|

Stablecoin for pig butcher scammers

Telegram-based illicit marketplace Huione Guarantee has launched its own stablecoin USDH, security firm Elliptic has revealed.

The platform is operated by Cambodian conglomerate Huione Group and is said to play a central role in enabling pig slaughter scams that exploit trust and relationships (often romantic) to trick victims. Huione Guarantee’s hundreds of suppliers provide illicit goods and services, including laundering pig slaughter proceeds.

Elliptic calls it the largest illicit online marketplace of all time, with a total transaction volume of $24 billion. Chainalysis claims to have tracked much higher transaction volume, over $49 billion.

Huione Guarantee and its users have relied heavily on Tether’s USDT, the world’s largest stablecoin by market capitalization. However, USDT includes a feature that allows Tether to freeze blacklisted accounts. This is a safeguard increasingly used to combat illegal activity.

Elliptic suspects that this asset freeze may have partially motivated Huione Guarantee’s decision to launch its own dollar-pegged cryptocurrency.

According to blockchain forensics company Chainalytic, pig slaughter scams are one of the most widely circulated scams. A University of Texas study estimates that more than $75 billion was stolen through these schemes.

These scams often involve victims of human trafficking or kidnapped individuals who are forced to commit the fraud. Victim-turned-assailants are trapped in compounds and exploited to target others. Some of these compounds are linked to politicians in Southeast Asia.

In Cambodia, award-winning journalist Mech Dara was arrested last year because human rights activists claimed he had been exposed to a cryptocurrency fraud hub and was linked to Senator Ly Yong Phat.

Phat, a leading member of Prime Minister Hun Manet’s ruling Cambodian People’s Party, faces charges related to human trafficking and forced labor linked to cryptocurrency fraud. He was sanctioned by the U.S. Treasury for charges that the Cambodian government publicly criticized.

Dara was released on bail after issuing a public apology to Cambodia’s former leader Hun Sen and his son, the current prime minister. He then announced his decision to retire from journalism.

Disgraced former Philippine mayor Alice Guo was also implicated. In 2019, Guo co-founded Baofu Land Developments, a company whose properties were later raided to rescue hundreds of human trafficking victims who had fallen victim to pig slaughter scams.

Sony’s blockchain ambitions clash with decentralization ideals and memecoins.

Sony launched Soneium, an Ethereum layer 2 network, but sparked controversy shortly after its debut after the platform blacklisted some memecoin contract addresses.

Blockchain participants observed two token contracts frozen by Soneium, leading to accusations that the chain was “strongly” demanding $100,000 worth of Ether from users.

Soneium director Sota Watanabe told Cointelegraph that the token was blacklisted for intellectual property infringement, but added that the decision could be appealed. The two projects in question have actually launched appeals and are updating their tokens to comply with network policies. He said the funds were not frozen because he limited public RPC interactions to only blacklisted contracts.

Meanwhile, the cryptocurrency community criticized the centralized nature of permissioned chains. While many expressed concern about whether other centralized networks might adopt similar practices, others used the incident as an opportunity to highlight the decentralization of their own platforms.

That said, community members have shown that it is possible (albeit not straightforward) to bypass sequencer-based censorship to purchase banned tokens through forced transactions in L1.

Developed by Sony’s blockchain division, Soneium is built on the Optimism Foundation’s OP Stack (the same framework that powers other layer 2 networks, such as Coinbase’s Base).

The blockchain launch included partnerships with Sony Pictures and Sony Music to give fans access to exclusive content through non-fungible tokens.

Also read

characteristic

Safe harbor or thrown to the sharks by Voatz?

characteristic

1 in 6 new default memecoins are fraudulent, and 91% have vulnerabilities.

