Digital Asset Investment Products have raised $ 880 million in encryption in the world due to a surge in institutional interests last week.

This is a shame of $ 7.3 billion in commissions observed in early February, recording four consecutive days, and the inflow of YTDs every year (YTD) flowed to $ 6.7 billion.

Inflow of encryption for 4 consecutive weeks

The latest Coinshares report shows the fourth week of continuous positive flow. Previously, the inflow of encryption was $ 2 billion. In the previous week, the inflow of encryption reached $ 3.4 billion as investors turned into digital assets into their own refugees.

Before that, XRP gained trend to $ 141 million in digital asset investment products.

Coinshares’ researcher James Butterfill pointed out that Bitcoin imposed $ 860 million in inflow costs, reflecting the role of macro hedge as economic uncertainty increased.

Since the launch of the SPOT BITCOIN ETFS (Exchange-Traded Funds) in the United States in January 2024, the cumulative net inflow has been $ 62 billion and exceeded $ 61 billion in previous. Ether Lee has seen a strong price recovery, but the investor feelings remain lukewarm and only $ 1.5 million last week.

SUI, on the other hand, is noticeable between Altcoins. It recorded the inflow of $ 11.7 million every year and solana weekly and every year. SUI’s total inflow is now a $ 88 million YTD, surpassing Solana’s $ 76 million, but the latter has leaked $ 3.4 million over the past week.

Coinshares showed that the rapid rise in encryption prices and investment flow was due to a large number of macroeconomic trends.

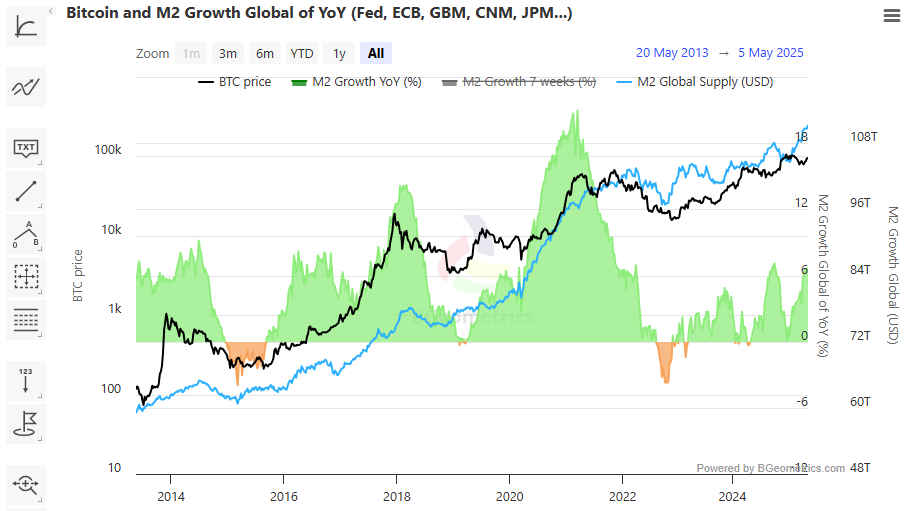

Butterfill thinks, “We believe that the rapid increase in price and inflow is led by a combination of factors. We believe that it is a few US stocks that approve the world’s rise in M2 currency, the risk of staplation in the United States, and Bitcoin as a strategic preliminary asset.”

In fact, the states, such as Arizona and New Hampshire, have developed their efforts with Bitcoin strategy reserves. Nevertheless, others like Florida hit brick walls.

Macro shift that provides a transaction compass for encryption investors

Similarly, the expansion of global M2 currency supply is focusing on Bitcoin investors. According to the data on TradingView, China’s M2 currency supply remains at the all -time high of $ 326.13 trillion. This represents the potential flood of global liquidity that risky assets such as Bitcoin are now being absorbed.

Analysts also observed that the price of Bitcoin is positively related to the global M2 trend. This outlook strengthens the story of Bitcoin with macro response assets.

But not all experts are convinced. Increasing agreements link M2 expansion with encryption price behaviors, but skeptics argue that relationships can be exaggerated.

The US economic recession is fueling more to encryption allocation. Goldman Sachs has raised the US recession to 45%over the last 12 months and quietly increased exposure to Bitcoin through funds including SPOT ETF products.

Investors interpret this as a signal that matches the extensive topic of encryption as a hedge to traditional Tradfi instruments and dollar expression assets.

This recognition is gaining institutional verification. Standard Char This is especially related because the US defect balloon and financial yields are maintained in volatility.

With the increase in roles in Bitcoin’s portfolio, the optimistic propulsion of encryption inflows suggests that investors are switching to digital assets with direction betting and macro hedge.

disclaimer

By complying with the Trust Project guidelines, Beincrypto is dedicated to unbiased and transparent reports. This news article aims to provide accurate and timely information. However, readers should check the facts independently and consult with experts before making a decision based on this content. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.