- Terra Luna Classic managed to turn its structure into a bullish one with a strong uptrend on Saturday.

- As the downtrend grows and long-term liquidations accumulate, a price decline appears imminent.

The Terra Luna Classic (LUNC) price rose 23.3% from the opening price of the day to the closing price of the day on Saturday, August 10. This move was accompanied by a surge in volume, and the high of the range appears to be the next target.

However, the short-term trend of Bitcoin (BTC) and the increasing level of long-term liquidations suggest that LUNC may soon experience losses and volatility.

Unsettled transactions surge as price breaks mid-level

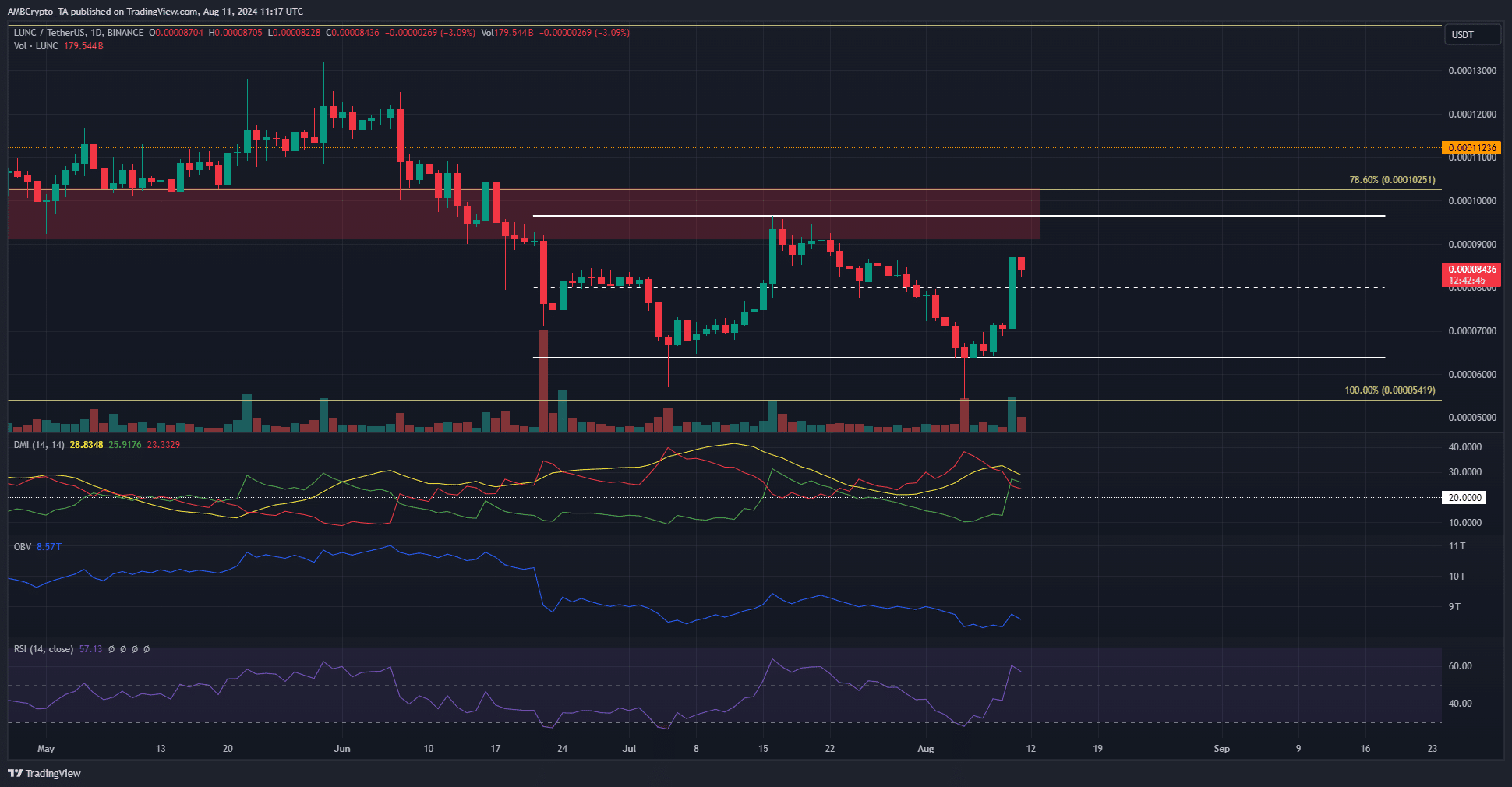

Source: LUNC/USDT on TradingView

During the 1-day period, LUNC made a bullish structural reversal after breaking above $0.000087 the previous day. The recovery from the range lows also caused the RSI to jump above neutral 50.

