- Bitcoin remains stable as Altcoin Metric has decreased sharply.

- Altcoins shows a repeated voice exercise signal that matches the historical correction period.

In recent years, the warm chain data exudes the trend between Bitcoin (BTC) and the rest of the Altcoin sector.

Cryptoquant analysts have confirmed that Bitcoin’s continuous integration is more than $ 83,000.

Source: cryptoquant

Altcoins, on the other hand, increases volatility, slides participating metrics, and points out value granted.

Momentum trends tell us the first part of the story.

From October 2022 to April 2025, Bitcoin’s 365 -day mobile average (DMA) surpassed the 30 -day average throughout the market, emphasizing the dominant momentum.

Altcoin seems to be losing steam. Since the ratio of non -BTC assets 365 and 30 days was -11%, it revered the stagnation of the witness in October 2023.

In fact, in the mid -cap and in the middle, a small cap altcoin sinks into repetitive negative areas, showing systematic achievements in Bitcoin.

A simple growth eruption appeared between April and June 2024. But this interval turned out that Altcoin was not able to maintain actual exercise.

However, Bitcoin has strengthened the position of dominance by showing consistent elasticity through strength and corrective wave.

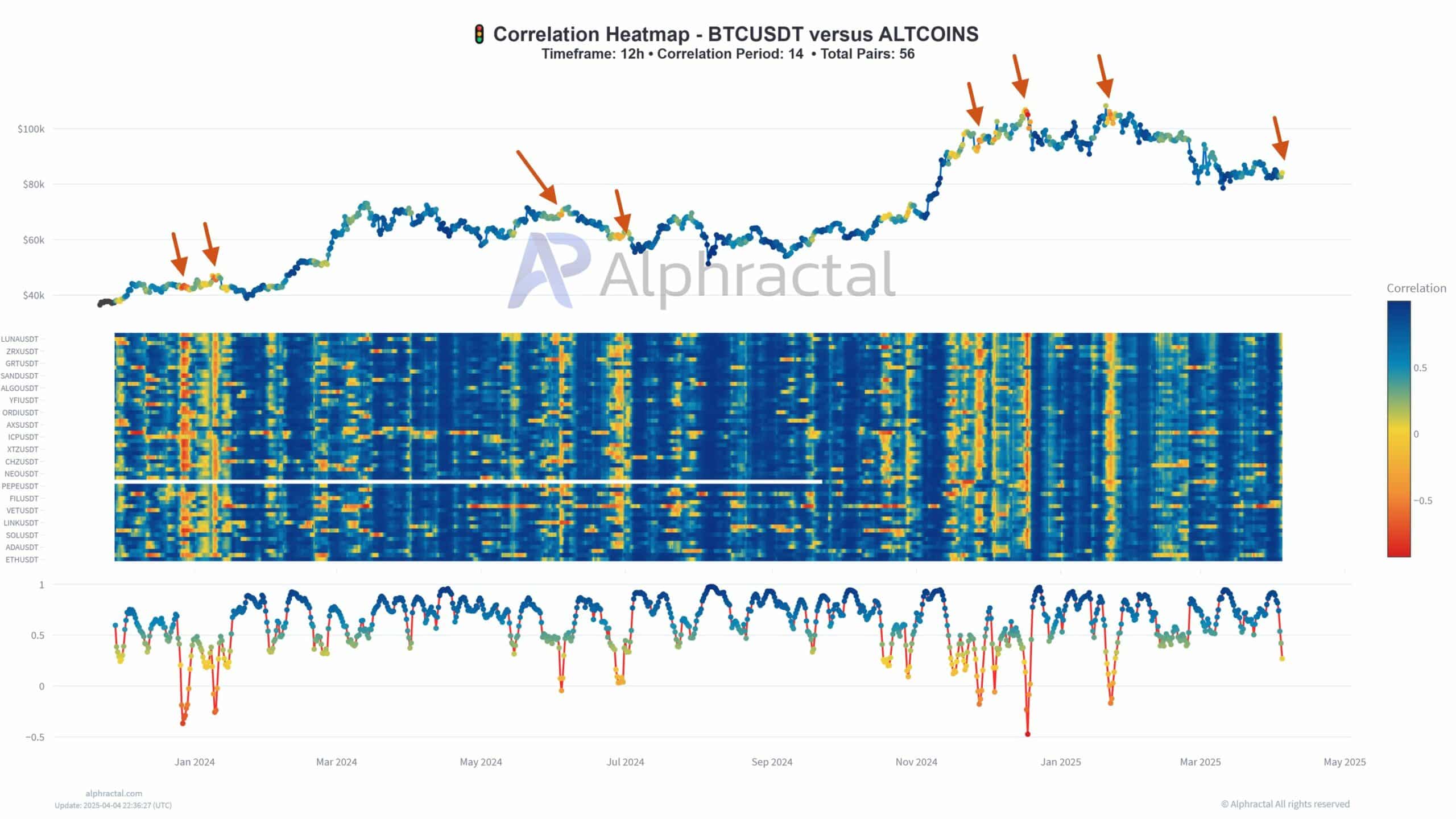

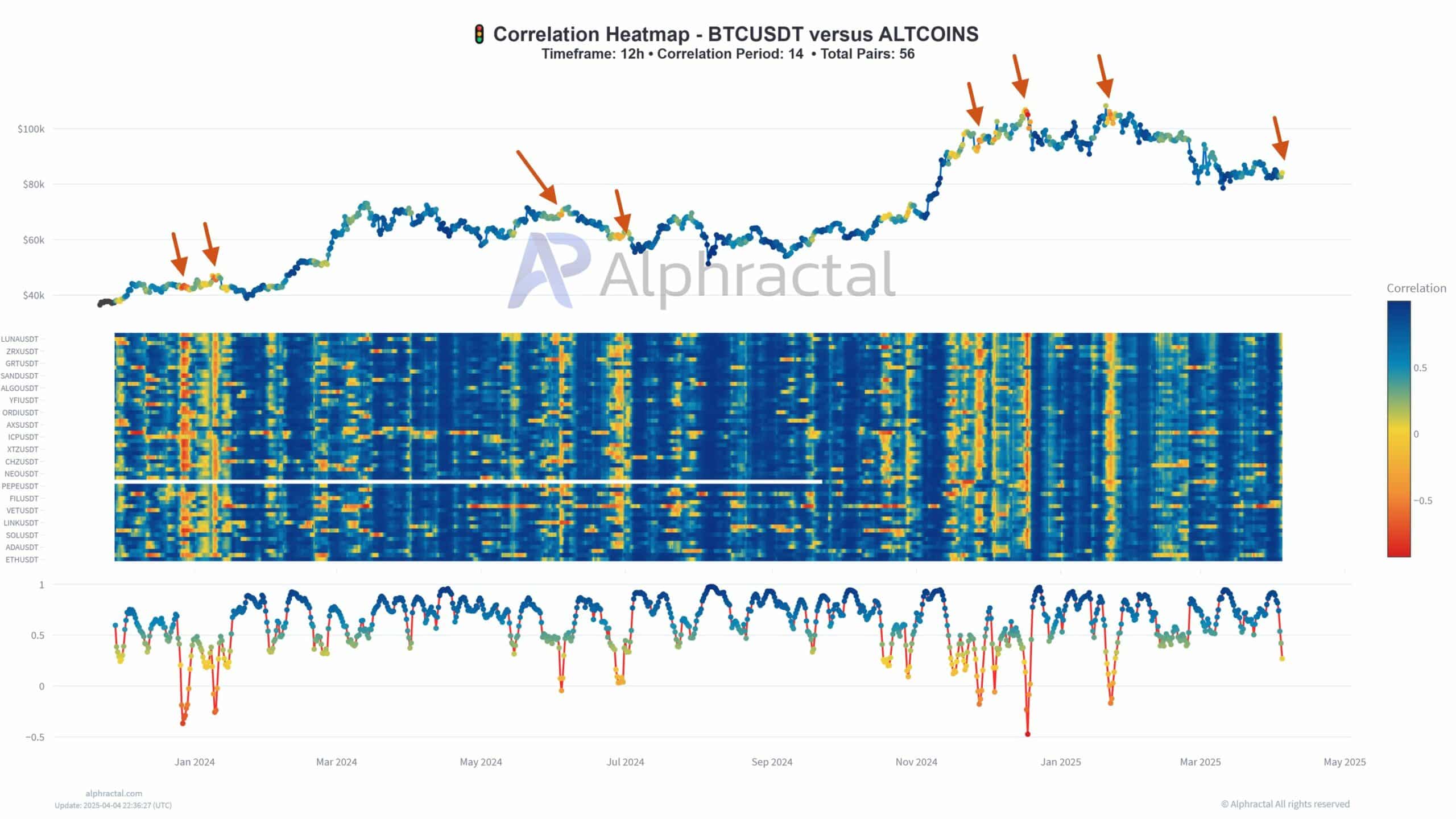

In addition, the correlation thermal map of Alfatal shows this divergence.

