- Sui broke through the $1.05 level, turning the market structure bullish.

- The rapid rise is supported by increased volume, increasing the possibility of a move towards $1.77.

SUI (SUI) has had a good run in the past week. From Monday’s low to Sunday’s high, the token is up 51.35% and has been trending down from a local high of $1.5769 in the last 24 hours.

The outlook is bullish across the higher time frames, but a short-term downtrend is expected. Here’s how swing traders can navigate the price trend over the next two weeks.

Is the SUI overextended?

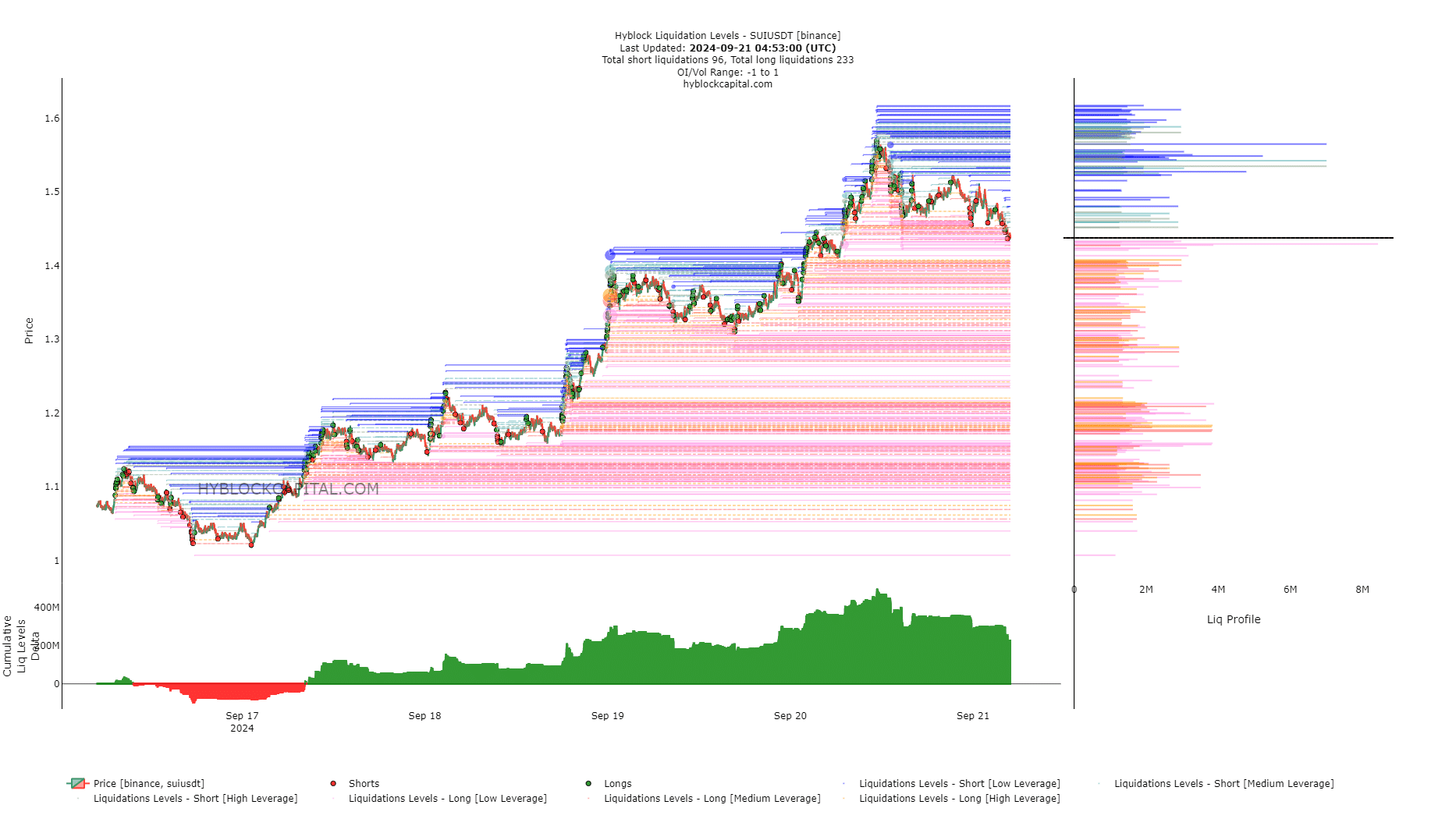

Source: SUI/USDT on TradingView

On Sunday, September 15, Sui closed the daily trading session above the $1.05 mark, a level that was the previous local high and forced a price rejection in August, which brought Sui down to the $0.79 support level.

As this $1.05 level was broken, the daily market structure turned bullish. The buyers wasted no time in influencing the market. The following week, they pushed the price higher, recording a 51.33% move in three days from Tuesday to Friday.

