- As SOL resumes the main support, whale activities are strengthened, resulting in short -term correction problems.

- Technology gives hints on recovery, but weak feelings and low social buzz keep the trader carefully.

big Solana (SOL) Whales made 71,448 soles (about $ 8.5 million) to Biny and caused fresh speculation.

This movement arises as concerns about increasing sales pressure of major holders across the Solana network increases.

In the press time, SOL has been traded at $ 107.32, reflecting a 1.08% decrease in the last 24 hours.

In addition to this transaction, more than 149,000 SOLs Off -road In the last 24 hours, other large -scale holders have sales from $ 102 to $ 108.

Interestingly, despite these remarkable withdrawal, the same whale still has 568,000 SOLs with about $ 68 million in a staying contract.

Such a thermal movement is questionable about whether Solana is heading for short -term modifications or whether whales are assigned prior to the next stage of market behavior.

SOL Price Action rebounds in support

SOL has recently defeated an important level of support near $ 103, which has been consistent with the demand area during the previous modification.

The bounce helped to stabilize the price temporarily and paid attention to the main resistance level of $ 120.43 and $ 143.84.

If you pass this area, you can inject fresh exercise and know short -term recovery.

However, if the SOL does not maintain more than $ 103 in the future, the sales pressure will be accelerated and the price can be raised back to two digits.

Therefore, the bull must maintain this level so that the market structure does not turn to a weaker trend.

