- As cryptocurrency asset prices fell, greed remained dominant.

- BTC remained below support levels.

The recent decline of major cryptocurrency assets such as Bitcoin (BTC) and Ethereum (ETH) has shocked the cryptocurrency industry.

While traders are closely monitoring price trends, the Fear and Greed indices indicate that sentiment remains positive for now.

Fear and greed index still positive

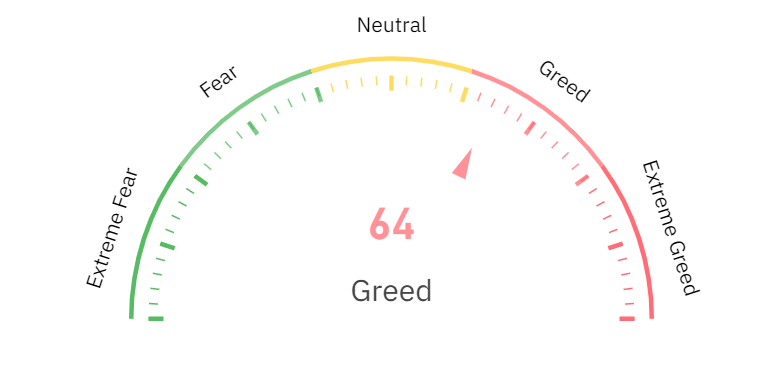

Analysis of the Crypto Fear and Greed Index shows that optimism remains despite the decline in the prices of most cryptocurrencies.

The index currently shows a greedy state with a viewership rating of about 64%.

However, analysis of Coinglass charts shows that the level of greed is decreasing at press time. The previous day’s index was around 74.

This suggests that although crowd sentiment remains positive, optimism is waning.

Source: Coinglass

AMBCrypto’s analysis of the price trends of Bitcoin and Ethereum explained why the Fear and Greed indices have shown such trends over the past few days.

