- Solana is struggling with faint momentum, low speed and demand, and is trapped for less than $ 135.

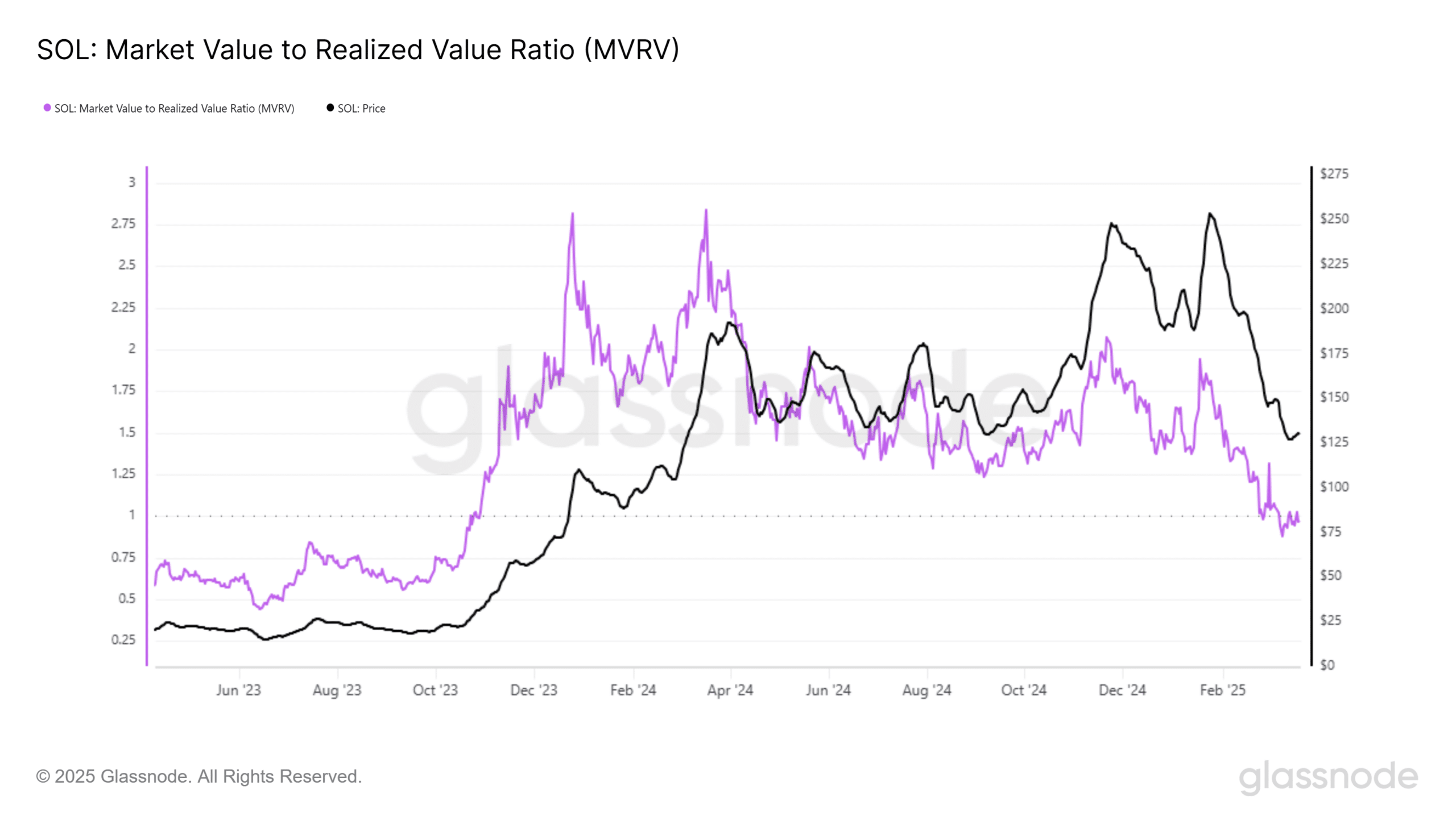

- SOL shows comprehensive pressure as the MVRV ratio drops to less than zero.

Is Solana (SOL) losing steam?

After showing the initial signs of recovery, Solana is once again having a hard time weakening faint momentum and demand.

The SOL, which is now around $ 130, is under the level of important $ 135 resistance that cannot be built in the past.

As the wider market situation is cautious and changing to dangerous appetite cooling, the outlook for Solana is increasingly uncertain.

While investors pay attention to more flexible assets, questions are raised about whether the SOL can be reinforced or in the long -term integration stage.