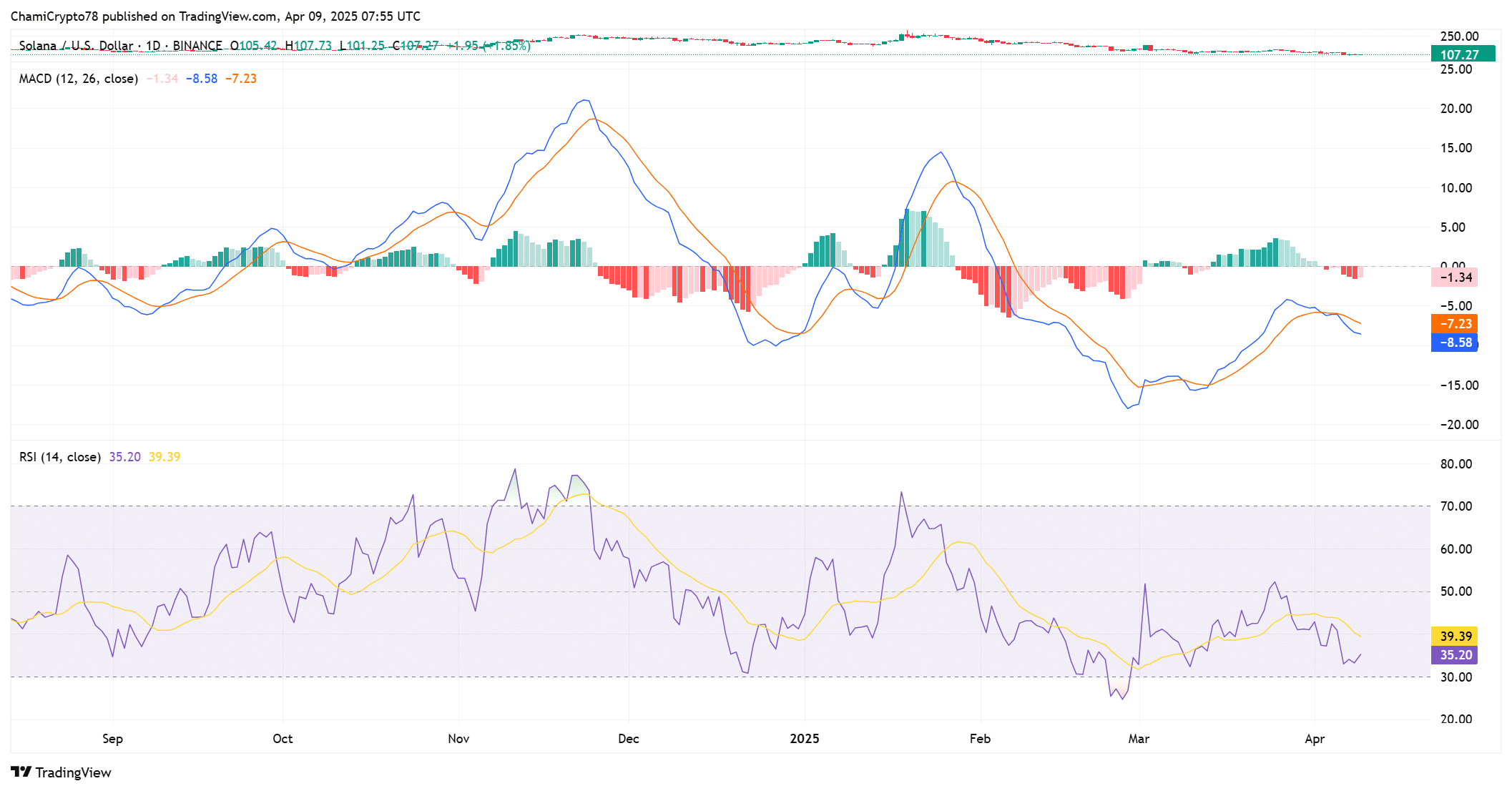

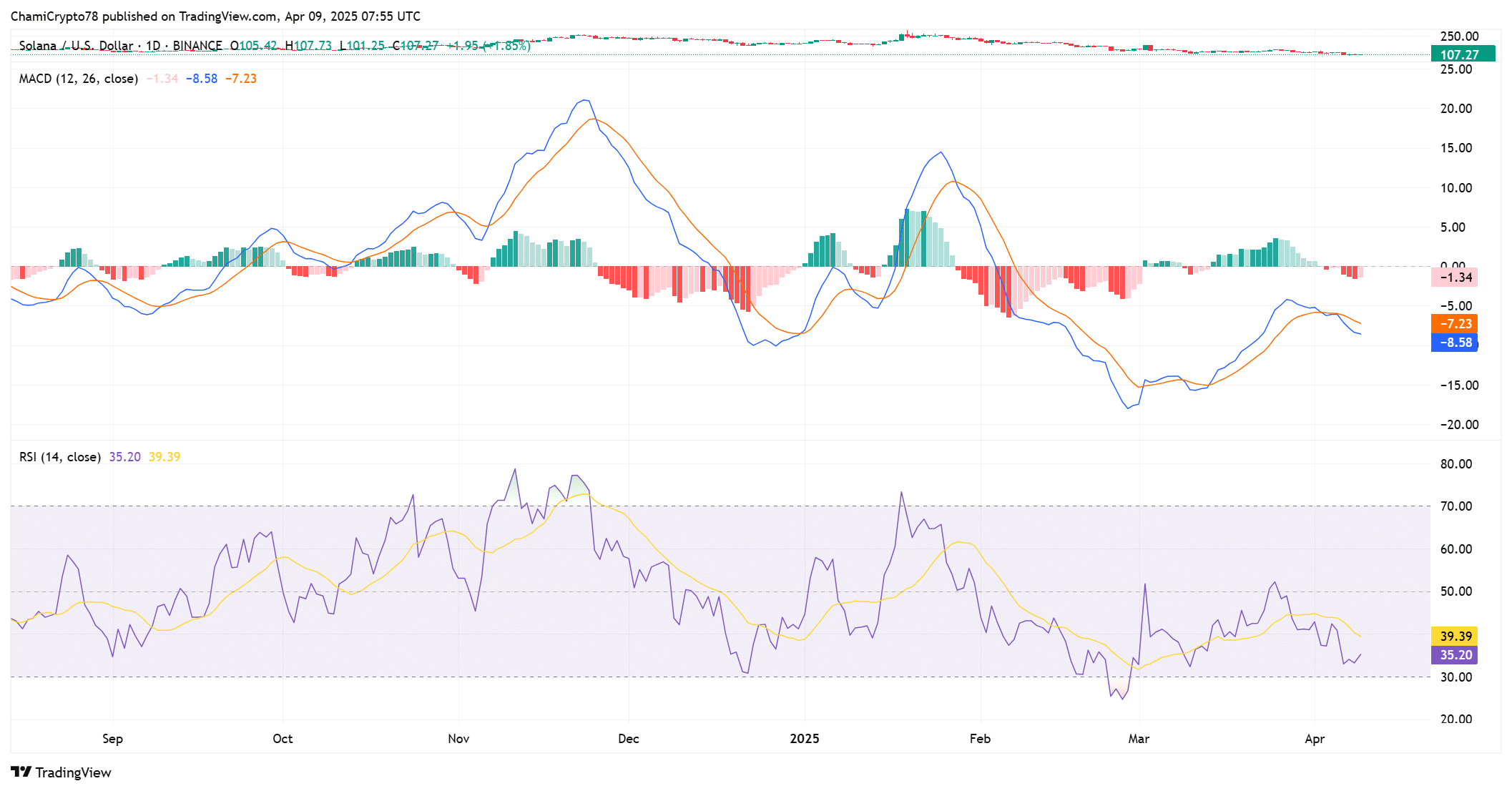

Source: TradingView

Merchants are cautious

Solana’s total weighting feelings are -0.178 in the press time, reflecting the general attention of the entire market. The traders seemed uncertain about the instructions of the SOL, especially according to the large -scale selling of influential wallets.

The price showed a temporary strength, but the emotions were fragile and reactive to the sudden change of chain behavior.

Thus, continuous meetings will have to renew the trust in the perception of the crowd and the foundation of Solana.