However, OBV did not show a significant uptrend. This would require continued buying volume, which was not present. DMI reflected the chaotic trend of Terra Luna Classic, which is typical of range formation.

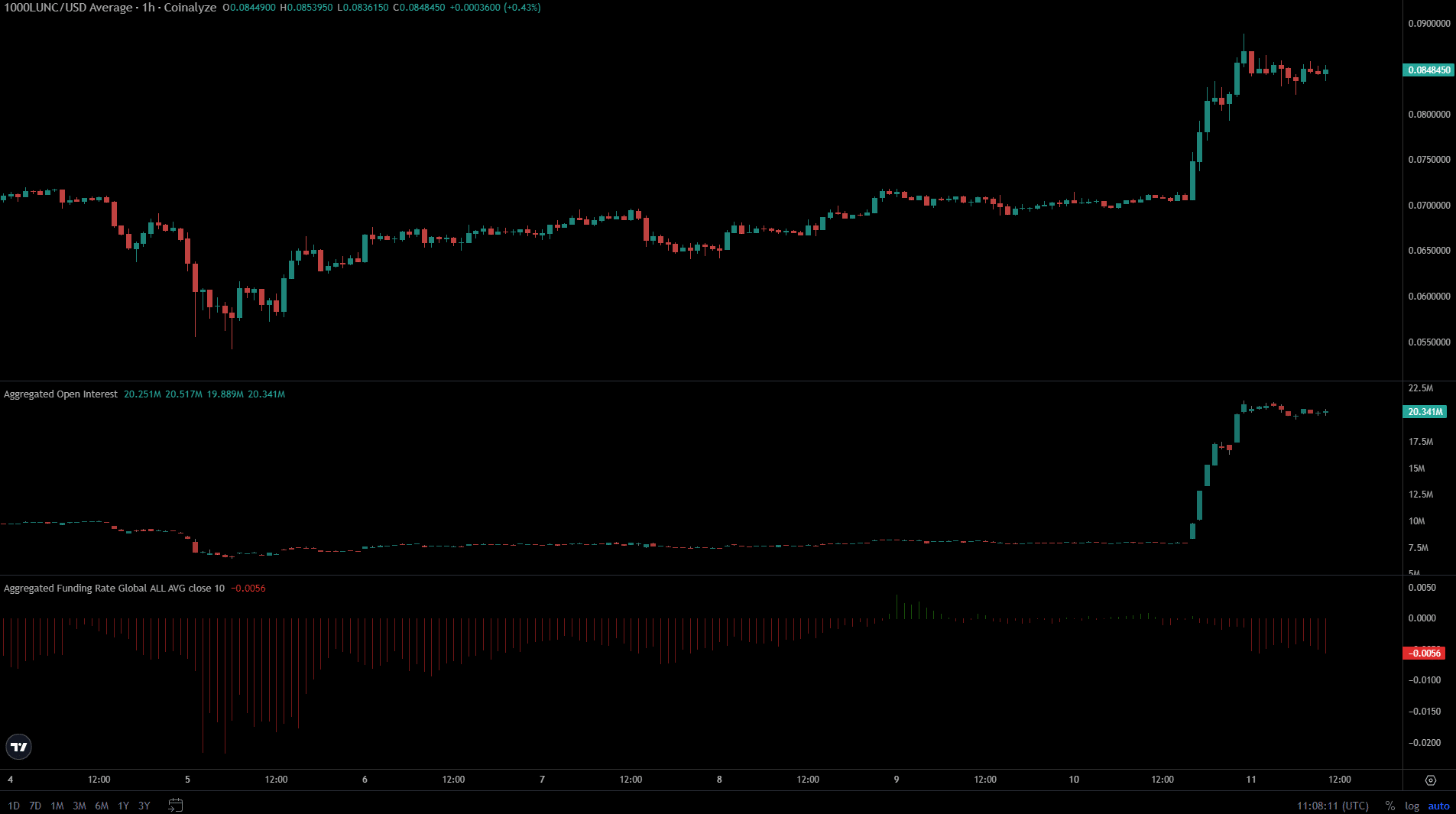

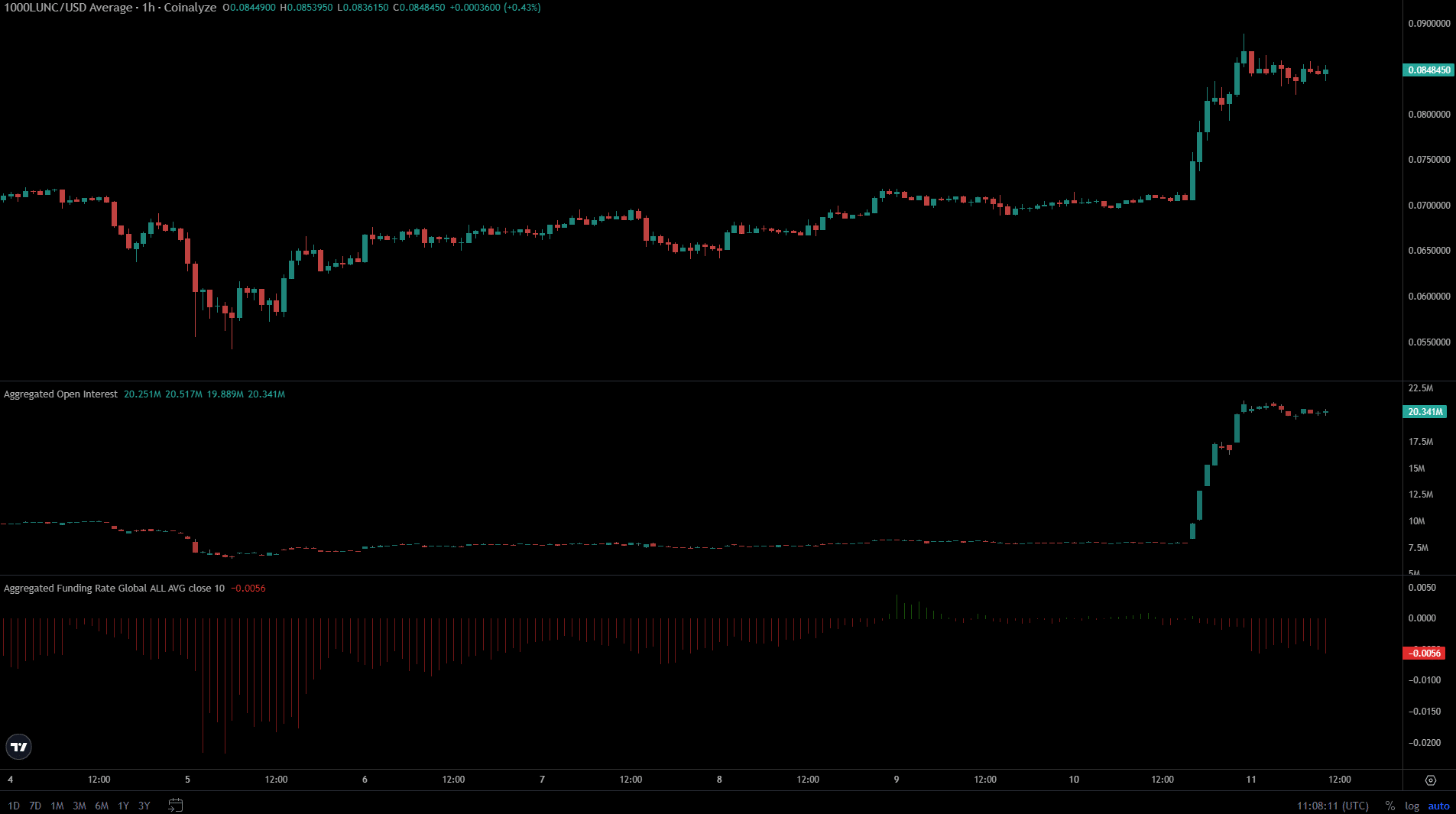

Source: Coinalyze

Open Interest surged from $8 million to $21.1 million, showing speculators looking to make some profit while LUNC was rising. In the past few hours, OI has peaked and the funding ratio has become even more negative.

This indicates that the downtrend is growing.

Can Terra Luna Classic test its mettle at the highest level?

