- ADA is down more than 4% over the last 24 hours, despite some recovery.

- Despite this decline, the trend of active addresses remained stable.

Cardano (ADA) has been in a downtrend on the charts recently, hindering any potential recovery plans. And this downtrend is expected to have significant repercussions, especially since the number of active addresses has not moved much during this period.

Cardano crashes and burns

Analysis of the price trend of Cardano (ADA) on the daily time frame chart shows a significant decline recently. Specifically, ADA recorded a sharp decline of 7.38% on August 2nd, after which it briefly recovered on the chart.

Needless to say, the aforementioned price decline has influenced the movement of ADA’s short-term moving average (yellow line), which has established a strong resistance level around $0.40.

The fact that this moving average acts as a resistance level suggests that ADA would need to gather significant buying pressure to break this level and potentially initiate a trend reversal.

Source: TradingView

It is noteworthy that despite the slight recovery in altcoins over the past few hours, the Relative Strength Index (RSI) reading is close to 40, indicating that the ADA market is dominated by bearish sentiment.

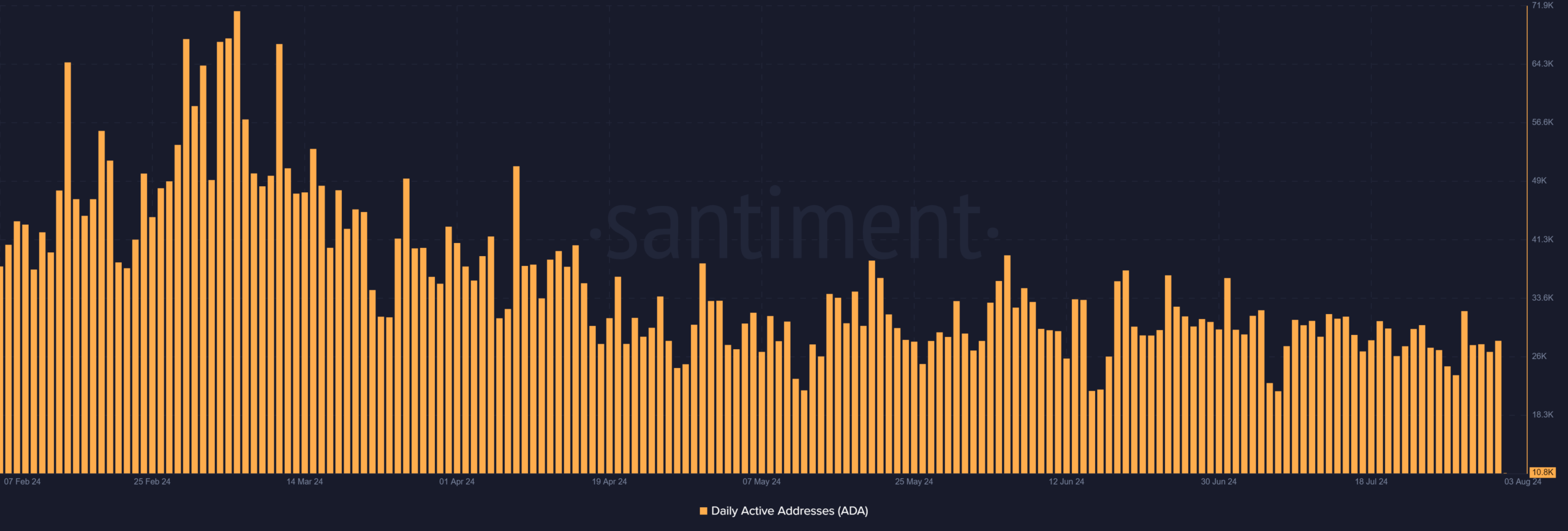

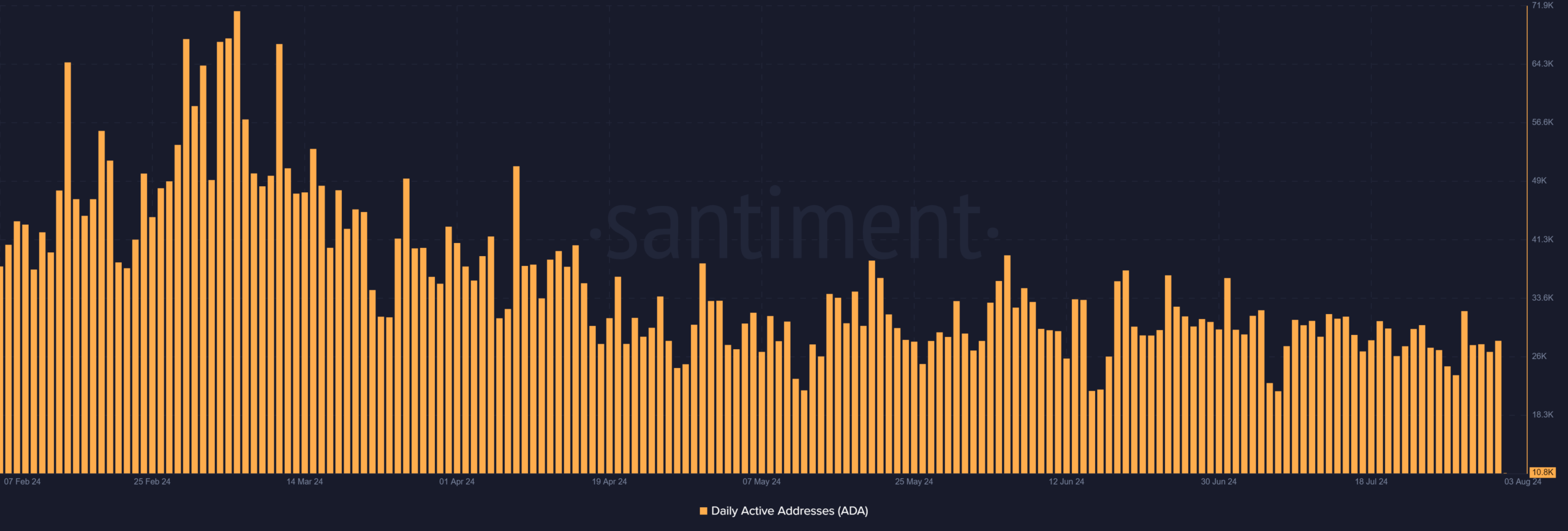

Cardano’s active addresses remain stable

Santiment’s analysis of Cardano’s daily active addresses metric shows that user activity has been stagnant across the board. In fact, the number has fluctuated between 26,000 and 27,000.

This level of activity signals a steady, yet unobtrusive, level of engagement among users within the network.

Source: Santiment

However, there was a brief but noticeable increase in activity on August 2nd, with the number of active addresses increasing to around 28,125. This increase, while small, could indicate a temporary surge in transactions or interactions on the network.

What’s interesting is that at the time of writing this, the number of active addresses has also decreased significantly, dropping to around 10,000.

The volume increased slightly

Finally, when analyzing Cardano’s trading volume, an interesting pattern seems to emerge.

ADA’s trading volume has increased significantly over the past few days. Trading volume was around $280 million at the beginning of the month, but surged to over $400 million on August 2 as prices dropped.

This volume trend and the stable number of active addresses suggest that ADA holders are holding. They are not panic selling in large quantities, nor are new investors aggressively buying at low prices.

– Is your portfolio green? Check out the Cardano Profit Calculator

In short, investors may be waiting for more definitive signals of altcoin recovery or further declines.