- The SOL/ETH chart has a significant surge in suggesting that Solana is getting more traction than ETH.

- This large -scale surge may be due to the growth of recent transactions and network use.

Solana (SOL) and Ethereum (ETH) showed various performance last month, and assets occupied other channels.

On the other hand, SOL has been optimistic with 3.45%positive results over the last month. ETH is another scenario. 14.37%decreased to add the power of the former.

However, the analysis shows that Solana’s recent profits and prices of assets compared to Ether Lee’s last day.

New record, high interest

In the last 24 hours, the SOL/ETH DAILY chart has been over $ 0.08043, the highest from the beginning. Naturally, this milestone signals fresh capital rotation to Solana.

Source: TradingView

Its meaning is clear. Investors are allocating more funds to SOL compared to ETH.

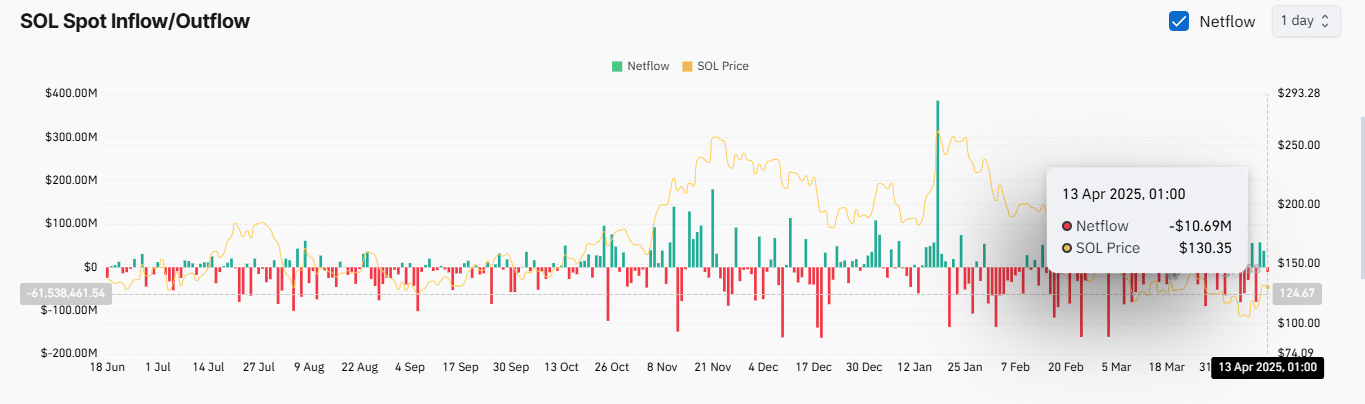

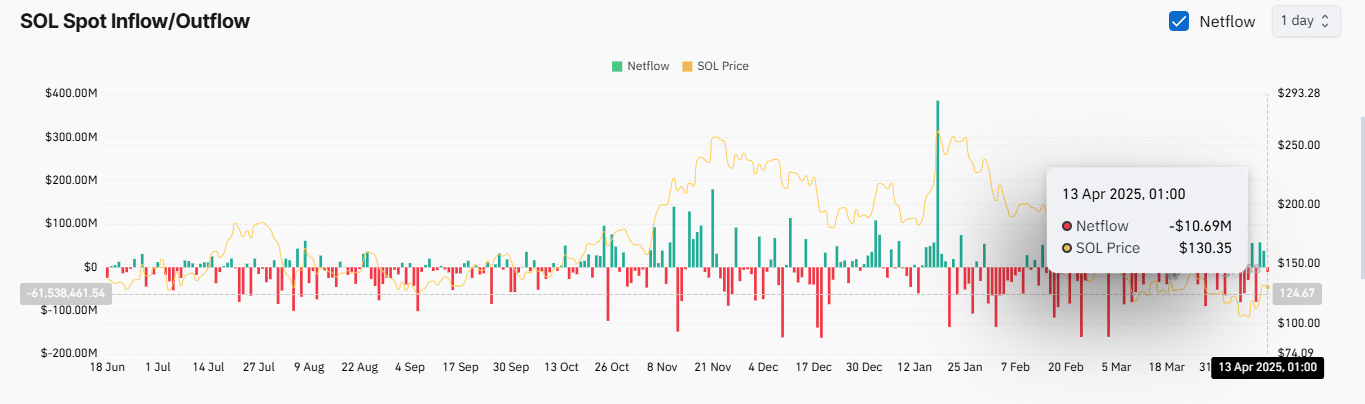

This kind of movement usually reflects the expectation of Solana’s powerful performance from short and mid -term. In addition, the liquidity flow data of artemis is consistent with these changes.

