- The XLM reached its peak at $ 0.9, but plunged to $ 0.1 by 2019, down 90% in 2018.

- The liquidation heat map of XLM showed price fluctuations between the main liquidity zone and $ 0.262026 to $ 0.289401.

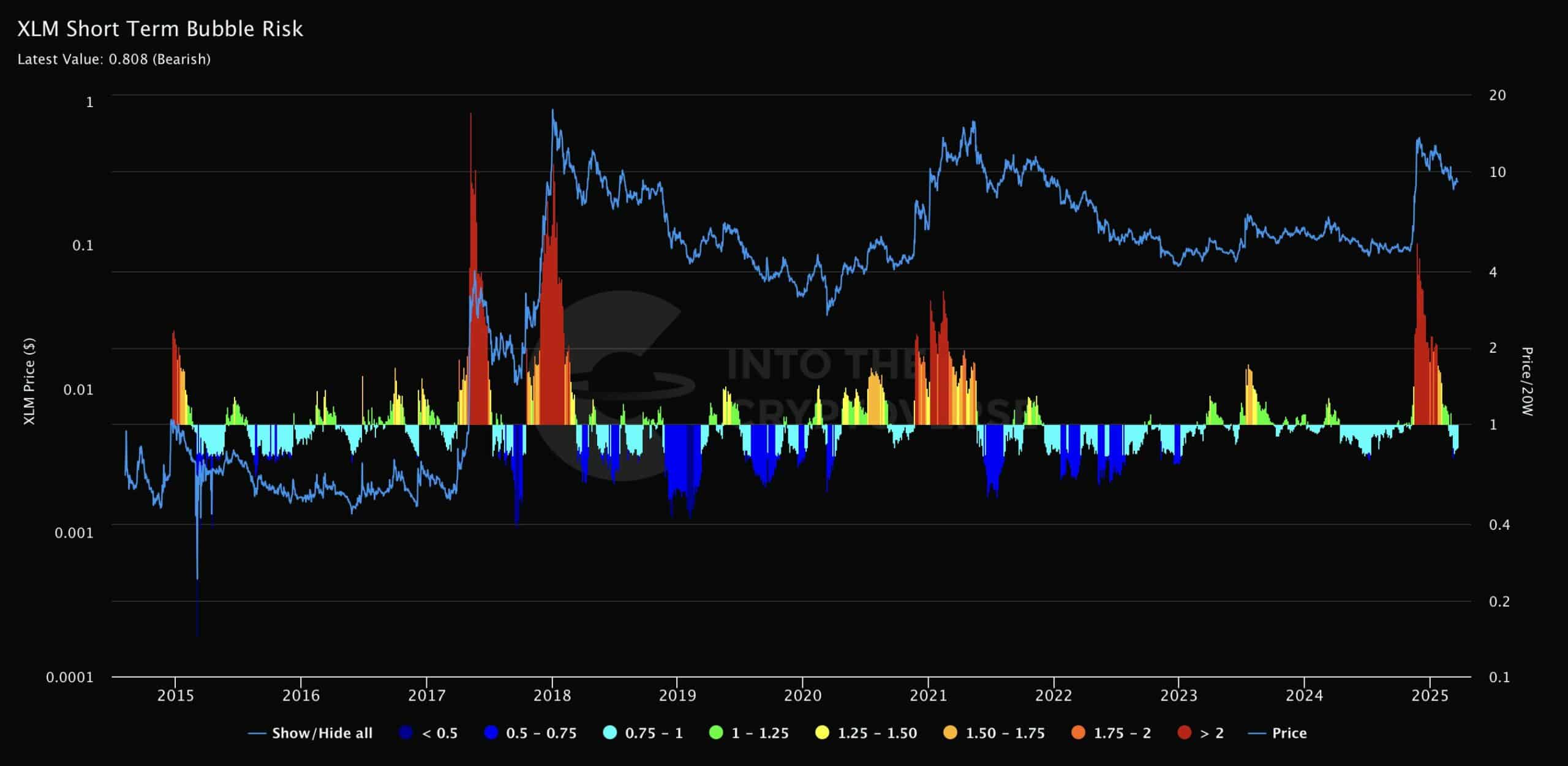

Stellar (XLM) has been in general for quite some time. This showed a historical pattern of rapid price fluctuations according to the peak of the bubble risk oscillator.

Therefore, the short -term bubble risk chart tracks the price at the oscillator level.

The oscillator from 0 to 1 repeatedly spike to 0.5 or more, indicating a high bubble risk. Notable spikes occurred in 2017, 2018, 2021 and 2025, and each is related to significant price drops.

Source: INTOTHEBLOCK

In 2017, XLM reached its peak at $ 0.9, but in 2019, it plunged to $ 0.1 by 2019, down 90% from 2018. Similar trends were shown in 2021, and similar trends appeared when XLM reached $ 0.7 by 2023.

In 2025, XLM has soared to $ 0.4 before it falls back to $ 0.1, indicating a strong weakness in match with the highest point of the oscillator at 0.808.