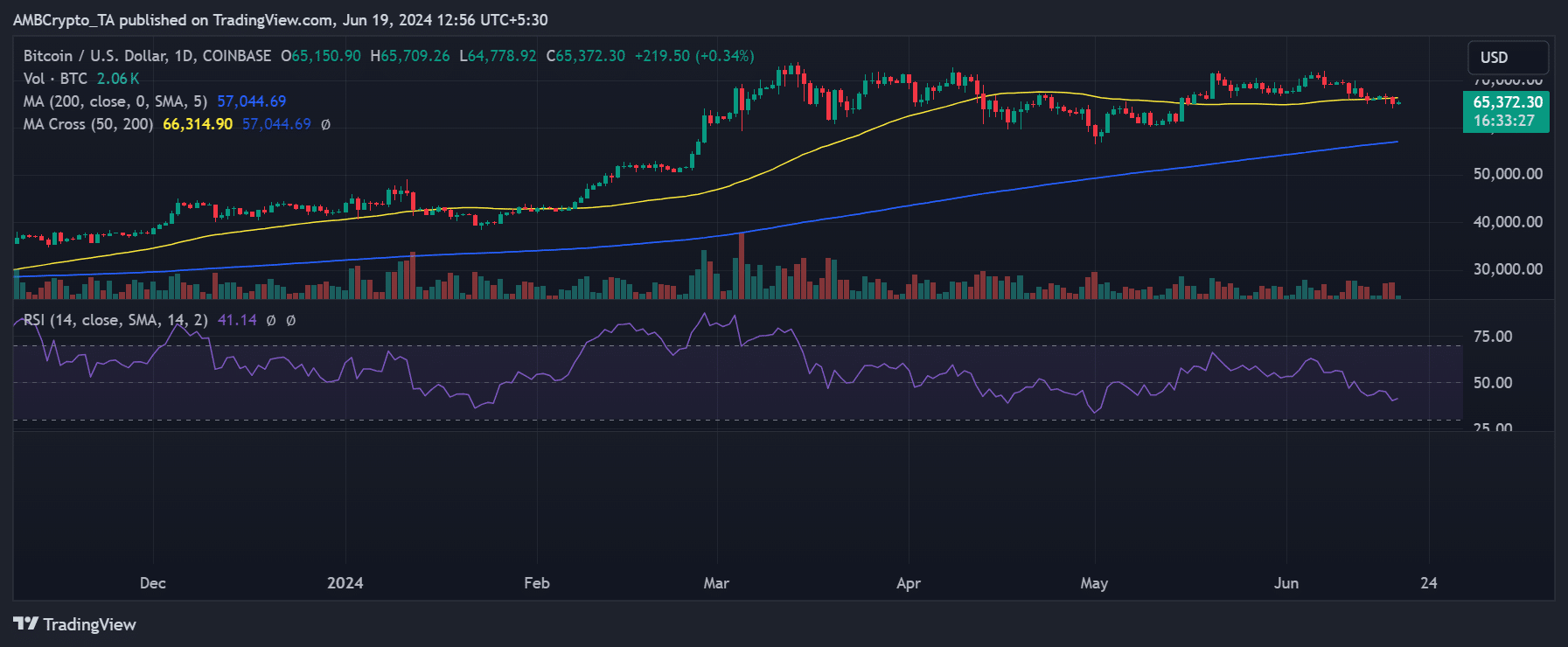

How Bitcoin Affected the Index

Looking at the Bitcoin price trend, we can see that the $65,000 price range served as a long-term support level. However, the recent downturn has broken this support.

According to the analysis, Bitcoin finally broke below support on June 18 when the price fell 2% before reaching $65,152.

Source: TradingView

The relative strength index (RSI) also appears to be staying below the neutral line, suggesting a strong bearish trend.

At current prices, the sentiment on the Fear Greed Index remains positive, but could fall further if Bitcoin price falls further.