In contrast, BTC maintained elasticity.

Since early 2024, the correlation score between BTC and 56 Altcoins has been shaken greatly.

Source: Alphractal

In addition, if the correlation level in blue is lowered, the volatility spike of the bitcoin and the price reversal occurs and match the local BTC top.

At the time of writing, the correlation value vibrates between +1 and -0.5, showing unstable in the way Altcoins reflects the price behavior of Bitcoin.

The performance data of the main Altcoins shows a dark picture.

Source: X

ETHUSDT plunged from -9.9%to 0.749, BNBUSDT dropped from -25.1%to 0.4299, LTCUSDT was almost -99.66%, and near 0.0006 transactions were -33.97%.

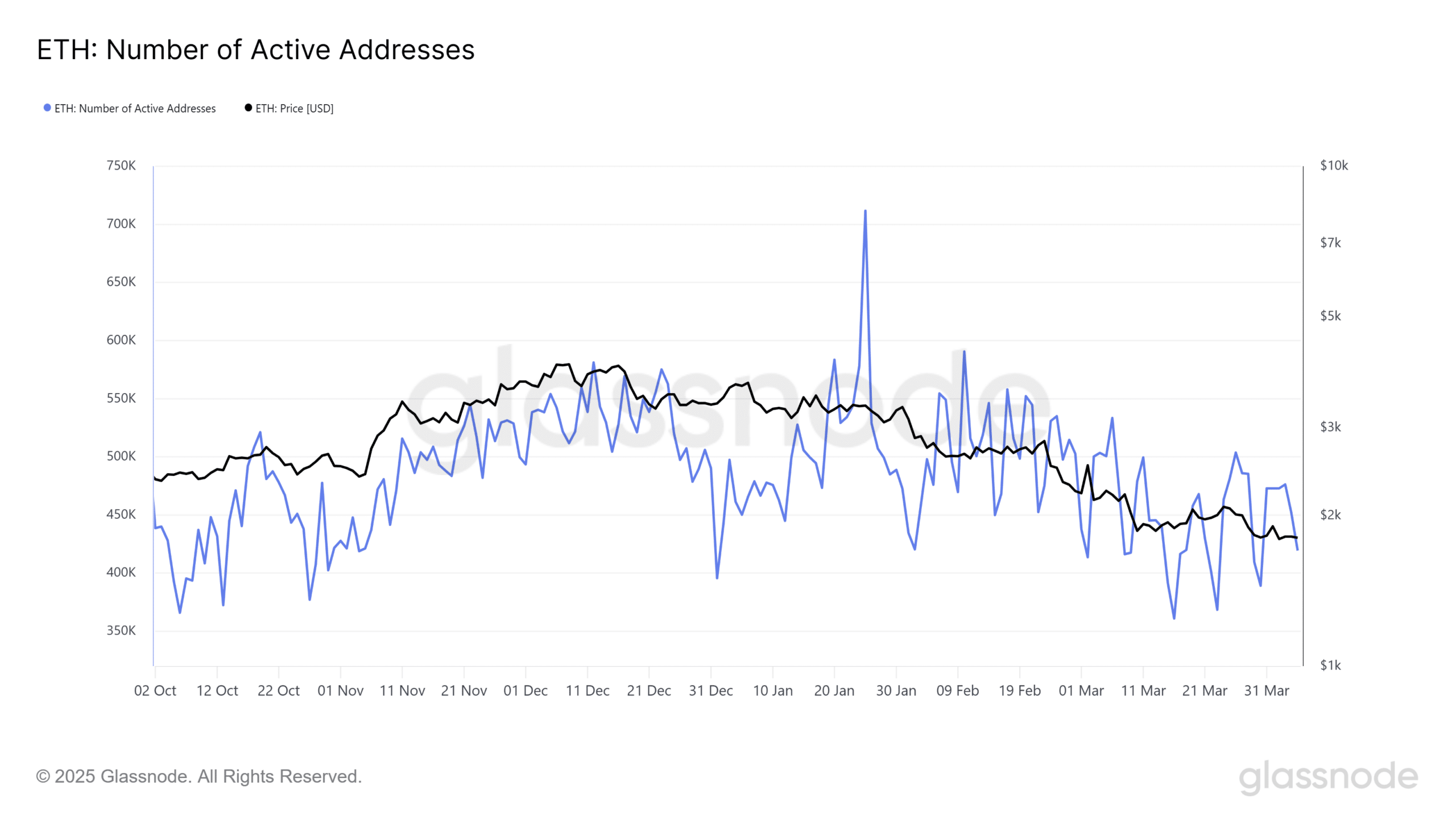

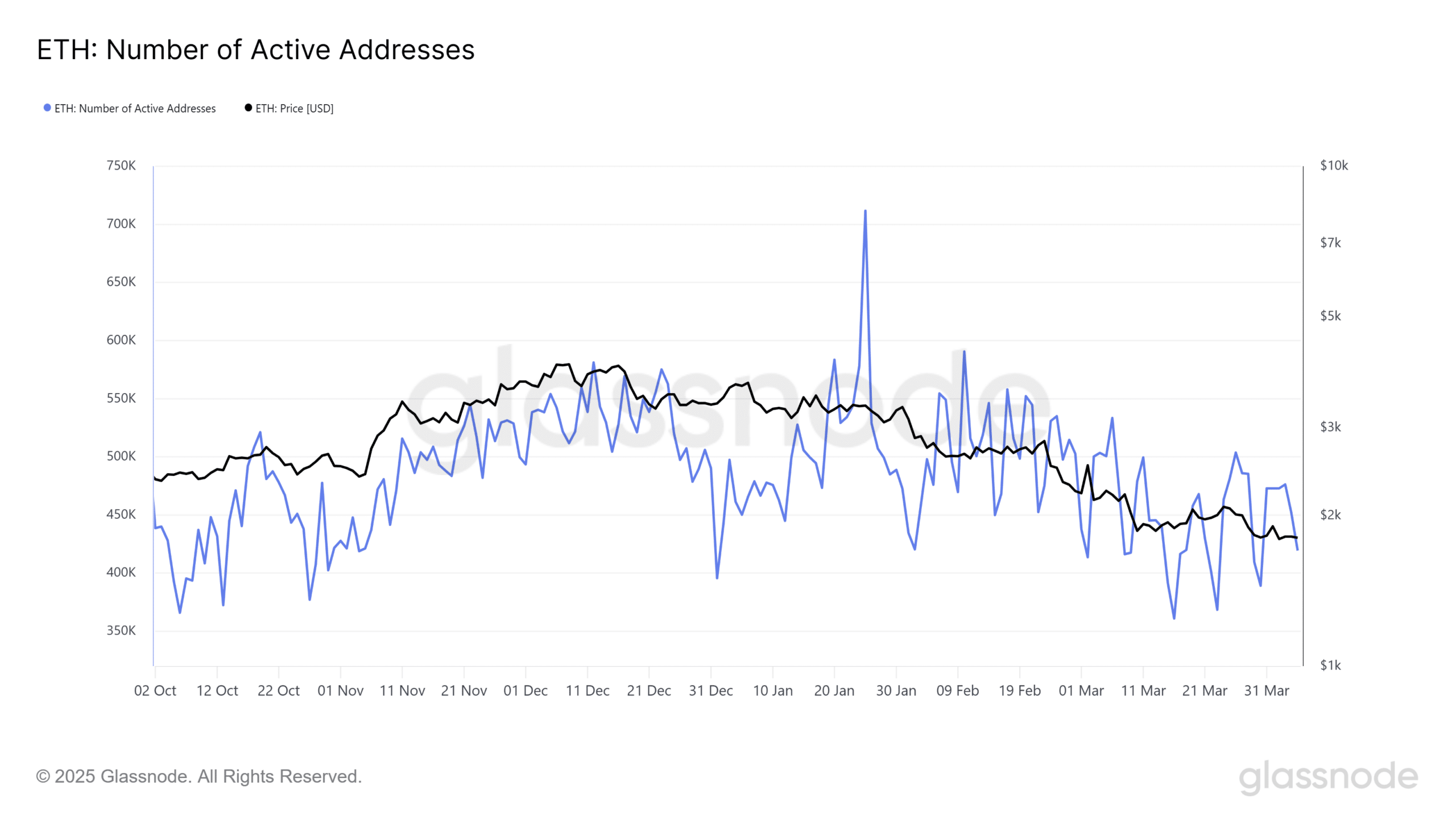

Ether Lee’s (ETH) On Chain Indicator confirms weakness.

Source: Glass Node

For example, from the end of January to the first week of April, the daily activity address decreased by 41%, down from 711,578 to 419,445. The ETH itself, on the other hand, collapsed $ 1,805.96 at $ 3,319.97.

