Very expected ICO (initial coin operation) of plasma for XPL tokens ~ Above 1,100 depositors.

The event, which is dizzy of capital deployment and gas war, raised concerns among members of the community.

Does Plasma ICO look forward to the unlock of $ 1200 million by raising $ 500 million in the whale craze?

Although the token has not yet been released, the expectation that the final unlock can no longer get $ 1 billion to $ 2 billion is already swelling.

Plasma said, “We have reached a deposit limit of $ 500 million, we have more than 1,100 wallets and have an average deposit of $ 35,000.

But deeper stories come to mind in headlines and overloads. Concerns are more and more meaningful that the token launch, which is extended from whale domination and internal rich approach, is becoming more and more gate events for Krypto Elite.

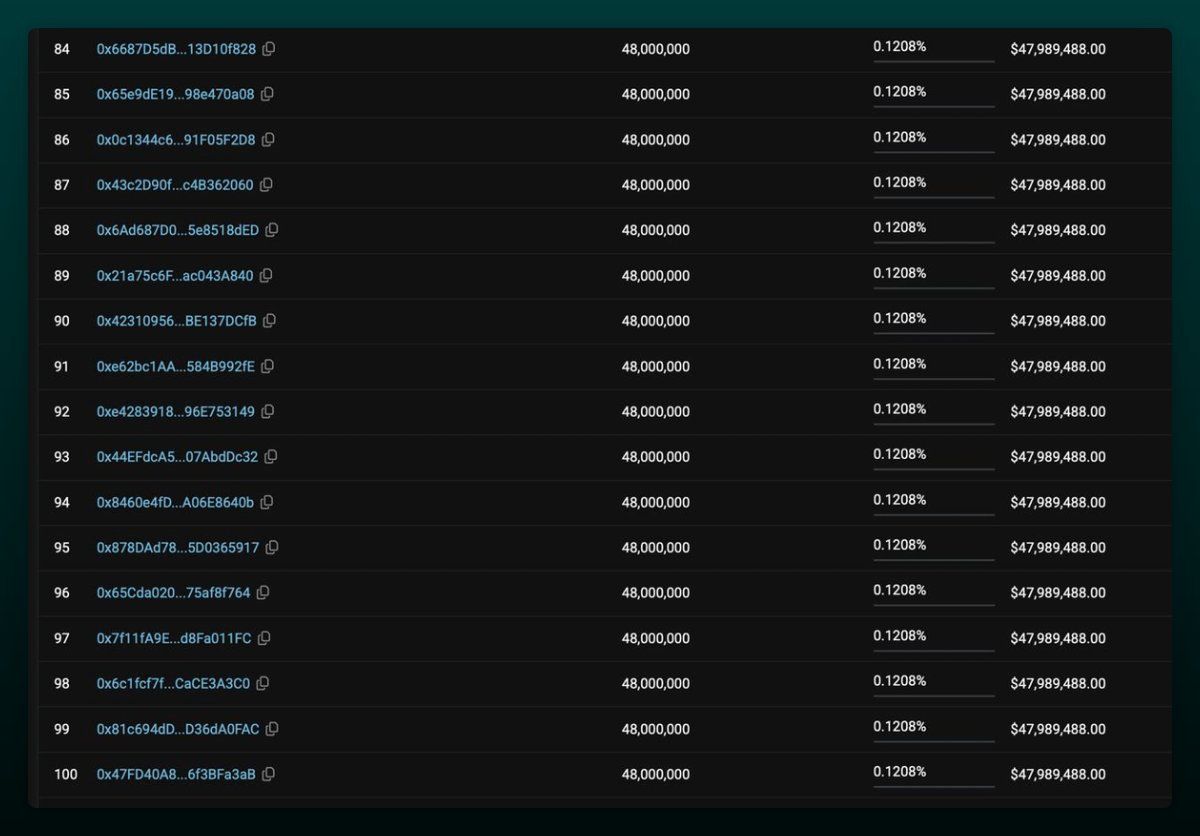

This number shows that only a few wallets have explained a large allocation. More specifically, more than $ 100 million in controversial contributors were placed with the top three contributors.

Perhaps a user paid 39 ETHs (currently $ 104,871 for $ 2,689) for a gas fee, which has secured $ 10 million USDC allocation.

Monamoon, the founder of Duck FrenS NFT Project, said, “This man has deposited 100k to plasma from Gas (230,000 GWEI).

This shows the intensity of the FOMO and the length of the participant to go for an early approach. Nevertheless, the enthusiasm was good. As whales take the lion’s share, many people call anything except this lunch.

“It’s an obvious skip on the community. Only $ 50 million wallets each … This wallet alone will have an excess of 100x. Unfortunately, the price is very attractive but not fair.

In public sales, only 10% of the total XPL token supply was provided, but the retail user was effectively pushed into a side job with $ 500 million FDV. They will probably enter later at a price of 10 to 16 times.

Critics Slam Plasma’s skills and token study-ICOs were not released, but locked.

This rapid difference is not a wider community, but dubbed “Whale Sales”. Moreover, there may be a bad optics in play. The encryption merchant, Hanzo, suggested that the adjusted internal rich behavior was raised by raising serious red flags.

Hanzo requires more than 100 wallets that receive $ 48 million USDC, each, and some of these wallets have approved token interaction before the token contract is released.

“This means that insiders can approach mint and trade early. This was not an amazing release. It was a personal party. The sleeve was not invited.”

The epidemiology of the impression also raises questions. Some of the hosted in Sonar/Echo were called the “Migration Simultaneous List”, and the time weight of the safe deposit was determined for the plasma’s deposit period.

Participants had to lock Stablecoin from Ether Leeum with at least 40 days of lock. But as the deposit limit suddenly rose to $ 500 million and almost immediately filled, many users wondered if this would be an open opportunity.

Even the technology that supports plasma could not avoid investigation. One user knew that it was not enough to destroy the chain’s architecture.

“Plasma is another L1 chain … I use the ‘Classic’ PBFT consensus layer with a steak certificate, and simply posting a status difference, using Bitcoin as a ‘settlement’, which looks like a lot of ALT-L1 EVM fork. It is promoted.

From his point of view, the influence of plasma and the use of Bitcoin branding are more marketing venous than technical substances.

Nevertheless, not everyone agrees. Zaheer of SplitCapital pointed out a wide range of holders with over 1,100 wallets and $ 50 million wallets.

“Everything was considered a total of $ 500 million in total deposits, and I thought it was a good thing as if it were crazy. I saw only a few people with a small number of people and a single $ 50 million organization in my wallet.”

According to Zaheer, this is a typical whale contrasting with the dominant ICO and suggests a more comprehensive allocation strategy.

Plasma’s ICO is more important than innovation or accessibility.

Whether plasma becomes a basic chain or another story depends on how the ecosystem fair is fair beyond the number of locks and ICO overdue advertisements.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.