- The Sonic Network Upgrade has significantly introduced the liquidity liquidity of the chain.

- Spot and derivatives are currently using market sentiment to bet and buy assets.

The last 24 hours of trading activities did not fully reflect the positive development of SONIC (S) chains as the tokens decreased by 7.22% within this period.

But the market sentiment is still strong, but S still suggests that there is a chance to continue to profit from 13.95%last week. In particular, more liquidity flows through the chain, and market participants continue to get assets.

The network upgrade spark was interesting

In the last 24 hours, SONIC has announced that it improves the overall performance of the upgrade to the consensus protocol layer known as SONICCS 2.0.

The upgrade is greatly improved the consensus process, doubling the transaction verification speed, to more than 16,000 to 30,000, from 16,000 to 30,000.

The memory usage decreases by 68%, which reduces the hardware requirements for the validation tester and promotes greater decentralization by allowing more validation testors to join the SONIC network.

The upgrade benefits the various protocols of SONIC, including distributed transactions and tokens.

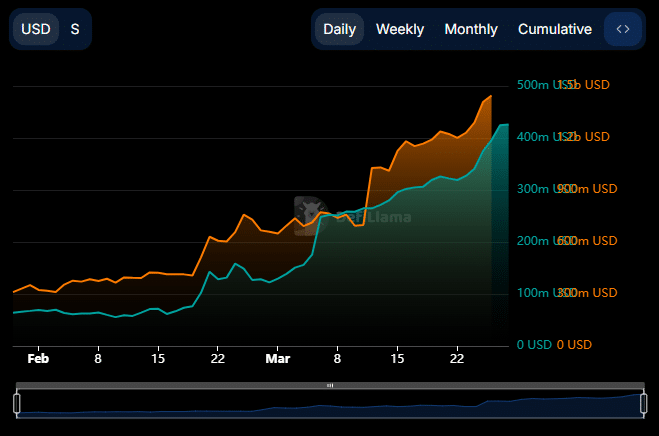

After the announcement, liquidity inflow to the chain has soared, and the stablecoin balance and the bridge tvL (total value lock) have noticed.

Currently, the total size of the eyeballs processed in Sonic Chain is $ 28.41 million, reaching $ 429.6 million, compared to the previous one.

Source: Defillama

When the demand for stablecoin on the chain increases, market participants often actively support activities, often showing positive development. This may include the indigenous tokens of SONIC, S, or deposit funds to protocols for compensation.

Similarly, the bridged total value lock (tvL), which measures the liquidity between the chains, shows that $ 144.5 billion in the protocol of other chains. This represents a strong desire for participants to participate in the chain.

As reported that all spots and derivatives have adopted a strong prospect, optimism expands beyond chain activities.

SONIC: Spot and Fivative Traders is optimistic

Both spots and derivatives are located for S for S rally.

