- As weak hands exit the market, SUI could be ready for a breakout.

- If this happens, your ranking within the top 20 may change.

Sui (SUI) has shown significant influence, surpassing Litecoin (LTC) in market capitalization over the past 30 trading days. The growing user base has certainly fueled this upward trend.

However, recent weekly declines of more than 3% have put SUI on the top loser charts.

This gap led analysts at AMBCrypto to investigate whether the recent decline was a deliberate attempt to shake off a weak hand, setting the stage for stronger pressure that could push SUI to close near $2.40.

If so, a rebound could nearly depress its status as the 17th-largest cryptocurrency by market capitalization. Otherwise, Litecoin appears ready to reclaim its position.

SUI has reached a trading milestone.

Interestingly, SUI has shown strong upside potential over the past two months. Despite the bearish cycle, the bulls prevented a retracement and held on to the last support level at $0.53.

Trading at $2.06 at press time, SUI has seen an impressive rise in a short period of time. This surge was marked by a significant peak, with RSI becoming overextended.

However, despite these concerns, the token maintained its upward trajectory, experiencing only minor issues and running smoothly strategically with bullish support.

This momentum is fueled by a network design that aims to address the shortcomings of traditional blockchains by enabling faster transactions without congesting the network.

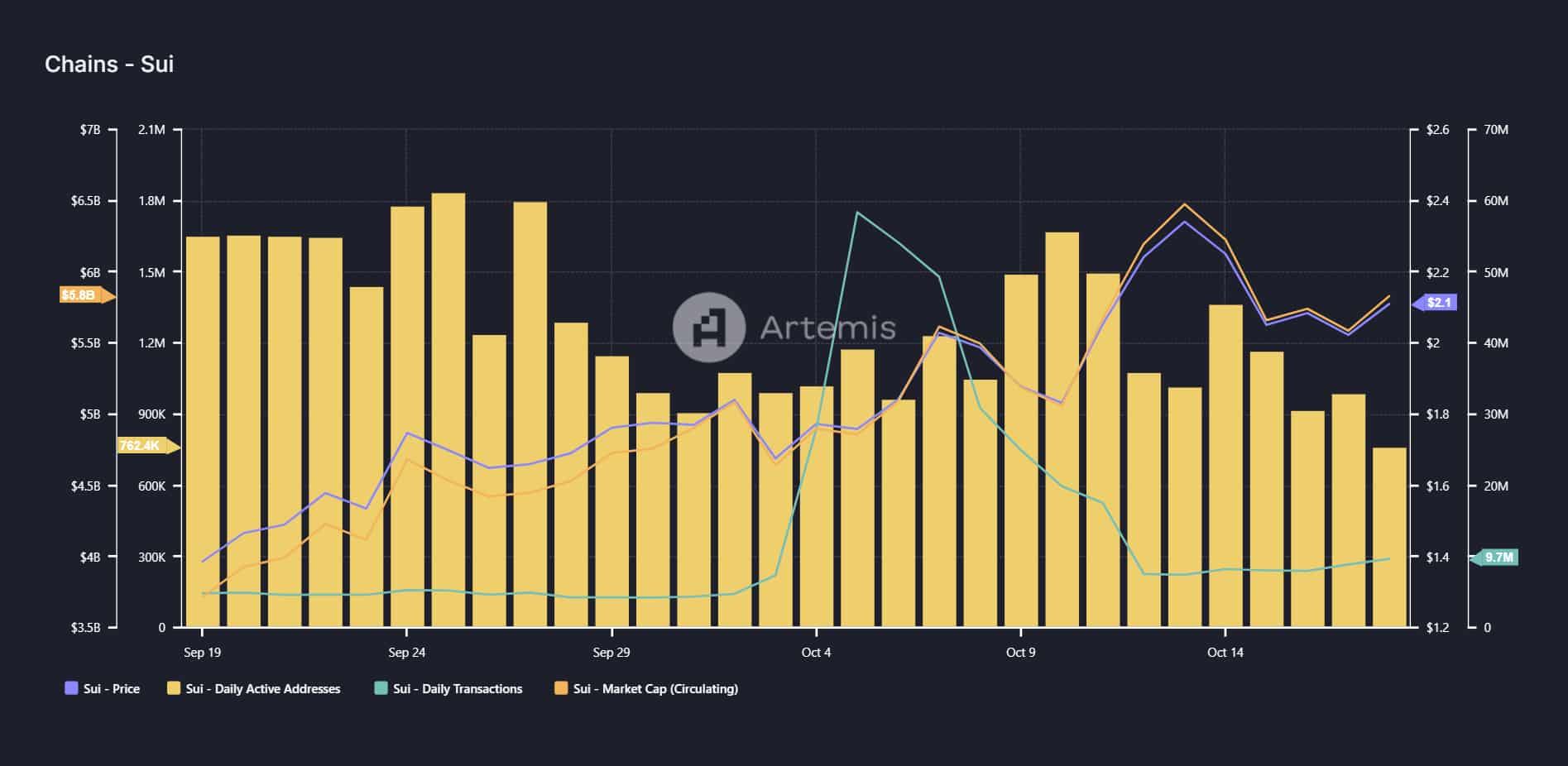

SUI, which achieved 270K TPS, boasted an incredible trading volume of $6 billion and created a huge stir among cryptocurrency users.

This success led SUI to hit an ATH of $2.40 just a week ago.

However, as this price range represents a potential high, many wallets have begun offloading their holdings, leading to a significant decline in daily trading, which has halved to $20 million.

Source: Artemis Terminal

This trend suggests that the surge has turned many stakeholders to the benefit, forcing the weaker hands out.

However, for a bounce to materialize, it will be important for new buyers to target the local low of $2 with potential downside hoping for a rally that could deliver significant profits.