Last week, Solana had a positive net inflow of $ 25.4 million, subtracting leaks from the total inflow.

In contrast, Ether Leeum has seen a negative trend of $ 8.8 million, indicating the full back of investor trust when fluidity escapes from the network.

Source: Artemis

More factors surrounding SOL’s rule

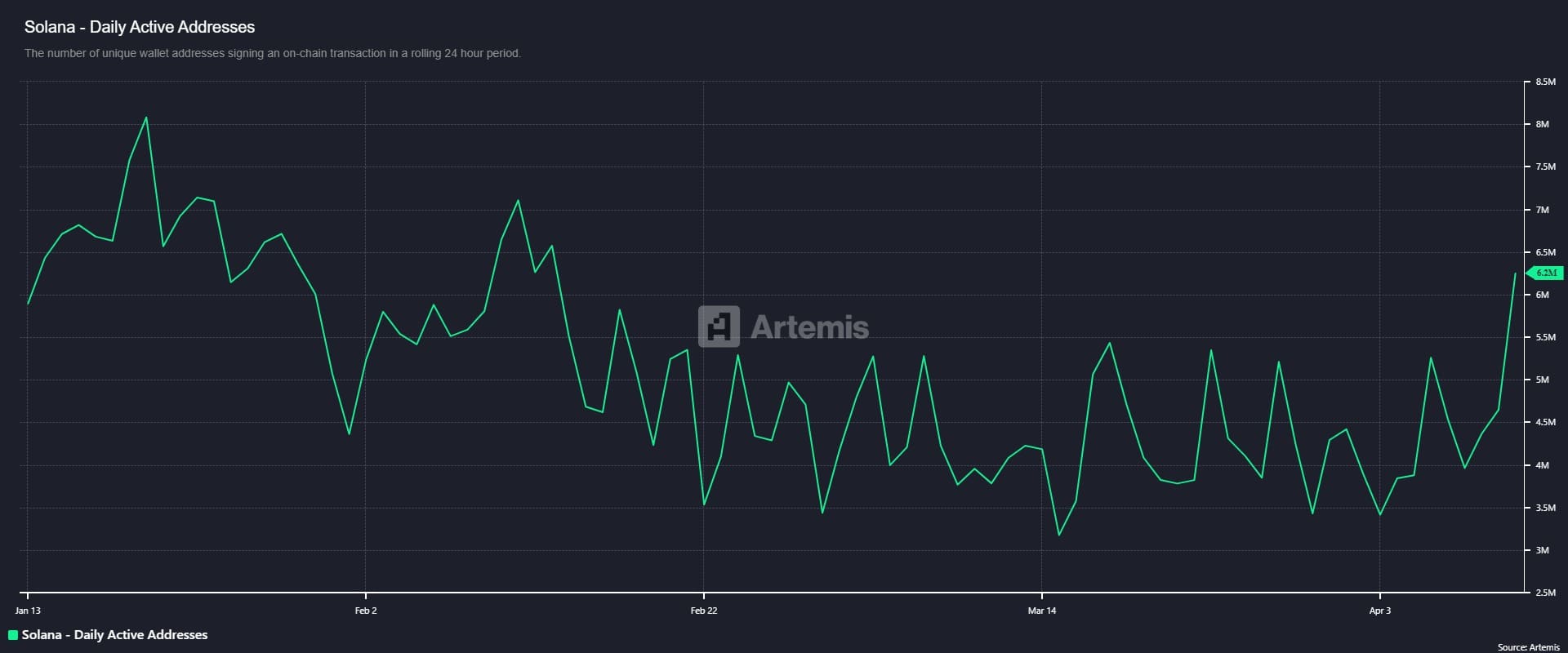

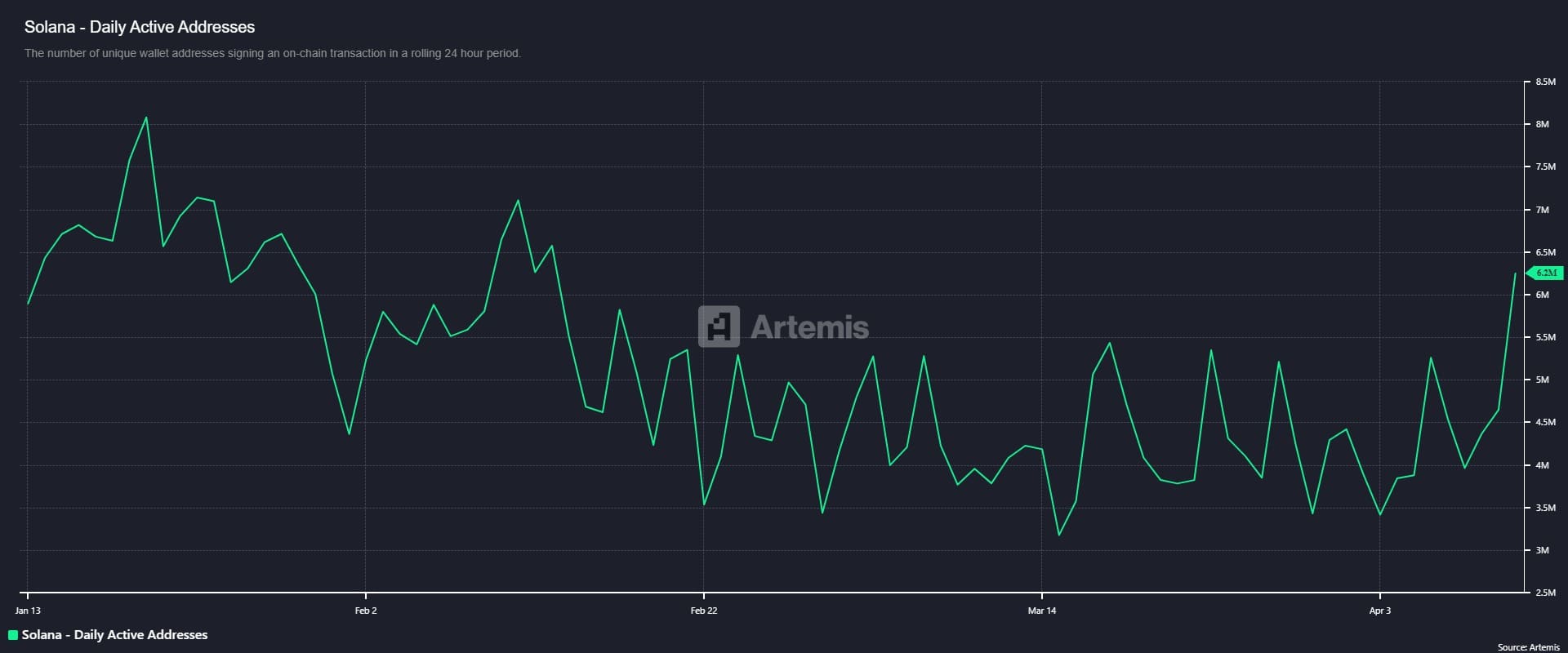

Solana’s recent market share growth has been promoted as warm chain increases. The daily active address has recently reached 6.2 million and the highest level since February.

This surge is increasing interest in the market. As emotions improve, more users are actively participating in the network.

Naturally, this increased activity causes demand for SOL.

Source: Artemis

As a result, Solana’s daily transactions increased to 69.5 million on March 1, emphasizing the strengths and growth of the market.

In fact, Solana’s availability reached $ 12.6 billion, which was the last saw in February.

If the supply of Stay Blemoin increases, it means that the demand for use in the network increases, and the value of the SOL is added over time.

Source: Artemis

The market responds positively

The market response to Solana’s recent activities was encouraging.

After $ 95 million in the market after two days of sale, SPOT Traders resumed the purchase.

In the last 24 hours, SPOT Traders has purchased an asset worth $ 9.28 million to increase emotions.

Source: COINGLASS

If the warm -up activity continues to prefer the bull in the market, the SOL is primary for additional rally with continuous spot traders.