Main takeout

- The strategy spread 130 Bitcoin during the week of March 16.

- The acquisition was sold by selling Series A preferred shares to fund $ 17 million in net proceeds.

Share this article

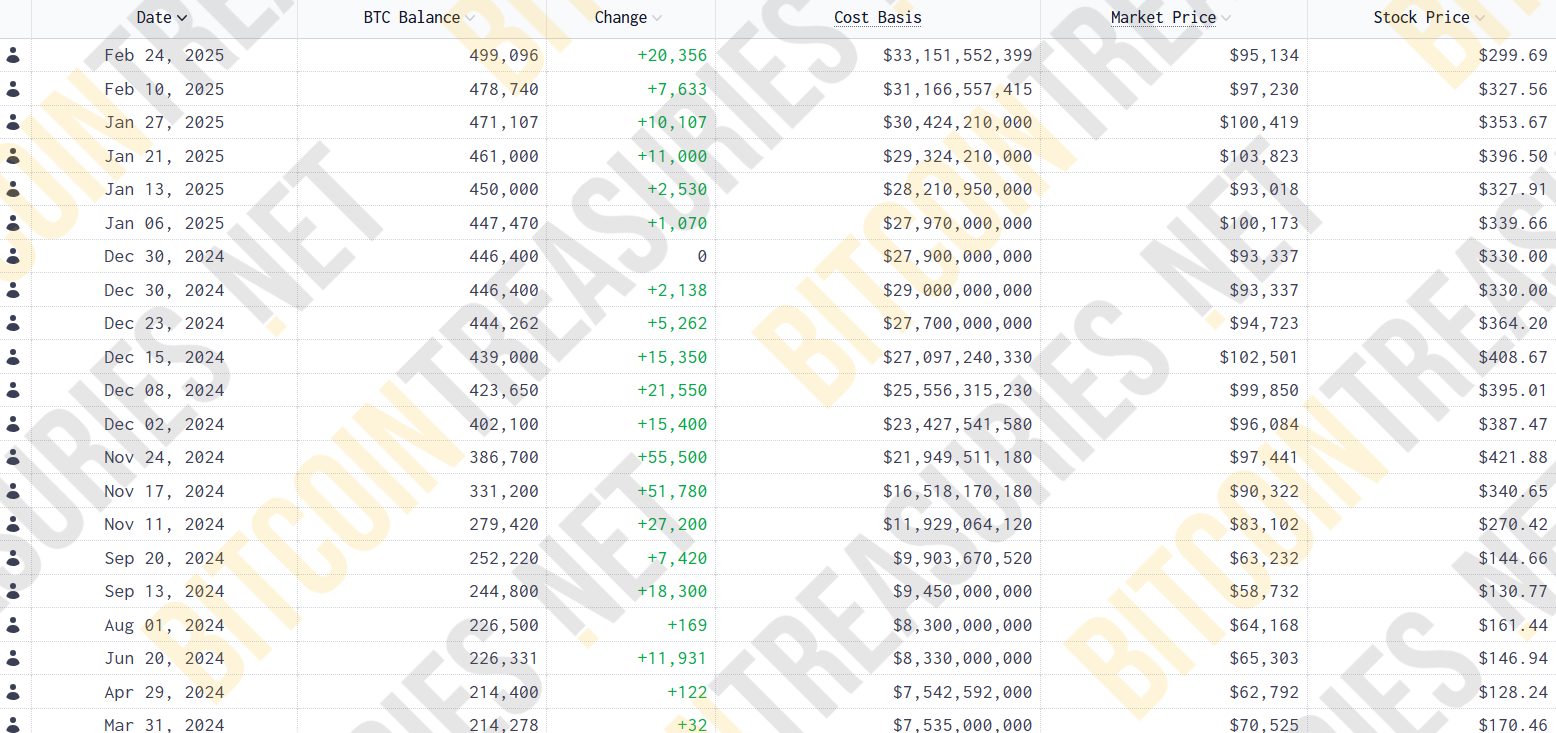

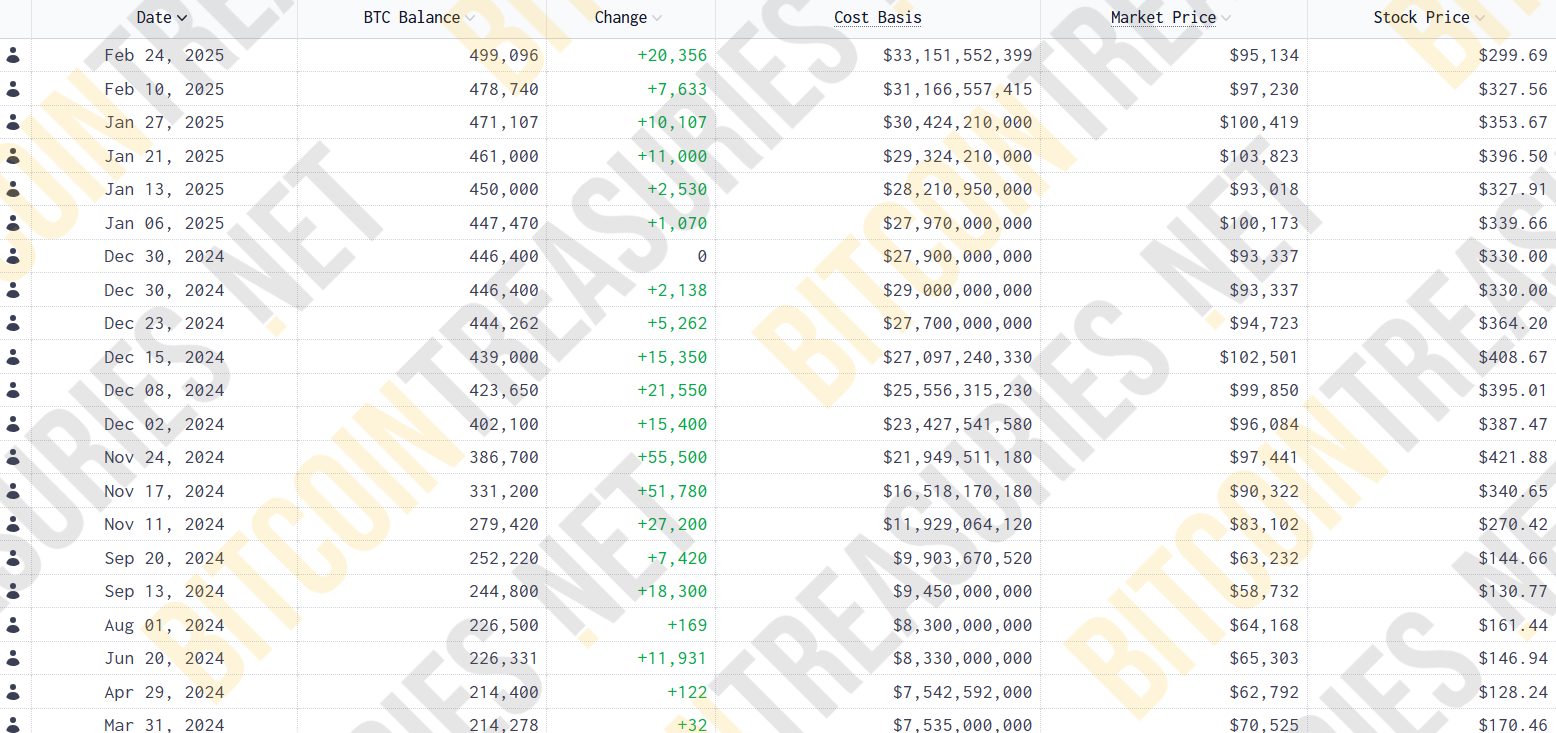

The company’s strategy for business intelligence, which was previously known as Microstrategy, said it acquired 130 Bitcoin for $ 13.7 million for $ 82,981 per coin between March 10 and March 16.

According to data from Bitcoin Treasuries, the acquisition was the smallest since April.

According to the latest release of the strategy with the SEC, the purchase was raised by generating a net profit of about $ 17 million in a profit that sold 123,000 shares of the 8.00% Series A Permanent Strikes (STRK stock) of the strategy. The company confirmed that Class A’s common stock was not sold for the same period.

The company’s total Bitcoin Holdings is now worth more than $ 41 billion in 499,226 BTC. The co -founder of the strategy and chairman of Michael Saylor said the company’s total shares were purchased at an average price of $ 66,360 per BTC, including commissions and costs. The company currently owns more than 2% of Bitcoin’s 21 million supply.

According to the Yahoo Finance Data, the company’s share price rose 13% to about $ 297 on Friday and reached more than 77% last year. Stocks are slightly low in market transactions today.

Share this article