- Telcoin was approved for the Digital Asset Bank Charter in Nebraska.

- As a result, Telcoin is located as the first federal regulatory digital deposit bank in the United States.

- Using this Charter, Telcoin can now issue Stablecoins and hold deposits from a federal deposit insurance company.

In a breakthrough decision, Nebraska Bank Bank and Financial Bureau give Green Fire to Telcoin and INC. Nebraska Financial Innovation Act (LB 1074, 2024).

This approval, which is expected after the December 2024 public hearing, indicates an important milestone in integrating digital assets into traditional bank frameworks.

Telcoin’s business plan

Telcoin’s application for this charter was accompanied by a wide range of business plans with hundreds of pages with 29 appendices. This document showed the detailed background of the director and executive, and the validity of Telcoin’s proposed operation as well as adequacy.

This plan clearly reveals the vision of issuing the US dollar -supported stabble recomin called “digital cash” or EUSD to facilitate safety maintenance and smooth integration with the independent node verification network using an independent node verification network. .

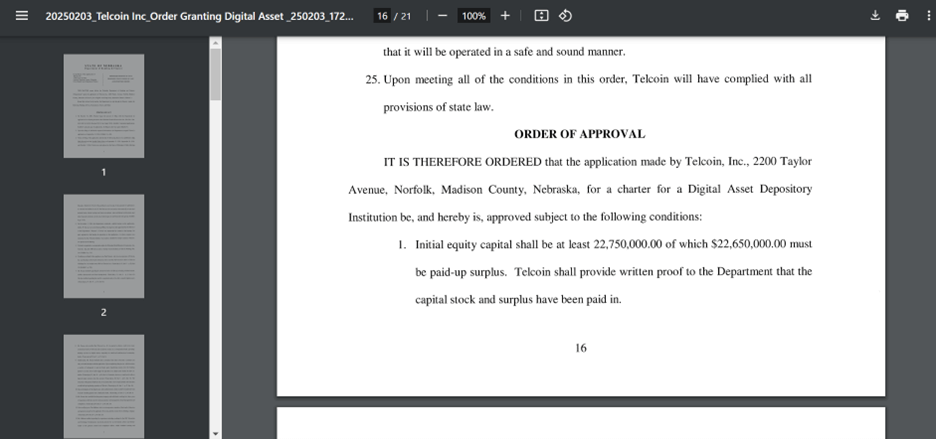

Conditions in which telecommunications companies start operations

The approval of the Chart of Digital Asset Deposit Bank was assigned based on the conviction that Telcoin would be operated safely and soundly.

In particular, on December 5, 2024, the thoroughness of public hearings and business plans was pivotal to approval.

In order to operate as a federal -regulated digital asset deposit bank in the United States, Telcoin maintains the US dollar, which is 100%of the US dollar, which is 100%of the unprecedented stability and consumer protection. It must be.

In addition, strict regulatory conditions must be observed, such as providing a $ 1 million asset guarantee bond or pledge.

In addition, all US currencies received from customers should be held by Nebraska’s FDIC insurance agency to ensure the safety of customer deposits.

Another notable aspect of the Telcoin Charter is related to the participation and education of community. The company has been tasked with maintaining public files that will help to meet community demands, including financial literacy programs for Nebraska students who focus on digital assets, budgets, and credit.

Telcoin should also noticeably mark that digital asset deposits are not guaranteed by FDIC, along with warnings about their own risks with digital assets.

In addition, telcoin must guarantee clarity and recognition in the market using the entire legal name “Digital Asset Bank, Telcoin Bank” in all official communication and branding. The Charter also stipulates that telcoin must pay $ 50,000 of the charter fee and cover the cost of approval.

In addition, material changes can lead to modification, suspension or withdrawal of approval before the communication conditions are completely operated.

If these conditions are met, Telcoin has legal authority to start operations and issue Stablecoins and utilize the independent node verification network for the payment system.

This approval has provided a route with Nebraska Bank Bank and Financial Bureau, with digital assets coexisting with traditional banks and focusing on safety, soundness and consumer education.

This approval is likely to open a way for further innovation in the financial sector by setting a precedent on how digital asset companies can operate within the regulatory framework.