- USDT minting has reached a total of $16 billion since Bitcoin peaked at $74,000.

- Whale activity increases as Bitcoin and USD liquidity become correlated.

Tether Treasury minted 1 billion USDT on Ethereum and sent 183.2 million USDT to Cumberland for exchange deposits in the last 13 hours, according to what SpotOnChain observed on X.

After the August 5 cryptocurrency market crash, Cumberland received 953 million USDT from Tether and invested 906.7 million USDT in various exchanges, including Coinbase, Kraken, OKX, Binance, and Bullish.com.

Source: SpotOnChain

Additionally, Tether ($USDt) was integrated into the TON blockchain, driving USDT’s market cap to an all-time high of $115.6 billion.

As of today’s writing, Tether’s $1 billion worth of coins combined would bring the total value of the coins to $16 billion since Bitcoin hit its all-time high of $74,000.

As big financial players prepare to enter the market, they can use this liquidity to drive the price higher. This new Tether development is a sign of increased whale activity on centralized exchanges due to smooth transactions.

The ongoing mining coincides with the recent market surge, supported by secure and efficient infrastructure such as MPC wallet providers, custodians, and RPC solutions. In short, all of this leads to more activity on centralized exchanges.

Therefore, there is reason to expect that these castings and transfers will drive the momentum in the cryptocurrency market.

Source: TradingView

Whale Watching Hike

However, after the minting and previous activity, Whale “0xbe6” withdrew 935.1 WBTC ($55.6M) from Binance at an average price of $59,451.