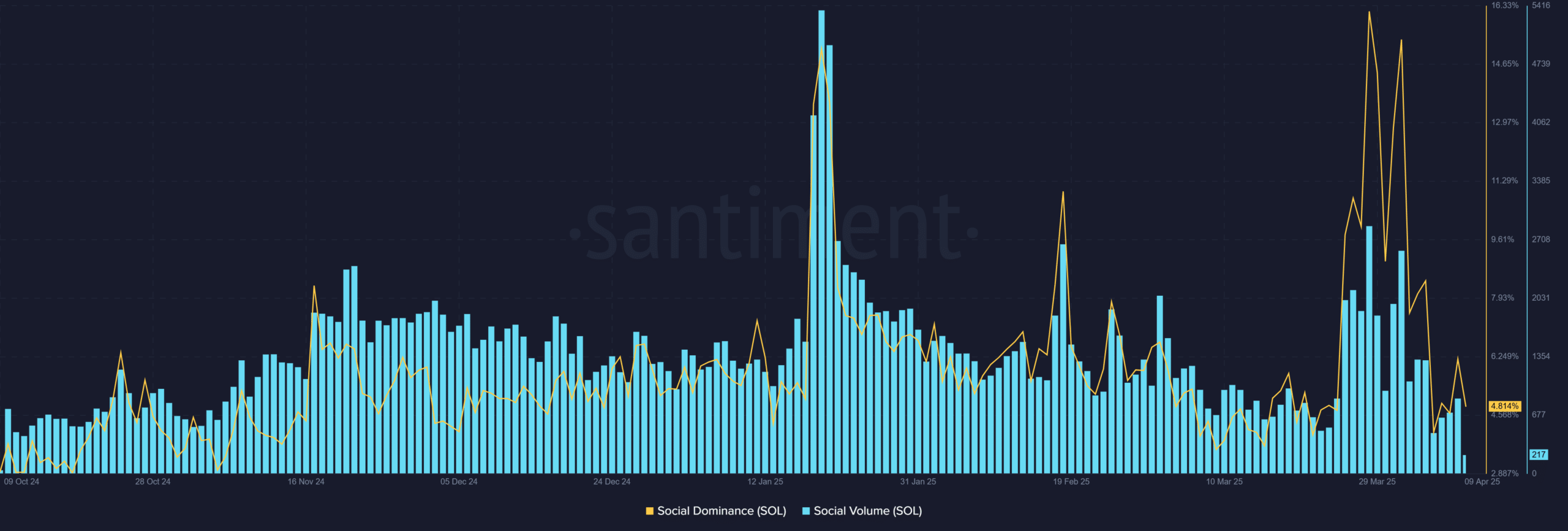

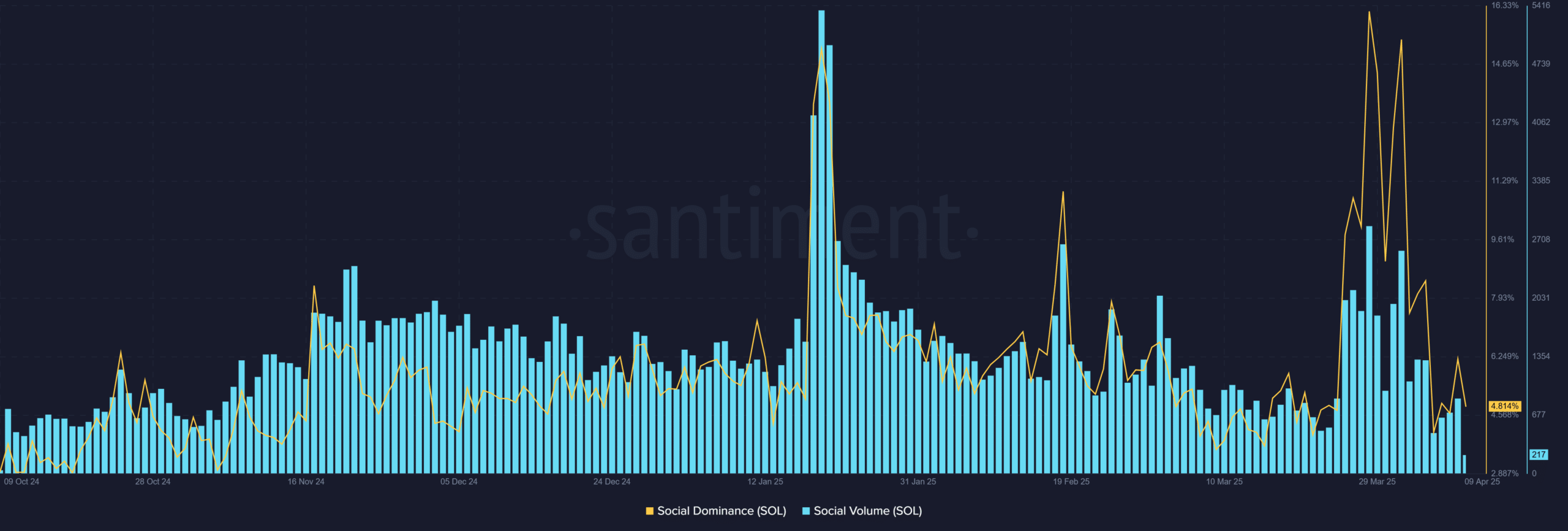

Source: Santiment

Momentum brewing?

Solana’s RSI crossed about 35 people at the time of writing and placed it close to the hold hold area and showed the possibility of a price rebound.

In addition, MACD is approaching a crossover point from momentum movements as the signal line narrows.

This provides a technical foundation for recovery if it does not guarantee meetings but supports the upward exercise. Traders must monitor these indicators closely to confirm the short -term trend reversal.

Source: TradingView

Solana’s social buzz is cooled: Can the excitement come back?

Social interest in Solana has noticeably dropped by reflecting the uncertainty of a wider market. According to Current dataThe amount of sociality is 217, and social dominance has dropped to 4.81%.

This reduction suggests that many retail merchants are moving to a side job and waiting for more powerful prices before they are re -recovered.

But social feelings are often reactive and can change rapidly. The decisive movement of more than $ 120 can be especially supported by a wide range of market optimism, which can attract the attention of the community and amplify strong momentum.

Source: Santiment

Correction or reorganization for sol?

Technology settings suggest that Solana can see the short -term bounce supported by RSI with radiation hold levels and potential MACD crossovers.

However, as the emotions, whale activities and social participation still need to be weak, we need stock.

Currently, the temperature -chain behavior looks similar to strategic reorganization than the entire exit, but traders should pay attention to volatility.

Confirmed movements above the resistance level will strengthen the case, but until then, the risk is increased.