join us telegram A channel to stay up to date on breaking news coverage

A Spanish research institute plans to cash out its forgotten $10,000 Bitcoin purchase from 2012. This jumped from 1,000x to $10 million.

The Institute for Technology and Renewable Energy (ITER), run by the island council of Tenerife, reportedly acquired 97 BTC as part of a blockchain research project a decade ago. no way report by Spanish newspaper.

Juan José Martínez of Tenerife’s Innovation Council said the council was currently finalizing sales plans with approved Spanish financial institutions. Proceeds will fund new ITER research, including research into quantum technologies.

Lab’s Bitcoin Vault Soars 100,000%

Bitcoin prices have soared since 2012, boosting the institute’s investment by 100,000%.

In early October, when the price of Bitcoin reached an all-time high (ATH) of approximately $126,198, the custodial value of Bitcoin was more than $12.2 million.

The Lab’s purchase of Bitcoin was not an investment

Martinez told the news outlet that the 2012 purchase was by no means meant as an investment, but rather was part of an experimental project to understand Bitcoin’s underlying blockchain technology.

More specifically, ITER’s computing team investigated how the Bitcoin mining process works.

“This was one of many research projects undertaken by ITER to explore and experiment with new technological systems,” Martínez said.

ITER is currently working with Spanish banks and Spanish financial institutions approved by the National Securities Market Commission (CNMV) to facilitate Bitcoin sales.

Martinez said he expects the deal to be completed in the coming months.

Major U.S. academic institutions invest in Bitcoin

Although ITER said its Bitcoin purchase was not for investment purposes, other major academic institutions have begun investing in the largest cryptocurrency by market capitalization.

The Harvard Management Company, which oversees the university’s $50 billion endowment, recently disclosed $116 million worth of assets in BlackRock’s iShares Bitcoin Trust (IBIT) in a report. quarterly report With the U.S. Securities and Exchange Commission (SEC).

Did you know?

Harvard University’s portfolio contains more Bitcoin ETFs than Google stock. pic.twitter.com/iiPWbEr2Cq

— Binning (@bitinning) September 19, 2025

This investment gives Harvard indirect exposure to Bitcoin price fluctuations through BlackRock’s regulated spot BTC exchange-traded fund (ETF). It is also one of the university’s top five public stock rankings, behind Microsoft, Amazon, Booking Holdings and Meta.

Harvard’s investment comes after a U.S. spot Bitcoin ETF received regulatory approval for launch in 2024. They have since attracted billions of dollars in investment and provided traditional investors with a familiar means to gain BTC exposure.

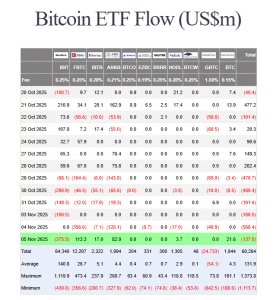

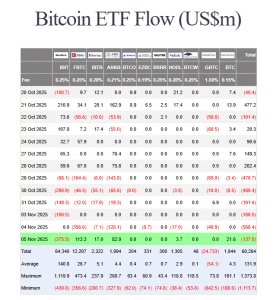

Among these ETFs, BlackRock’s IBIT has been the most popular, with cumulative inflows of $63.34 billion to date, according to data from Farside Investors.

US Spot Bitcoin ETF Flows (Source: farside investor)

Brown University also reported holding approximately $4.19 million worth of IBIT stock as of mid-year. University of Texas at Austin earlier this year. presentation Within the endowment there is a dedicated $5 million “Bitcoin Fund.” Proceeds will be held in BTC for at least 5 years.

Related articles:

Best Wallet – Diversify your cryptocurrency portfolio

- Easy to use and highly functional cryptocurrency wallet

- Get early access to the upcoming token ICO

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake to win native token $BEST

- 250,000+ monthly active users

join us telegram A channel to stay up to date on breaking news coverage