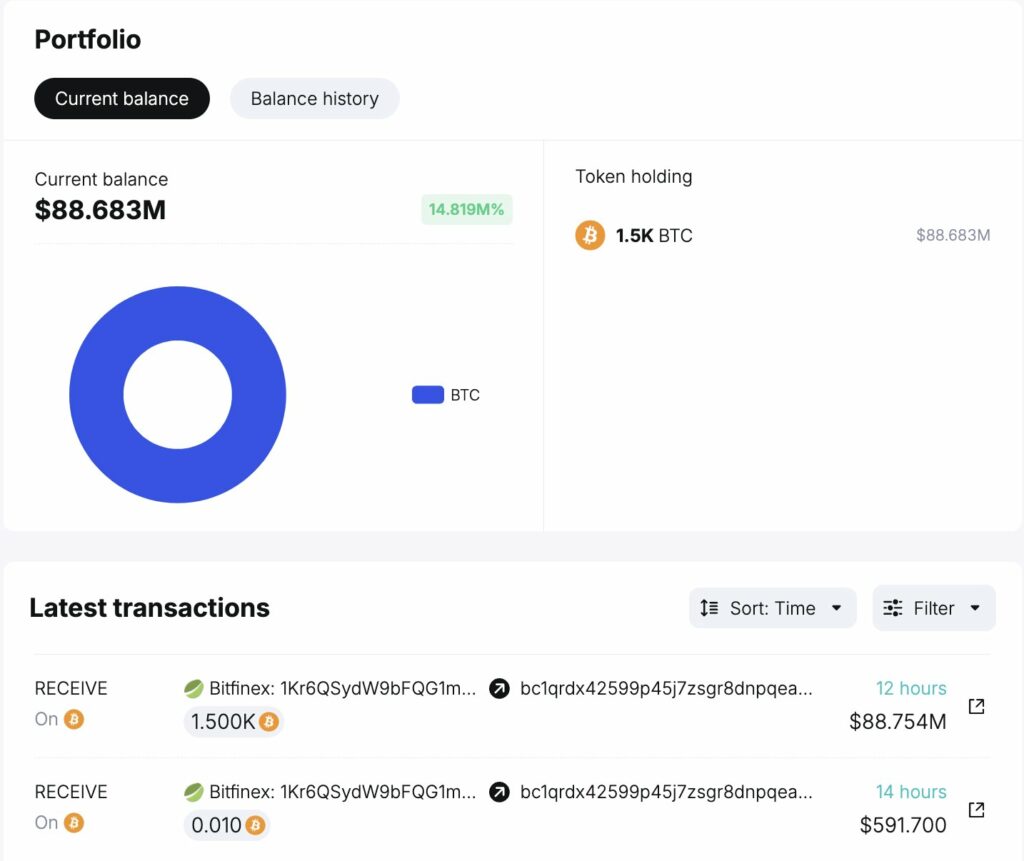

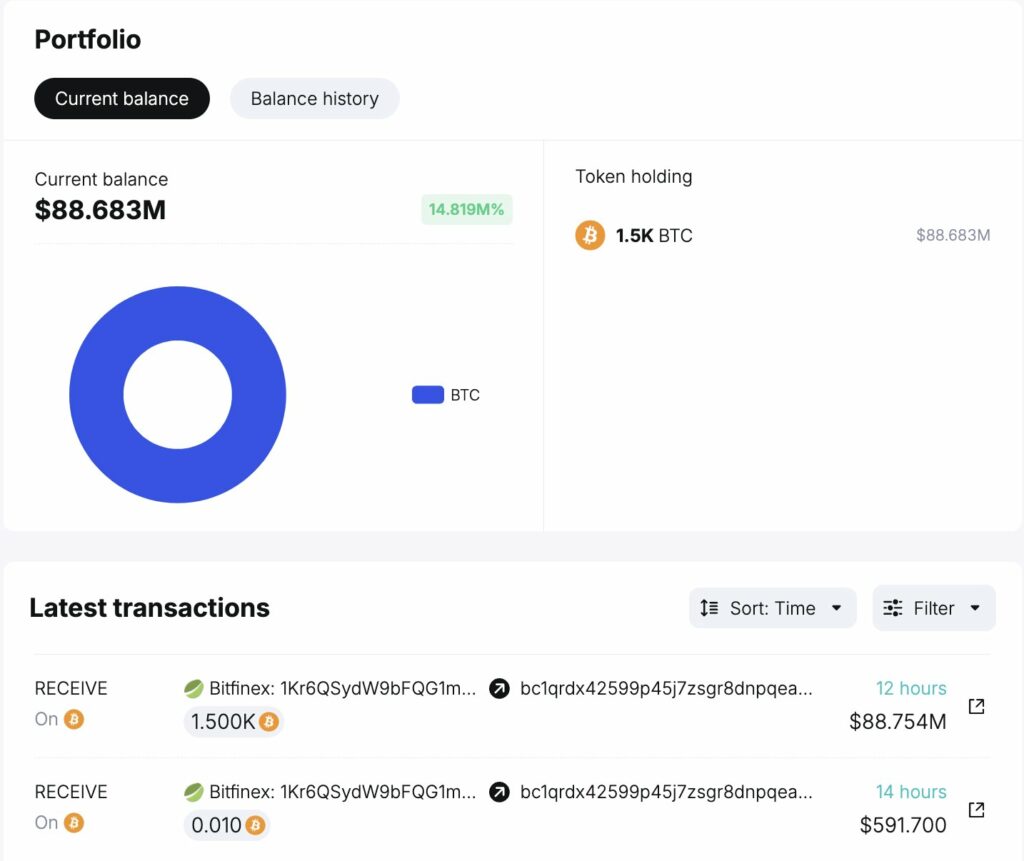

Similarly, a few hours later, another whale, “bc1qr,” withdrew 1,500 BTC ($89.1 million) from Bitfinex for $59,393.

The significant transactions between these two prominent whales have been confirmed through data from SpotOnChain.

Source: SpotOnChain

Bitcoin and USD liquidity rhymes.

It’s also worth noting that Bitcoin and USD liquidity typically move together, but ETF flows have driven BTC higher this year despite lower USD liquidity.

Conversely, USD liquidity is currently increasing on the charts, which could increase risk assets as the trend continues due to the minting of USDT.

Source: TradingView

This new rhythm between BTC and USD liquidity is likely to have implications for USDT, especially since it has recently been released in large quantities on centralized exchanges.