- Sui price prediction is expected to surpass $3.54.

- Steady buying pressure in recent months has been a sign that SUI is likely to rise further.

Sui (SUI) recorded a trading volume of $3 billion in the last 24 hours and the asset’s market capitalization is $9.4 billion, ranking 14th on CoinMarketCap.

Multi-billion dollar assets sometimes have a harder time rising faster than smaller assets.

The strength shown by SUI since September was evidence of bullish confidence in the token. A move above $3.54 and $4 is a more likely scenario than a decline to $2.5.

SUI price prediction is bullish on higher time frames

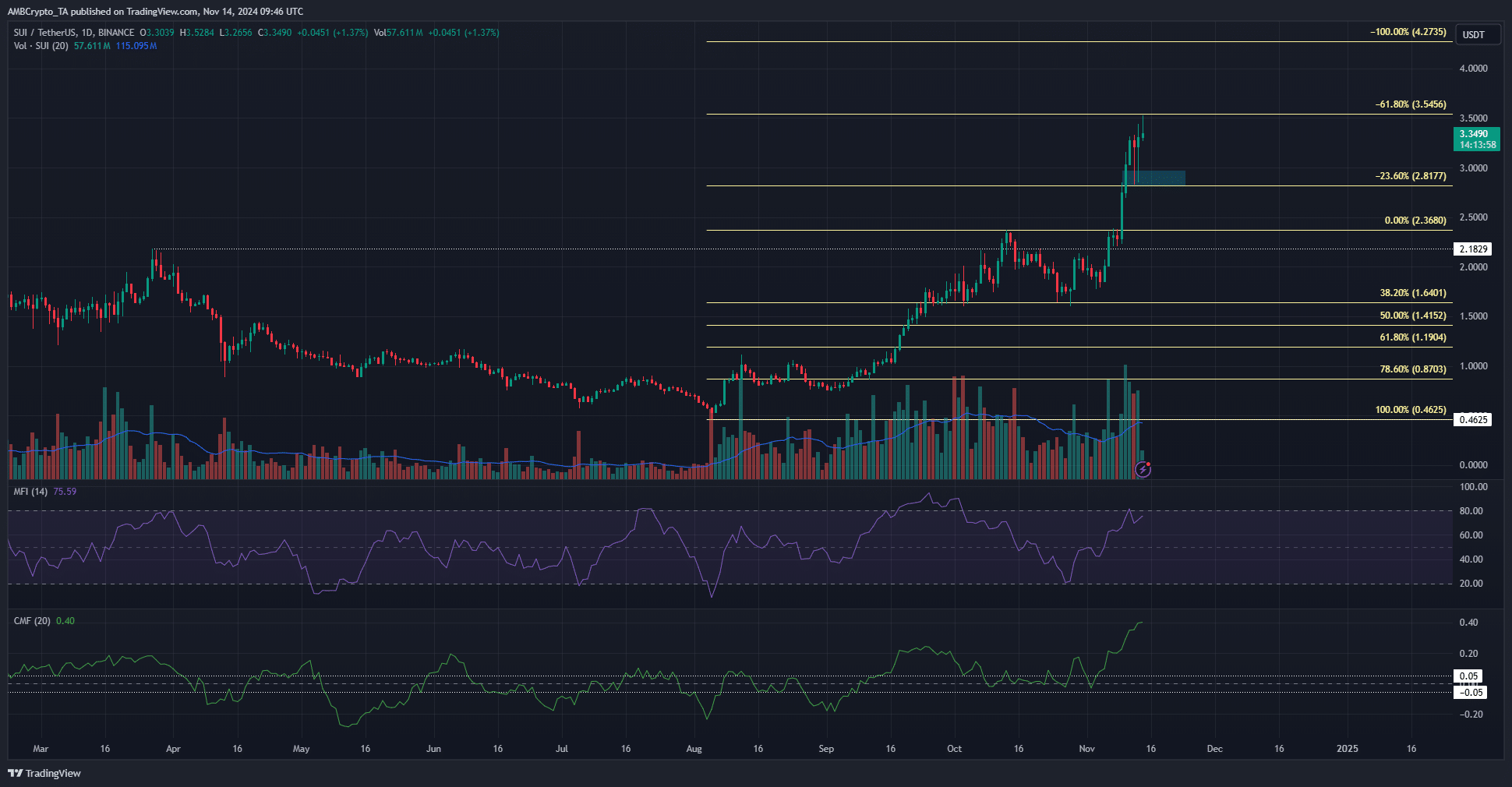

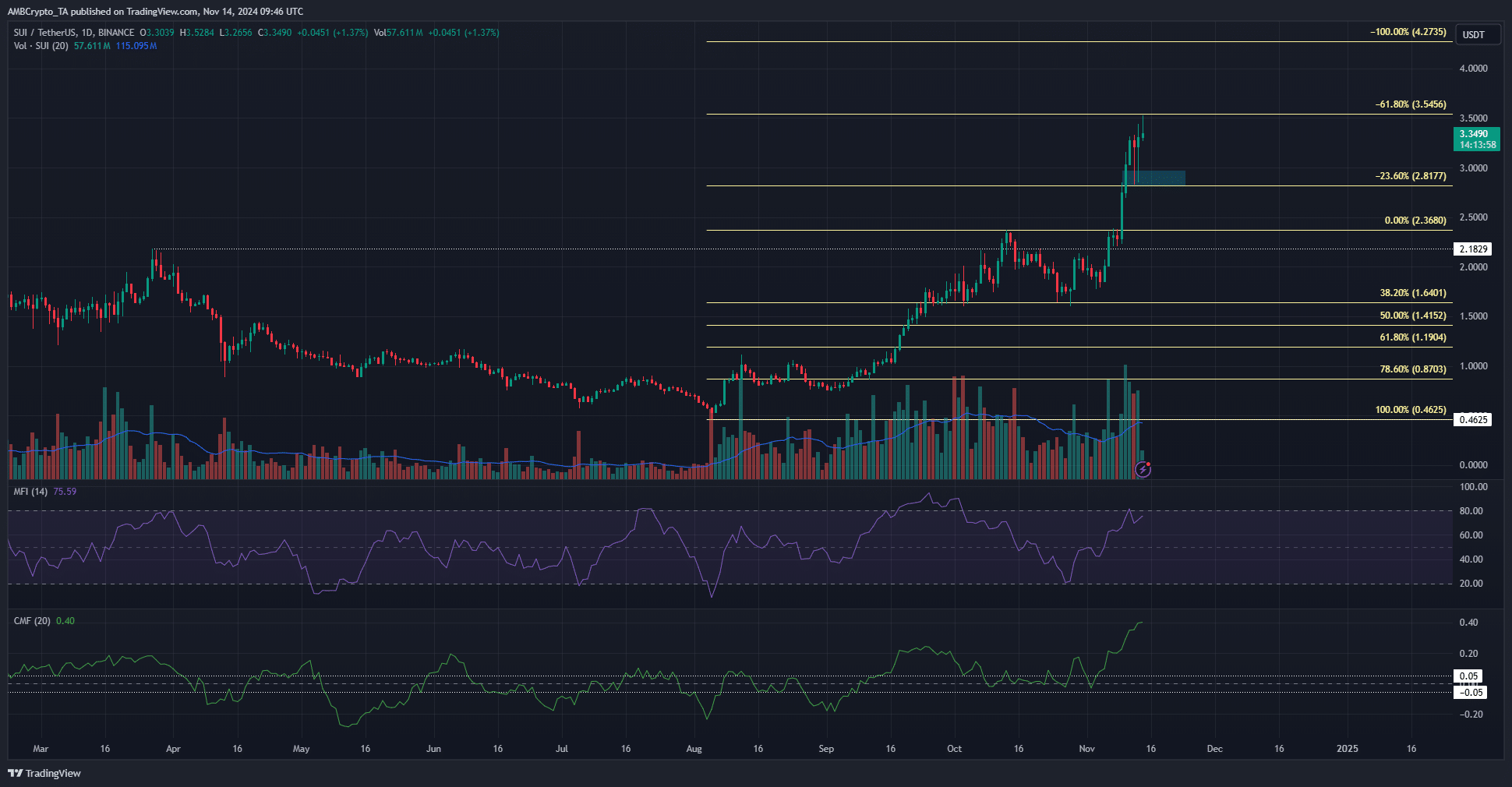

Source: SUI/USDT on TradingView

SUI has a very optimistic market structure. It has been on an upward trend since mid-September, but there were signs of a rebound in August.

Altcoins have been on a downward trend since April, with low trading volume.

