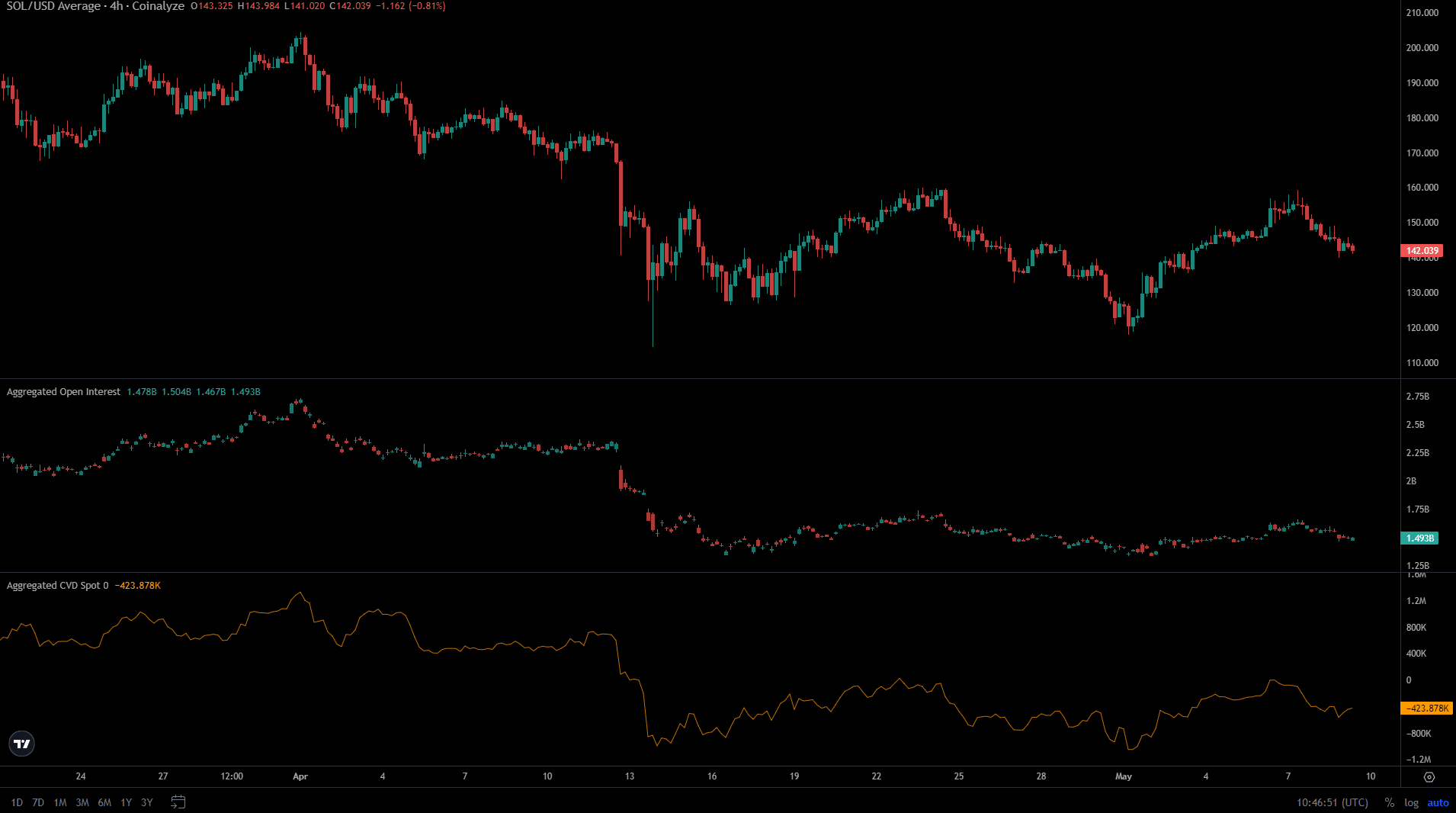

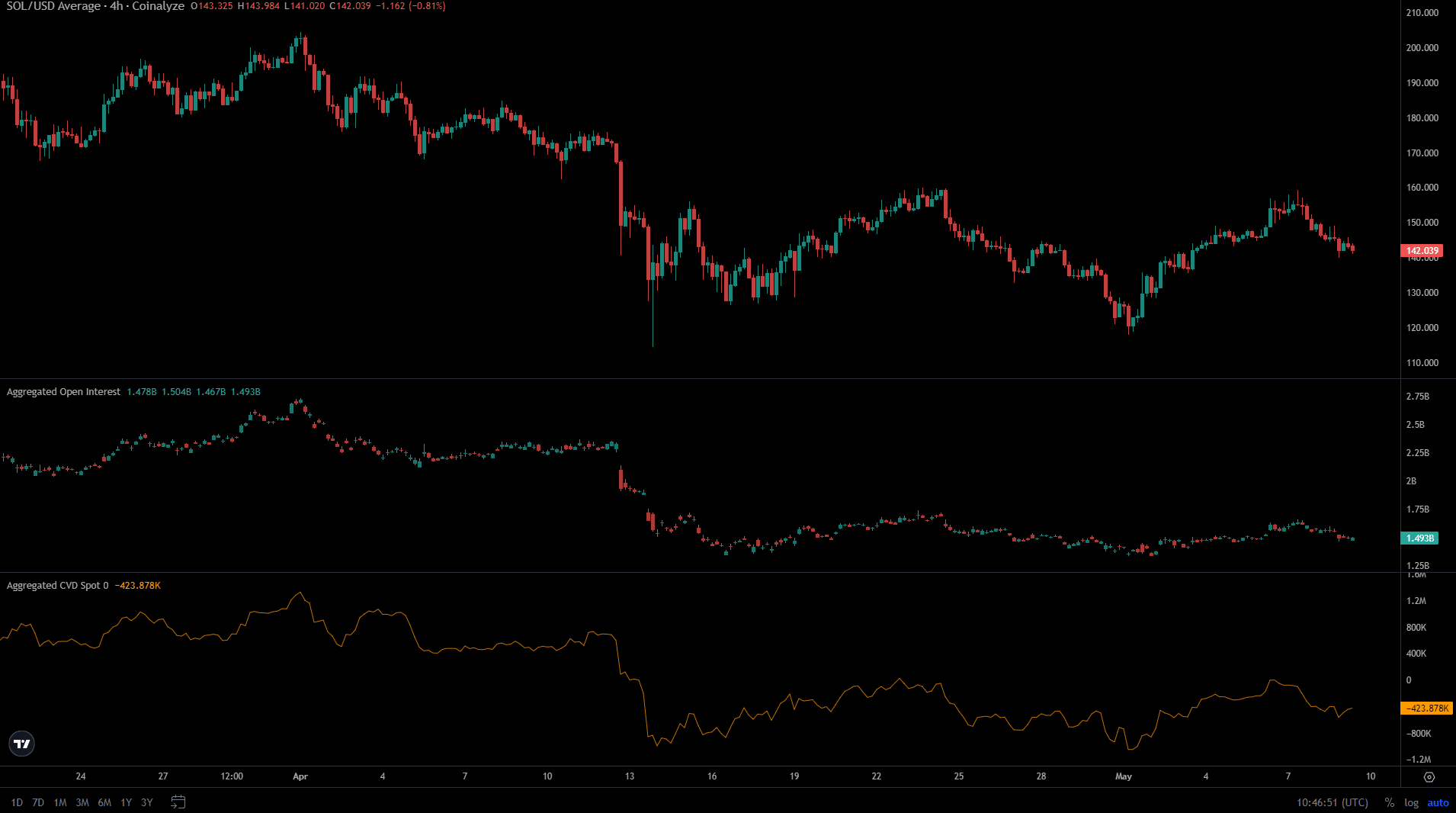

- Solana did not see buying pressure pick up during the month-long range consolidation.