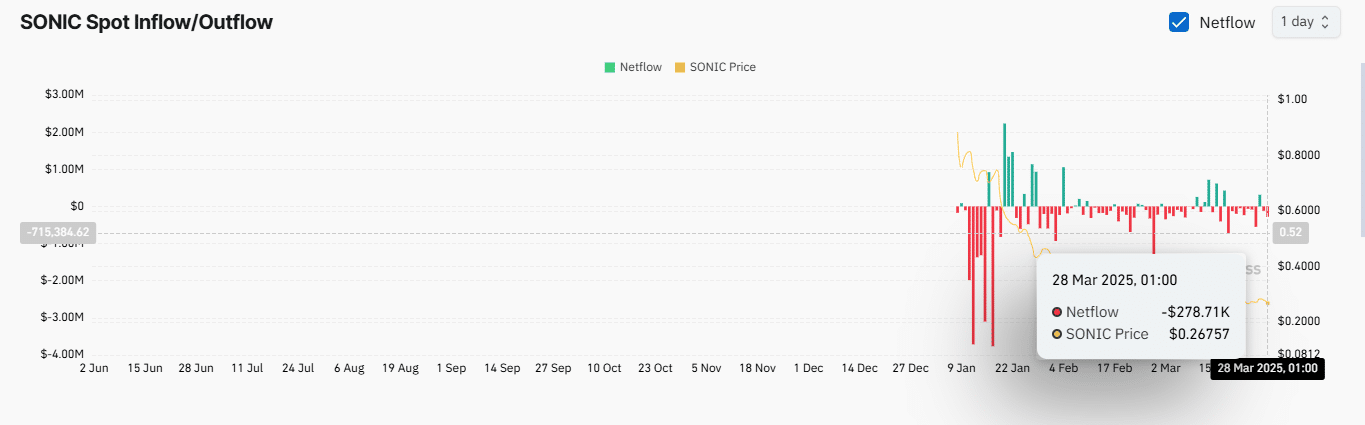

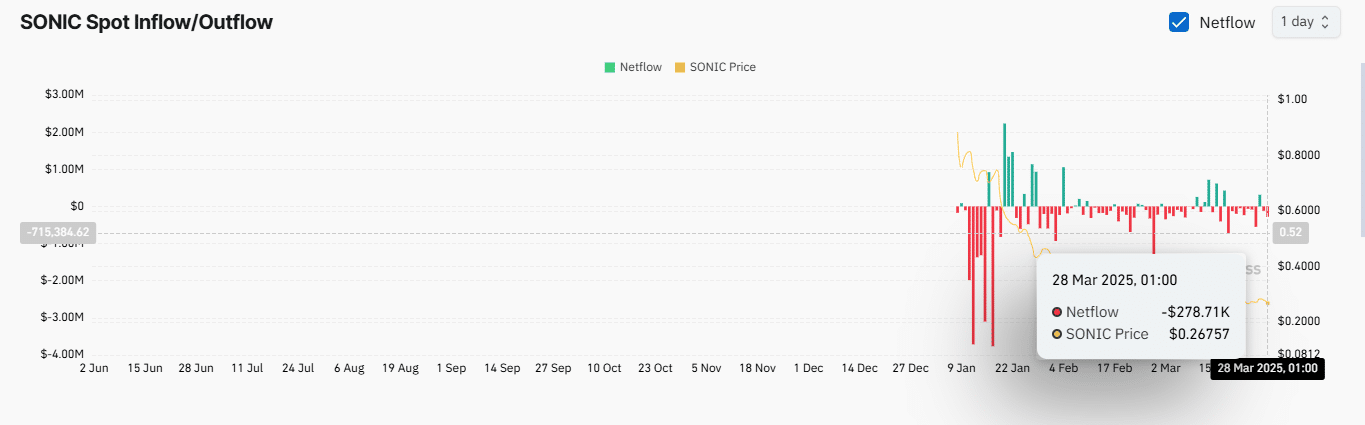

Source: COINGLASS

In the press time, SPOT Traders continued to purchase SS by adjusting expectations for assets. In the last 24 hours, the trader purchased more than $ 278,000 and closed the state with a total purchase of $ 742,000.

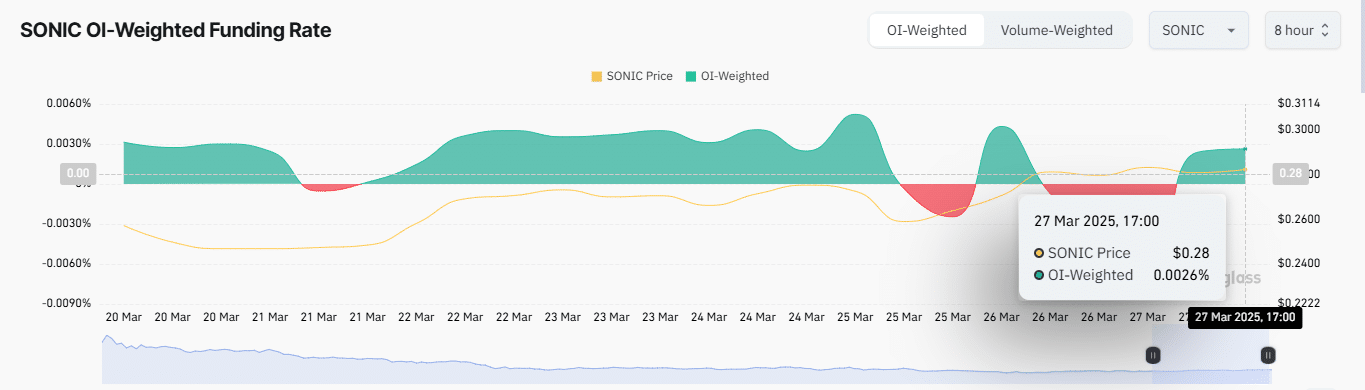

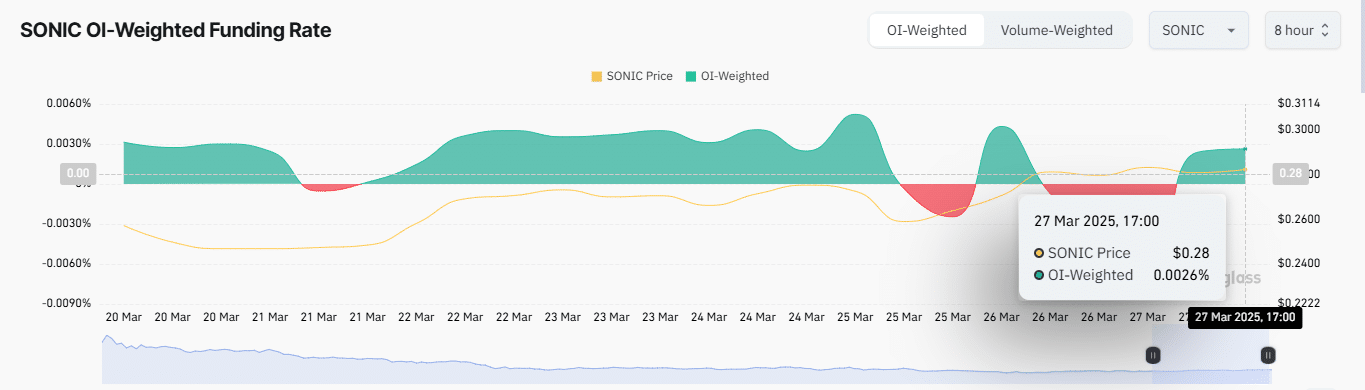

In the derivative market, the trader has a long bet on the public interest rate financing rate (indicators that capture the market trend depending on the rate of public interest and financing).

Source: COINGLASS

The press time is 0.0026%of the readings, suggesting that the traders of the derivatives market are more powerful than the weak. If this number continues to increase, S can see the main market rally.