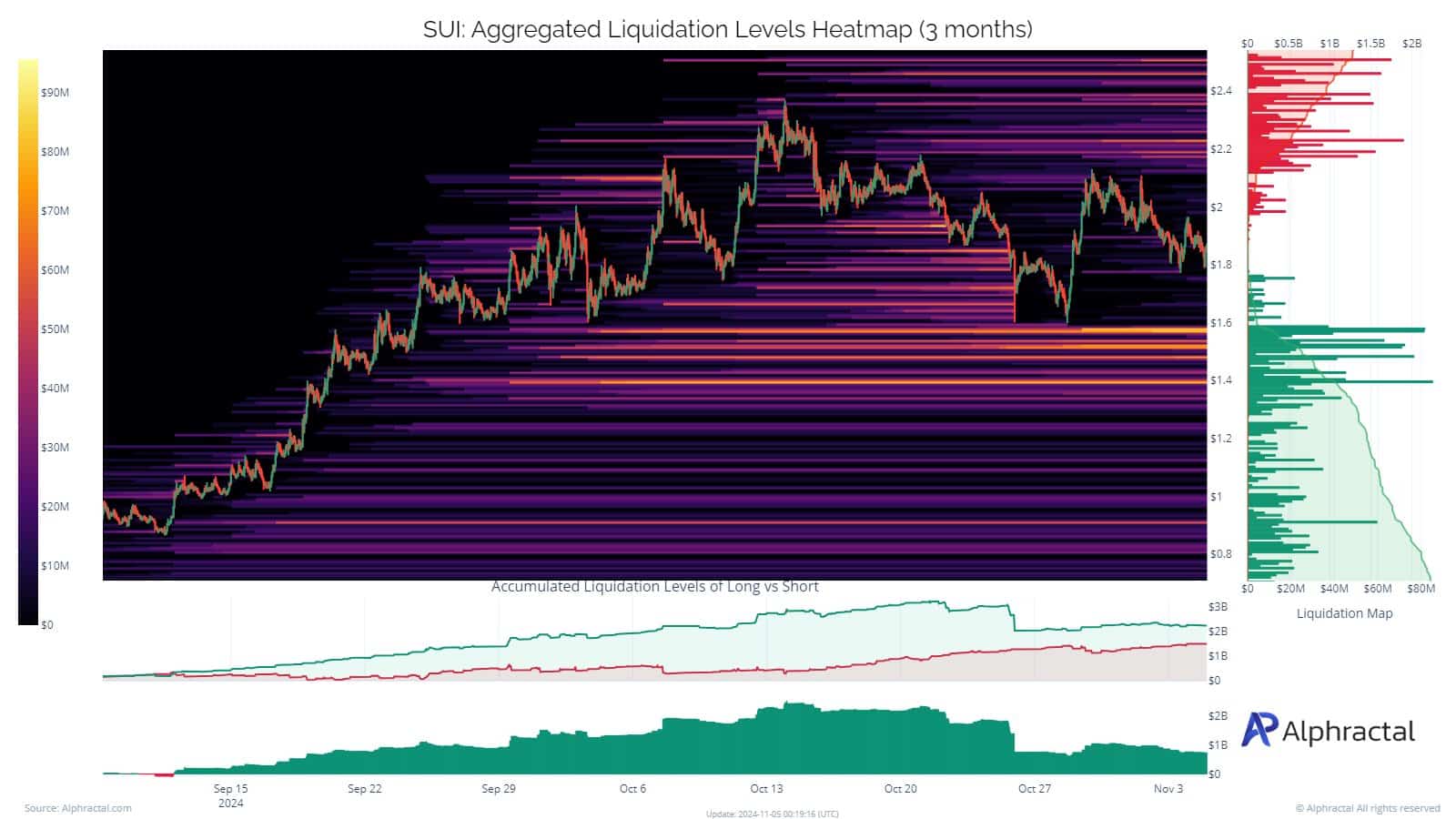

- The $1.6 leveraged buy created a ton of liquidity.

- A drop below that level could create a risk of rapid liquidation for leveraged bulls.

SUI was one of the best performing Layer 1s in 2024. Japanese food Ethereum and Solana (SUN) On some fronts.

In fact, it was one of the assets to hit record highs during the market recovery in October. This resulted in SUI price retracements later proving irresistible to sideline speculators.

