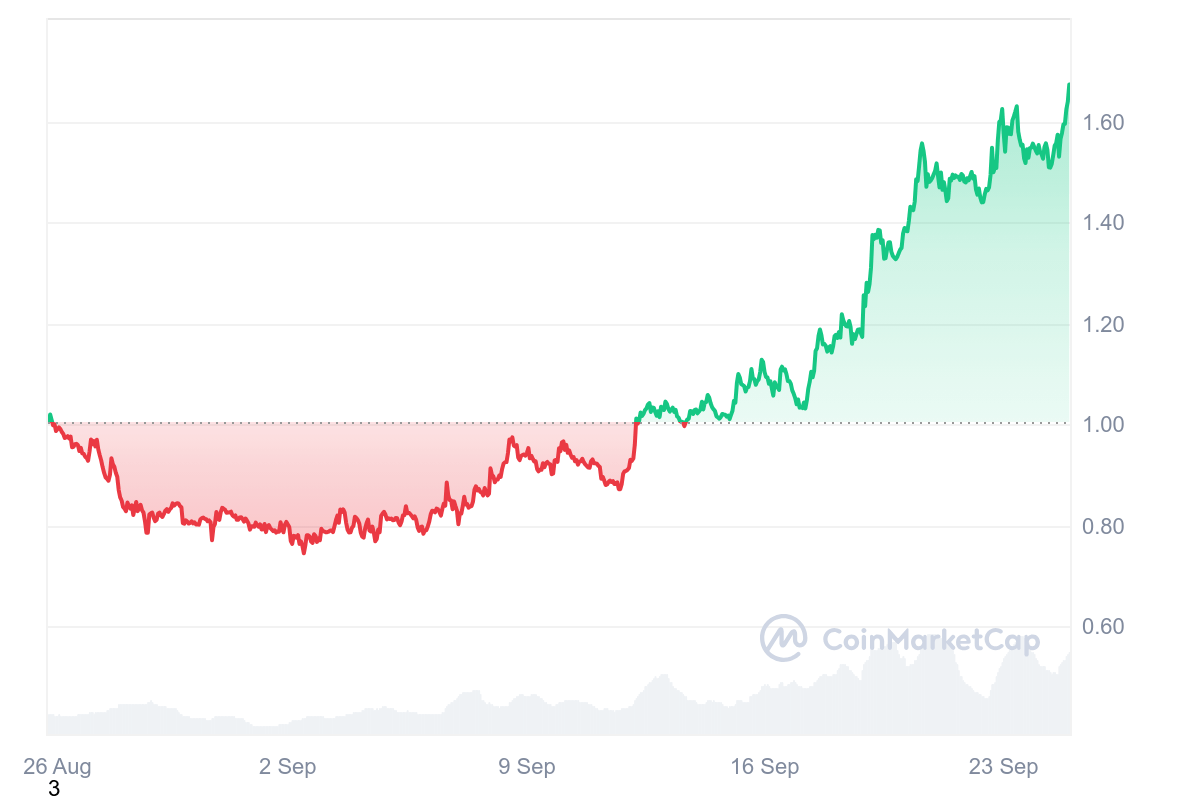

- Sui’s price has surged more than 44% in the past week and more than 65% in 30 days.

- Profits accrue after the Grayscale Sui Trust is opened for accredited investors.

- SUI Network’s total fixed value (TVL) exceeded $1.34 billion.

The price of SUI has soared, with its total value locked (TVL) surging to $1.3 billion, up 44% in the past week to trade above $1.67.

The gains include gains of more than 65% over the past 30 days. This means that the native token of the layer 1 blockchain platform has reached a high last recorded in early April.

What prompted the SUI price surge?

Sui saw a notable surge in trading volume after Grayscale announced that it had opened the Sui Trust to accredited investors.

SUI’s daily trading volume surged after the news, pushing the price above $1.

The rise in the price of Sui above $1.67 coincided with a rapid increase in TVL across various decentralized finance (DeFi) protocols in the Sui ecosystem. OKX Ventures noted that Grayscale Sui Trust has increased SUI market confidence as institutional interest grows.

Sui’s TVL hit $1.3 billion.

Optimistic sentiment about this outlook is reflected in on-chain activity, with TVL reaching $1.34 billion.

Sui’s TVL surpassed $1 billion in May, up from about $250 million in early 2024, according to DeFiLlama. However, it fell to $462 million on August 5 due to the cryptocurrency market crash that saw the price of Bitcoin fall below $50,000.

But what’s notable is that less than a month later it surges back to $1 billion and accelerates to $1.34 billion. This represents an increase of 377% year-to-date and a monthly increase of over 47%.

Sui’s growing DeFi ecosystem behind this surge includes increasing adoption of protocols across lending, decentralized exchanges, real assets, derivatives, and yield.

Navi Protocol recorded a 34% month-on-month increase in TVL to over $449 million.

The TVL figures for lending protocols Scallop and Suilend are $246 million and $230 million, respectively. This represents a 34% and 100% surge in the month-to-date totals, respectively.