- The core has previously been over $ 0.4775.

- Despite the surge in trading volume, the rally did not persist.

Core (Core) collected 33%from $ 0.39 to $ 0.52 on March 30 to $ 0.52 on March 29 to 11 hours. This brought many speculative traders to the core market.

According to Coinalyze’s data, the open interest of tokens has risen 116% over the last 24 hours.

It was unclear whether this rally could last. The higher the chart was firmly weak. In general, strong meetings for weekends mean liquidity hunting.

The reason why core bulls are having trouble

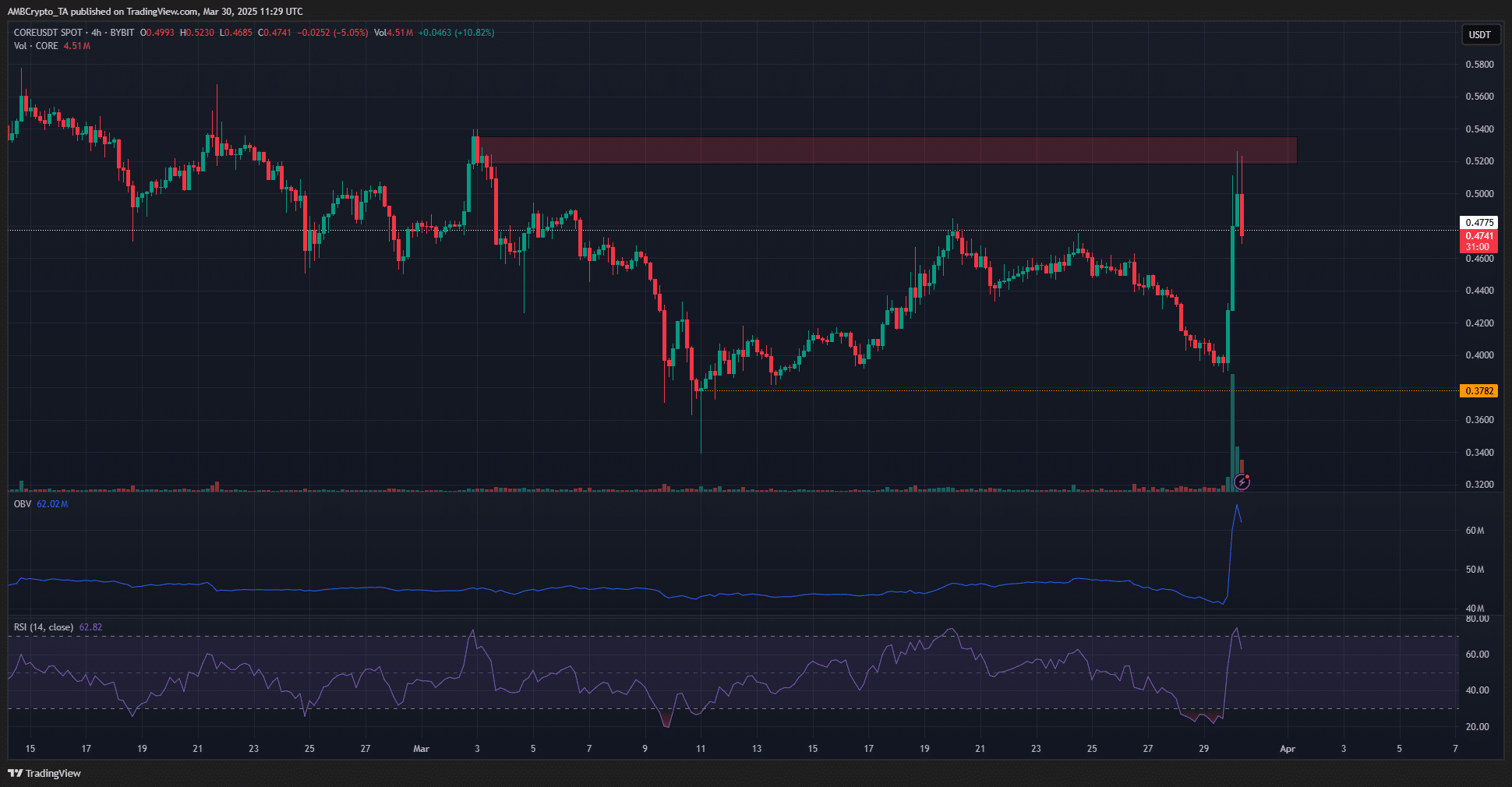

Source: TradingView Core/USDT

On the day’s chart, the core was stubbornly weak. The recent rally again tested the $ 0.4775 resistance level. This level was also used in February and in February 2024.