As a result, many speculators opened long positions at around $1.6, and liquidity built around the support line for a while.

According to AlpharactalDue to the large liquidity at $1.6 support, a forced liquidation could occur if the price falls below that level.

Source: Alpharactal

Is SUI liquidation imminent?

Alphractal claimed that $2.2 showed a huge build-up of liquidity when buying was initiated at that level. However, the recent downtrend wiped out the position. So will $1.6 suffer the same fate?

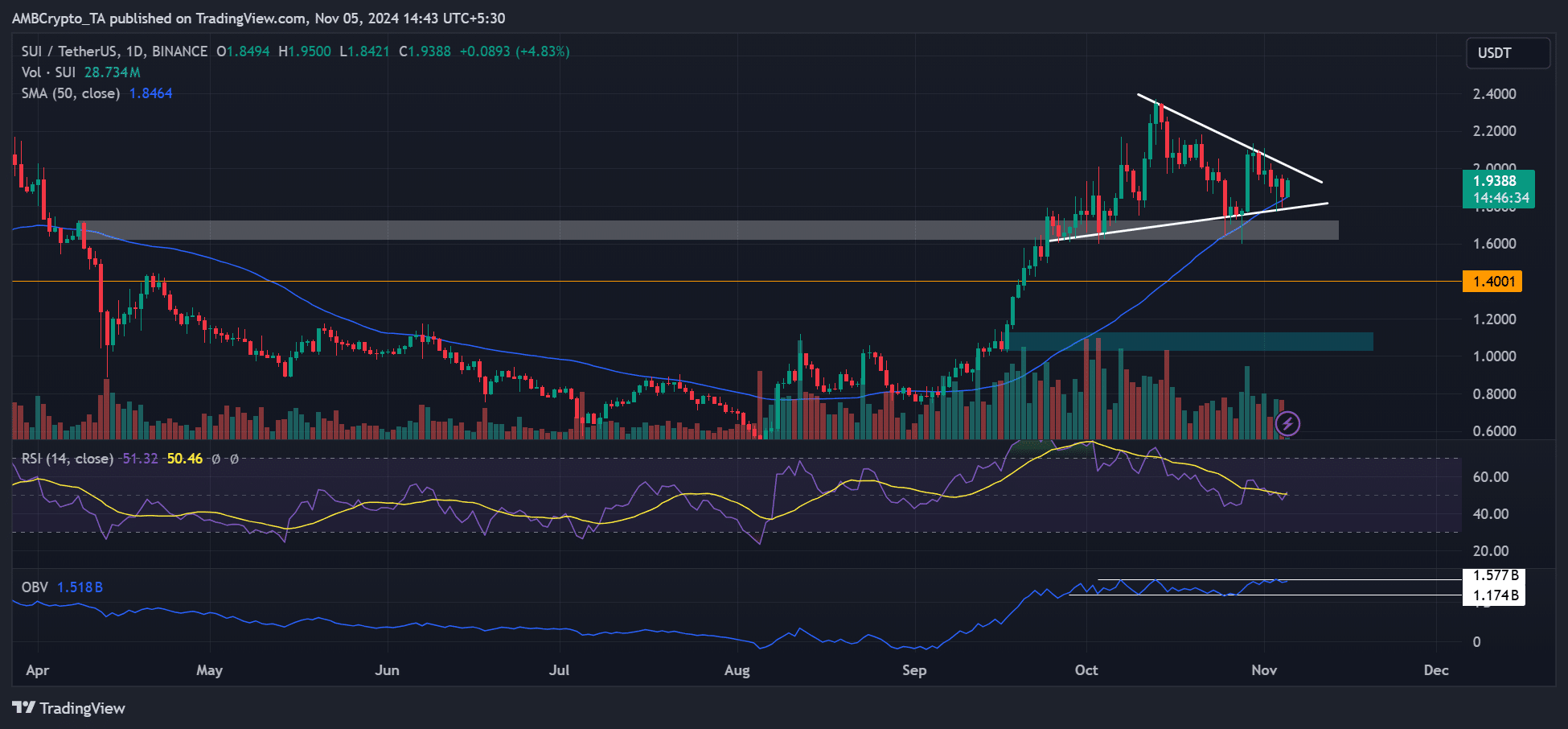

