- Several Solana Whale addresses have abandoned more than $ 46 million tokens a day.

- Altcoin can fall more if the wider emotions remain weak and the level of support is not strong.

The wave of whale activities recently shook the Solana (SOL) market.

According to Altcoin’s warm -chain data, some large holders on April 5 have been feared in deeper price modifications.

According to Lookonchain, according to a recent tweet, the wallet address Hujbzd has left an exodus by discarding about $ 3.3 million of $ 3.3 million.

Clearly, BNWZVG sold 80,000 SOL ($ 9.47m), while 8RWUQ5 and 2uhuo1 offered 30,000 and 25,501 soles, respectively.

This dumps $ 46.3 million in a short window.

Is it a deeper correction of the horizon?

These heavy sales are generally when the hints of weakness of Solana, especially whales lead the sales pressure.

If such sales occur immediately after the SOL is not proven, at least now it suggests that there is no interest in long -term holding.

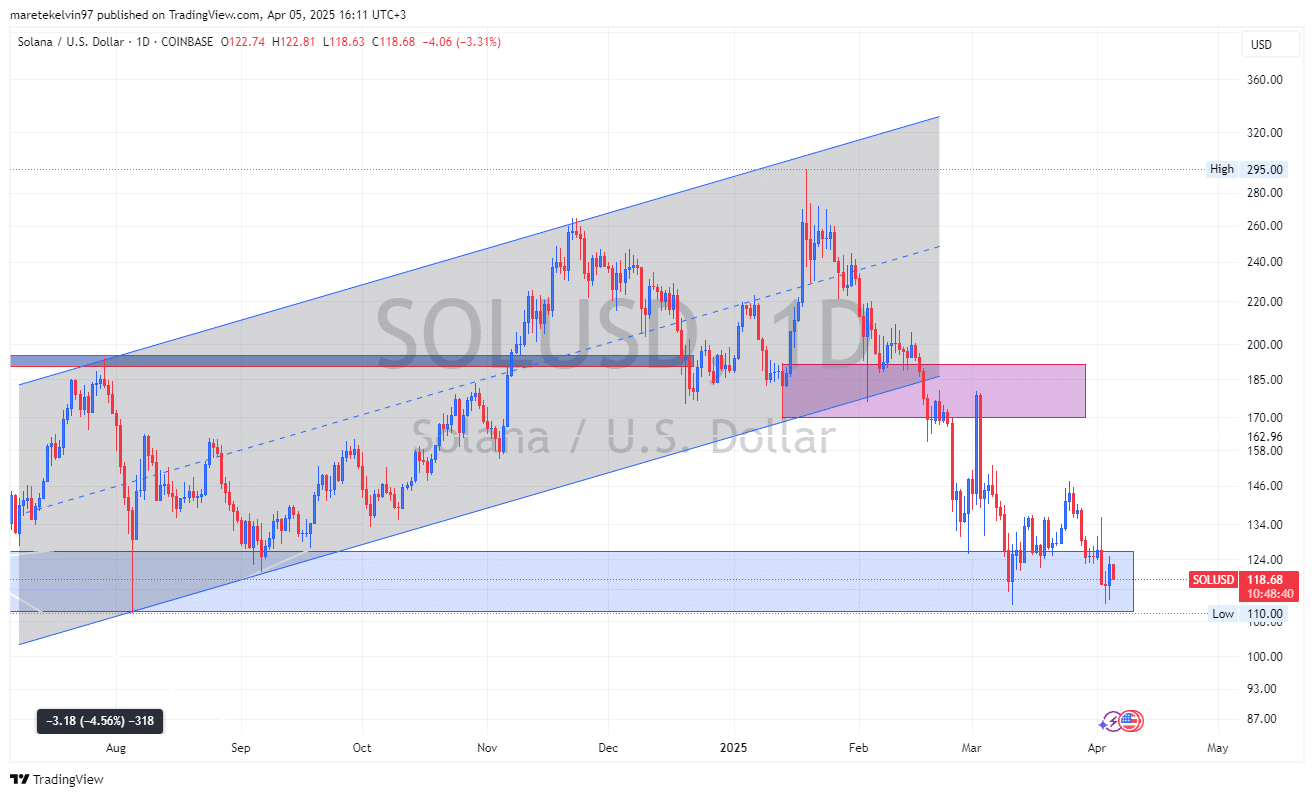

At the time of writing, SOL was already struggling to regain the level of resistance of $ 120. If the pressure is added to a new sale, the $ 1OO support area may be restarted.

If the buyer does not defend the range, the dip may probably extend to $ 98, or psychological threshold.

Source: TradingView

Market sentiment is cautious about SOL

The wider market does not help. Altcoins seems to be following the lawsuit because King Coin is still volatile. When fear comes back, both retail and institutional investors can stay in a side job.

This reduces the likelihood of recovering SOL in the short term due to positive ecosystem development or improved macro trends unless a new catalyst comes out.

However, it is worth noting that whale activities do not always mean fate for sleeping. In the past cycle, a large dump sometimes prioritizes the accumulation stage.

Watching whether this whale is going back or loosening your fresh wallet will be the core for market participants.

Technically, SOL prices are trying to reverse in major demand areas. This area has seen some rejection and has been found to be strong many times.

If this periodic pattern is maintained, the SOL will not be lost despite the Exodus, and the area can refuse the price.

Currently, both merchants and investors must watch out for the volume trend and how SOL acts for about $ 110 near the current demand area.

Large quantities of bounce can know short -term reversal, while weak purchases can open doors that can fall less than $ 100.