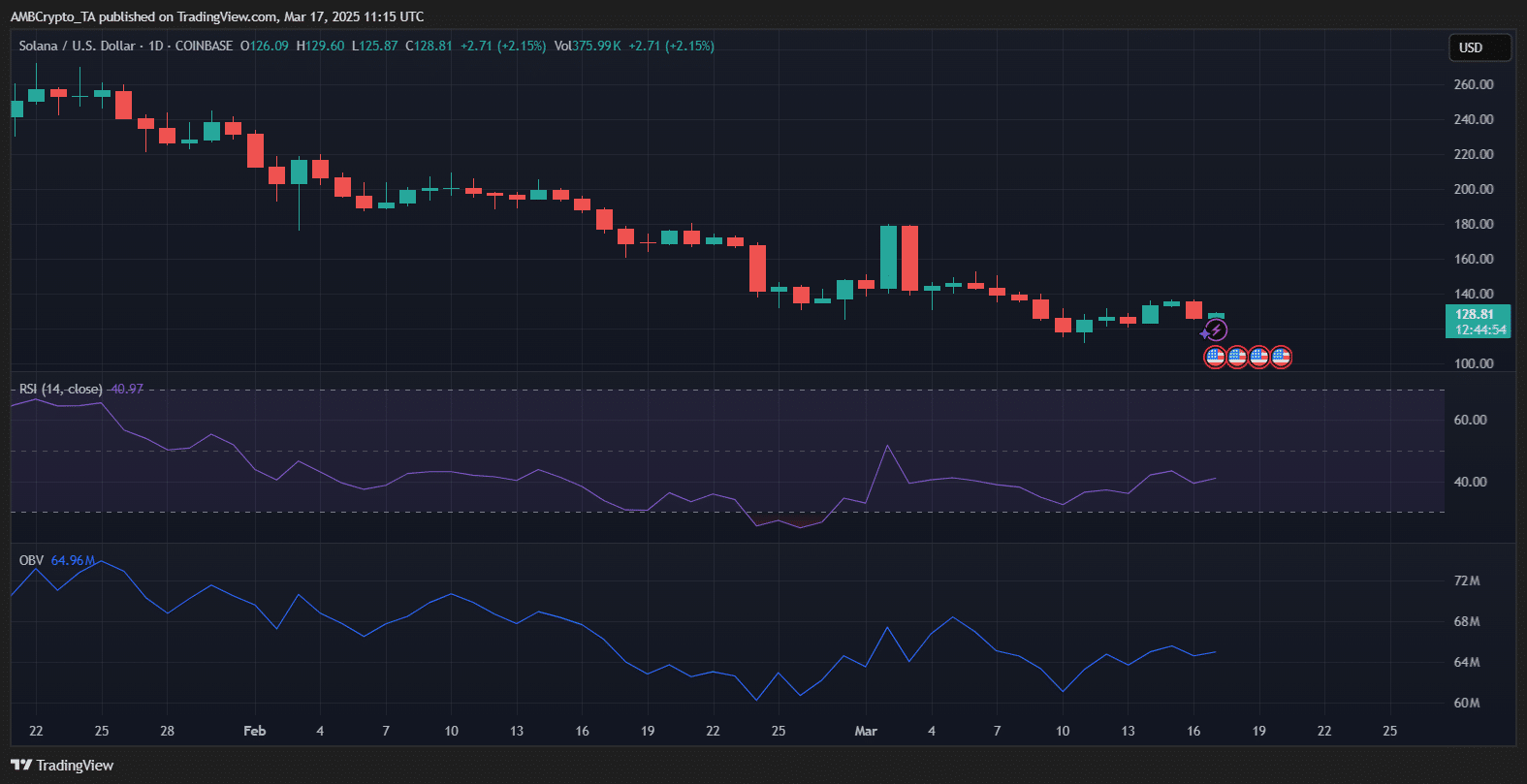

SOL was traded at $ 128.81 for Press Time after a 2.15%benefit every day. The RSI hovered around 41, which showed weak optimistic momentum and left well below 50 neutral marks.

OBV has 69.6 million people, which did not show meaningful spikes for purchase pressure.

Source: TradingView

Price measures also strengthen the weakness by reflecting a clear low storage structure from the end of February. If the bull does not convincingly collect the $ 140 level, the SOL will be in danger of falling.

Due to the thinner volume and emotional cooling, the next main support is near $ 120.