- Solana’s $ 127 price still remains an important battlefield that acts as a support and resistance.

- If the sol is broken, it can go higher, but the road is not easy.

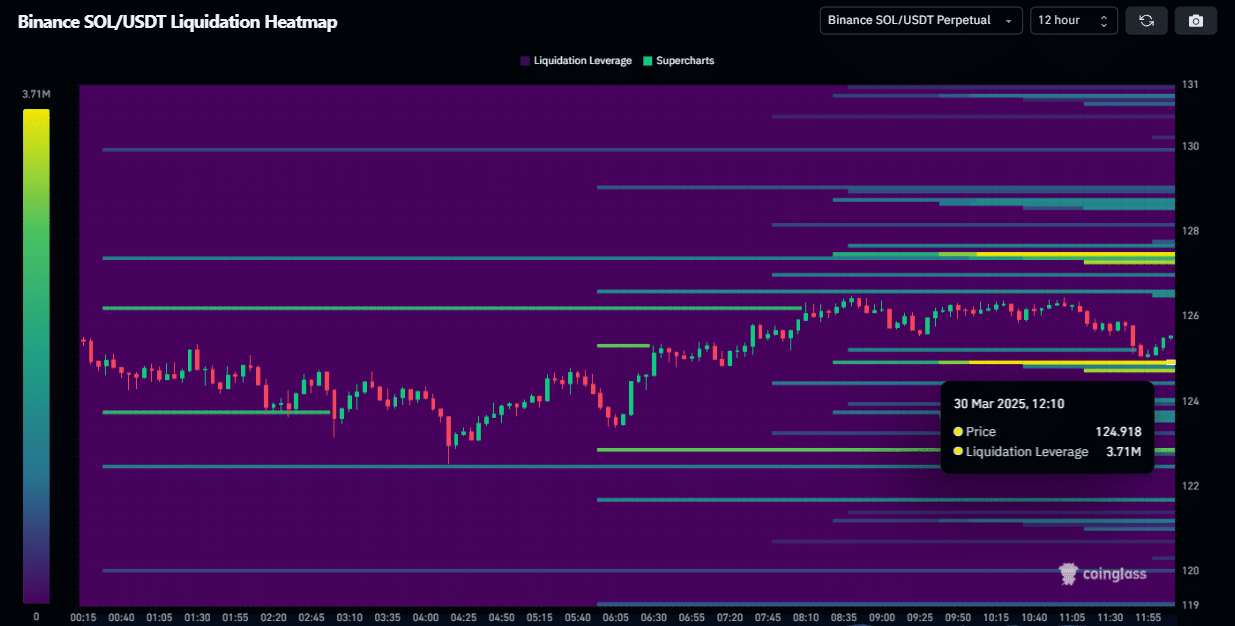

The price level of $ 127 is an important technical marker of Solana (SOL), which has been used as support and resistance in the recent trading session.

Overcoming this barrier is important for Solana aimed at higher resistance, such as $ 140 and $ 150.

But some factors make this a challenging achievement. One main concern is a weak defi activity, which is lower than the pre -election level. This suggests that the participation in the warm chain has not yet recovered.

In addition, as market uncertainty works, many traders ignore the SOL and add potential sales pressure.

Whales have recently been out of 60,298 SOL for $ 127, and have strengthened this level into strong supply and potential distribution points.

As a result, the relative robbery index (RSI) is downward, but has not yet reached overreation.

This suggests that sales momentum can continue unless a wider market experience new capital inflow. Therefore, Solana is vulnerable to another corrective movement.

Source: TradingView (SOL/USDT)

The main level of monitoring Solana’s Daum Dip

Solana’s struggle through major indicators suggests that there may be no local floor yet.

Surprisingly, this shows that optimistic news did not cause a strong recovery shortly after $ 1.7 billion in investing in Blackrock’s Solana BUIDL initiative.

In addition to concerns, the SOL/BTC pair recorded the lowest level in the daily chart. Low minimum consistent formation indicates a change in investor preference, suggesting that capital is flowing elsewhere.

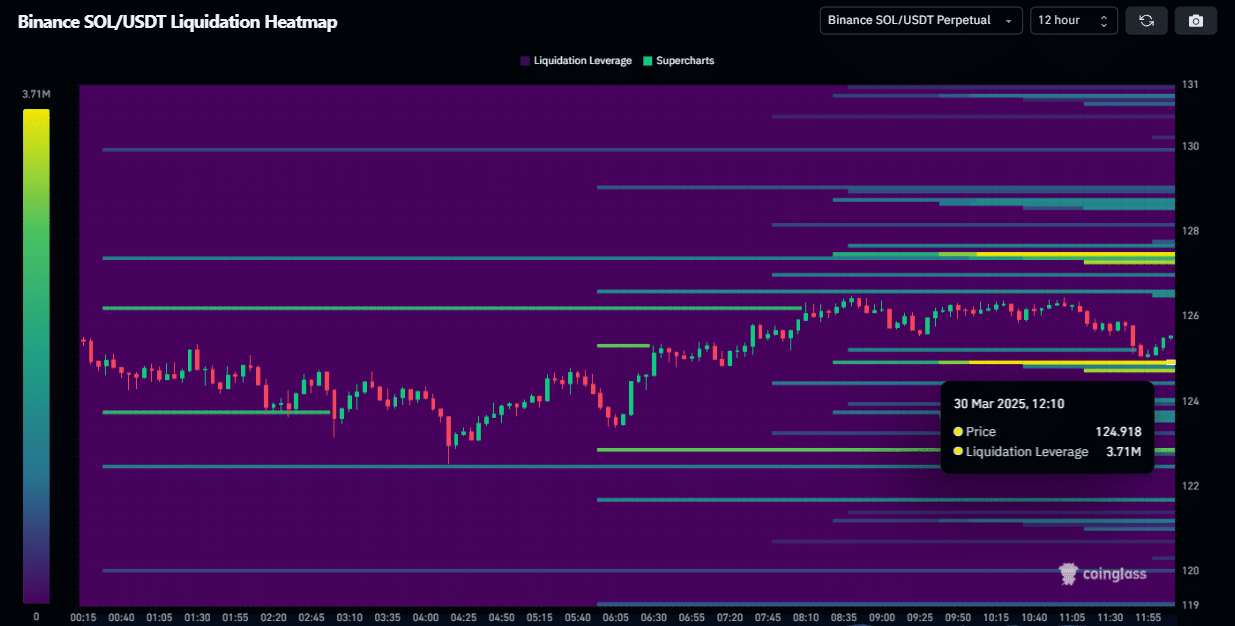

Due to the lack of strong driving force, 37.1 million people of the 12 -hour derivatives chart have a higher risk of liquidation and must restart the level of $ 124.91.

Source: COINGLASS

In Solana’s trading volume, 32.54%of contractions reduce the risk of falling by reducing the possibility of strong strong defense by $ 20 billion.

In addition, macro uncertainty has been added as the risk feelings have increased as the market for high steak tariff decisions set this week increased.

As Q2 increases volatility, it seems to be more and more likely to return to the demand area of $ 110-115. Therefore, Solana merchants should pay attention.