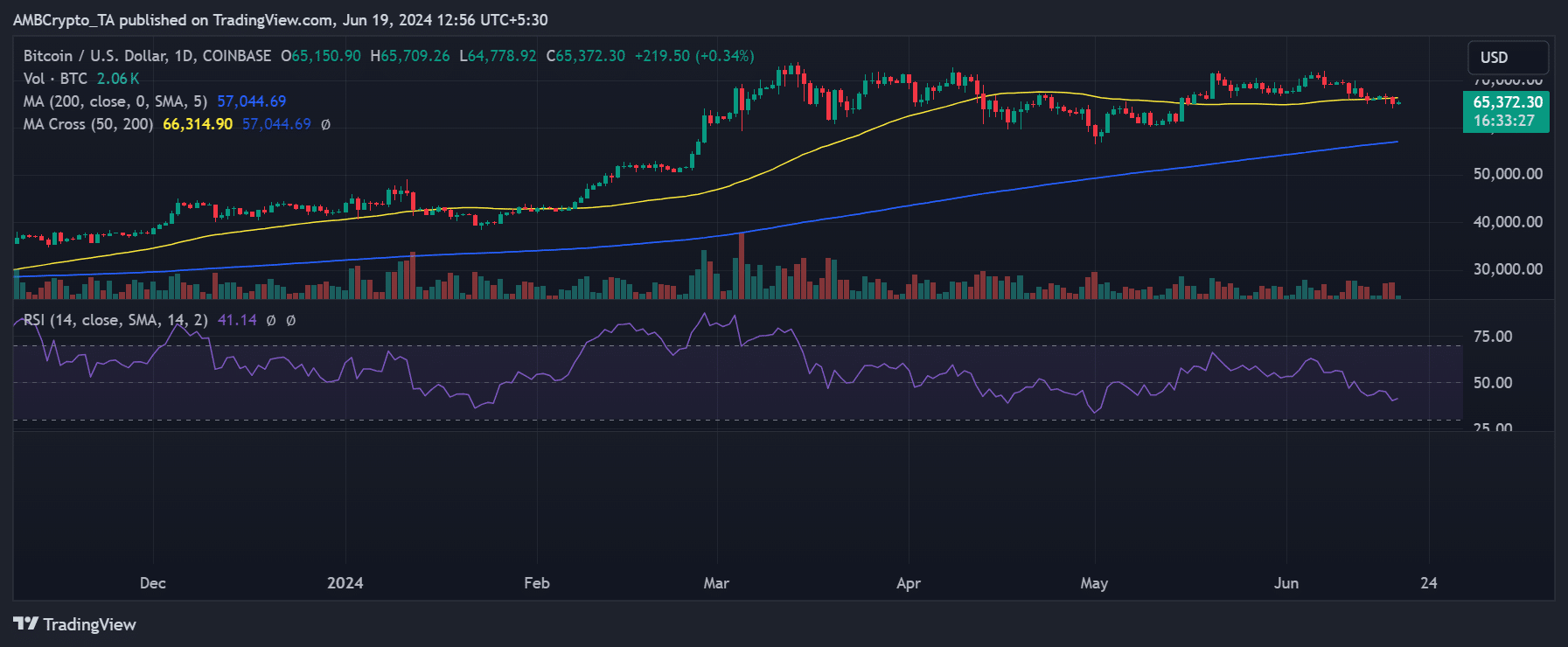

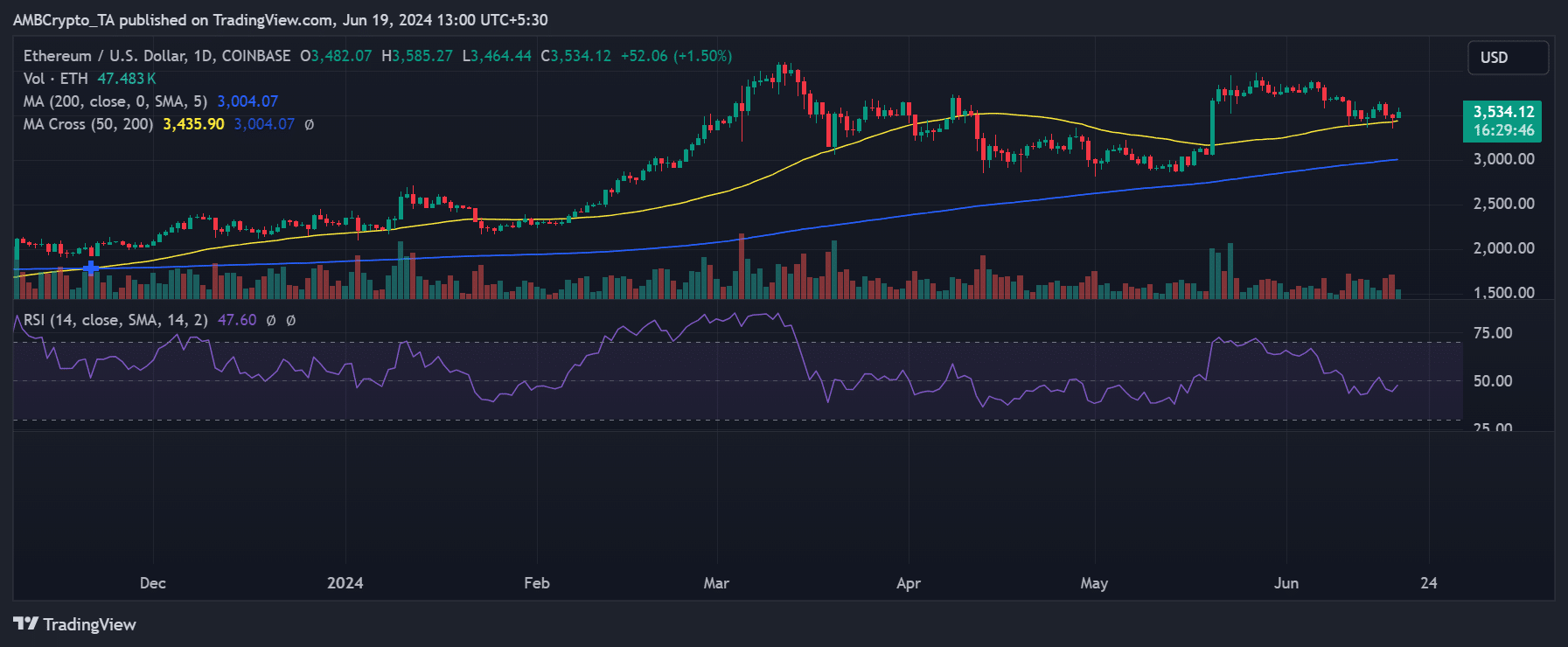

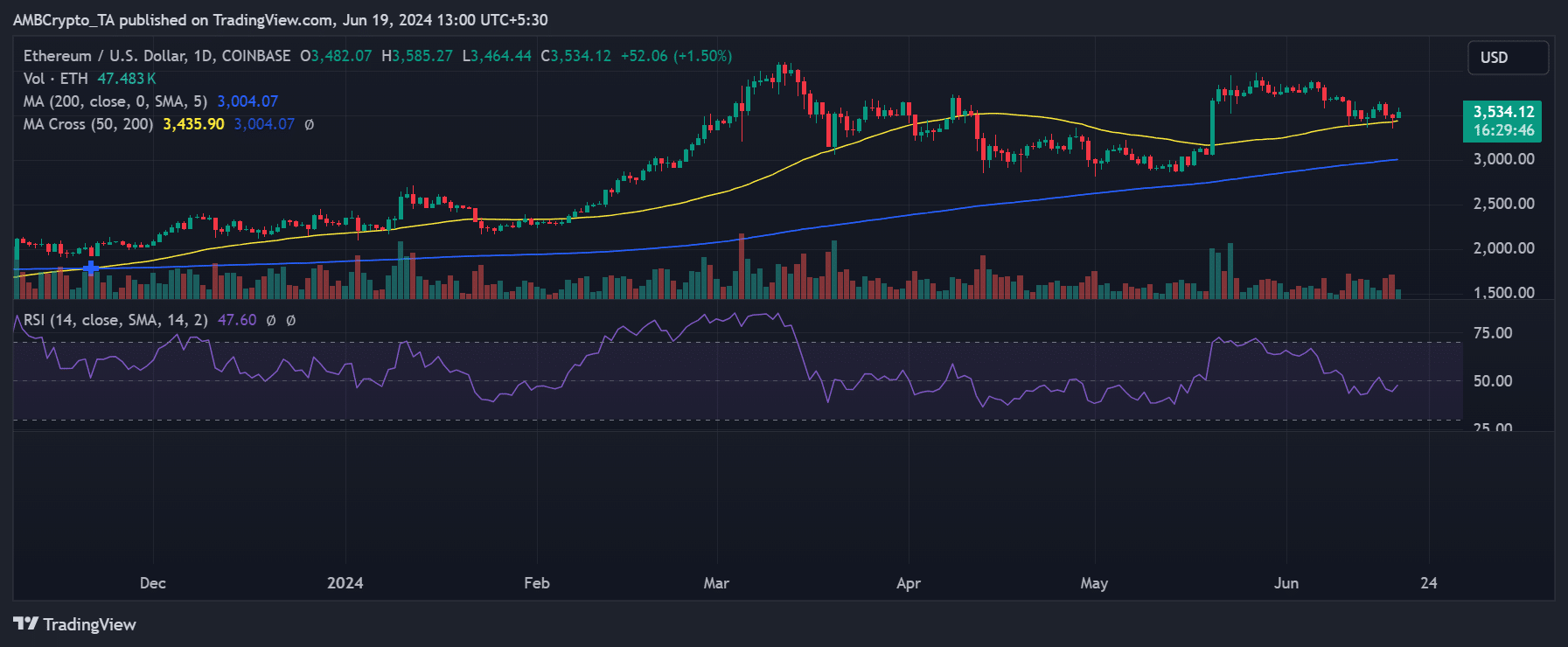

Ethereum’s impact on indices

Looking at the price trend of Ethereum, we see that the price has been falling over the past few days. However, unlike Bitcoin, support levels were maintained despite the decline.

According to the chart, Ethereum fell less than 1% on June 18, with the price falling to around $3,482. As of this writing, it is up more than 1% and trading above $3,500.

Source: TradingView

Read Bitcoin (BTC) price prediction for 2024-2025

Although the BTC price may fall, causing the Fear Greed Index to decline, the overall price trend has helped maintain balance so far.

However, given BTC’s dominance, further decline in price could send the index into panic mode.