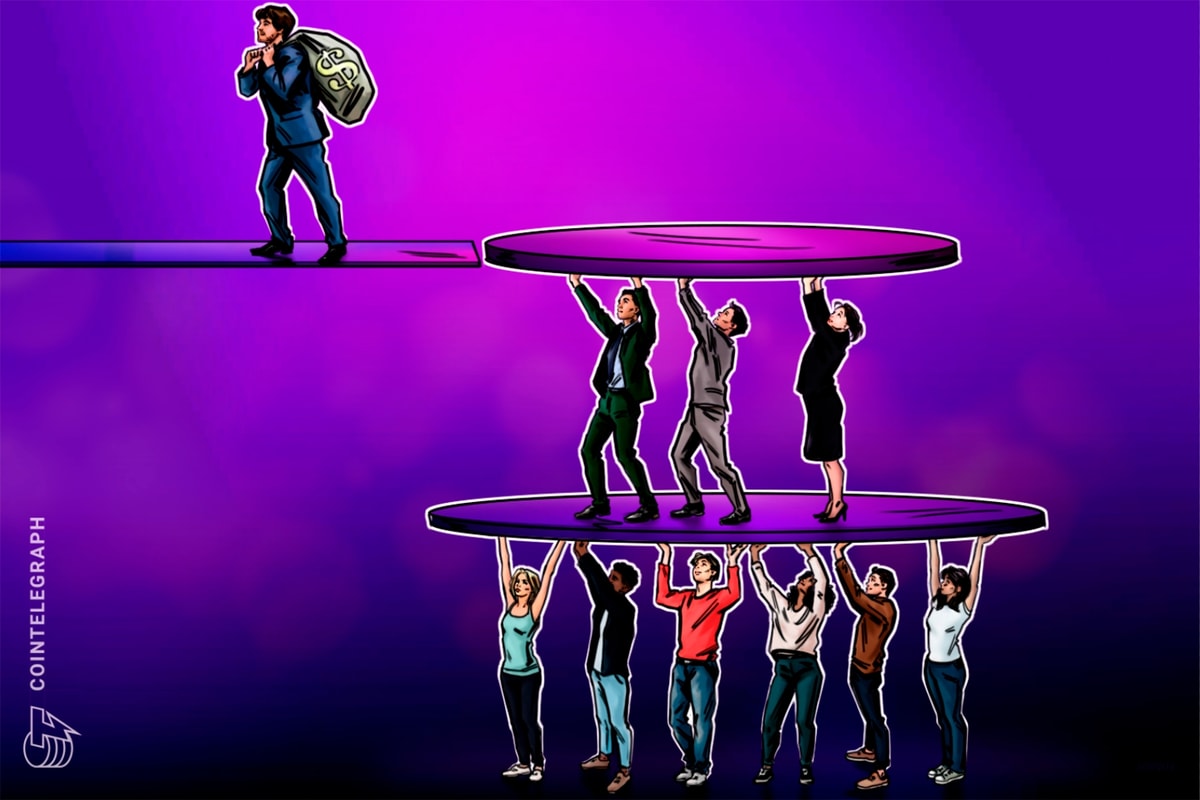

The Commodity Futures Trading Commission sued the pastor and accused him of facilitating a cryptocurrency Ponzi scheme for 1,500 people, including some who attended his church in Washington. Pastor Lee is known to have pocketed $6 million.

The CFTC said on December 10 that it had filed charges against Francier Obando Pinillo for fraud and misappropriation as part of a multi-level marketing scheme.

The CFTC filed a complaint Dec. 9 in Spokane federal court, alleging that Pinillo, a pastor at a Spanish church in Washington, had been using social media to tell congregants and others that he was engaging in a “deal that compensates users through high performance.” He claimed that he was “operating the platform.” ” Cryptocurrency Trading.

source: CFTC

The regulator said Pinillo had owned and operated Solanofi, Solano Partners Ltd. from November 1, 2021 to December 31, 2023. and Solano Capital Investments, which he claimed developed and traded in the “Solano ecosystem.” We trade Bitcoin (BTC), Ether (ETH), Tether (USDT) and other cryptocurrencies on behalf of our clients.

The CFTC said Pinillo promised customers they would earn monthly returns of up to 34.9% through Solanofi, which they heard used bots and other software for cryptocurrency trading.

According to the complaint, staking services for Bitcoin, Ethereum, Solana (SOL), USDT, and Dogecoin (DOGE) were also provided through a service called Solanophy 2.0 that “guarantees profits to customers.”

As part of the scheme alleged by the CFTC, users were shown an online dashboard that displayed account statements showing account balances, profits, and offered a 15% referral fee to encourage others to sign up.

The CFTC claimed that no trading or staking service existed as promised. Source: CFTC

“These statements and account statements were false,” the CFTC said in its complaint.

“There was no automated computer trading program, there were no customer accounts, no transactions were taking place and no revenue was being generated, and the defendants were misusing all digital and fiat assets sent by customers,” he added.

The CFTC alleged that “unsophisticated customers” with little or no experience trading digital assets, trading commodity interest, or staking digital assets were targeted.

relevant: The CFTC bag hit $17 billion in 2024 thanks to massive cryptocurrency enforcement.

“Defendant’s solicitations were made almost entirely in Spanish, allowing him to abuse his position of trust as a pastor,” the CFTC wrote.

The regulator is seeking compensation for defrauded customers, forfeiture of all funds generated through the scheme, a trading ban and a permanent injunction.

Information about Pinillo’s attorney was not immediately available. Pinillo did not respond to requests for comment sent through social media.

magazine: How to Pick Crypto Gaming Token Winners in This Bull Market: Web3 Gamer