- Activity across the Solana blockchain has increased, but the price of SOL has fallen.

- The correlation between SOL and BTC has decreased as indicators suggest that SOL may fall below $160.

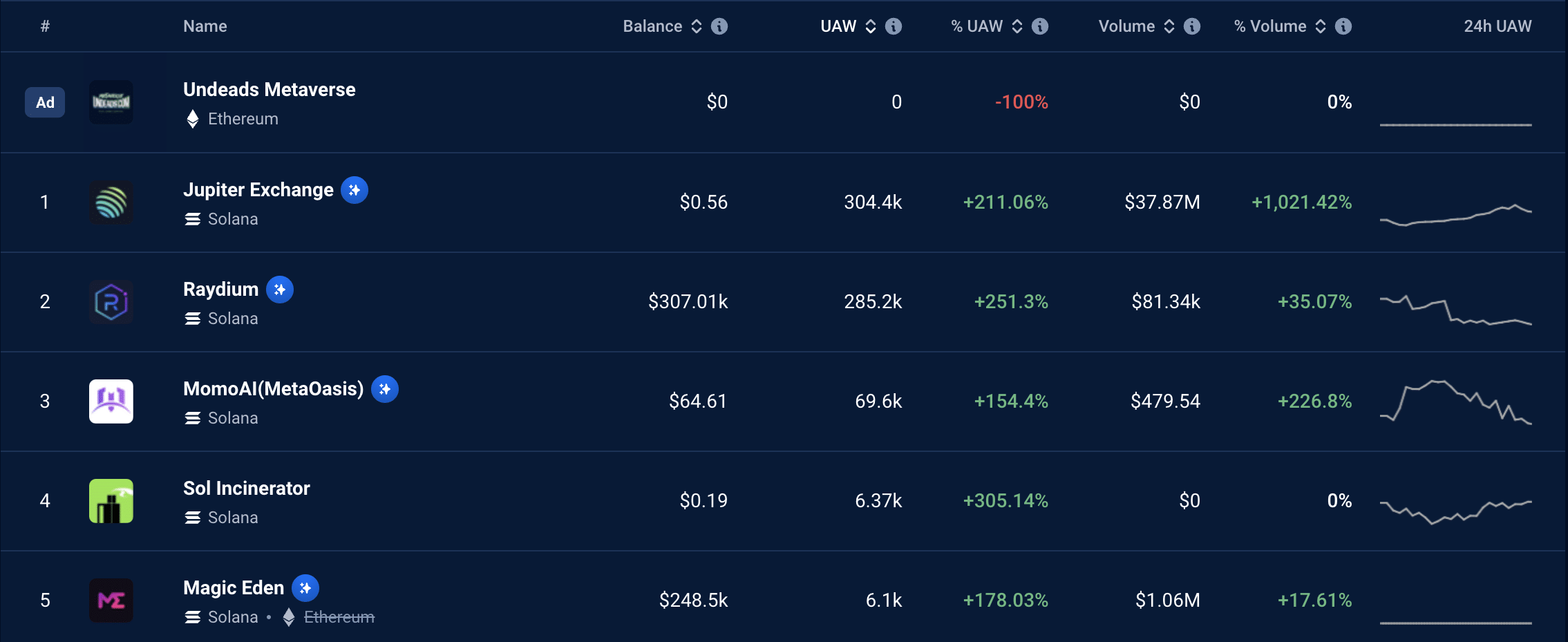

According to DappRadar, Solana (SOL)’s Unique Active Wallet (UAW) has seen a massive surge over the past 24 hours. Decentralized applications including Jupiter, Raydium, and Magic Eden contributed to the aforementioned surge.

AMBCrypto found that the number of UAWs on aggregator Jupiter Exchange rose 251% to 307,100. For Raydium, it rose to 285,200 while NFT activity was picking up. Finally, in Magic Eden, the same figure increases up to 178%.

Memecoins are moving SOL up and down.

The increased activity of Raydium and Jupiter can be linked to the increased activity of memecoin in the market. An assessment of the platform suggests that the buzzing memecoin story can be attributed to GameStop (GME) and legendary trader Keith Gill, popularly known as “Roaring Kitty.”

On June 7th, a number of derivative tokens linked to traders appeared. Additionally, these Solana-based tokens have jumped to incredible market capitalizations in a short period of time.

The increase also signals increased demand for SOL. However, at the time of press, the price of Solana was $162.44, down 5.44% in the last 24 hours.

It is also worth noting here that AMBCrypto discovered why SOL is unable to sustain its increases despite increased demand.

For many degenerates, the idea of purchasing memecoins does not stick for long. In cryptocurrency, a degenerate is an individual who trades highly volatile and speculative tokens without any fundamental principles. So, once the tokens have earned a certain level of profit, they are exchanged for Solana native tokens and sold for stablecoins or fiat currencies.

There have been so many such pump-and-dumps these days that they may not stop anytime soon. In this case, SOL may continue to move sideways.

Can I do token banking in BTC?

