- Jupiter may soon form another bullish flag pattern on your chart.

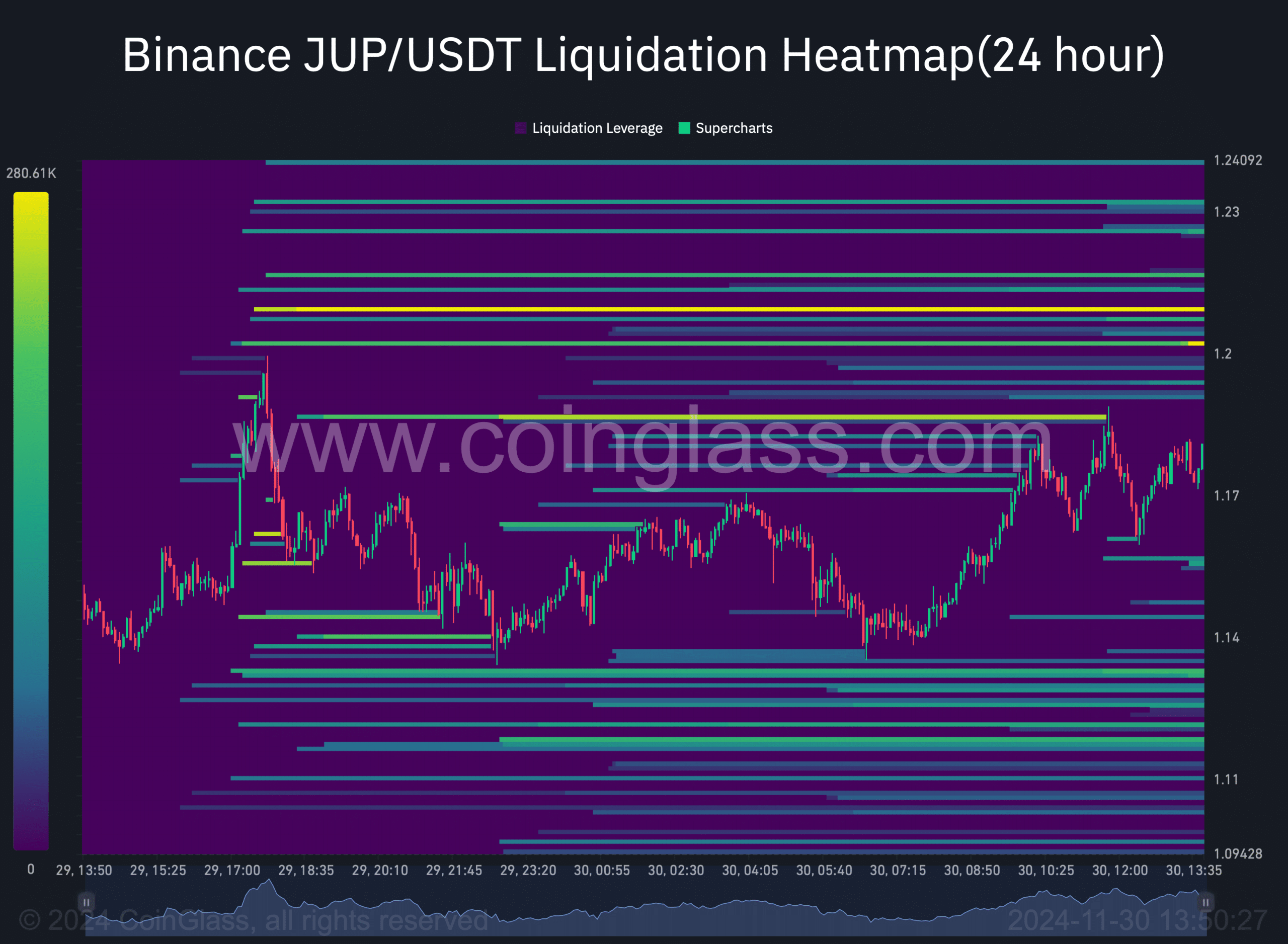

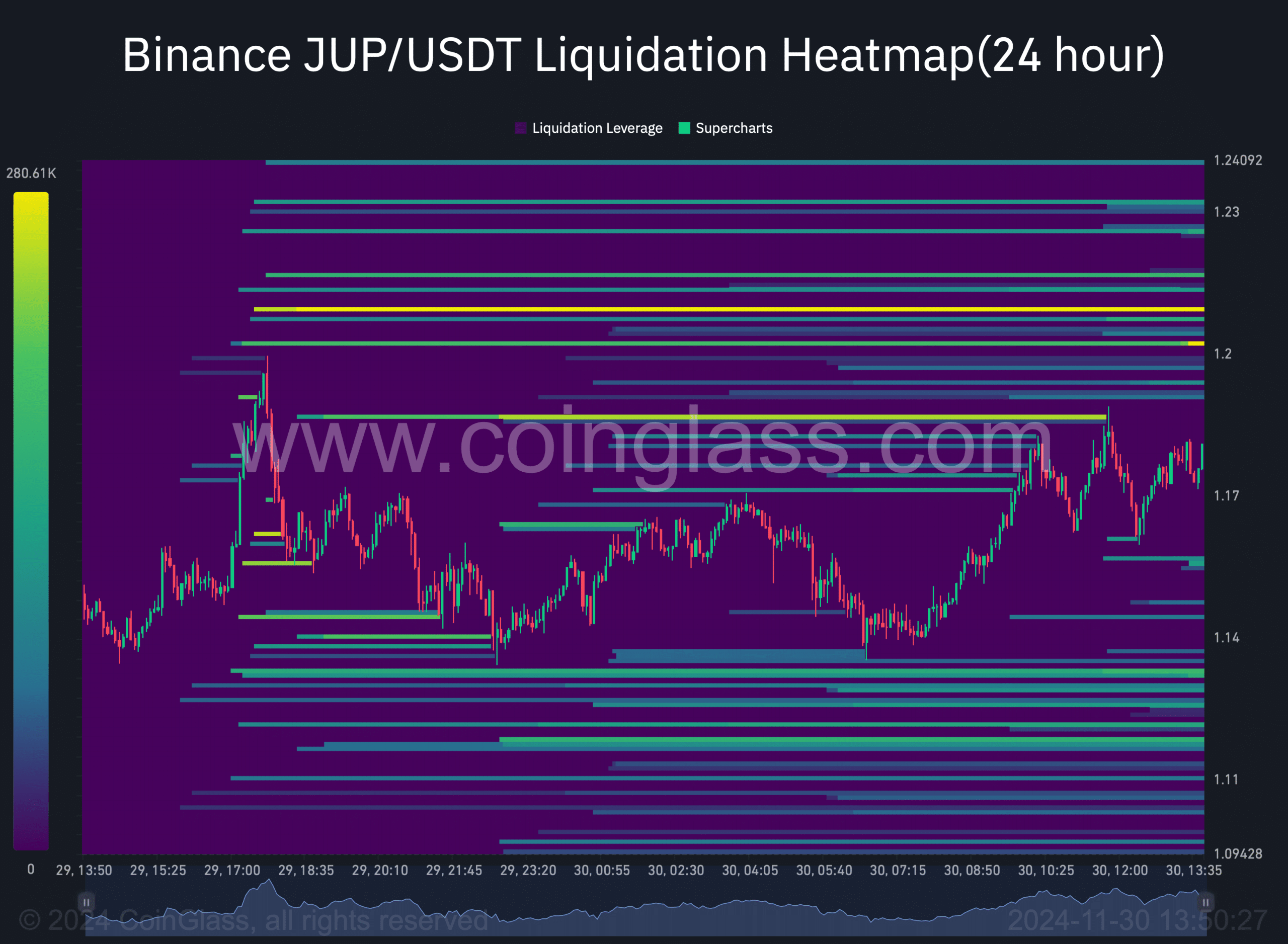

- The token may face a liquidation barrier near the $1.2 level.

Jupiter (JUP) The charts have been consolidating for several days with fairly minimal price movements. However, there may be more to the story here as the altcoin quietly rises above another bullish pattern.

Could this be the trigger that pushes the token to $2 in the future?