The Three-Party Pledge to Lazarus

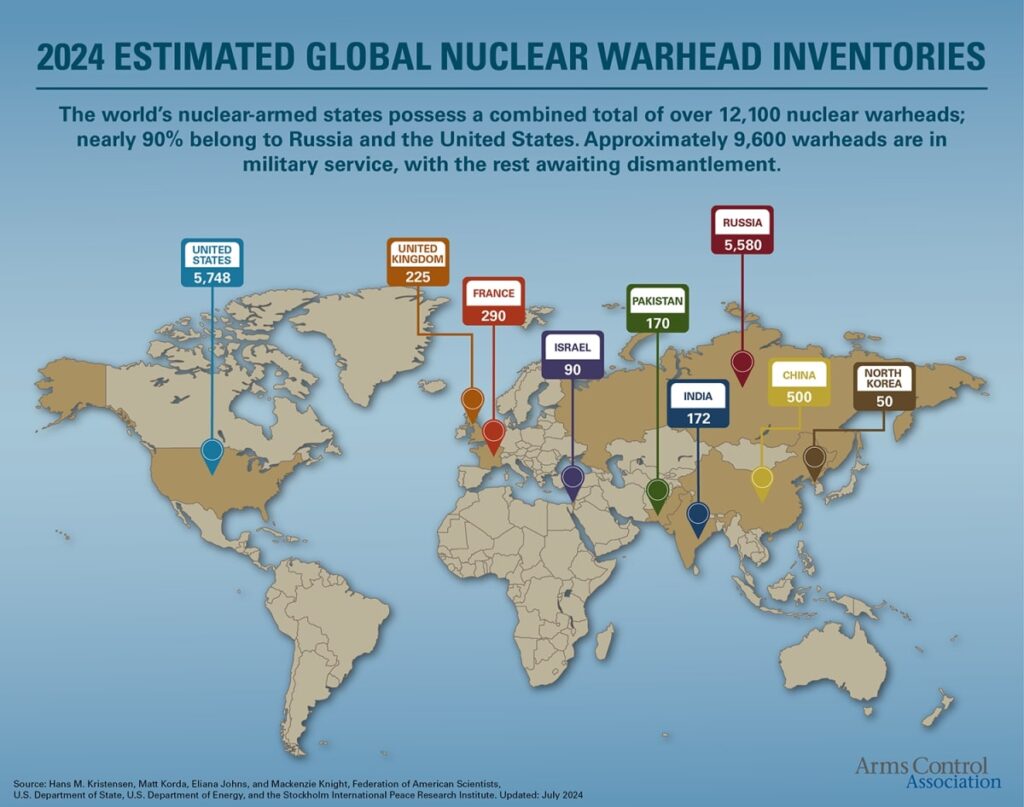

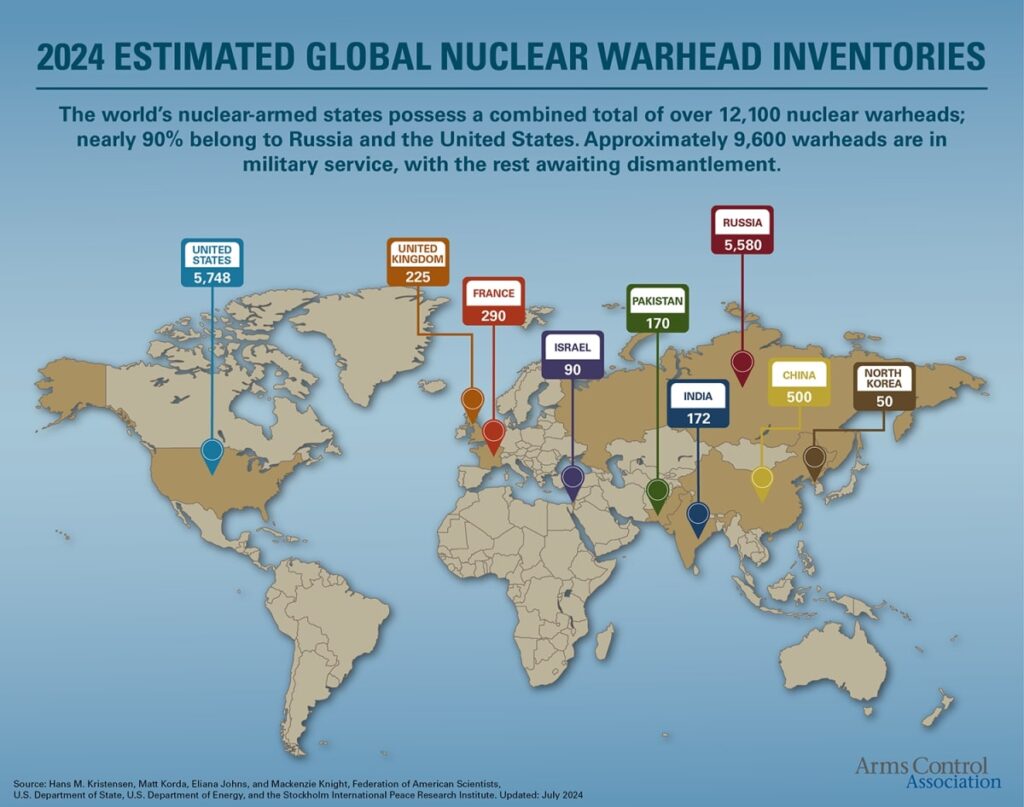

According to a joint statement from Japan, South Korea, and the United States, North Korea’s cryptocurrency theft by 2024 will amount to at least $650 million.

The biggest thefts of the year targeted Asia-based exchanges, with $308 million stolen from Japan’s DMM Bitcoin and $235 million from India’s WazirX. Even before the official statement was made, security experts had linked these attacks to North Korean state hackers, including the infamous Lazarus Group.

According to the United Nations, the reclusive kingdom is using stolen funds to finance its weapons program. The U.S. Arms Control Association estimated in a July 2024 briefing that North Korea had developed 50 nuclear warheads. The United States and Russia possess 5,748 and 5,580 warheads, respectively, which is far smaller than North Korea’s arsenal.

The joint statement warned of a sharp increase in sophisticated social engineering tactics by North Korean operatives designed to distribute malware through cyberattacks. In addition to hacking, North Korea’s information technology workers pose a serious internal threat to the private sector. According to the United Nations, these IT agents are estimated to generate between $250 million and $600 million in annual revenue for the regime by posing as legitimate employees.

North Korea’s brazen tactics and reliance on cybercrime highlight its growing dependence on illicit activity to sustain its ambitions. With blockchain companies and exchanges in the crosshairs, the global cryptocurrency industry is at the forefront of the dark economic war.

Also read

characteristic

Proposal to regulate cryptocurrencies in the U.S. amid fears and doubts from lawmakers

characteristic

The FBI directly arrested Virgil Griffith for violating sanctions.

Korea’s largest exchange in Limbo

It has been reported that Upbit received an order to suspend operations from financial authorities on charges of violating know-your-customer and anti-money laundering obligations.

According to anonymous sources cited by Maeil Business Newspaper, Upbit received prior notice from the financial authorities on January 9 about the alleged violation.

Once the suspension is confirmed, Upbit will be restricted from signing up new customers for up to six months. Upbit must submit a written opinion to the authorities regarding the business suspension order by the 20th.

