- The rise in TVL means that the project has regained market confidence.

- Unless ETH rises significantly, the price of STRK may continue to fall.

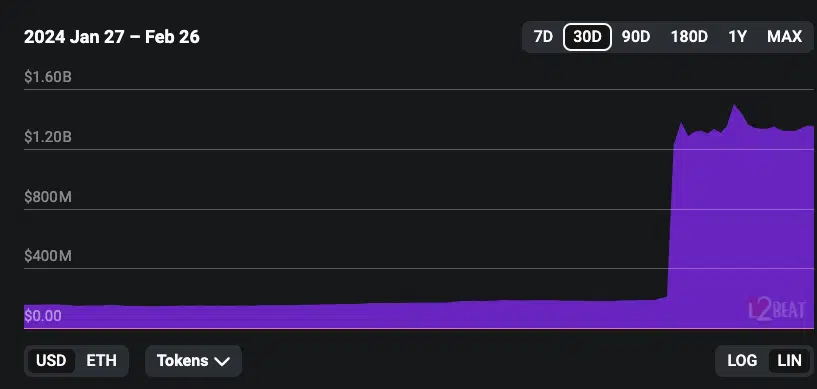

According to data obtained by AMBCrypto from L2BEAT, the total value locked (TVL) of Starknet (STRK) has increased by 194%. At press time, Starknet’s TVL was $1.32 billion.

The increase in TVL means that Ethereum (ETH) Layer 2 has become the fourth largest L2 among projects already launched on the blockchain.

TVL measures the value of an asset locked in a specific blockchain network. For Starknet, this growth can be considered impressive.

The trend has improved

This is because it was only released on the mainnet on February 14th. The launch of Starknet was successful as it rewarded early adopters with over 700 million STRK tokens.

Source: L2BEAT

However, as AMBCrypto previously reported, its introduction was not without controversy.

Over the past week, there have been claims that the Starknet team has been selling huge amounts of tokens and dumping them on the community. This caused the price of STRK to fall below $2.

An error occurred in token issuance as well.

Moreover, the increase in TVL showed that the tide may have turned. A decrease in TVL may indicate that market participants were cautious about adding liquidity to Starknet.

Therefore, this impression suggests that participants perceive the L2 as trustworthy.

If TVL continues to increase, STRK is likely to surge higher than its press time value. However, TVL alone cannot determine whether the price of STRK will rise or not.

So we took some time to look at other indicators.

Can STRK stop its losing streak?

One of the indicators we considered was development activity. Development activity tells us whether the project brings new features to the network. This is done by tracking public GitHub repositories on the network.

If the metric increases, it means developers are releasing new features.

Therefore, the decline in development activity on Starknet means that developers are committing code more slowly. Reading the indicator can be considered a bearish signal.

But that doesn’t entirely mean it’s headed for ruin, even though STRK was one of the biggest losers of the week that just ended.

When it comes to stablecoin supply on the network, Santiment’s on-chain data shows that there has been some improvement. As of this writing, the supply of stablecoins held by whales has increased to 53.99.

The increase here suggests that whales have enough buying power to trigger a surge in STRK’s price.

Source: Santiment

Realistic or not, here is STRK’s ETH market cap:

In the future, the price of STRK may stabilize or record significant increases. One of the reasons may be related to changes to the token unlock schedule.

Another factor that may affect the price is ETH. If ETH rises to $3,500, betas such as STRK may also rise.