- 68.20% of top SUI traders hold buy positions, while 31.80% have sell positions.

- Traders are overleveraged, with a bottom of $3.326 and a top of $3.538.

SUI, the native token of the Sui Network, is making waves in the rapidly evolving cryptocurrency landscape by outperforming major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and other major financial assets.

Aside from the impressive performance, the altcoin is poised to continue this rally as it has formed a bullish price action pattern.

SUI technical analysis and key levels

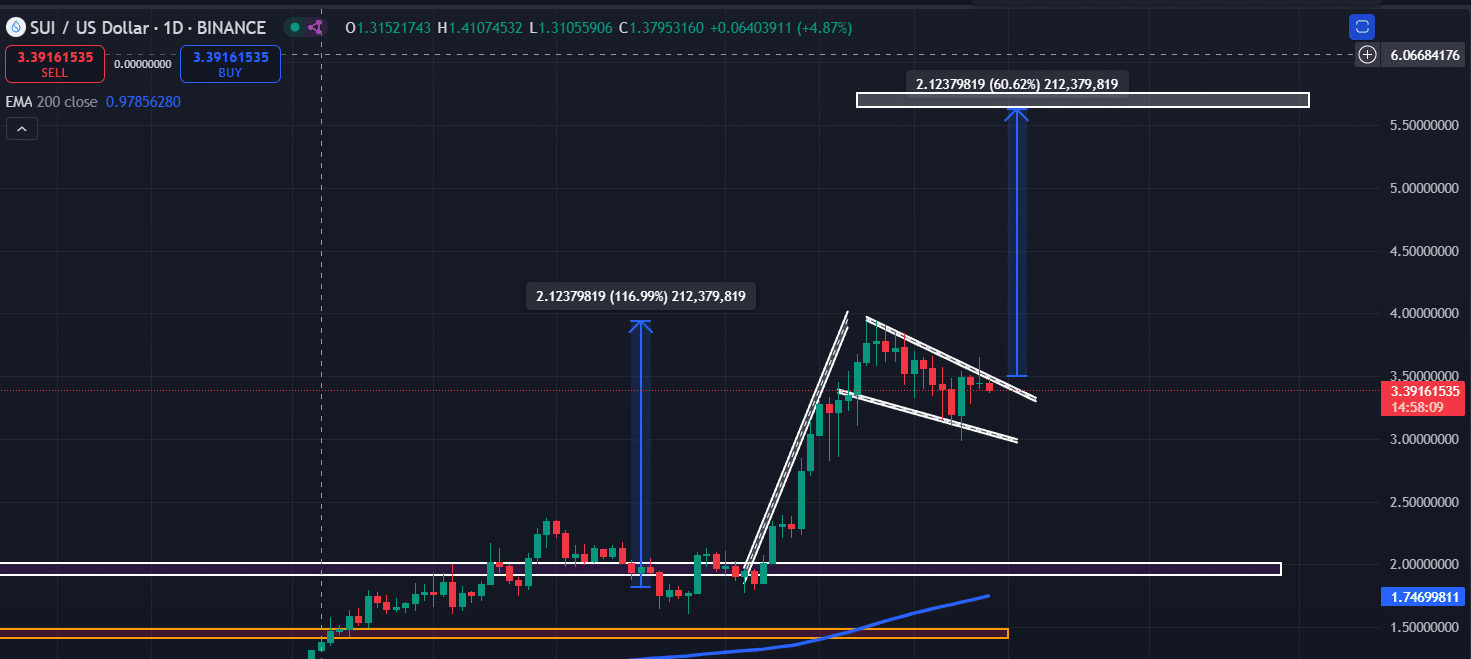

According to expert technical analysis, SUI has formed a bullish flag and polar price action pattern on the daily time frame and is on the verge of breaking out of this formation.

Source: TradingView

Based on recent price action and historical momentum, if SUI breaks and closes the daily candle above the $3.5 level, it is likely to surge 60% and reach the $5.70 level in the coming days.

Based on the SUI daily chart, it appears that the price has already corrected enough to continue its upward trend.

On the positive side, SUI’s Relative Strength Index (RSI) stands at 58.60, indicating a bounce is likely as the token remains below overbought territory.

Bullish on-chain indicators

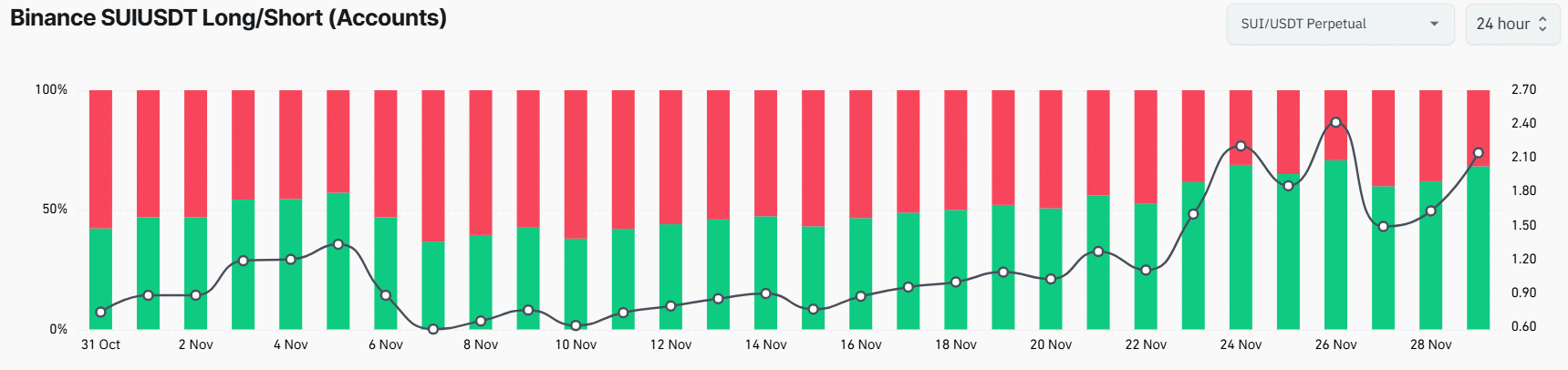

According to a report by on-chain analytics firm Coinglass, traders on Binance are actively engaging in the token due to the strong bullish price action.

According to the data, the Binance SUIUSDT Long/Short ratio is currently at 2.14, indicating strong bullish sentiment among traders. Currently, 68.20% of top SUI traders hold buy positions and 31.80% have sell positions.

Source: Coinglass

This data from an on-chain analytics firm indicates that traders are expecting the price to rise, which has the potential to attract more investors and traders in the future.

Key Liquidation Levels

According to Coinglass’ SUI Liquidation Map data, the current key liquidation levels are $3.326 at the bottom and $3.538 at the top, with traders being overleveraged at these levels.

If market sentiment does not change and the price rises to $3.538, approximately $22.18 million worth of short positions could be liquidated.

Conversely, if sentiment changes and the price falls to $3.326, approximately $10.5 million worth of long positions could be liquidated.

Read Sui (SUI) price forecast for 2024-2025

SUI is trading near $3.41 and has experienced a price decline of over 3.5% in the last 24 hours. During the same period, trading volume decreased by 35%, reducing trader participation.

This means that traders and investors may be waiting for a breakout before deciding to participate further.