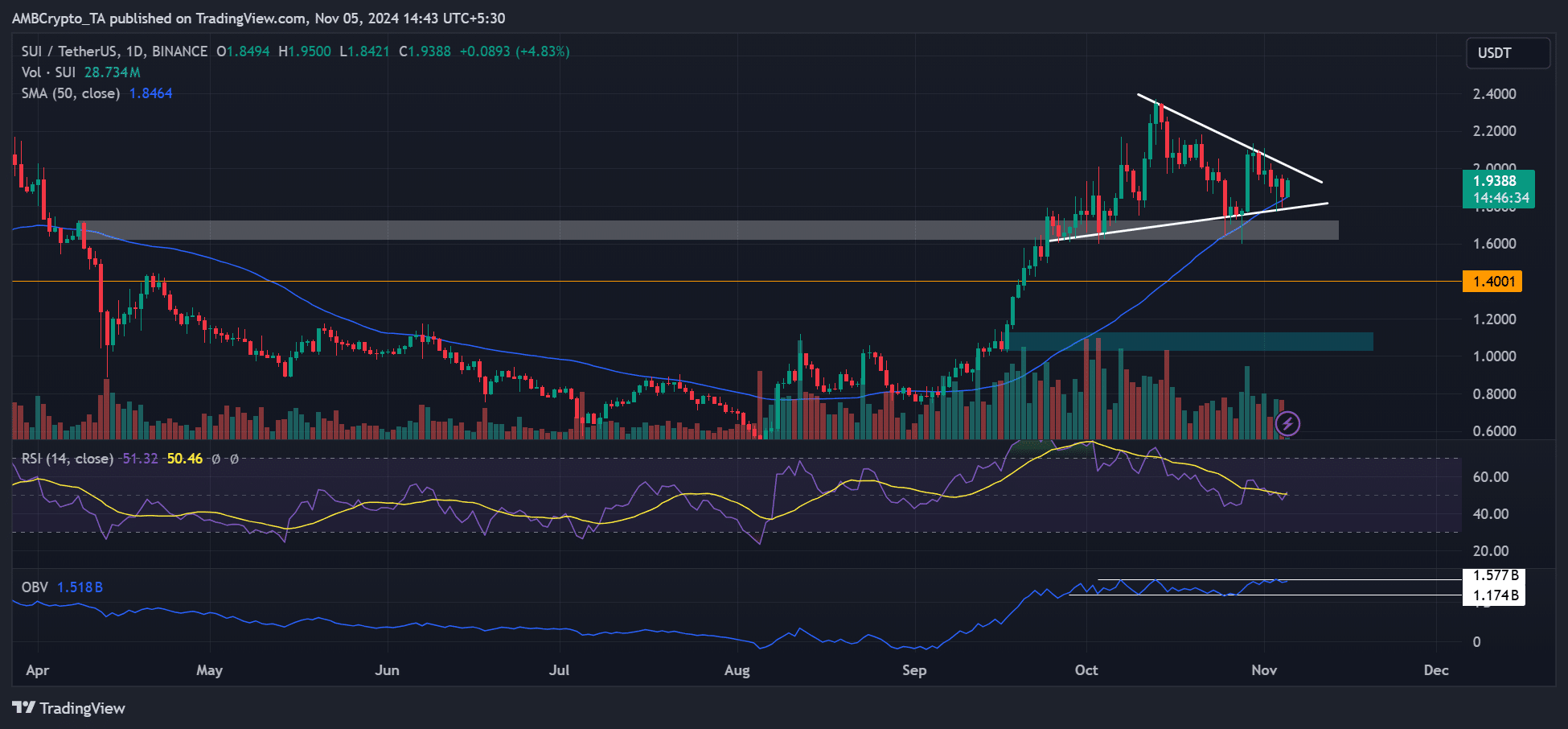

Source: SUI/USDT, TradingView

On the price chart, the daily order block (OB) formed in April served as SUI support in September and October ($1.6, white zone).

Additionally, the 50-day exponential moving average (EMA) has recently served as important dynamic support, smoothing out the late-October and November price plunge.

Put another way, $1.6 was a key support in the fourth quarter and generated a lot of buying interest and leveraged buying. A crack below could pull SUI into the next support at $1.4.

