- Synthetix’s development activities highlight the network’s expanding efforts to attract more users.

- The SNX downtrend was fueled by whale and institutional selling pressure.

Synthetix was one of the most promising crypto projects during the 2021 bull market. However, it has since struggled to gain traction as the DeFi sector becomes saturated. Likewise, its native token, SNX, has also seen a recent downturn.

Can Synthetix make a comeback? Well, this DeFi protocol has been struggling to stay relevant. Consider this: Synthetix has seen strong development activity recently, and has been rated as the best DeFi protocol in terms of DA over the past 30 days.

Is this a sign of a bigger move for SNX?

The aforementioned surge could be related to some of the project’s recent announcements. The protocol recently announced a new integrated protocol called TLX that enables leveraged trading. In fact, TLX announced just two days ago that it had achieved over $400 million in traded leveraged tokens.

Synthetix is also said to be developing a new perps integrator. These observations suggest that there may be increasing demand for SNX within the Synthetix ecosystem.

SNX has been in a downtrend for nearly five months. At press time, the price tag of $1.29 is 75% off its YTD high of $5.28 reached in March.

Source: TradingView

At press time, the price of SNX appears to be below the previous bearish price levels. So the question is: Can we see a rebound? Well, on-chain data has revealed some interesting results regarding the SNX token.

Whales and addresses and more…

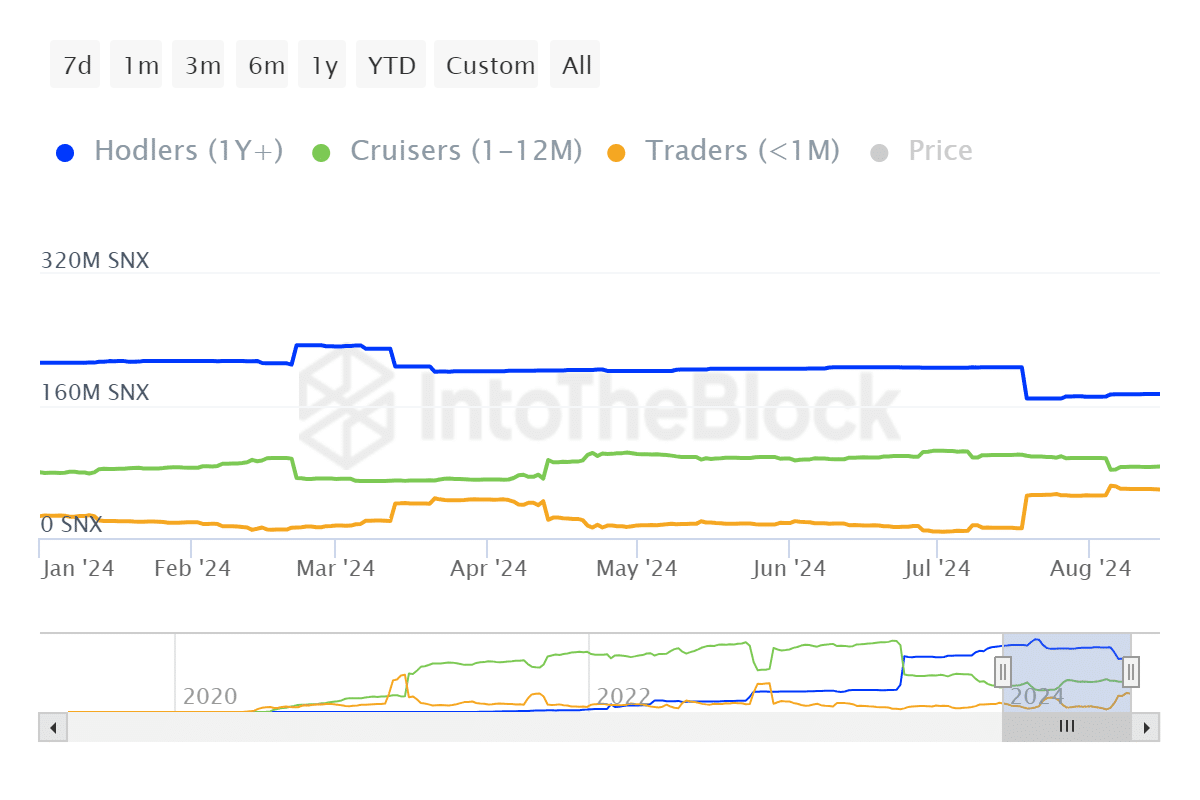

At the time of writing, approximately 98% of all addresses holding SNX were in a loss, while only 0.76% were in a profit. This suggests that accumulation was very low at or below the price level at the time of writing. This is consistent with the holding time balance, which shows that the number of HODLers has decreased by 37,830,000 SNX over the past 8 months.