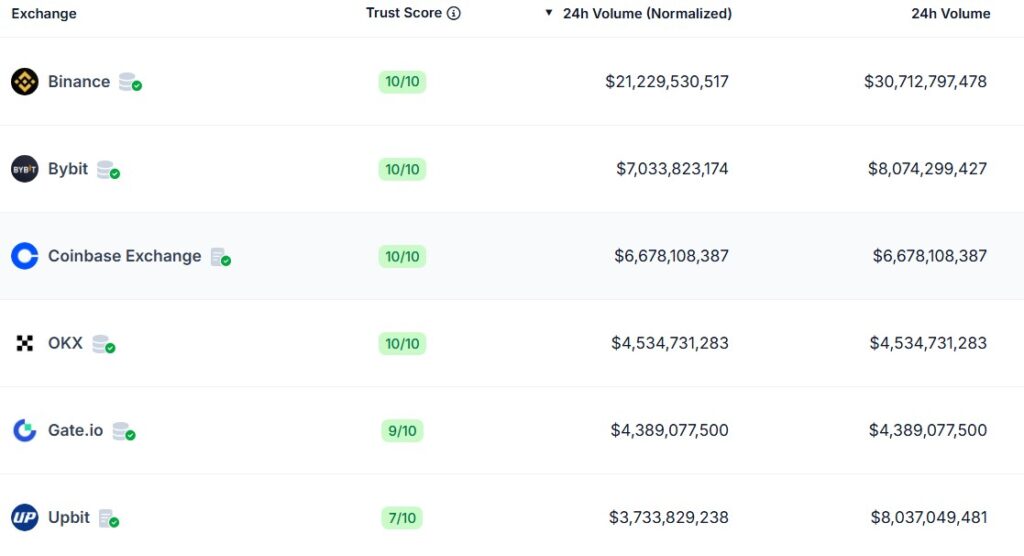

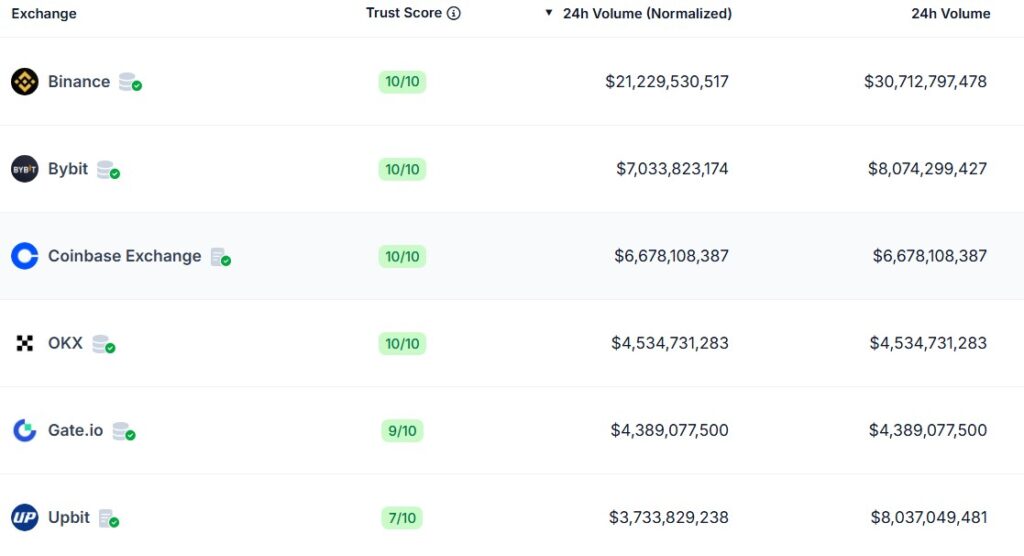

Upbit is Korea’s largest cryptocurrency exchange based on trading volume, and according to CoinGecko, it ranked 6th in global 24-hour trading volume on January 16.

The Financial Intelligence Unit (FIU)’s business suspension order is expected to affect Upbit’s ongoing business license renewal. The permit, which must be renewed every three years, expired in October last year and is currently under review.

FIU began on-site inspection of Upbit’s renewal application last August. During the inspection, approximately 700,000 instances of suspected non-compliance with KYC requirements were identified.

subscribe

The most interesting read on blockchain. Delivered once a week.

Yoon Yohan

Yohan Yoon is a multimedia journalist covering blockchain since 2017. He contributed as an editor to Forkast, a cryptocurrency media outlet, and covered Asian technology stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.