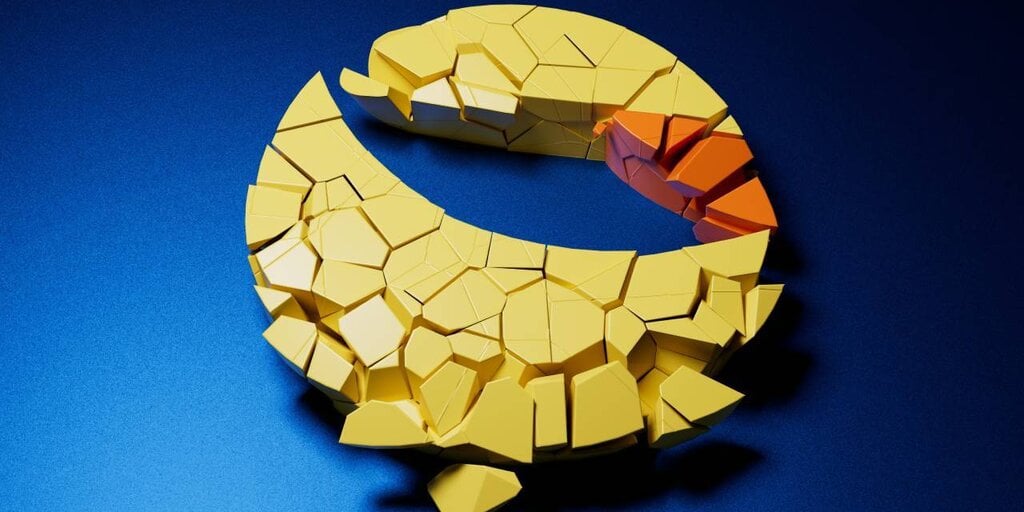

Terraform Labs, the company developing the LUNA and TerraUSD (UST) cryptocurrencies, has filed for voluntary Chapter 11 bankruptcy in Delaware.

In a Jan. 21 filing in state bankruptcy court, the company listed assets and liabilities of $100 million to $500 million and creditors ranging from 100 to 199.

“This filing will enable TFL to execute its business plan while pursuing ongoing legal proceedings, including a representative action pending in Singapore and a U.S. case involving the Securities and Exchange Commission (SEC),” the company said in a statement. The company also said it will continue to expand its Web3 business.

“The Terra community and ecosystem have shown unprecedented resilience in the face of adversity, and this action will allow us to continue working toward our common goals while resolving any unresolved legal issues,” Chris Amani, CEO of Terraform Labs, said in a statement. It is necessary to do this. .”

Terraform Labs, along with founder and former CEO Do Kwon, are facing a civil securities fraud lawsuit from the SEC related to the 2022 collapse of algorithmic stablecoin UST and governance token LUNA. The collapse of the Terra ecosystem triggered a multi-year bear market in the cryptocurrency market as the pandemic spread throughout the industry.

In December 2023, a judge ruled that Terraform Labs and Kwon Do-kwon had offered and sold unregistered securities such as LUNA and UST, which means that whether the cryptocurrencies constitute unregistered securities will be debatable when the case goes to trial. It means there is none.

Mr. Dokwon is currently serving a four-month sentence in Montenegro for using a fake passport to leave the country in March. The former Terraform Labs CEO has been the subject of a jurisdictional tug-of-war between U.S. prosecutors and prosecutors in his native South Korea.

Last week, a federal judge agreed to postpone Do-Kwon Kwon’s SEC trial after he requested that it be postponed until he was extradited from Montenegro so he could appear.