Stacks (STX) price is showing a downward trend despite falling more than 12% in 4 days.

This downtrend is due to a lack of confidence among STX holders as they already expected a decline.

Stack investors turn pessimistic.

The STX price is taking a hit from the decreasing confidence of investors who have switched their loyalty despite the slight decline. The negative funding ratio indicates that STX holders are expecting a decline and have started short-term betting. This suggests that there is a bearish sentiment among traders who expect the price to fall.

The change in funding rates over the past 12 hours has been surprising, as negative rates have not been recorded in the past two weeks.

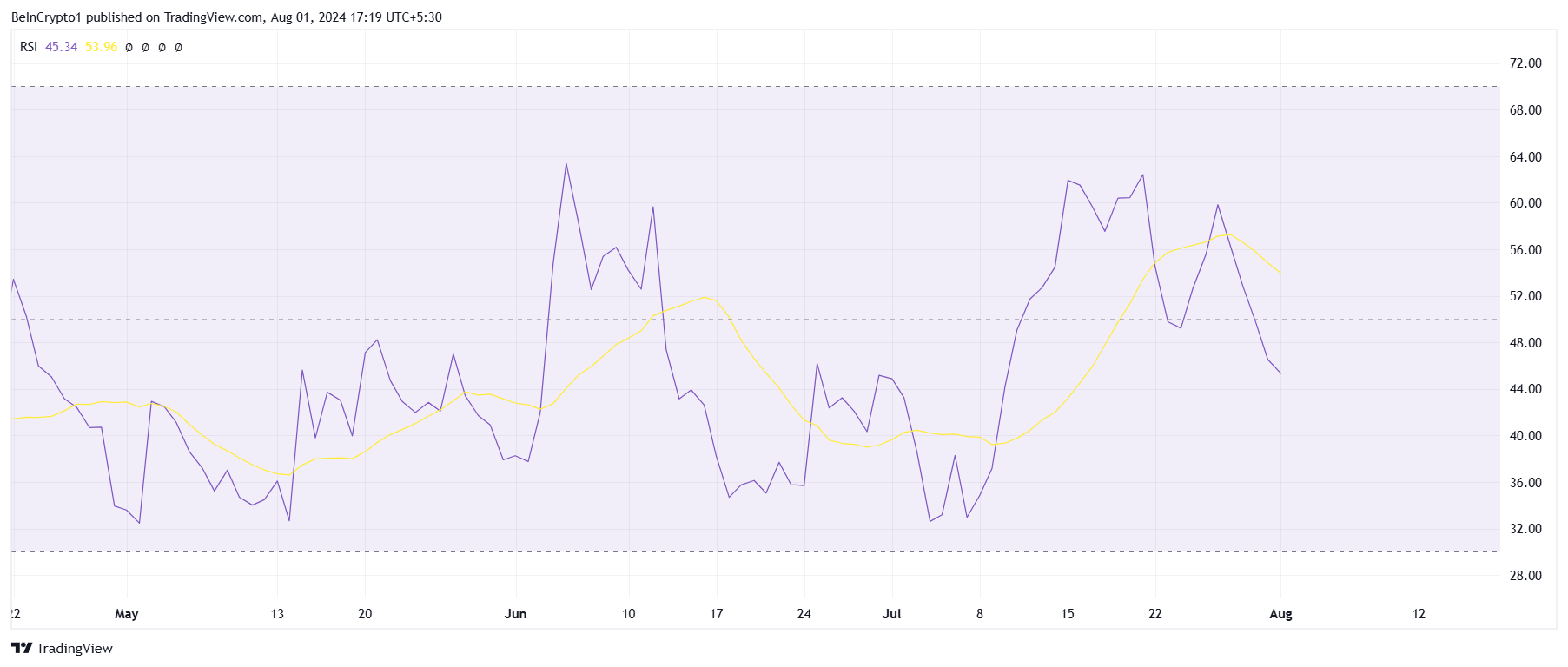

The Relative Strength Index (RSI) further confirms this lack of strength. Over the past 72 hours, the STX RSI has fallen below the neutral line. The RSI is a momentum oscillator that measures the speed and change in price movement.

A break below the neutral line indicates weakening momentum, with selling pressure outpacing buying interest. This can lead to a self-fulfilling cycle where selling pressure increases, pushing prices lower and attracting more sellers.

Read more: What are decentralized exchanges and why should you try them?

STX Price Forecast: Targeting Support

The STX price is at $1.70, well below the previous support level of $1.80, and is now targeting a moderate decline at $1.53. This altcoin has tested this level as support in the past, so there is a possibility that STX will bounce.

If support fails to hold, further price declines could see Stacks reach $1.24, which would erase the 47% gains the cryptocurrency has seen in the past two weeks in mid-July.

Read more: 10 Promising Cryptocurrencies for 2024

However, if the bounce from $1.53 is successful, STX could rise again to $1.80, which would guarantee a strong bullish signal for the broader market. A break of this resistance level could invalidate the bearish theory.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.