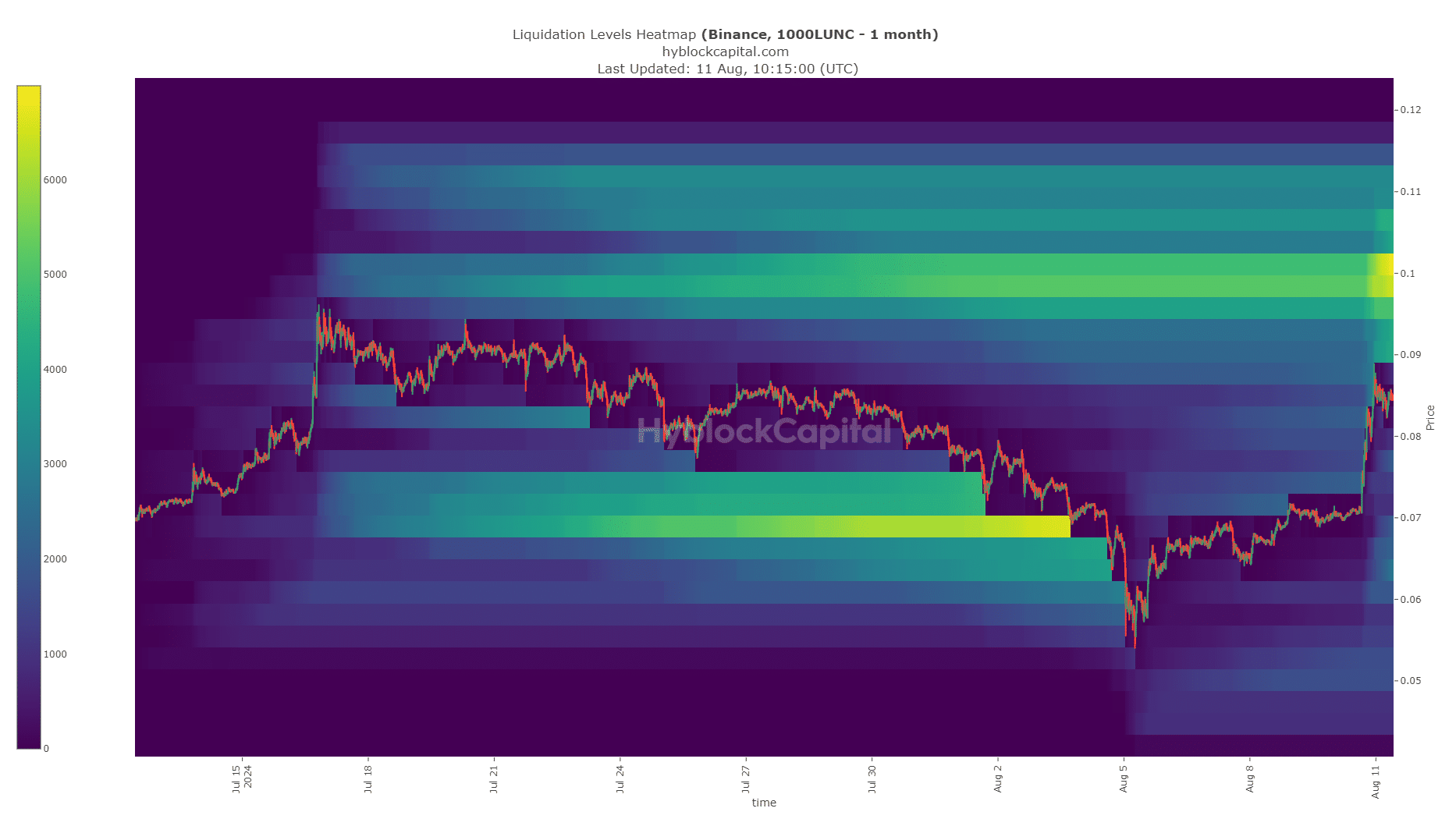

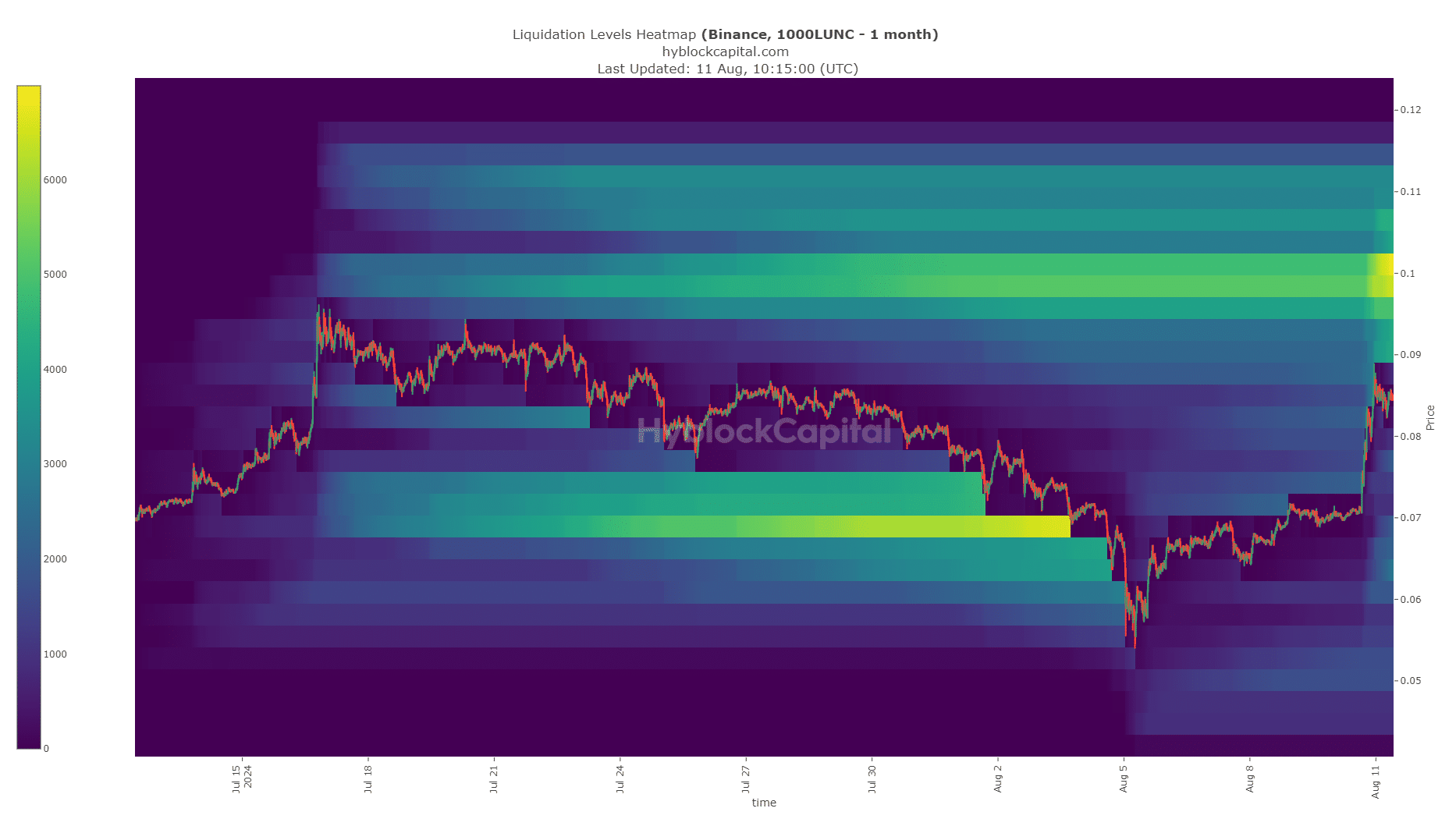

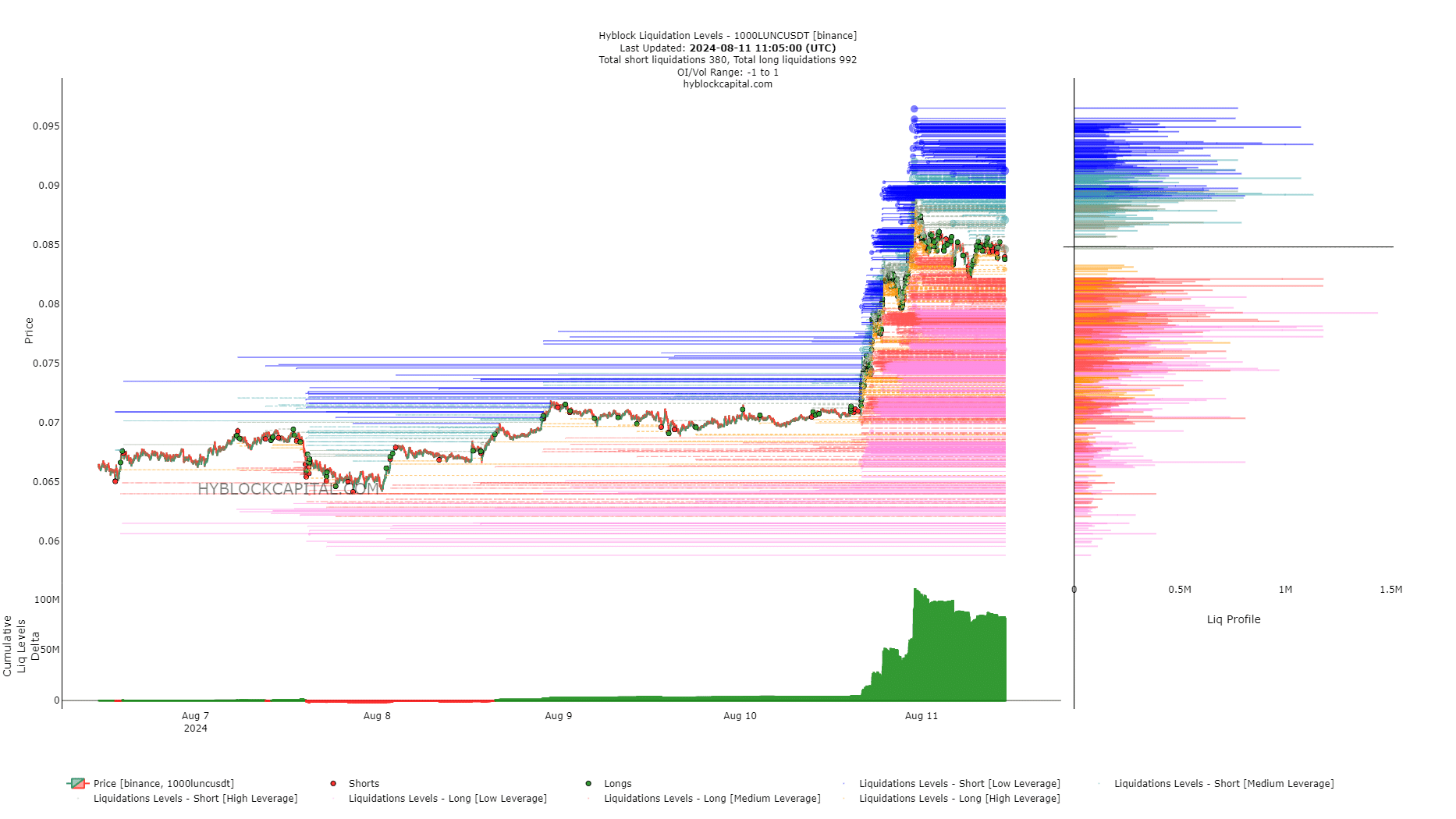

Source: Highblock

According to the liquidation heatmap, the answer is yes. There was deep liquidity at $0.0001, which could have been wiped out before a downside reversal. This coincided with the range high on the technical chart.