Jupiter’s Secret Plan

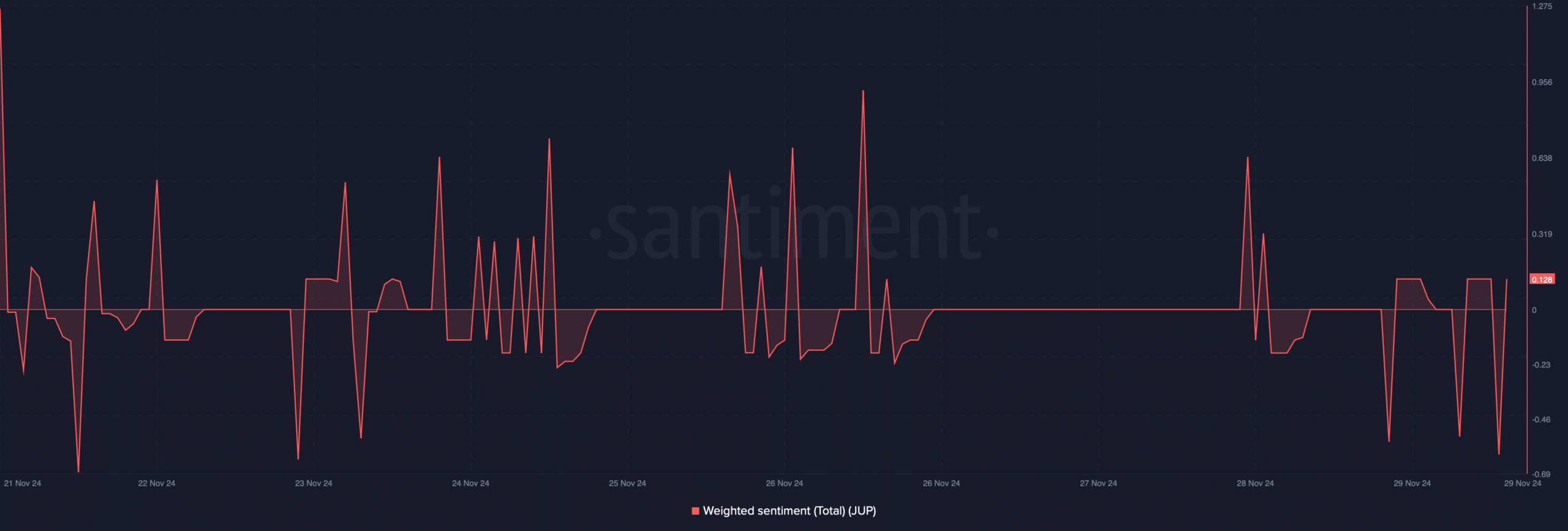

Thanks to the recent consolidation of cryptocurrencies, reduced volatility has had a negative impact on social indicators. In fact, the token’s weighted sentiment has declined sharply. This is a sign of increasing bearish sentiment across the market.

Source: Santiment

But investors shouldn’t fret. Especially because Jupiter may have secrets too. Renowned cryptocurrency analyst World Of Charts shared the following: tweet We highlight very important updates. According to the same, JUP quietly surpassed other patterns. This bullish descending wedge pattern emerged in the first week of November.

Since then, the price of Jupiter has been consolidating within it and breaking out on November 29th. If analysis is to be believed, the token could form another pattern, which is likely to push JUP towards $2 in the coming weeks.

Source: X

What’s next for JUP?

To be precise, JUP may soon form a bullish flag pattern. If that happens and a JUP occurs, it could reach $2. Therefore, investors may see the price of JUP decline after initially registering a few large candlesticks. To see if this was possible, AMBCrypto evaluated JUP’s on-chain data.

At the time of this writing, there were more short positions than long positions in the market, evidenced by the sharp decline in Jupiter’s long/short ratio. This could be due to the increasing bearish sentiment in the market due to the lackluster price action of JUP.

Source: Glassnode

Nevertheless, the token’s open interest (OI) has also been trending sideways recently. This suggests that investor interest in the token has not increased significantly. And this could trigger a trend reversal in the future.