Spot market demand for SUI is stagnant, as can be seen from the sideways movement in OBV (on balance basis). This means that SUI price could move in either direction depending on market sentiment following the US election.

Mixed market interest

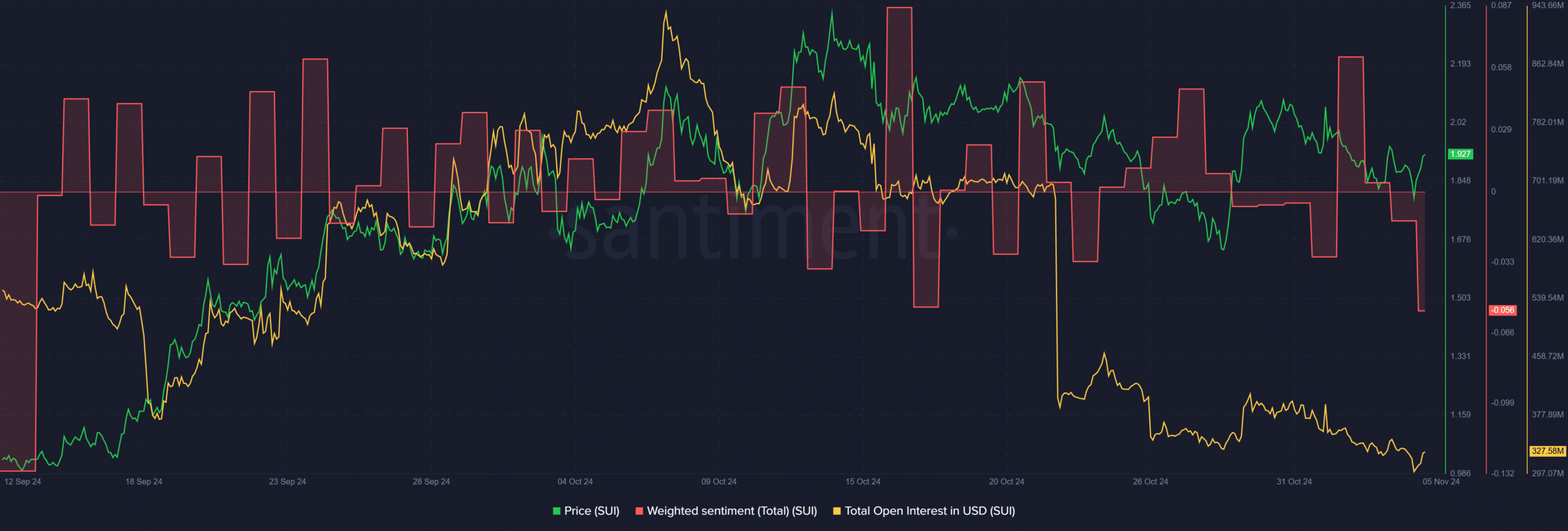

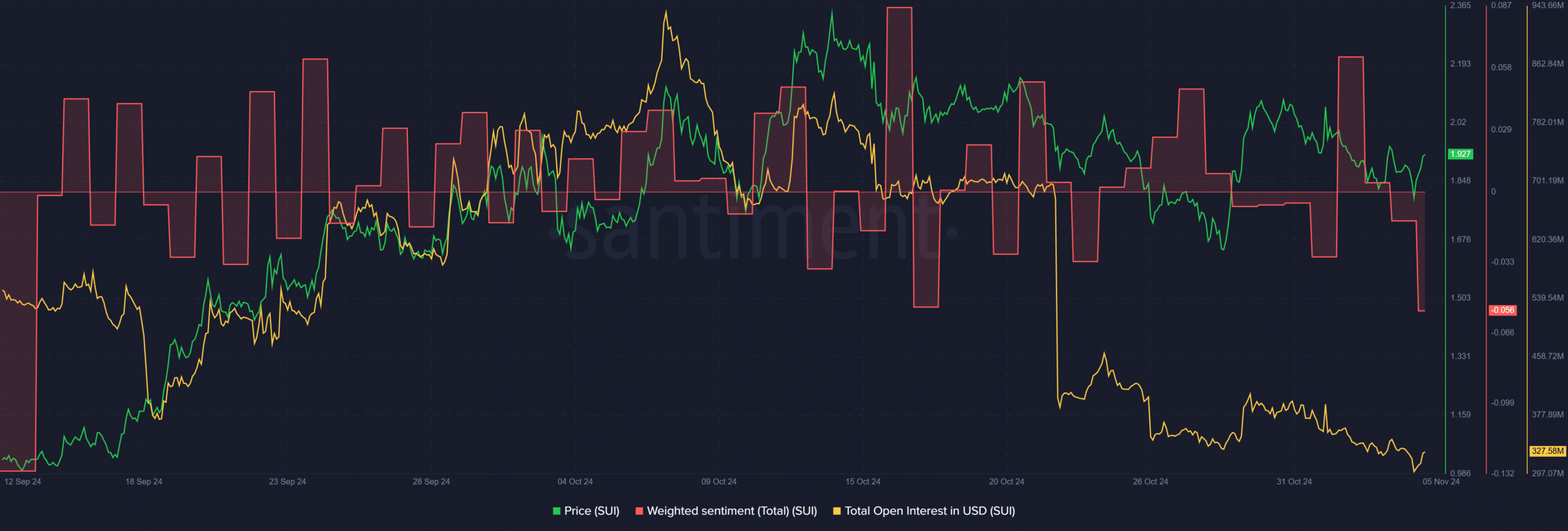

Source: Santiment

Sentiment data painted the same short-term market caution. Since October, SUI’s open interest (OI) interest rate has been falling. At the time of the press release, market sentiment also showed a downward trend, and SUI speculators looked cautious ahead of the US election.

