Highlights:

- The strategy purchased 8,178 BTC between November 10 and 16, 2025.

- The financing was raised through a €620 million preferred equity offering (STRE) and an on-the-market sale (ATM) of preferred shares STRF, STRC and STRK.

- Following this purchase, Strategy’s total Bitcoin (BTC) holdings increased to ~649,870 BTC.

Strategy Inc (NASDAQ: STRF, STRC, STRK, STRD, MSTR) expanded its already massive Bitcoin position, adding 8,178 BTC between November 10 and November 16, 2025, according to a new Form 8-K filed with the U.S. Securities and Exchange Commission (SEC). The acquisition, valued at approximately $835.6 million, was executed at an average price of $102,171 per BTC, including fees and expenses.

The strategy earned 8,178 BTC for ~$835.6 million at ~$102,171 per Bitcoin and achieved a BTC return of 27.8% YTD in 2025. As of November 16, 2025, we have 649,870. $BTC It was acquired for ~$48.37 billion at ~$74,433 per Bitcoin. $mstrer $StrC $STRD $STRE $STRF $STRK https://t.co/HI1TeYOvQ9

— Michael Saylor (@saylor) November 17, 2025

The purchase was funded primarily through the recent sale of €620 million worth of preferred shares and the company’s ongoing ATM equity program. Funds from both sources were used to expand the Strategy’s Bitcoin holdings and continued its policy of using the Treasury to accumulate digital assets.

As of November 16, 2025, Strategy holds approximately 649,870 BTC, with total purchases of approximately $48.37 billion and an average price of $74,433 per Bitcoin. For Bitcoin, the company’s own calculations currently suggest a return of around 28% year-to-date.

Preferred stock and capital market activities

The November 8-K filing provides important details about the Strategy’s capital markets activities, reflecting the company’s multi-channel approach to raising funds for its ongoing Bitcoin accumulation strategy.

Strategy reported gross securities sales of approximately $136.1 million for the week ending November 16, 2025, under its market offering program. The Company issued the following classes of preferred and common stock under this program:

- STRF (10.00% Series A Perpetual Strife Preferred Stick): 39,957 shares were sold for a notional value of $4 million, generating net proceeds of $4.4 million.

- Floating Rate Series A Perpetual Stretch Preferred Sticks (STRC): 1,313,641 shares sold for $131.4 million, generating net proceeds of $131.2 million.

- STRK (8.00% Series A Perpetual Exercise Preferred Stock): 5,513 shares sold for $600,000, providing net proceeds of $500,000.

The company did not issue any new shares in either the STRD or MSTR categories during the same reporting period. The company recently launched its STRE offering and has also been instrumental in its fundraising strategy. The offering, which was completed on November 13, 2025, included 7.75 million shares of Strategy’s 10.00% Series A perpetual stream preferred stock at a price of EUR 80 per share. The sale resulted in gross proceeds of €620 million ($716 million) and net proceeds of approximately €608.8 million ($703.9 million) after deducting acquisition discounts and expenses. Funds were quickly deployed to acquire additional Bitcoin, reflecting the company’s fulfillment of its corporate obligations.

Buy Bitcoin at a low price

Despite the current very low Bitcoin price, Strategy continues to invest in it. The company views Bitcoin as a long-term rather than short-term investment, and as a long-term store of value for the treasury. They continue to invest money in BTC no matter how bad the token’s current market value is, which shows that they believe in its future growth.

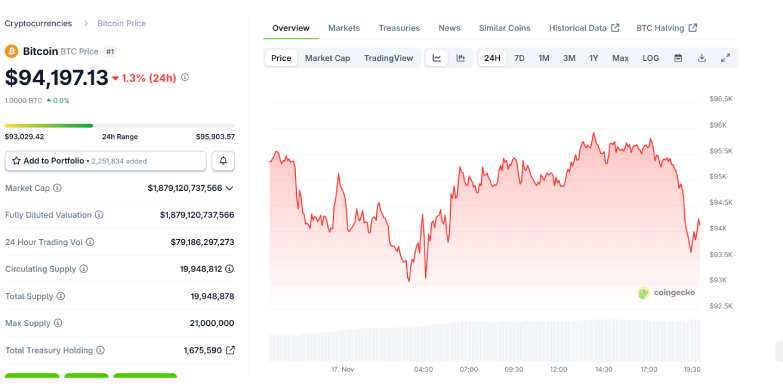

At press time, the token’s price was $94,197.13, down 1.3% over the past 24 hours, according to CoinGecko.

To keep investors informed, Strategy has a public dashboard on its website that shows real-time updates on Bitcoin purchases and other performance details. This kind of transparency is more common in the cryptocurrency world than in traditional companies and helps investors see exactly how the company is managing its digital assets. By combining consistent investment with clear reporting, Strategy positions itself as a forward-thinking company that fully integrates Bitcoin into its financial strategy.

Strategy Becomes Largest Corporate Bitcoin Holder

Following its recent purchase, Strategy now owns over 649,000 BTC, making it the world’s largest corporate Bitcoin holder, with balance sheet exposure exceeding $48 billion. Investors are watching preferred stock programs and ATM activity for future BTC acquisitions.

Also Read: Strategies for Buying Bitcoin Every Day Despite the Drop Below $95,000