- The SEC secures $ 1.1m when the defendant of the encryption fraud crosses the court.

- Stemy Coin falsely insisted on laboratory and stem cell support.

- The judge issues permanent prohibition and severe punishment for violations.

After the defendant did not appear in court, the US Securities and Exchange Commission made a $ 1.1 million ruling. On June 3, Georgia’s federal judge made a failure to make a failure to ignore Keith Crews, which ignored the SEC complaints raised in August 2023.

The court found that the crew violated the federal. Securities The law through fraudulent activities is associated with digital tokens known as “Stemy Coin”. The 69 -year -old boy, headquartered in Kennesaw, was operated through two objects: STEM BIOTECH LLC and four Square Biz LLC. The SEC claimed that between October 2019 and May 2021, the crew misunderstood almost 200 individuals and secured more than $ 800,000.

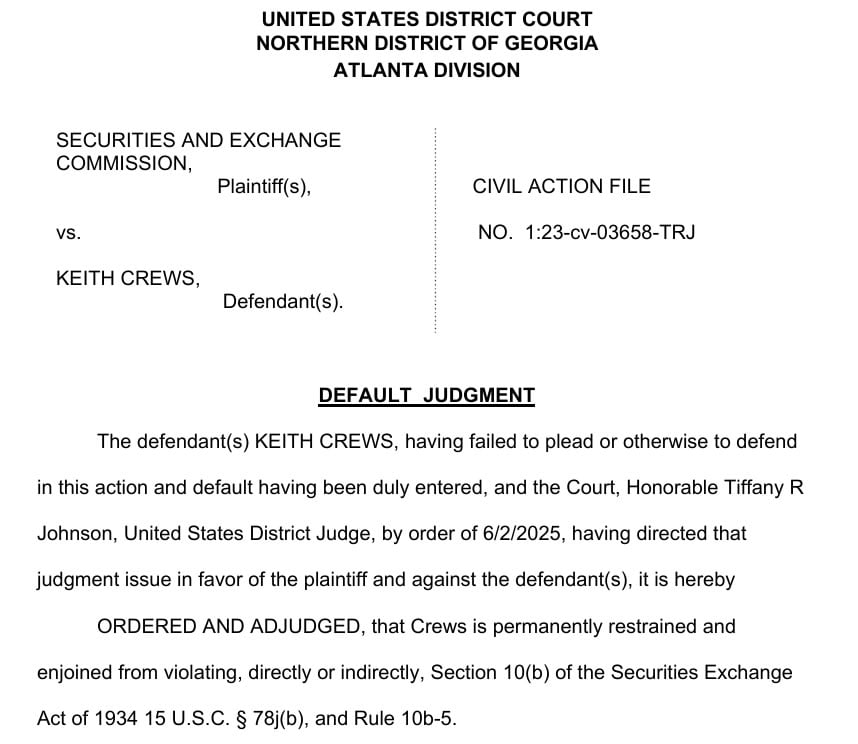

Hate, civil punishment and permanent prohibition

Tiffany Johnson, a US local judge, ordered more than $ 1.1 million as a total penalty. The ruling included illegal interests of $ 530,000, interest of nearly $ 51,000 and $ 530,000 for civil fines. This ruling also imposes a permanent prohibition order that the crew prohibits the violation of the Securities Law in the future.

that secretary The crew seduced investors by false claims about high -end medical products and gold support encryption. He insisted that his company had a work laboratory and biotechnology partnership, but there was no such infrastructure or affiliate. Many participants approached the church group and community relationship.

The agency made it clear that the crew had chosen for those who could not defend their assets. Participants have come to think that this study is related to innovative research with stem cells. In fact, the company did not produce anything, did not rent a space, and no one had partnership.

False statements and unregistered securities proposals

The crew promoted unregistered securities by presenting stem coins supported by tangible assets and medical science. His company falsely advertised medical professionals and research institutes and affiliates. The SEC said there was no basis for the statement.

The regulatory agency filed a claim in accordance with the fraud and registration provisions of the Securities and Exchange Act. The crew did not respond to legal summons or defend the charges. As a result, the court made a dismissal ruling in accordance with the favor of the SEC.

This decision is made when the SEC appears to have suspended the encryption. It is rare for institutions to be legally approved for digital assets.

This case emphasizes the wrong statement in collecting continuous problems surrounding unregistered products and money for cryptocurrency.