This volume trend changed significantly in August. Capital inflows were even, but the bulls won in September and SUI hasn’t looked back since.

Sui price predictions are optimistic in the long term, but may be somewhat volatile in the short term. Lower term analysis shows that the 23.6% Fibonacci extension level of $2.81 appears to be a key support area.

A deeper retracement below $2.81 would reverse the lower period bias to bearish, but the daily chart would remain bullish. MFI showed strong upward momentum and no bearish divergence.

CMF has surpassed its record high last November, reflecting massive capital inflows into the market.

Open interest has taken a bit of a hit.

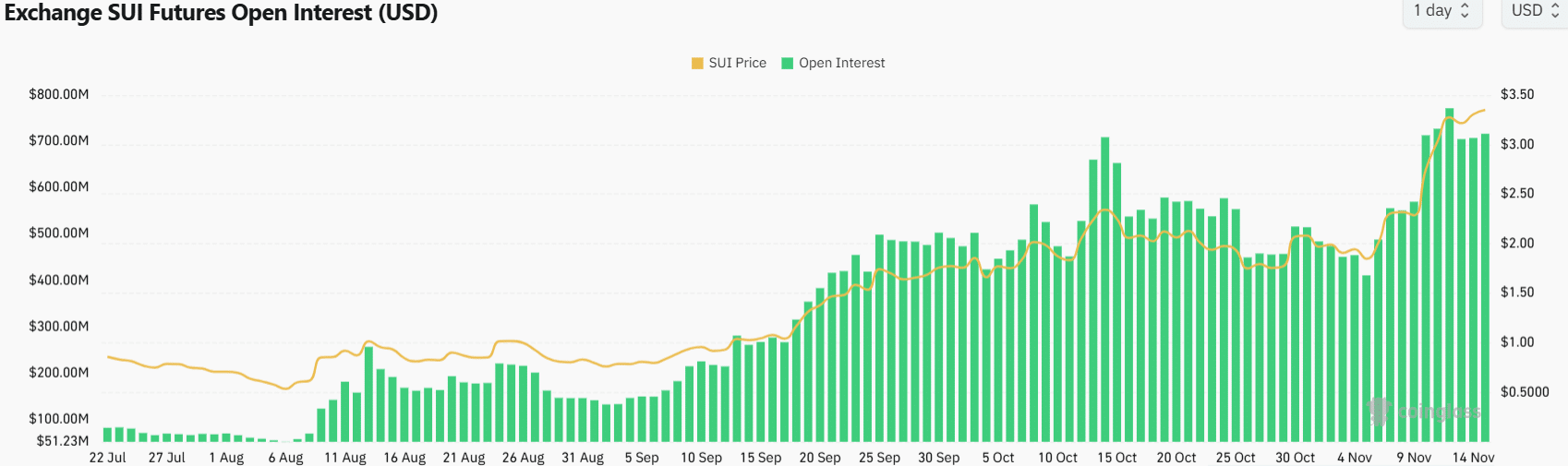

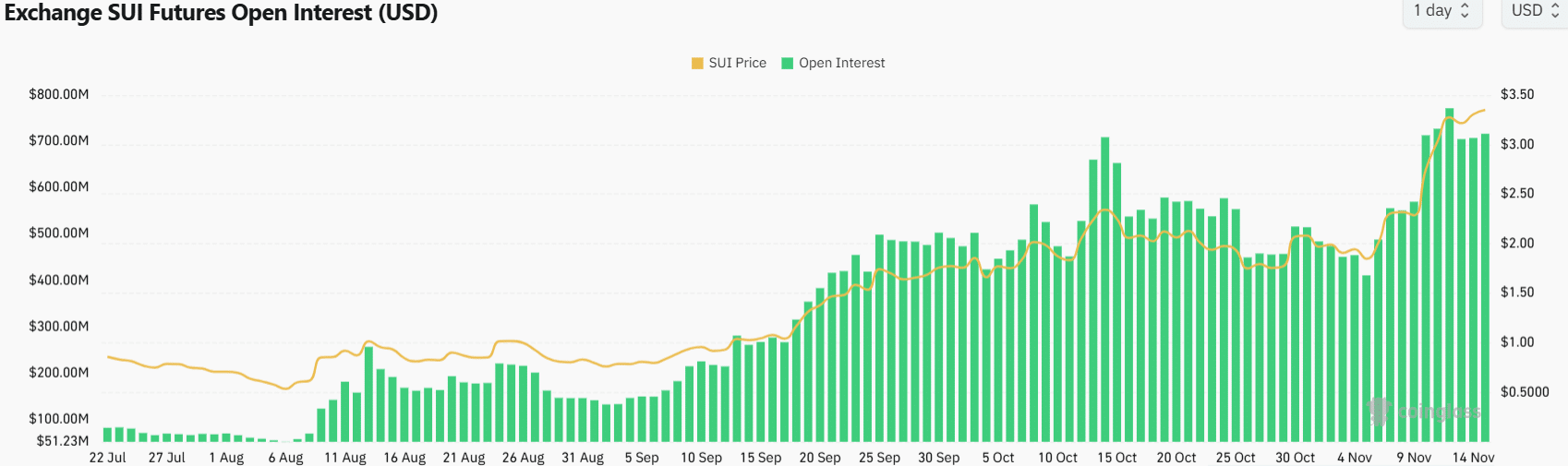

Source: Coinglass