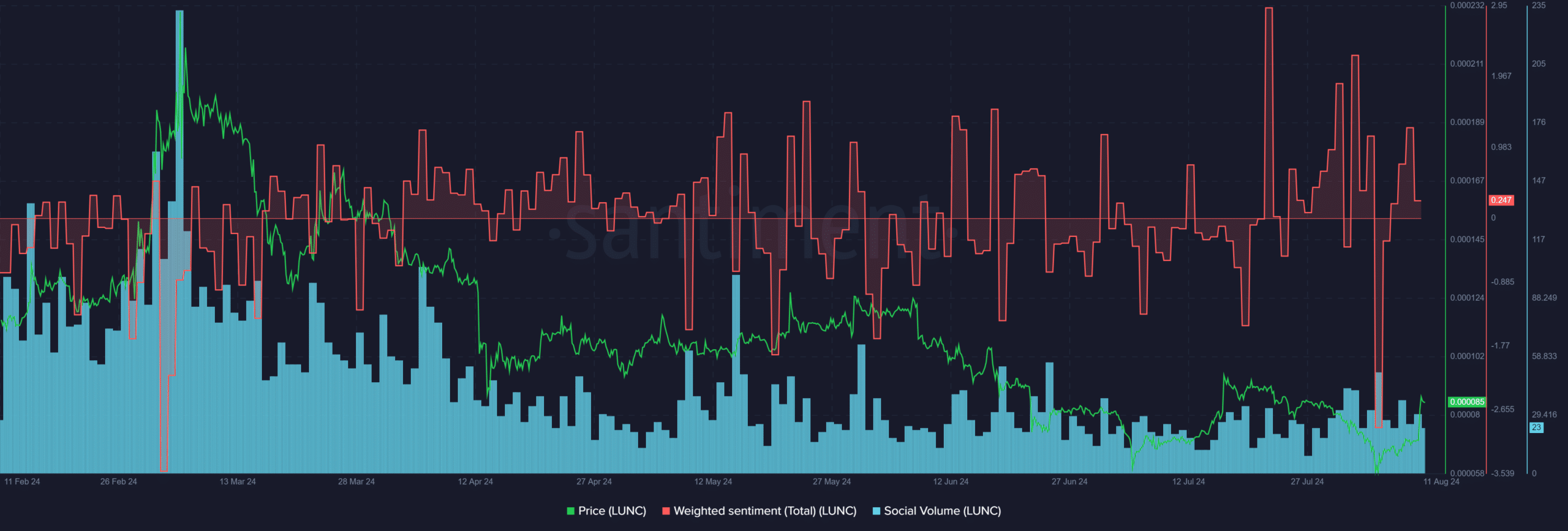

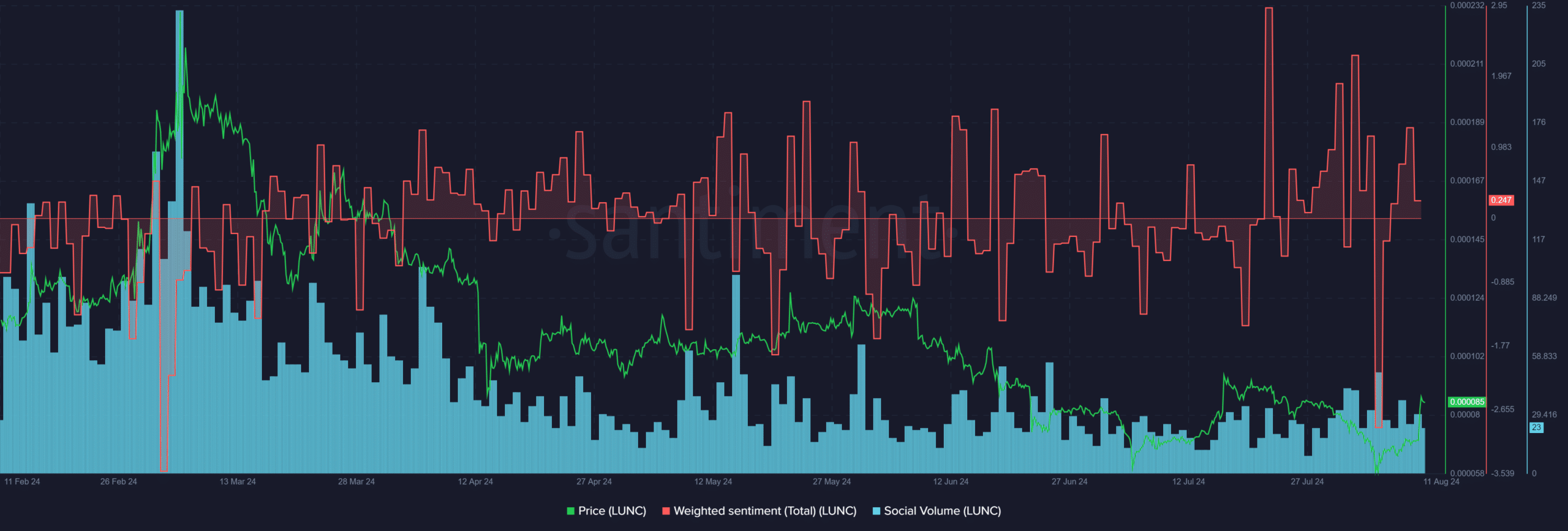

Source: Santiment

Weighted sentiment moved back into positive territory, with online engagement showing strength. However, social volume did not increase significantly despite the price increase.

This was a hint that LUNC lacks the hype, which could hamper the company’s bullish ambitions.

