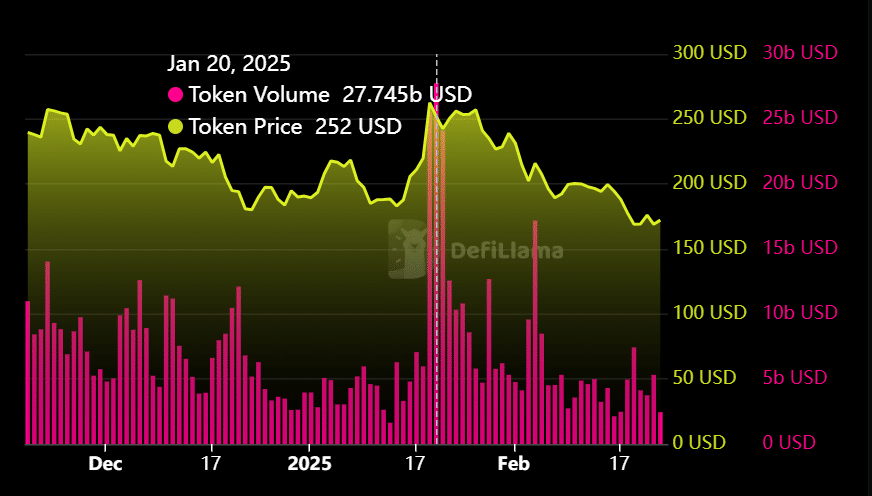

- Solana has seen a total of 87.5 billion USDCs since January 1.

- Did you affect the sol?

SOLANA (SOL) started in February with a market cap of more than $ 100 billion, but decreased to $ 7.2 billion in the media.

Continuous sales pressure surpassed demand, forcing the SOL to the lowest level of $ 140 in four months.

Can we promote the increase in liquidity when 250 million USDCs are newly embedded in the network?

Solana’s liquidity tension

Since the new year, USDC of $ 87.5 billion is a portrait of Solana, which is consistent with the launch of Trump Memecoin by pushing the network volume at $ 274.5 billion.

But since then, the book has been rapidly recovering to $ 1 billion, and Solana -based Memecoins has lost two digits.

Source: Defillama

This rapid decline suggests liquidity saturation and can signal outstanding in recent recent rally.

If the volume of the MEME division decreases by more than 50%, the 250 million USDC has recently been shocked, which can limit the increase potential of the sole.

As the demand for increasing demand increases due to the overflow of excess liquidity due to the faint faint liquid demand and the decrease in trading volume, there is a concern that Solana can be converted from organ value assets to short -term speculation.

Basic Contribution -Where do Sol’s future lie?