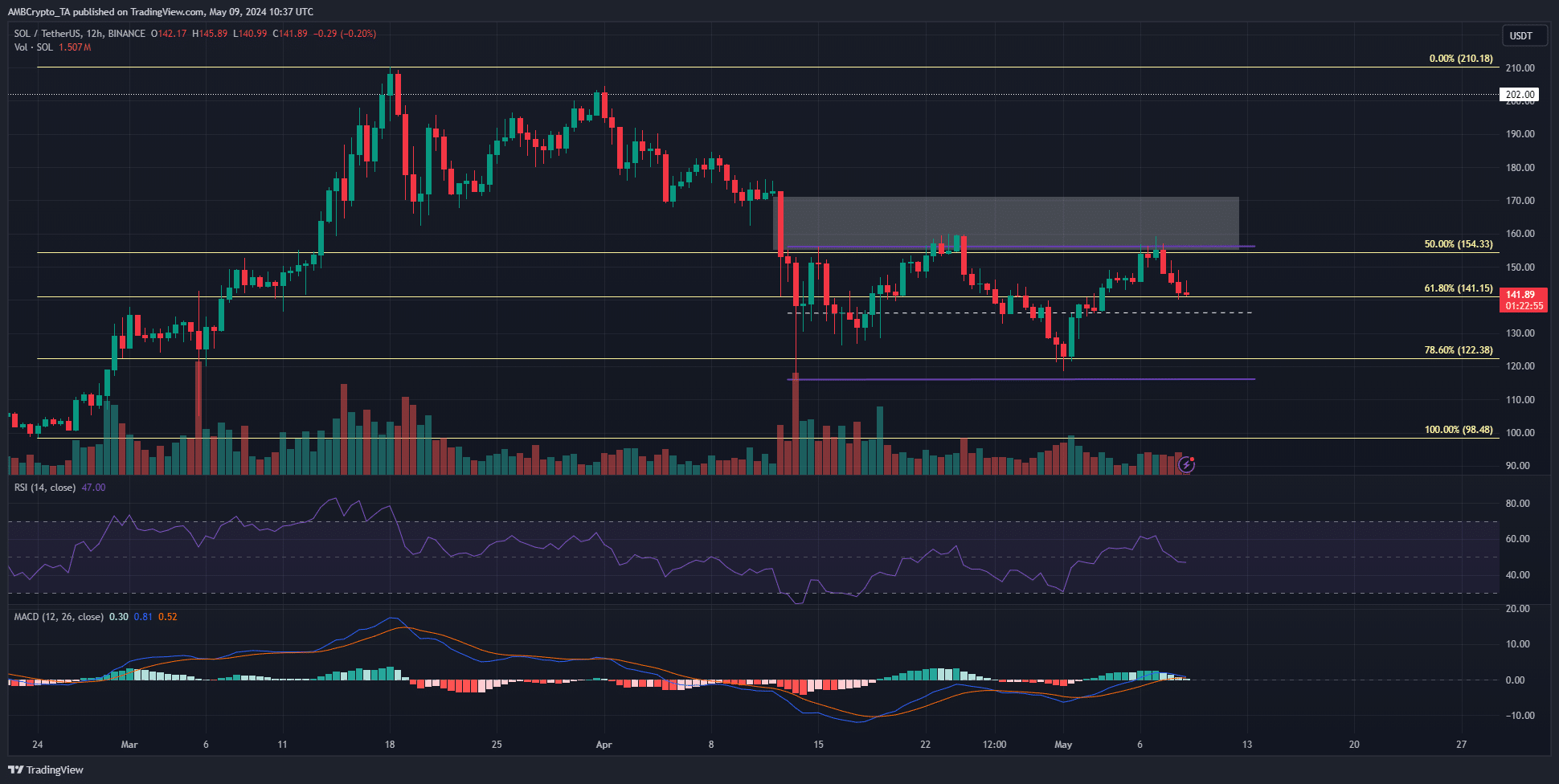

- The rejection of $160 highlighted how important resistance levels have been in recent weeks.

Solana (SOL) was forced to retreat from the $160 resistance area again.

A previous report by AMBCrypto indicated that SOL is likely to retreat into the one-month range unless the price reverses to support the $165-$170 region.

Another report pointed out that on-chain activity is also decreasing. This, in turn, reflected a decline in usage and demand for SOL. Therefore, traders can expect the current consolidation to continue.

Will we ever see a low point in the high rejection rate range again?

Source: SOL/USDT on TradingView

The midpoint of the $156 to $116 range (purple) is $136. Additionally, the Fibonacci retracement levels of $141 and $122 are expected to act as support.

It has fallen 10.8% since the rejection on Monday 6 May.

At press time, the $141 level held as support, but it was unclear whether the decline could be sustained for the remainder of the week.

RSI on the 12-hour chart fell below the neutral 50 level in an early sign of growing bearish momentum.

The MACD showed that the bullish momentum was strengthening, but quickly reversed over the last 48 hours. At press time, MACD was neutral but expected to be bearish.

Traders can expect some relief bounce from the mid-range support at $136. Trading volume has remained consistently low over the past two weeks, and if this continues it is likely that it will fall back to the $122 level.

Speculative activity has stopped.

Source: Coin Analysis

Over the past month, Solana’s price has ranged, while open interest has remained relatively flat. There have been some dips and bounces, with price fluctuations between the extremes of the range.

This indicates a lack of optimistic confidence among futures market participants.

Realistic or not, the market cap of SOL in BTC terms is:

Spot CVD also formed a scope. This was a positive outcome for long-term bulls as it highlighted a period of consolidation. Ideally, buyers want spot CVD to trend higher during consolidation.

Given the uncertainty and fear in the current market, it is good enough that spot CVD has not started a downtrend.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.