Bitcoin BTC

+0.92%

Miner TeraWulf has sold a 25% stake in its nuclear Bitcoin mining facility for about $92 million to fund expansion of its high-performance computing and AI data center hosting services.

TeraWulf’s interest in the Nautilus Cryptomine joint venture, located near the Susquehanna Nuclear Power Plant in Pennsylvania, was sold to its partners, a subsidiary of Talen Energy Corporation. The completion of the sale increases TeraWulf’s return on investment by 3.4 times, the company announced on Thursday.

The deal consists of $85 million in cash, approximately 30,000 Bitcoin miners contributed by Talen, and $7 million worth of related equipment, TeraWulf said. The company plans to reinvest capital into construction of its wholly-owned flagship Lake Mariner facility in New York, designed to host an HPC/AI data center and Bitcoin mining operations.

TeraWulf recently completed a 2MW HPC/AI proof-of-concept project designed to support current and next-generation GPU technologies at its Lake Mariner facility. Additionally, a 20 MW water-cooled colocation building is being built on site, which is expected to be operational by the first quarter of 2025.

The decision to liquidate its stake in the Nautilus mine comes ahead of the expiry of its power contract and land lease in June 2027. This is as the company aims to leverage superior cost efficiencies at Lake Mariner and lower expected future energy prices.

“This transaction aligns TeraWulf’s focus and investments with where we are most operationally efficient, have the greatest growth potential, and have the best opportunity to create incremental value for our shareholders,” said Paul Prager, CEO of TeraWulf. . “Going forward, we will focus on ensuring that TeraWulf is best positioned to benefit from the growing demand for HPC/AI by meeting the needs of our high-quality customers who want power availability and infrastructure that can meet their significant needs over the long term. there is. .”

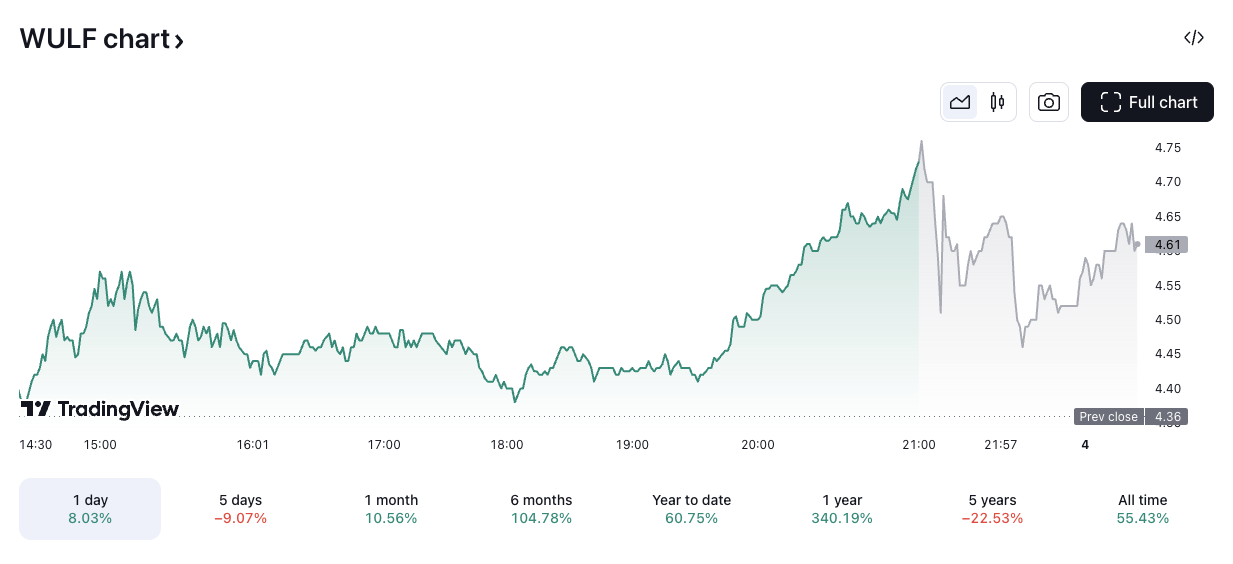

TeraWulf plans to hold its third quarter earnings call on November 12th. The company’s shares rose 8% to $4.71 on Thursday and are up 61% since the beginning of the year, according to TradingView.

WULF/USD price chart. Image: TradingView.

Bitcoin miner strategies vary

TeraWulf is one of several Bitcoin mining competitors like IREN and Core Scientific that are increasingly looking to diversify their operations in favor of AI data centers. This hopes to capture new demand from emerging sectors while also smoothing out the volatility of exposure to Bitcoin.

Despite the outstanding performance of the AI variety this year, other pure-play Bitcoin miners such as CleanSpark, Marathon, and Riot claim that the returns on Bitcoin mining’s cheap infrastructure and fast energy supply are much faster than the AI gestation period. I do not share this view. In the midst of a potential bull market. There are also other ways to address volatility in Bitcoin stocks through derivatives market hedging strategies.

TeraWulf is currently the 6th largest public Bitcoin miner with a market capitalization of $1.8 billion. This equates to a market share of approximately 7.5% among its competitors.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2024 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.