Solana’s MVRV ratio has fallen below the zero mark, indicating that buyers, especially those who have entered the market for the past two weeks, are sitting in unauthorized losses.

As you can see from the chart, this is the lowest MVRV level since early 2023, and strengthens the weakness of holding the sole.

Source: Glass Node

Negative MVRVs historically increase the risk of surrender, which historically sells short -term holders to reduce losses.

If investors do not decide to expect processing time, this pressure can deepen Solana’s slump. At this time, feelings are cautious and no optimistic catalysts may have difficulty in reversing the course.

This loss area is a dangerous area, especially if the wider encryption conditions continue to weaken.

The more momentum disappears to less than $ 135, the more SOL is stable.

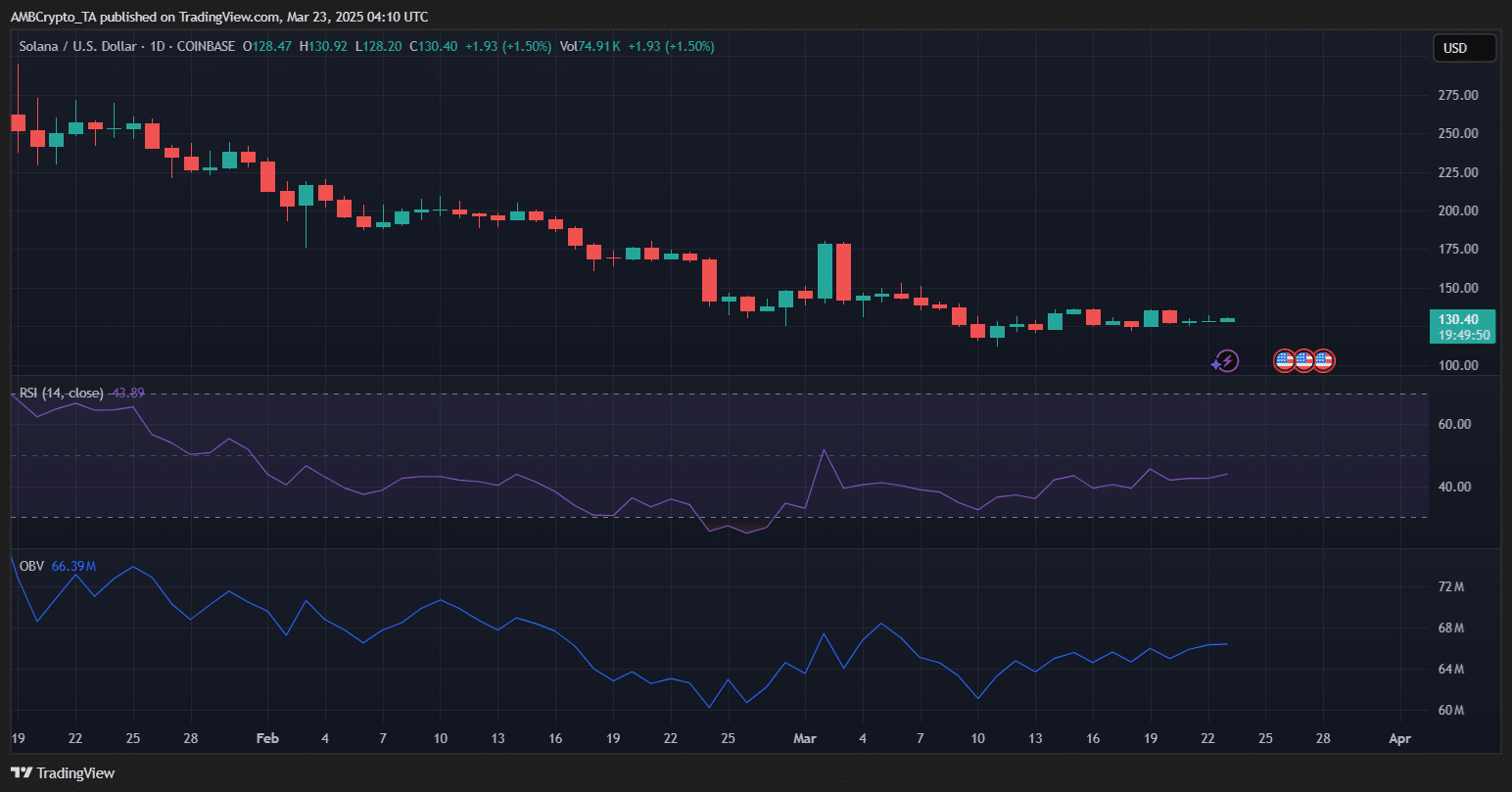

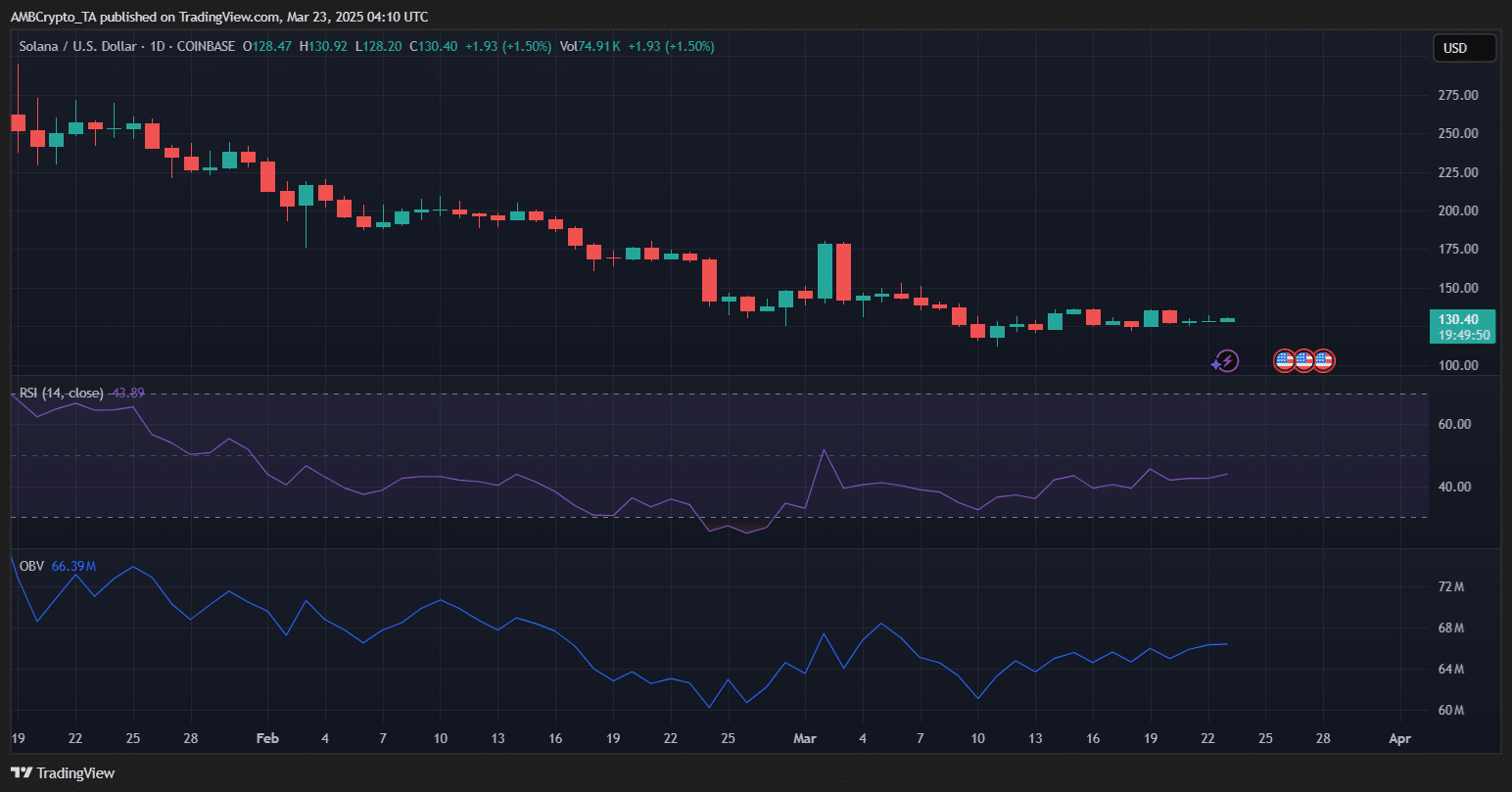

Solana traded at $ 130.40 and showed a slight profit of 1.5%on the day, but the wider trend was weaker. RSI represents a faint optimistic momentum with 43.89 (less than 50 neutral marks).

On the other hand, OBV suggests that about 66.9 million people are relatively flat, which lacks strong accumulation or distribution pressure.

Source: TradingView

The price of SOL has been integrated in a narrow range after recent modifications, struggling to exceed the $ 135 resistance area. If the buyer does not regain the level, the price can be returned to the $ 120- $ 125 support band.

On the other hand, the decisive ride of more than $ 135 can be opened at $ 150, but the current indicator refers to the weakening of demand.