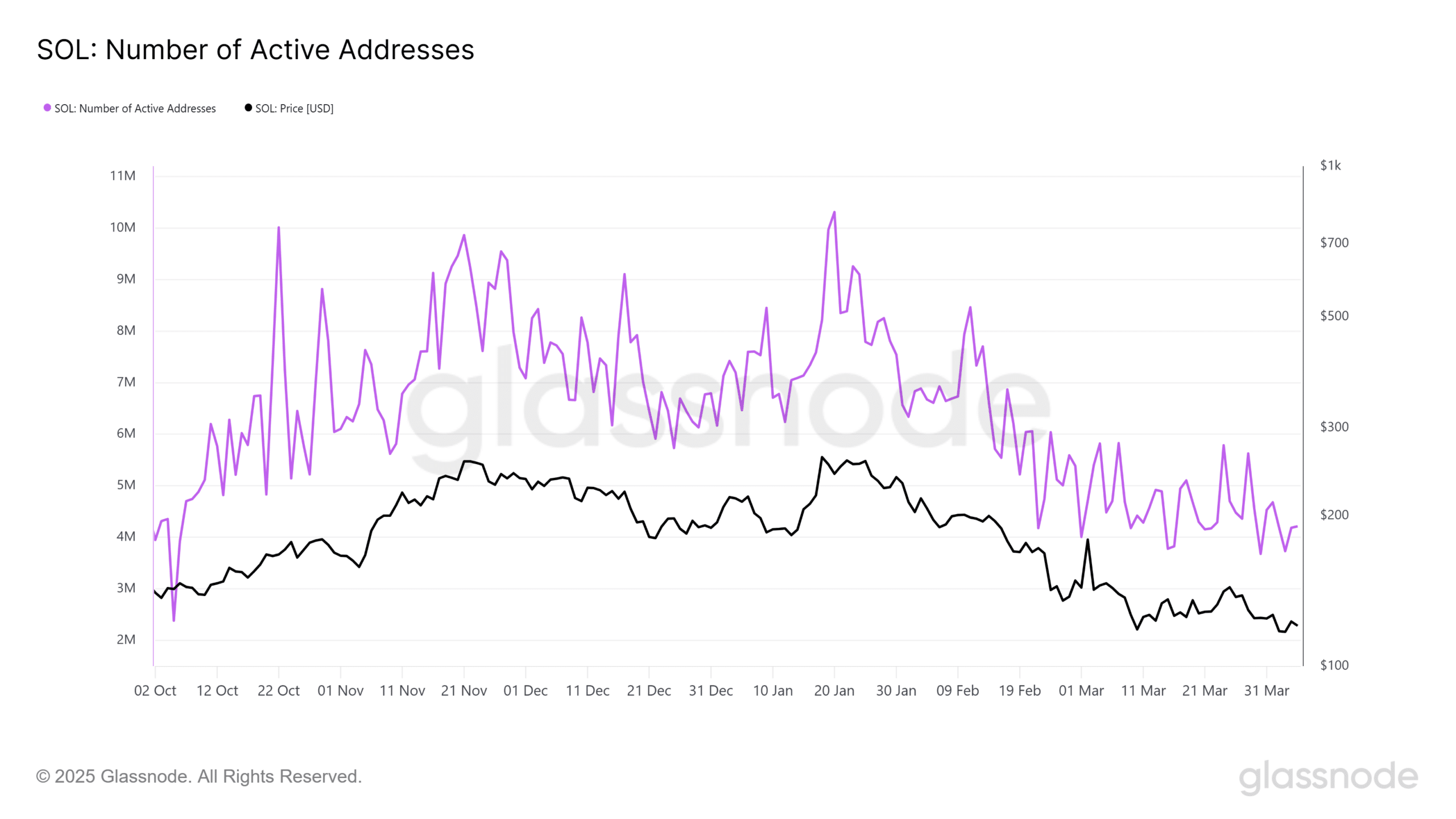

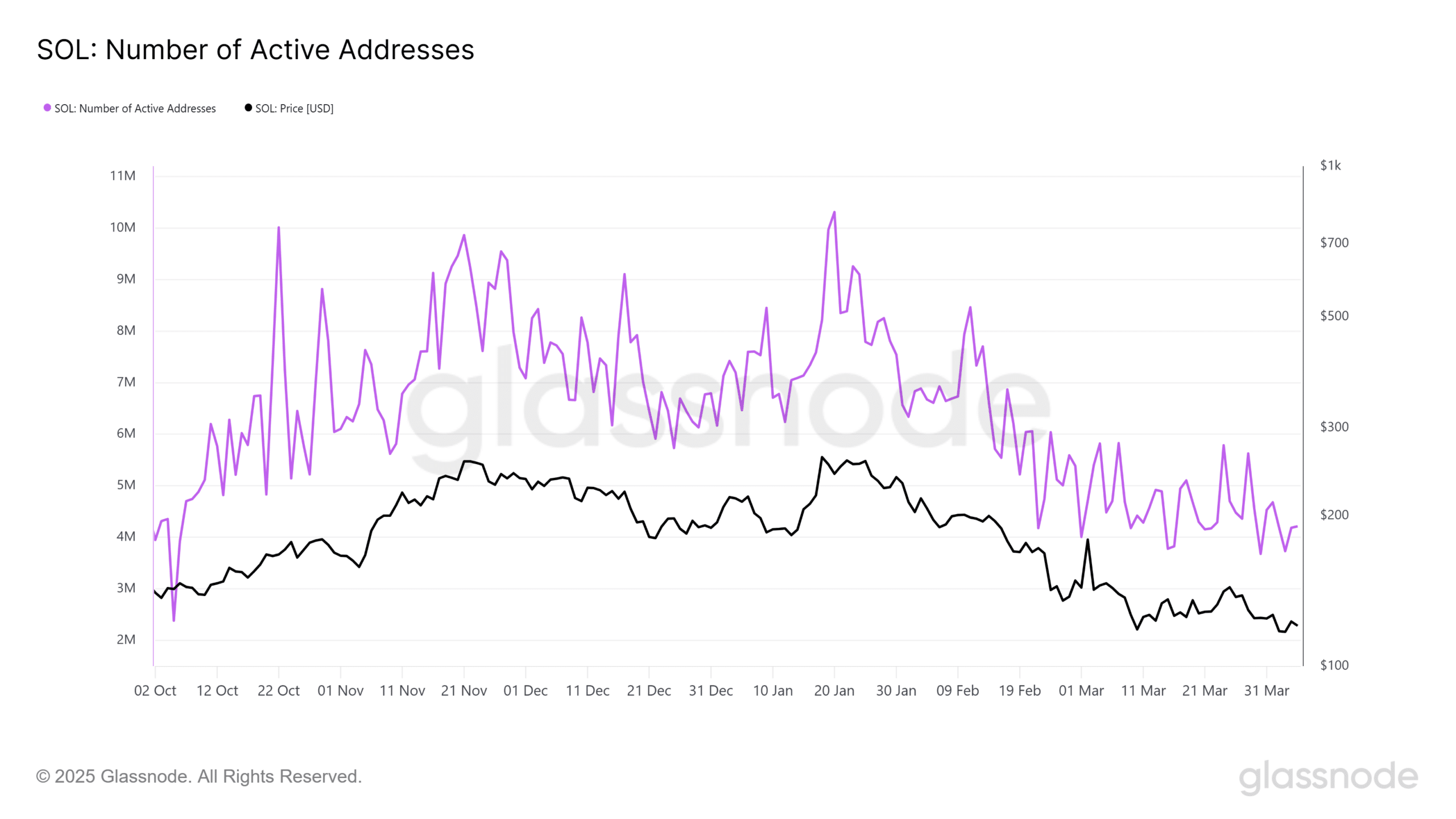

In fact, similar patterns are obvious in solana (sol).

Enlarging Solana will cause a deeper correction.

The Solana Active address dropped 59%from 4.18 million to 4.13 million on April 20 on April 20 and resigned from 242.35 to $ 122.77.

Source: Glass Node

The BTC looks more consistently compared.

The activity address decreased by 26%from 1.1 million in December 2024 to 809,254 from April 5. At the same time, the price is from $ 80,000 to $ 86,000 to March and April.

Source: cryptoquant

The trading volume of Bitcoin network decreased by 45%, down from 533,599 on March 23 to 293,310 from April 5. Nevertheless, the price of Bitcoin decreases by 4% over the same period, showing the integration stage rather than surrender.

This data emphasizes the contrast between major assets and alternatives in the bitcoin and encryption market.

Altcoin appears to be faced with deeper participation challenges, which will expand beyond simple prices. Bitcoin, meanwhile, still remains the most elastic option, but some see reduced network activities as a sign of reducing speculation.