Source: IntoTheBlock

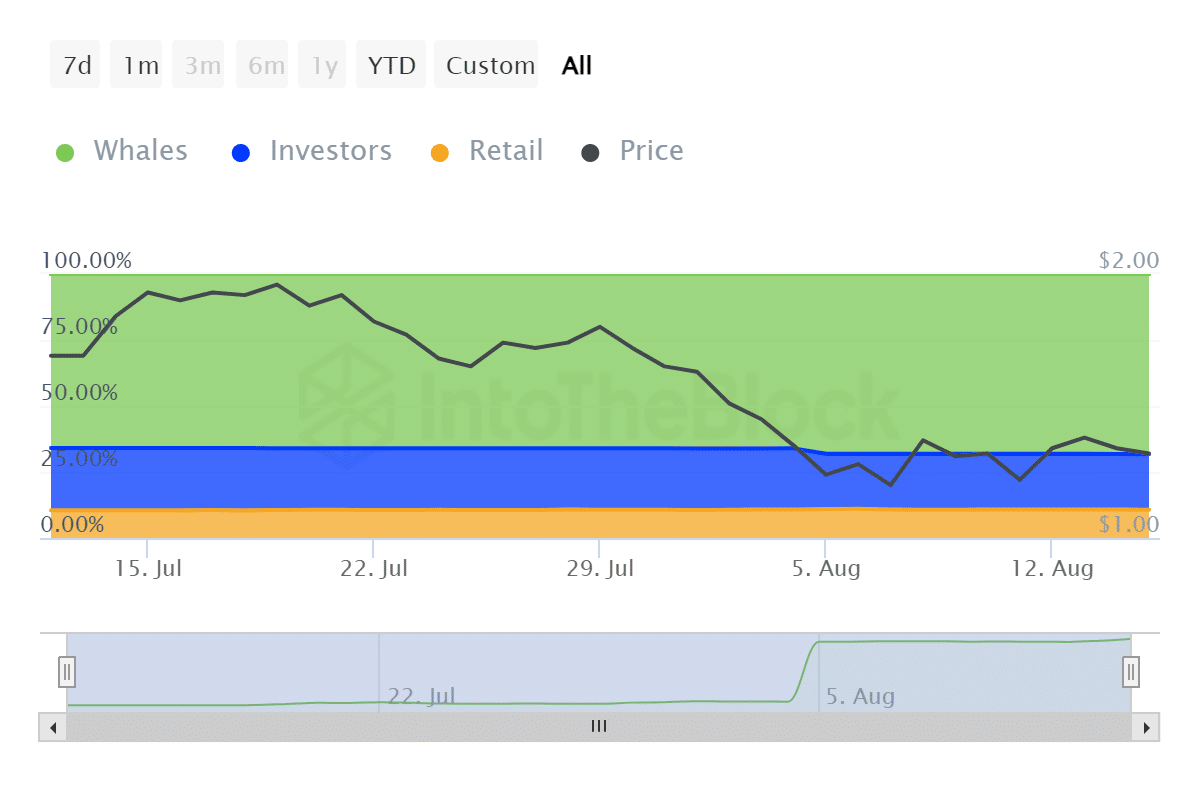

The number of SNX traders has increased over the past two months, indicating a preference for short-term price increases. As a result, SNX has been unable to maintain a proper uptrend. Meanwhile, ownership statistics show that whales have been contributing to the selling pressure over the past 30 days.

Whale addresses have lost about 7.3 million SNX in the past four weeks. Investor addresses have lost 7.78 million coins over the same period. Retail addresses, however, have seen a positive growth of about 490,000 SNX.

Source: IntoTheBlock

The retailer’s acquisition hinted at a possible change in sentiment.

However, retail buyers may not have much influence on the market. Unless whales and investors turn their holdings into accumulation, SNX may remain stagnant.