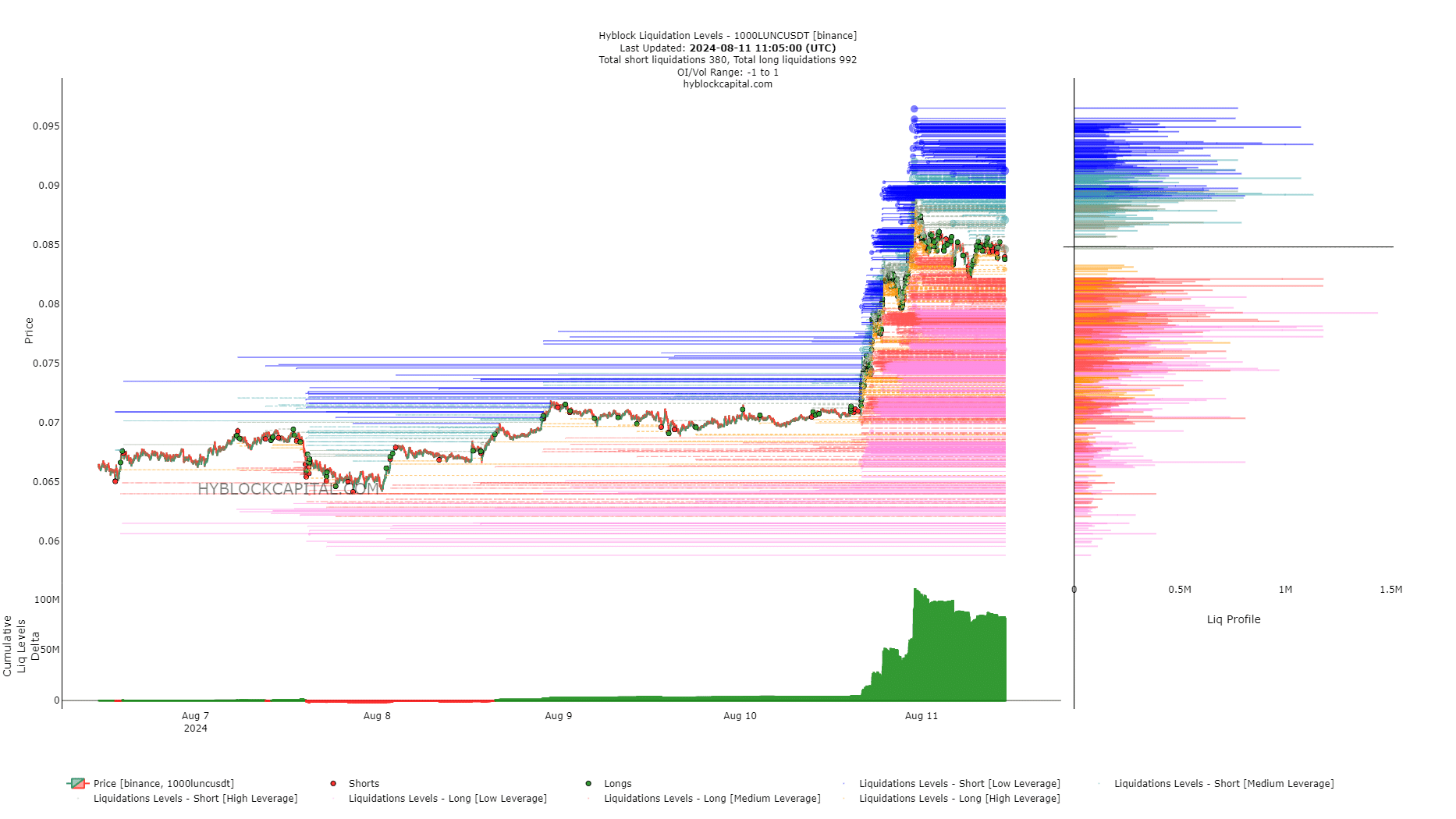

Source: Highblock

Another short term hurdle was found in the liquidation level heatmap. Due to the price surge, the liquidation level delta was extremely positive.

Realistic or not, here is LUNC’s market cap in BTC terms:

As a result, long positions may be pressured and forced to liquidate.

The $0.0008 level is a short-term target and coincides with the mid-range support level. Whether the bulls can sustain the rally after a retest of this support will depend on whether BTC can stay above the $60k mark.