Injective, a popular Cosmos-based blockchain for decentralized finance, continues to retreat amid ecosystem concerns.

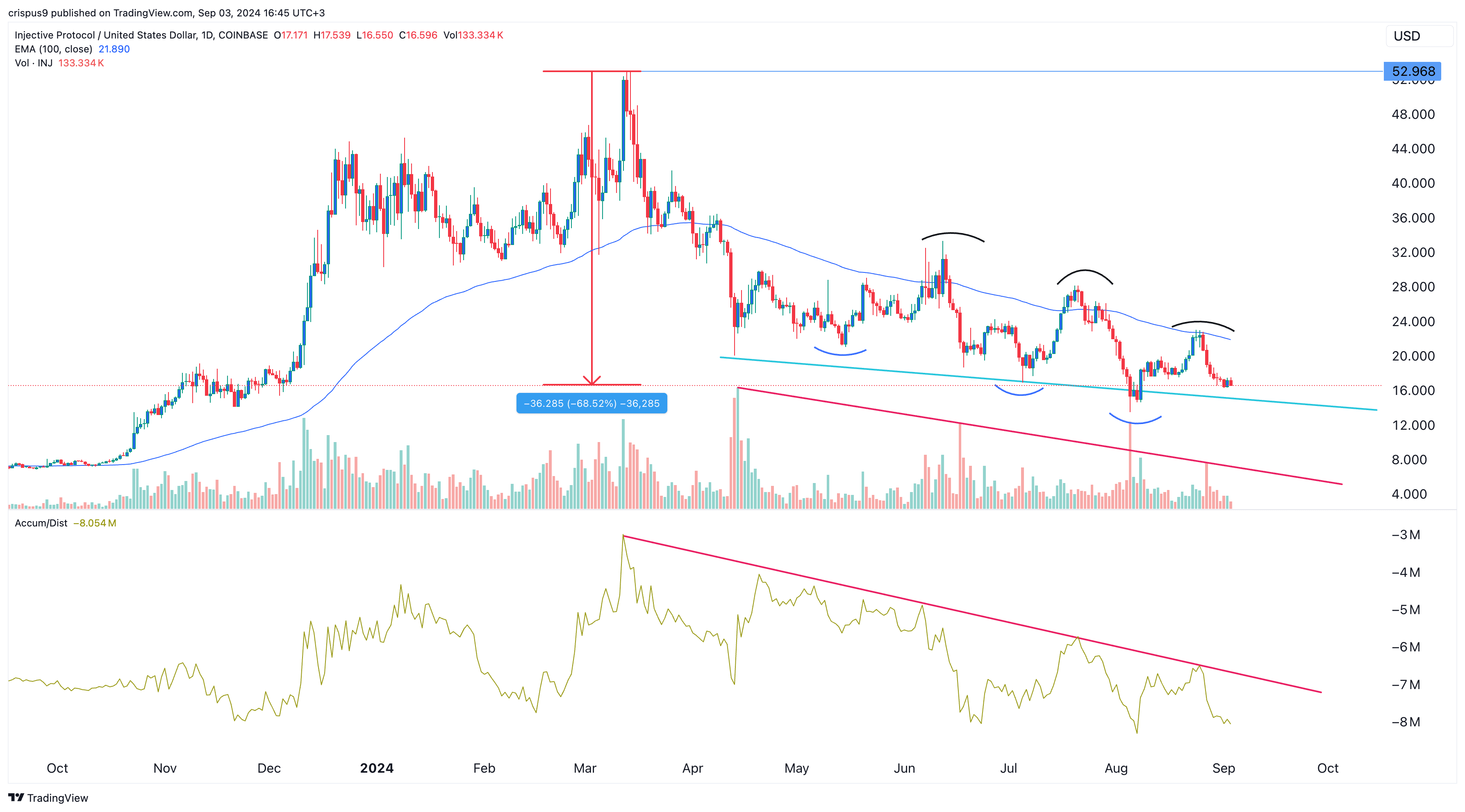

The Injective (INJ) token fell to $16.90 on September 3, its lowest level since August 8. It has fallen more than 67% from its high this year, wiping out most of its gains in 2023. Its valuation has fallen from $4.8 billion in March to $1.65 billion.

Challenges to the ecosystem still remain

Injective’s price action coincided with a sell-off in most altcoins, with the Fear and Greed Index for cryptocurrencies remaining at a neutral level of 47.

This decline comes despite a significant increase in the network’s on-chain transactions. According to its website, Injective has processed over 918 million transactions since launch.

However, concerns about the ecosystem persist when it comes to valuation. According to data from DeFi Llama, the DEX protocol processed $43.7 million in the last seven days, making it the 23rd largest chain in the industry, behind platforms like Osmosis, Mantle, and Blast.

Injective’s DEX trading volume peaked at $611 million in March of this year and has been steadily declining since, showing that the DEX ecosystem is not experiencing growth.

The total value locked in the Injective ecosystem has fallen to $46.5 million, making it the 51st largest chain. This TVL has also been declining since peaking at $72 million earlier this year. Additionally, the stablecoin trading volume in the ecosystem has fallen to $22.6 million.

The reason why Injective has achieved notable success in the DeFi industry is because the company’s goal is to become a blockchain for the financial services industry.

Injective tokens also fell as staking inflows decreased. Data shows that the network experienced outflows over the past two days, and staking yields fell to 10.4% from a high of 18.7% last month.

Traders, Warning About Injective

The INJ token has been in decline since hitting a high of $52.96 in March. It has recently formed a series of lower highs and lower lows, indicating that the bears are in control. Altcoin Sherpa, a trader with over 222,000 X followers, warned in a note that the token is at risk of further decline.

Injections also remained below the 50-day moving average, while the accumulation/distribution indicator continued to decline, suggesting that distributions are increasing.

Volume continues to decline, suggesting further downtrend. This sell-off will be confirmed by a break below the downtrend line connecting the lowest swing low since April 12.