If this trend holds, SUI could experience an intense rebound, potentially leading to a new ATH. In such a scenario, the ranking within the top 20 may fluctuate due to market capitalization.

Fierce competition ahead

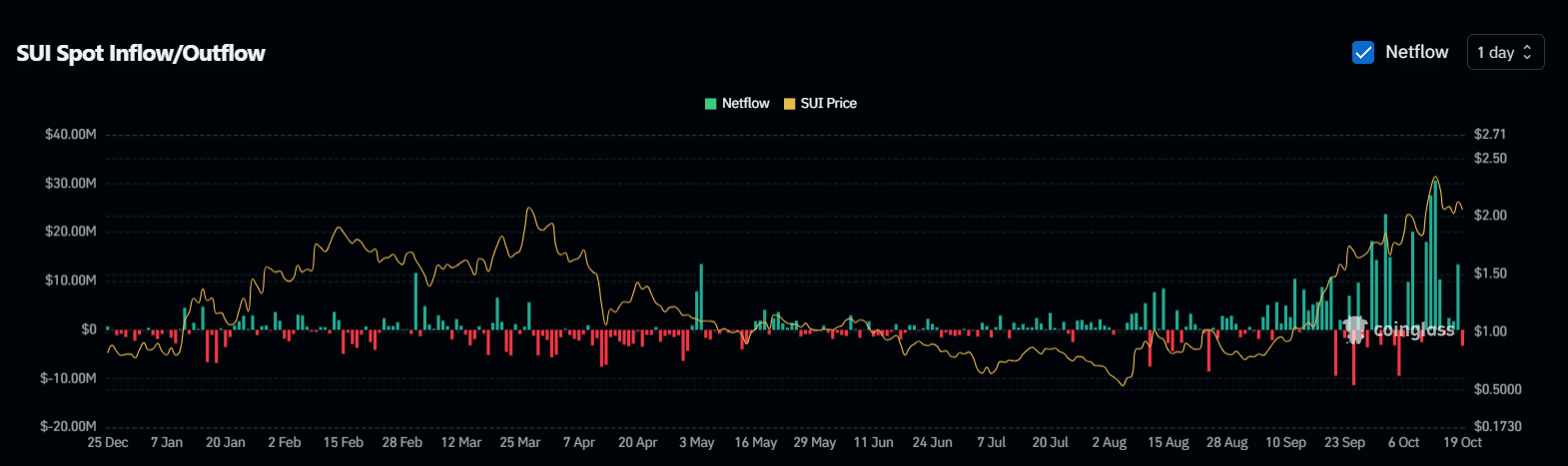

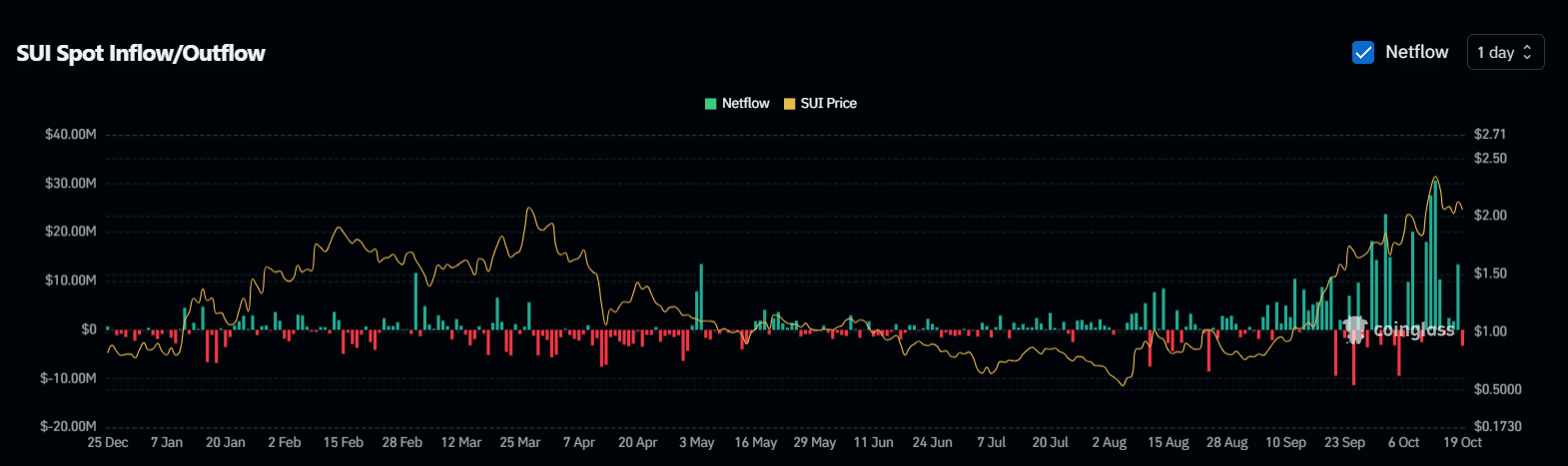

Surprisingly, despite the surge experienced by SUI over the past 60 days, spot traders continued to sell off their holdings, reducing daily trading volume to $30 million.

However, prices have stabilized, suggesting potential accumulation by stakeholders, which is critical for a rebound.

Source: Coinglass

The recent weekly decline has brought SUI closer to $2.05, so it is essential for holders to view this as an ideal entry point. Recent red wicks indicate that many people are adopting this strategy.

Read Sui (SUI) Price Prediction for 2024-25

If this trend holds, SUI could be primed for a significant correction near $2, as the recent MACD crossover has turned bearish, suggesting prices could fall unless spot traders increase buying activity.

If this new interest materializes near $2, a strong rebound could follow. However, to outperform NEAR, a rebound would require SUI to return to around $2.40.