- Solana’s voting transactions account for 85% of all activity, raising concerns about validator fees and network decentralization.

- While failed transactions cost users thousands of dollars in fees, large validators profit from Solana’s voting system.

Recent data has brought to our attention: Solana (SOL) There is growing interest in the network, especially with regard to transaction distribution and the challenges faced by validators.

analyze share Dave, an avid supporter of Cardano development and decentralized exchanges, highlighted the overwhelming weight of voting transactions on Solana and questioned the fairness of the network.

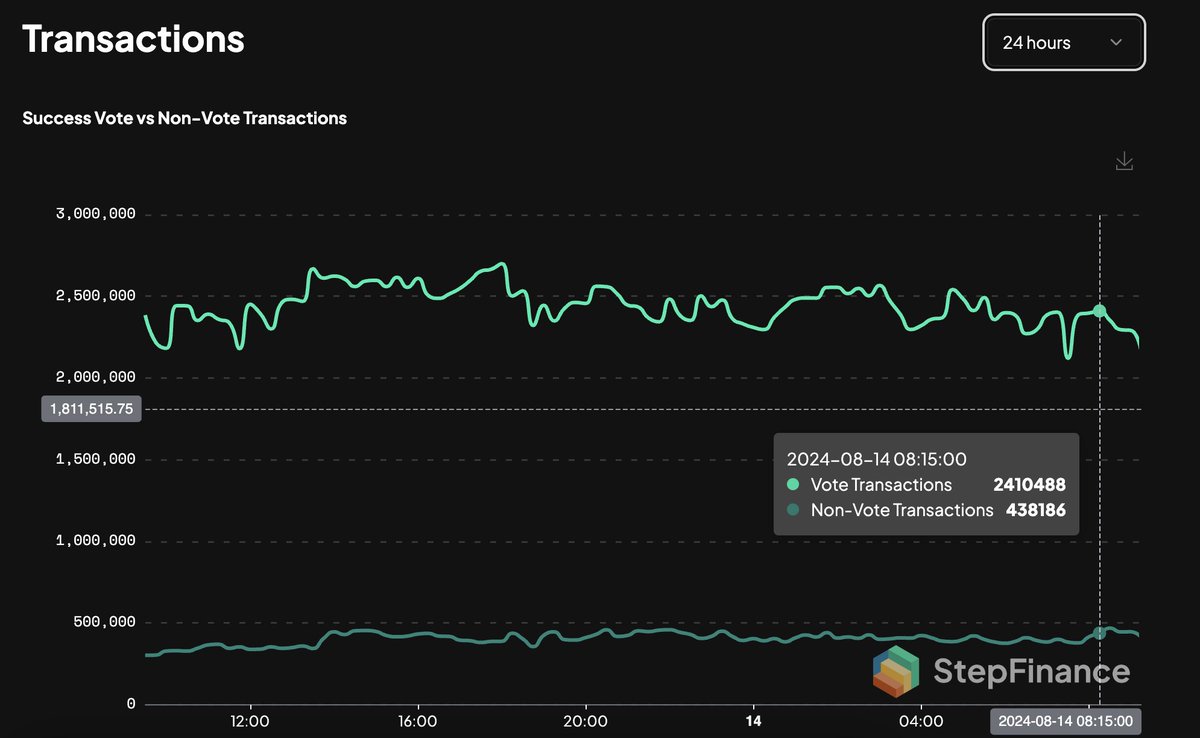

According to Dave, Solana processed about 2.4 million voting transactions, or about 85% of all transactions during this period.

The remaining 15%, or about 438,000 transactions, were non-voting transactions.

Source: X

The distribution has sparked discussion about the nature of Solana’s transaction volume, with some observers questioning the discrepancy between actual user activity and transactions generated by the system.

Dave points out that while voting transactions are essential to the functioning of blockchains, they disproportionately benefit large validators.

He likened the system to a “Ponzi” scheme, where new validators must submit a large number of votes, which in turn generates fees that are collected primarily by existing validators.

He noted:

What I find really interesting is Solana’s voting mechanism. Similar to a typical Ponzi scheme In it A new validator is needed Vote to join the network.

Dave also explained:

“These dynamics contribute to the network’s long-standing minority problem.”

He noted that currently just 17 validators control 33% of Solana’s staking assets.

The “Rich Get Richer” Phenomenon

Solana’s validators must cast a large number of votes to ensure optimal performance.

According to Dave’s analysis, a fully functioning validator would need to submit about 216,000 votes per day, which equates to about 6.48 million votes per month.

Considering that each voting transaction costs approximately 0.000005 SOL, this equates to a monthly cost of 32.4 SOL, or $4,728.29 at market exchange rates at the time of writing.

These costs burden smaller validators, while larger validators continue to profit from transaction fees, potentially strengthening their dominance on the network.

Critics argue that this creates a “rich get richer” dynamic as new and smaller validators struggle to compete due to high operational costs.

In response to Dave’s tweet, DBCrypto famous Solana computes various system-related operations, such as oracle calls and compute budgets, as transactions.

According to DBCrypto, this will increase transaction volume on the network.

He added that Solana’s actual transaction throughput could be quite low, excluding transactions generated by the system, and is estimated at 20 to 40 transactions per second (TPS).

Solana’s Transaction Failures and User Fees

Another concern is: Recent The discussion is about transaction failures on the Solana network.

Jupiter Aggregator, a decentralized exchange aggregator, has experienced an 83% failure rate in the last 24 hours.

Of the 10.31 million transactions processed, 8.56 million failed, leaving users charged fees even though their transactions failed.

Is your portfolio green? Check out the SOL profit calculator

Dave highlighted that users paid a total of $6,334.4 in fees for failed transactions, raising questions about the reliability of the Solana network in real-world applications.

This issue has drawn attention from the Solana community, with many pointing out the potential role of bots and validators in the high failure rate.