Read Sui (SUI) price forecast for 2024-2025

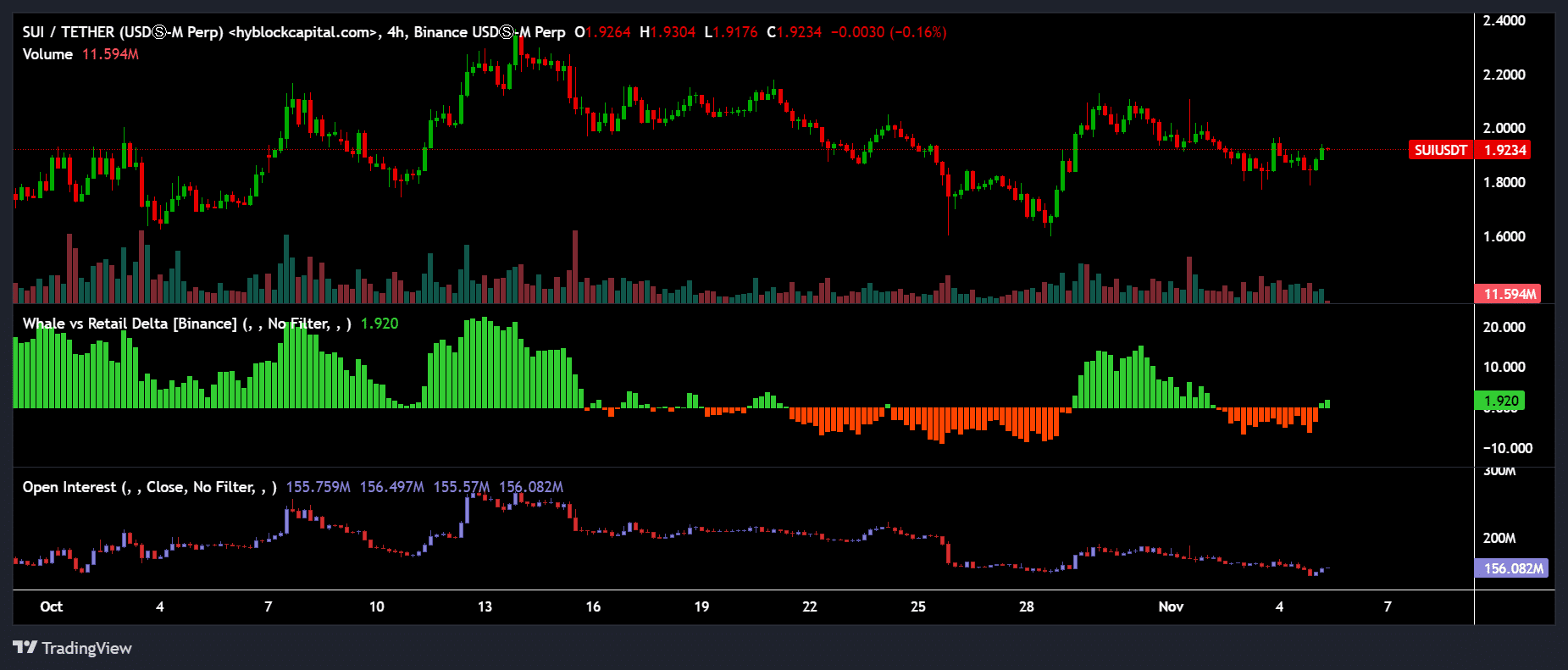

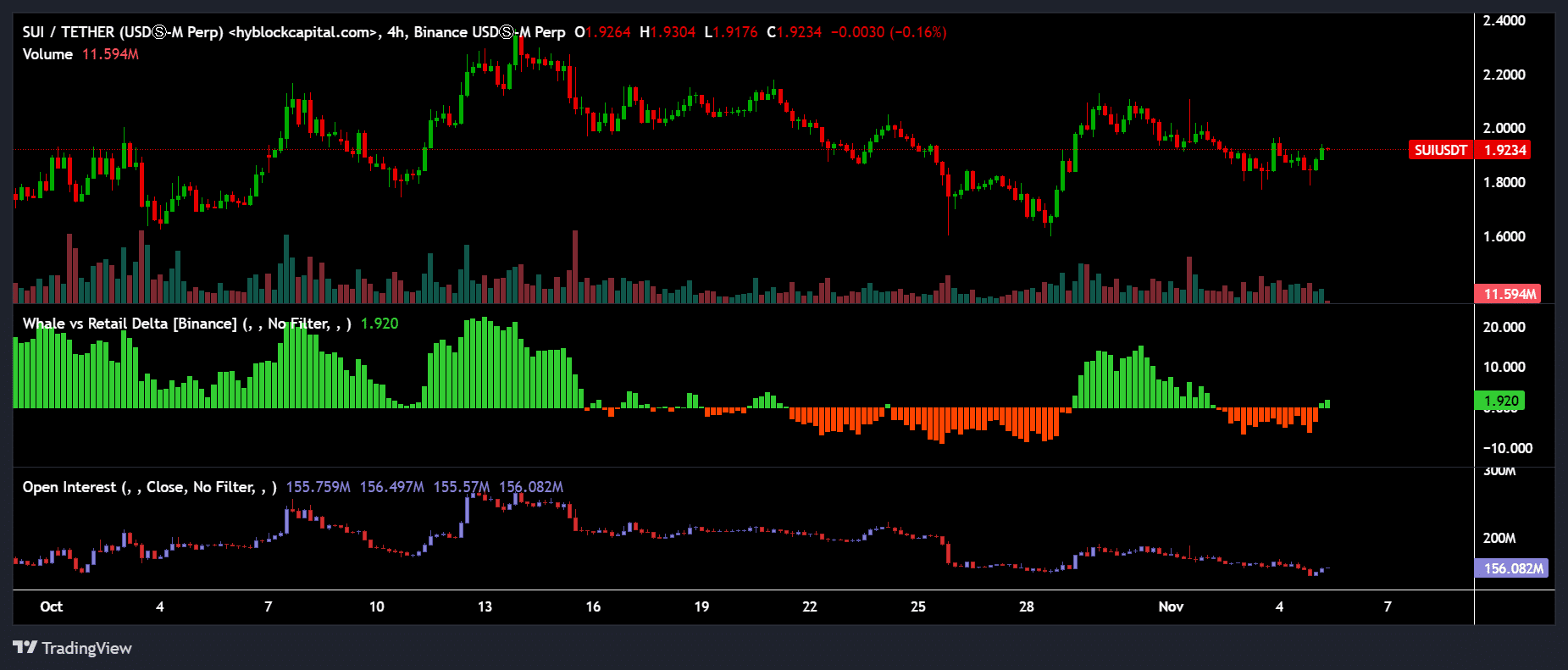

But the whales seemed interested in adding seats despite the general caution. This was hinted at by a positive reading on the Retail vs. Whales Delta indicator, which measures long positions of whales vs. retailers.

Source: Hiblock

In short, there was some whale interest in SUI. However, the price was at a critical point as a plunge below the $1.6 support could result in losses for several leveraged bulls.