Historically, each oscillator spike of 0.5 or more has significantly decreased, suggesting continuous volatility.

Despite the historical decline, the drop of less than 0.5 due to stability can signal the reversal.

If the XLM keeps the price more than $ 0.4, it can escape the steep reduction pattern and potentially optimistic.

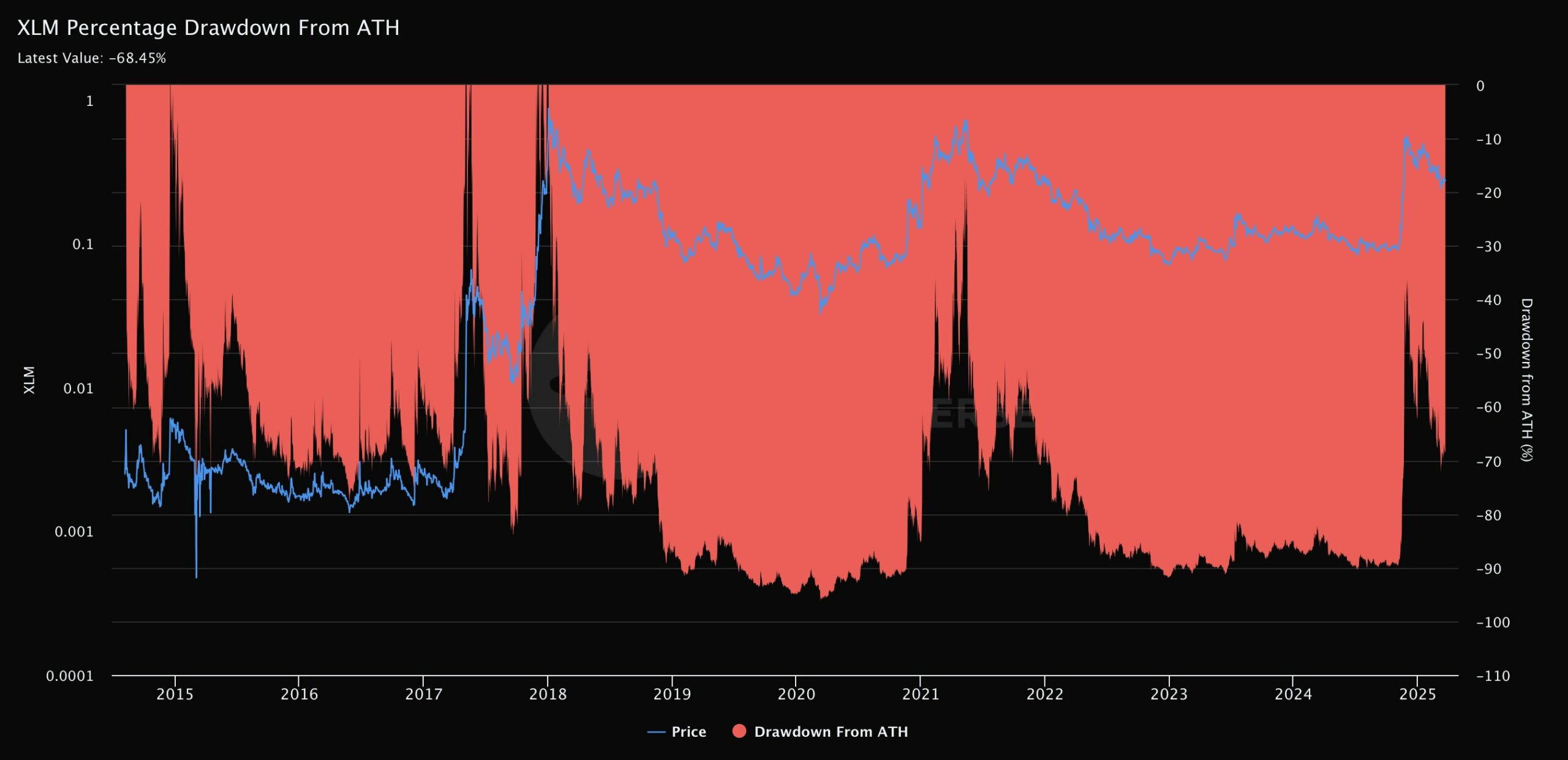

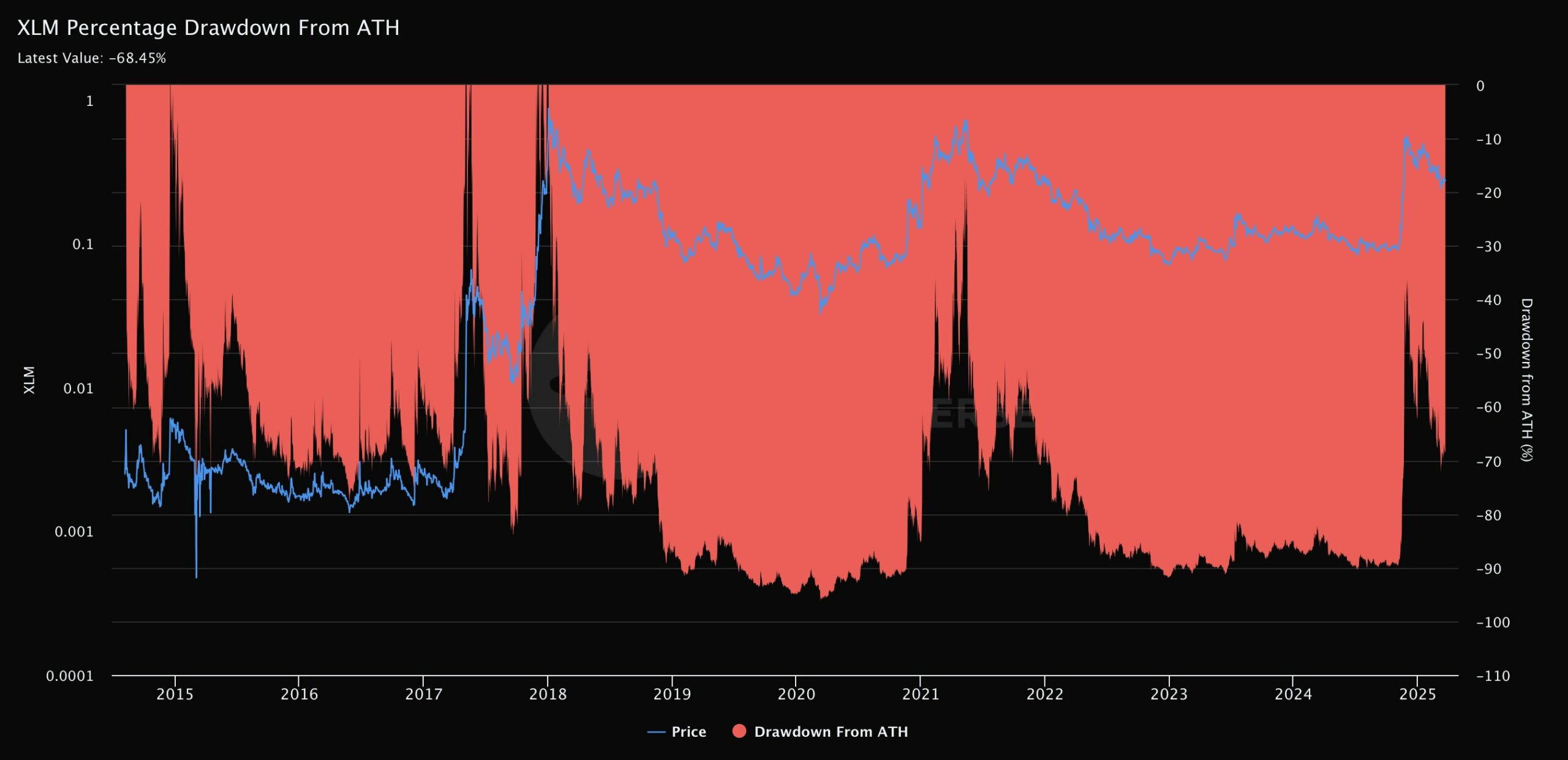

XLM: The insight of ATH is reduced

The decrease in the XLM percentage of the ATH chart emphasized the price record and significant decrease in the coin. After reaching the peak at $ 0.9 in 2018, XLM has decreased to $ 0.1 by more than 90% by 2019.

Source: INTOTHEBLOCK

In 2021, it was the same highest at $ 0.7, which is -80%in 2022. In 2025, the XLM fell -84.5% before it fell to $ 0.1 for a moment.

-80% ~ -90% consistent patterns emphasize the volatility and weakness of assets.

Thus, constant prices of more than $ 0.4, combined with a fall of less than -50%, can show optimistic reversal. If XLM is stabilized by a decrease in volatility, it can be far from the historical trend of steep reduction.

Liquidation risk and safe immigration area

XLM’s liquidation heatmap shows price fluctuations between the main liquidity zone and $ 0.262026 to $ 0.289401. The press time price was $ 0.263026, and the liquidation leverage is more than $ 0.28.

When the price rises, the dense cluster of $ 0.285 and $ 0.289401 emphasizes the risk of liquidation.

Source: COINGLASS

Alternatively, the low liquidity pool is present at $ 0.27 and $ 0.265, and there is a safer entry point compared to $ 0.262026, with a minimum liquidation pressure.

Therefore, investors who lower the risk of liquidation can avoid the position of more than $ 0.28, taking into account the admission between $ 0.262026 and $ 0.265.

Over $ 0.289401, which has been reduced by liquidation, can be optimistic, and exercise traders can be exhibited more than $ 0.29.

Finally, the historical trend of XLM shows continuous volatility along with rapid price modifications according to the oscillator peak.

However, the stabilization of the blow and the reduction of liquidation pressure can provide a recovery path.