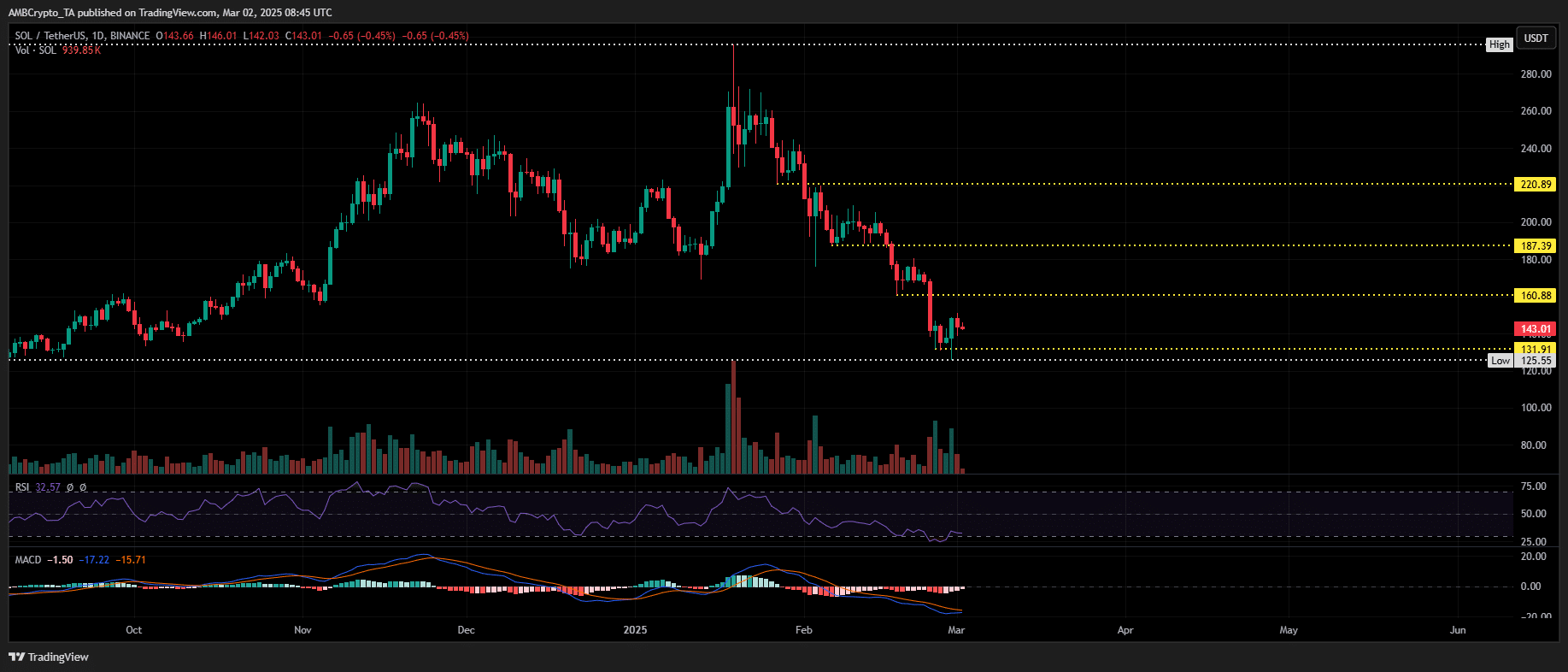

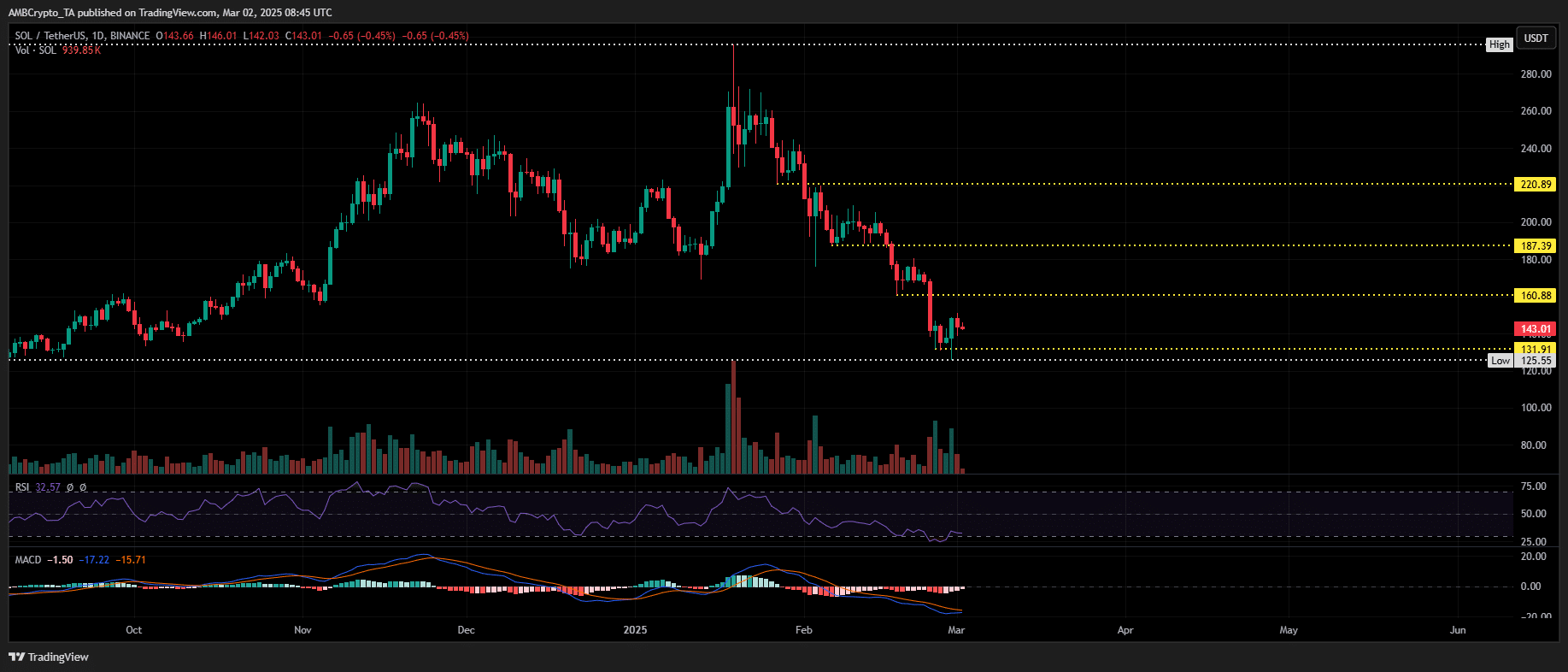

Since the record of $ 295, SOL has not received strong support at the level of maintaining a continuous decline, unlike its competitors.

In the previous cycle, SOL broke the major resistance level in the “over -advertising” centered on elections and memes, but if there is no strong demand under weak conditions, it is now a breaking market structure.

Source: TradingView (SOL/USDT)

The weakening of the bidding price continues to limit the strength of the sales pressure, which is in danger of the $ 140 support level.

Short pressure has triggered $ 2.3 million liquidation, suggesting that the recent rally is not fundamentally leading, but mostly speculative.

If Solana’s foundation is not significantly improved, the effect of 250 million USDC can be ignored.

Instead of liquidity -centered rebounds, SOL is more likely to return to $ 125.