Open interest, as well as trading volume, began to recover in August.

The rise in OI, along with higher prices in late September, reflected steady bidding in the futures market. It described optimistic beliefs.

OI has declined from $771 million to $716 million over the past three days as SUI faces some selling pressure in the $3.3 region.

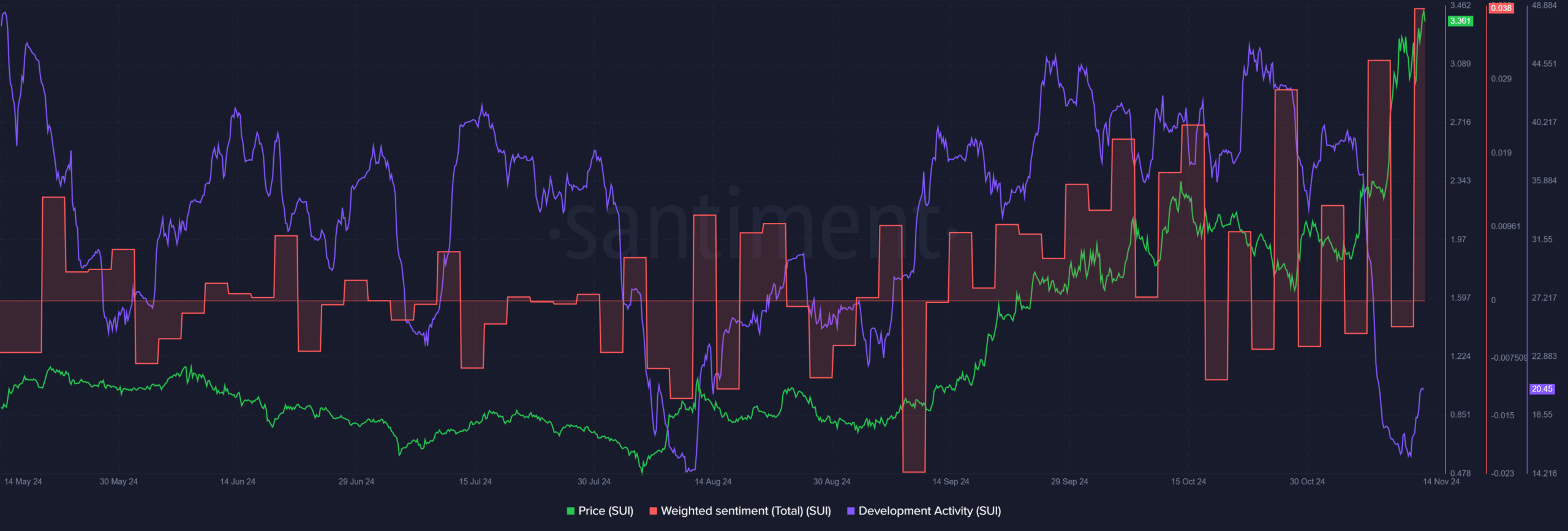

Source: Santiment

Realistic or not, the market cap of SUI in BTC terms is:

Weighted Sentiment remains solidly bullish and has been so for most of the past month. However, development activity has declined sharply in recent weeks.

There have been several such declines in 2024, so this decline is unlikely to be a cause for concern.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.