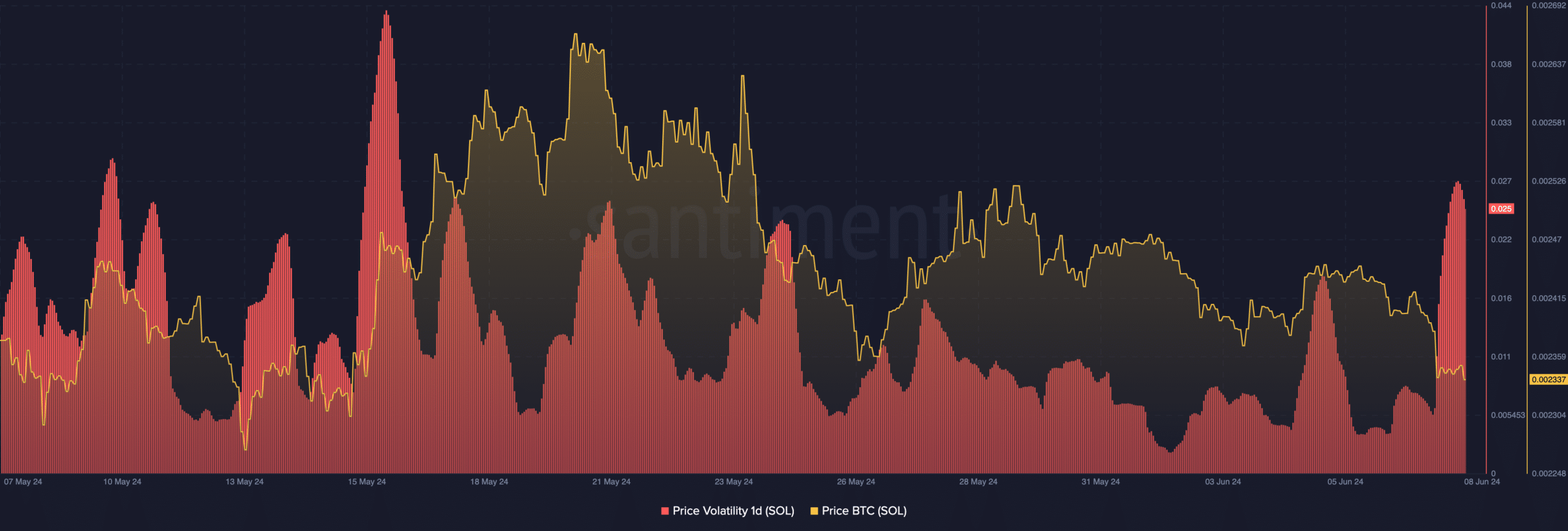

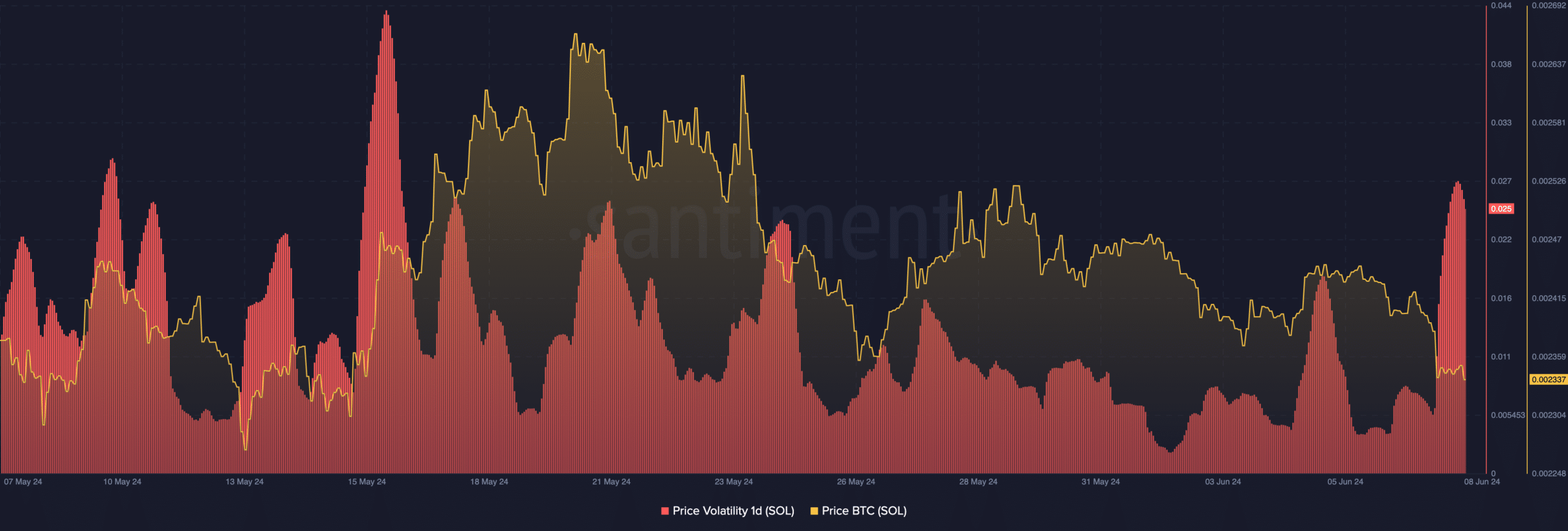

AMBCrypto also discovered that SOL’s daily volatility has spiked. Volatility tracks how quickly prices can change. Therefore, increased selling pressure amid high volatility could cause the token to fall off the charts.

On the other hand, increased buying pressure combined with high volatility can trigger price spikes. However, depending on circumstances, SOL may fall below $160 in the near term.

Solana splits from Bitcoin

Another factor that can affect the price is Bitcoin (BTC). According to data from Santiment, Solana’s correlation has been declining since June 6, indicating that individual prices may not always move in the same direction.

Therefore, there is no guarantee that SOL will revisit $187 if BTC rises above $71,000 again. But if a broader market recovery takes place, prices could follow a similar path.

Is your portfolio green? Check out the Solana Profit Calculator

Regardless of which direction SOL goes, the cryptocurrency is unlikely to reach $200 next week. There are predictions that SOL will reach $1,000 in the long term. For that to happen, market conditions must improve.