This long -term S/R weak re -test meant that the price of the core DAO token may be lowered in the future. But the volume was very high during the weekend.

This surged OBV to the highest level in December.

Meanwhile, RSI was on the verge of closing the daily session beyond 50 neutral 50. This is another sign of the movement of the driving force, but it is not imminent.

The higher the trend should be respected, and it would be better for investors to doubt this rally than to give up on FOMO.

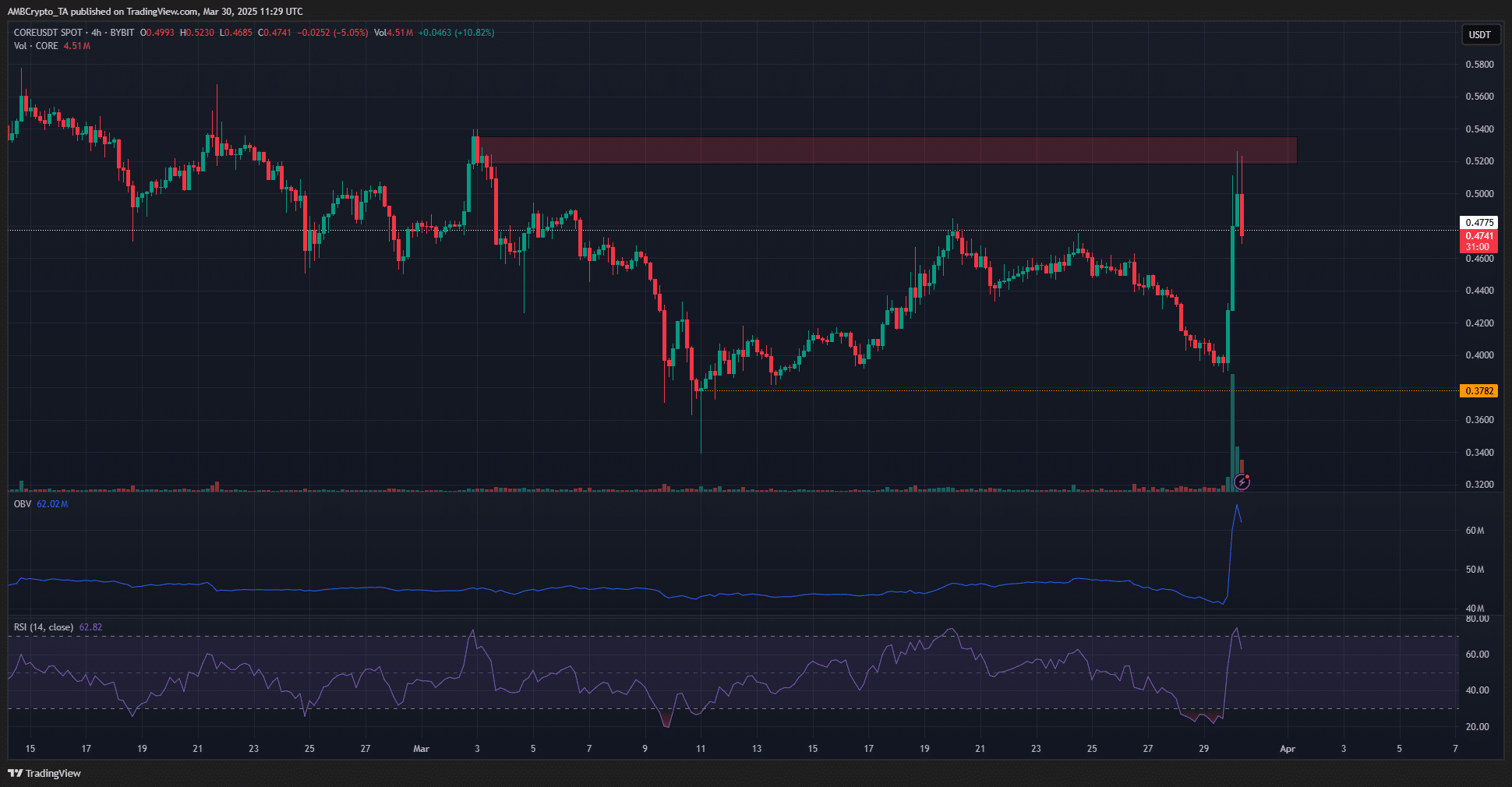

Source: TradingView Core/USDT

On the H4 chart, a clean rejection has been shown in the weak order block of $ 0.52 from early March. The price has been reset to $ 0.4775, but may not be maintained.