OBV broke through local resistance levels and the daily RSI reached 78, which was overbought territory. The upward speed meant that a short-term reversal was possible.

The next few weeks are likely to be bullish for SUI, as the 100% extension level of $1.77 is the next target. The $1.44-$1.52 resistance has been tested and may temporarily reverse the bullish trend.

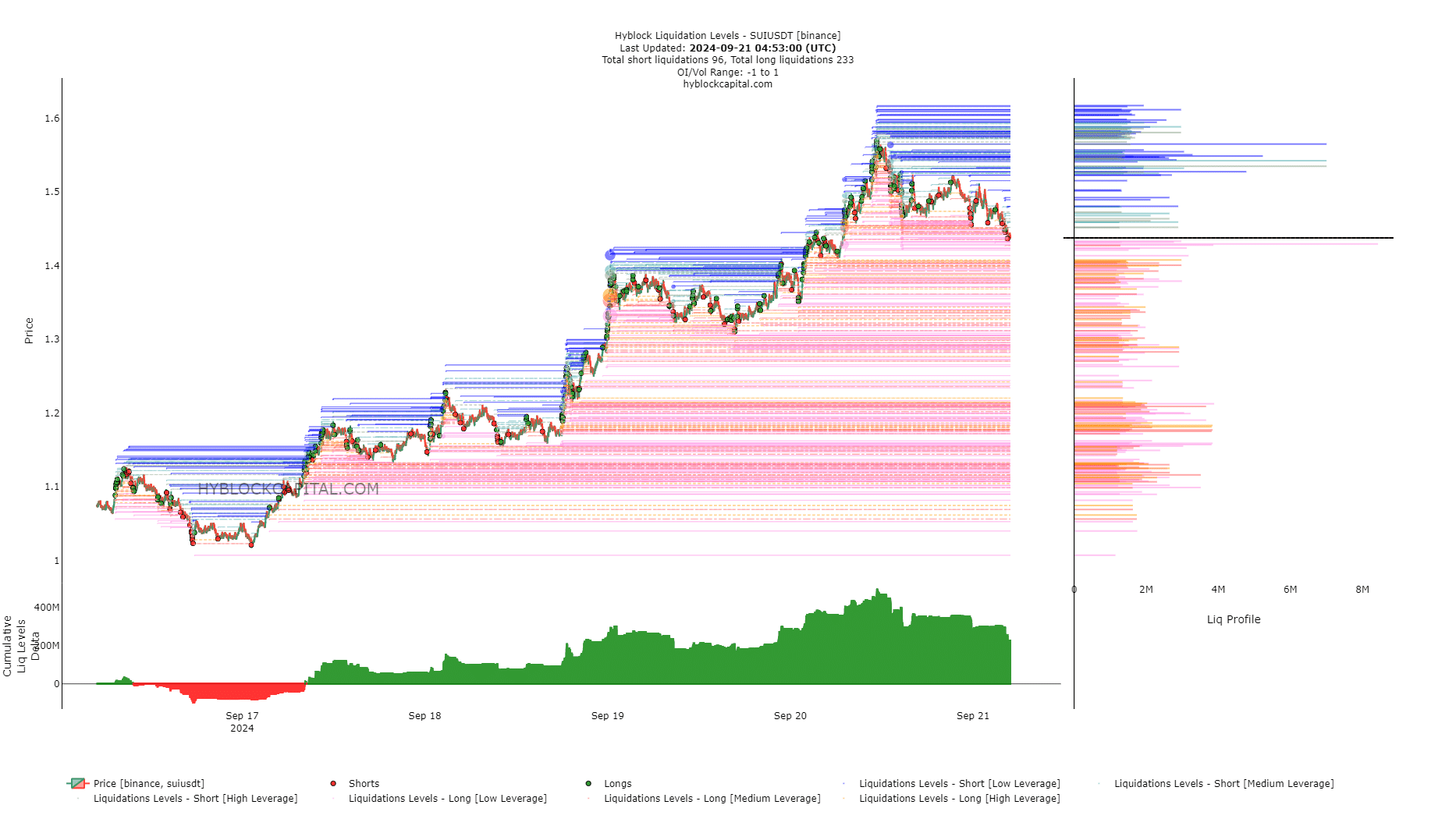

Liquidation levels show how low the decline can go.

Source: Highblock

AMBCrypto found that the cumulative liquidity level delta is generally bullish. The token has decreased slightly over the last 24 hours, dropping from $1.57 to $1.44, but a deeper decline is possible.

Read Sui (SUI) price prediction for 2024-25

The liquidation level cluster of $1.42, $1.37, and $1.3 was the next short-term target. If Bitcoin can hold above the $60k support, a price bounce from these levels is expected next week.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.