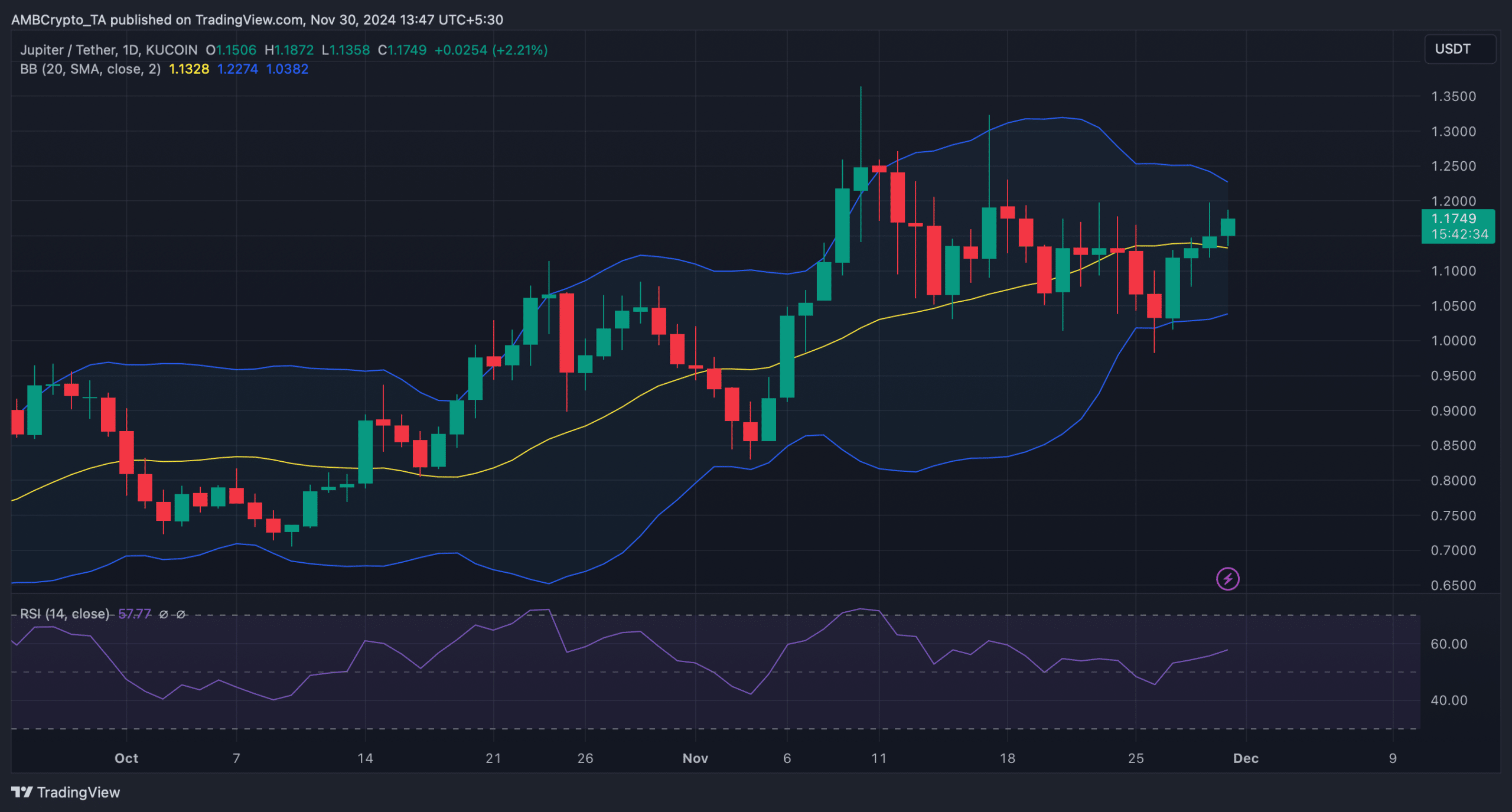

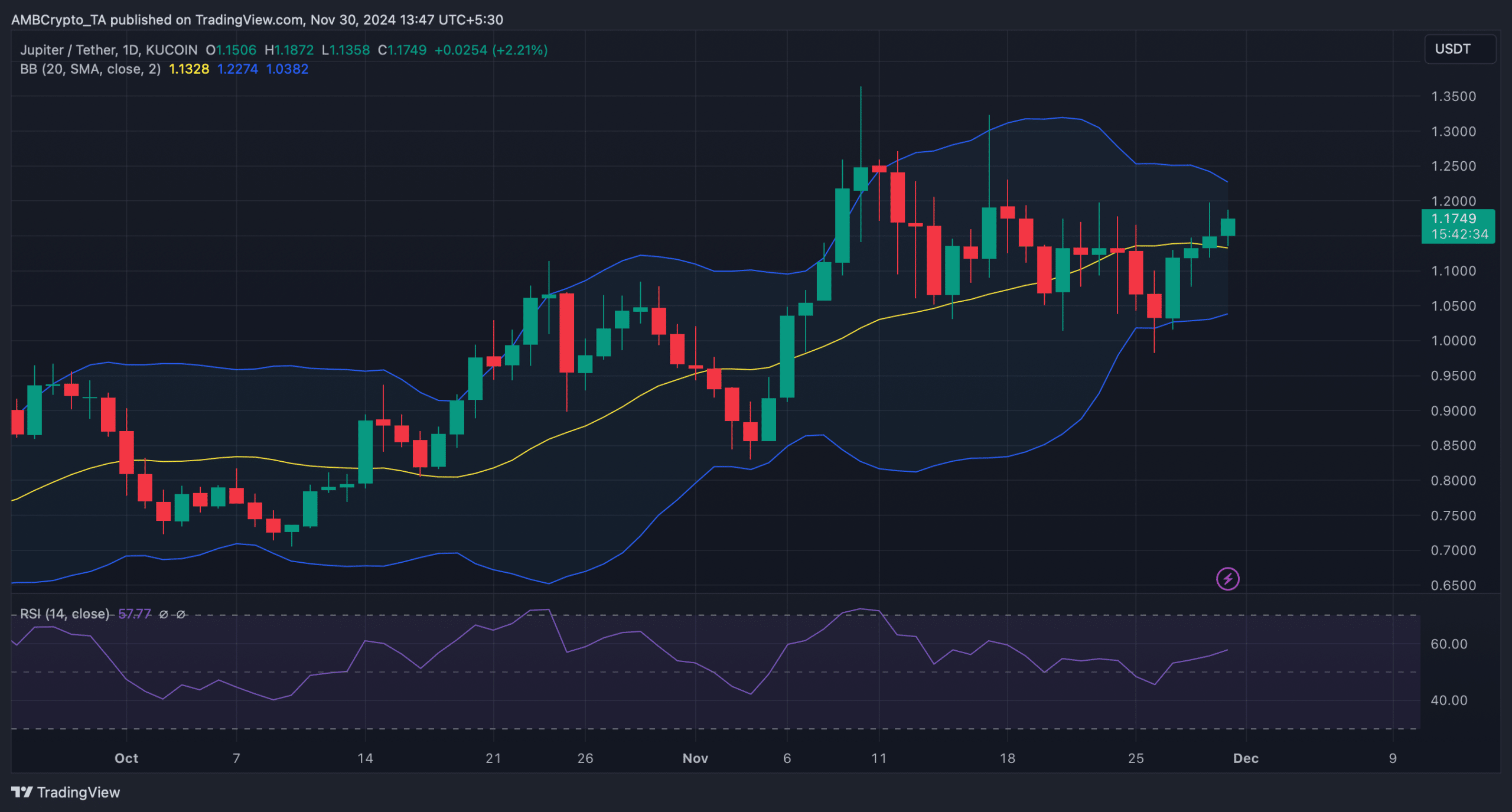

Moreover, market indicators also supported the possibility of a bullish trend reversal.

For example, the Relative Strength Index (RSI) is moving north, indicating increasing buying pressure. Jupiter’s price also appeared to be testing support at the 20-day SMA. In case of a successful test backed by high buying pressure, it would not be ambitious to expect a new bullish rally before the bullish flag forms.

Source: TradingView

Realistic or not, the following is JUP market capitalization based on SOL

However, the token will face significant barriers going forward.

Jupiter’s liquidation heatmap shows that the token’s liquidation will increase sharply near $1.2. Typically, high liquidation volumes result in price adjustments. So, if we want to target $2 in the near future, we need to jump above that level.

Source: Coinglass