Fast profit during the weekend means that the price measures are more vulnerable to the behavior of the market participants when the trading volume is generally low.

The $ 0.378 was the next level. Movement beyond $ 0.52 will give Core Bulls more food for thoughts.

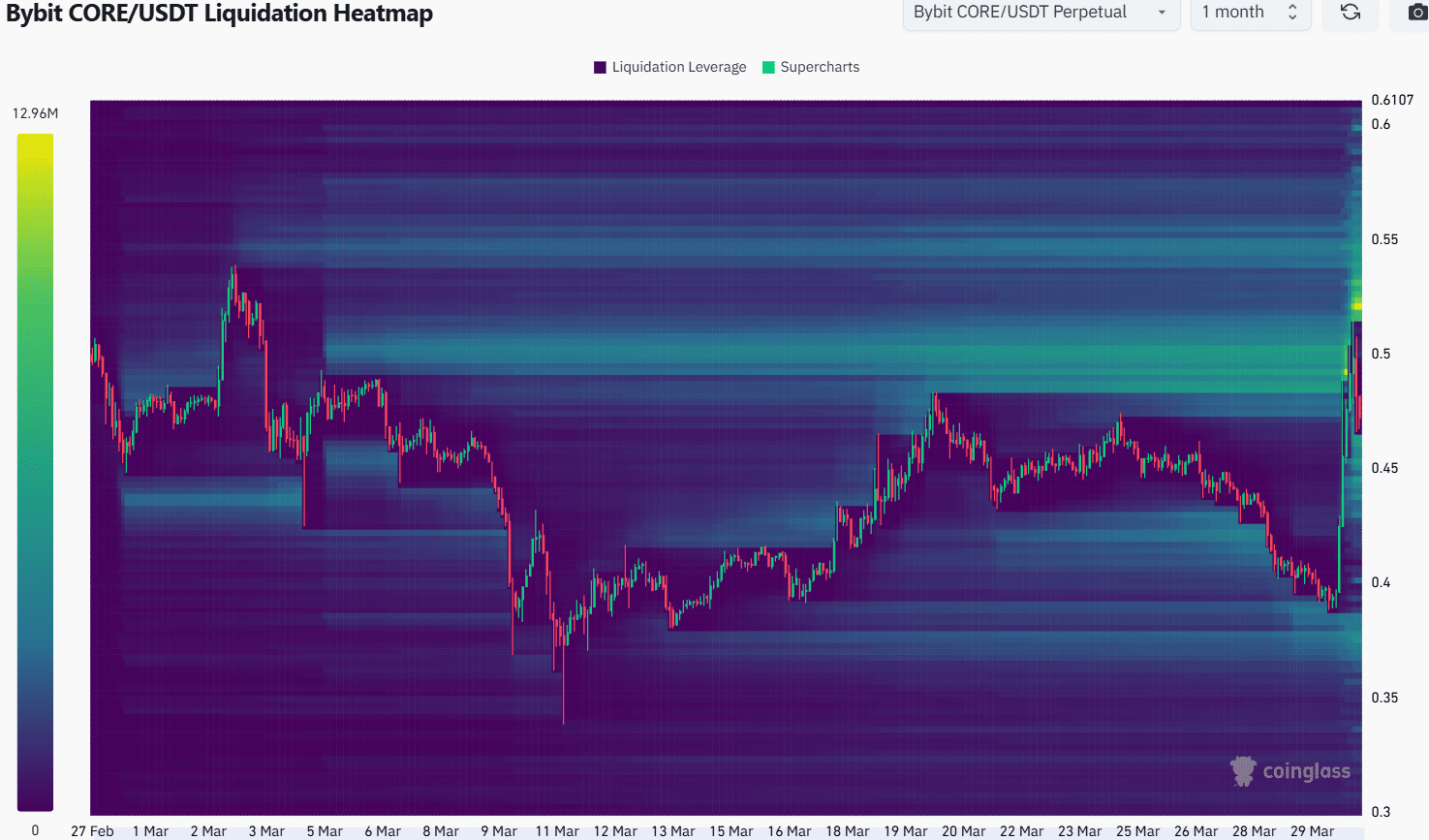

Source: COINGLASS

The liquidation heat map has emphasized the $ 0.5 area with its own area over the past month. The recent price behavior has been swept by this liquidity pocket.

In this process, a stronger self -area filled with short liquids appears $ 0.52.

Therefore, the core will see more volatility in the future. Another test in $ 0.52- $ 0.53 will provide a short core opportunity.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.