join us telegram A channel to stay up to date on breaking news coverage

USDT issuer Tether has obtained key regulatory status in Abu Dhabi, opening the door for licensed entities to use the stablecoin in regulated services across multiple blockchain networks.

Recently presentationTether said its USDT token has been officially recognized as an “approved fiat reference token.”

It said this milestone means regulated entities within the Abu Dhabi Global Market (ADGM) can now offer trading, custody and other services related to USDT on multiple blockchains, including Aptos, Celo, Cosmos, Kaia, Near, Polkadot, Tezos, TON and TRON.

Tether’s USD₮ has been recognized as an accepted fiat reference token by Abu Dhabi’s ADGM for use on several major blockchains.

Learn more: https://t.co/PKmF7w5aUx— Tether (@Tether_to) December 8, 2025

ADGM serves as a special economic zone and international financial center for the UAE capital and operates under its own regulatory and legal system.

The latest approval is based on ADGM. previous recognition USDT on Ethereum, Solana and Avalanche.

Tether said in a statement that the latest recognition would create “new opportunities for collaboration and growth across the Middle East.”

Tether CEO stated that ADGM approval strengthens the role of stablecoins in the modern financial system.

Stablecoins are digital assets pegged to an underlying asset (usually fiat currency, such as the U.S. dollar).

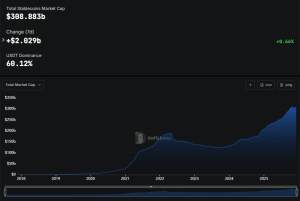

The stablecoin market will grow significantly in 2025, with the total capitalization of stablecoins exceeding $300 billion for the first time in history this year.

Stablecoin market capitalization (Source: Dipilama)

This growth is largely due to the more favorable regulatory environment in the United States and President Donald Trump signing the GENIUS Act into law in July.

The regulatory clarity gained with the signing of the GENIUS Act has fueled stablecoin fever, with several companies announcing plans to launch or explore stablecoins.

Tether’s USDT maintains its dominant position. With a market capitalization of over $185.737 billion, this token accounts for approximately 60.12% of the stablecoin market.

Commenting on the recent ADGM approval, Tether CEO Paolo Ardoino said, “The introduction of USDT within ADGM’s regulated digital asset framework strengthens the role of stablecoins as an essential component of today’s financial landscape.”

“ADGM further strengthens Abu Dhabi’s position as a global hub for compliant digital finance by expanding awareness of USDT across several major blockchains,” he added.

Abu Dhabi aims to become a DeFi hub and is targeting stablecoins.

Tether’s USDT is not the only stablecoin gaining popularity in Abu Dhabi.

Recently, local regulators approved Ripple’s RLUSD dollar-pegged stablecoin as a fiat reference token. This also opened the way for institutional use.

The latest approval comes amid growing expectations of a separate plan backed by some of Abu Dhabi’s biggest financial firms.

A consortium comprising UAE sovereign wealth fund ADQ, International Holding Company, First Abu Dhabi Bank and others has announced plans for a dirham-pegged stablecoin, pending approval from the UAE Central Bank.

Abu Dhabi has also launched broader efforts to become a global cryptocurrency hub. Just yesterday, Binance, the largest cryptocurrency exchange by 24-hour trading volume, announced that it had secured full rights to operate its global platform within the ADGM framework.

“ADGM is one of the most respected financial regulators globally, and holding an FSRA license under their standards framework demonstrates that Binance meets the highest international standards for compliance, governance, risk management and consumer protection,” said Binance Co-CEO Richard Teng.

Related articles:

Best Wallet – Diversify your cryptocurrency portfolio

- Easy to use and highly functional cryptocurrency wallet

- Get early access to the upcoming token ICO

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake to win native token $BEST

- 250,000+ monthly active users

join us telegram A channel to stay up to date on breaking news coverage